Alabama - LLC

Learn the Benefits of an LLC

There are many benefits to setting up an LLC in Alabama. LLCs not only have more tax options, but they also offer decreased liability, reduced record keeping, and sharing of profits. They are simpler to set up and maintain, with much simpler rules and regulations. There is decidedly less registration paperwork and lower-costing startup expenses.

But is an LLC the right business structure for you? Some business types come with suggested business structures. For instance, many small business lawyers recommend you create an LLC for an e-commerce business. Why? With e-commerce businesses, products fall under product liability statutes. This means that anyone involved in the sale and distribution of the product could be held liable—even if the problem lies with the manufacturer. An LLC provides you with limited liability in case you are sued by creating a separate and distinct legal entity and isolating business assets from your assets. Therefore, compensation can only be taken from the LLC’s assets, not your personal assets.

Why is an LLC a good idea for an e-commerce Business?

If there is an issue with a product, an LLC protects you. Compensation can only be taken from the LLC’s assets, not your personal assets.

Start Your LLC Now

Besides protecting you and your assets, creating an LLC in Alabama provides a business owner with more options for federal tax purposes.

- For instance, if an LLC has only one owner, it’s referred to as a single-member LLC or SMLLC.. Owners have the option of being taxed as a Sole Proprietorship, an S Corporation, or a C Corporation.

- If an LLC has more than one owner, it’s categorized as a multiple-member LLC. Owners have the option of being taxed as a Partnership, an S Corporation, or a C Corporation.

An advantage to having an AL LLC with multiple members is that the members decide how to report profits and losses for tax purposes and have several options as to how they prefer to be taxed.

For federal tax purposes, if you’re the sole member of an LLC, your business is treated as a disregarded entity. This means that although you and your business are separate entities, the SMLLC’s income and expenses are reported on the owner’s personal tax return rather than an SMLLC tax return, and the IRS ignores the SMLLC’s status as a business entity. However, for purposes of employment tax and certain excise taxes, an SMLLC is still considered a separate entity. The way a sole proprietorship is taxed is the IRS’ default option for a single member LLC in Alabama.

In contrast, a corporation only has two choices: S corporation or C corporation.. A business operated as a sole proprietorship or a partnership also doesn’t have an option as to how it will be taxed.

The best part of getting an LLC in Alabama is the fact that it combines the liability protection of a C Corporation with the tax treatment of any of the above business entities. Plus, it is easier to set up than a corporation.

But Alabama LLCs have a few disadvantages. If LLC owners do not choose to file for a tax status as a corporation, individual members pay high self-employment taxes. Those taxes often are higher than corporate taxes. Also, if business owners decide they may want to take the company public and sell stock, an LLC does not permit this (unless you file as an S corporation). Despite these disadvantages, creating an LLC for your startup business is usually recommended. It is well worth it to protect your personal assets and simplify the process of starting a business.

Easiest way to form your Alabama LLC online

Learn the Benefits of an LLC

For most folks looking to register an LLC in AL, the best type of company to form is what's known as a Limited Liability Company (LLC). An LLC can:

- Run a business

- Hold assets (such as office equipment/real estate)

- Open a bank account

- Enter into contracts

Assign Member Roles

One of the steps of your Alabama LLC formation is deciding whether you will run this business on your own or with another member’s or organization’s assistance, how small or large you intend for your team to be, and which duties each member will have.

- Member-managed LLC - Member-managed LLC - These may consist of single or multiple members. Each member plays an active role in the management and operation of the business and has the authority to make decisions to bind the LLC. This is ideal if the business is small, has limited resources, and all members have management skills.

- Manager-managed LLC - These may consist of single or multiple members, but members must relinquish the authority to the manager and cannot interfere with the manager's operational decisions. This is ideal if your business is too large or complex to efficiently allow the sharing of management duties among all members, or if some of your members do not have management skills.

Member-managed LLC

All members can make authoritative decisions.

Works best when:

- business is small

- has limited resources

- all members are skilled

Member-managed LLC

Only the manager can make authoritative decisions.

Works best when:

- business is too large/complex

- not all members are skilled

If you know your LLC in Alabama will have employees, you also know that you will have to pay them. Plus, you will need to figure out the amount you should deduct from their wages for tax purposes. Employees will need to fill out a W-4 Form, and you will need to give them pay stubs with their tax information. Before this all gets overwhelming, keep in mind that we offer Payroll, Tax and HR compliance solutions with our partner, ADP.. We make it easy to pay your employees, track time, and file taxes effortlessly. Plus, you and your employees can view and update payroll information via an app--accessible anywhere, anytime, backed by 24/7 live customer service support.

Easiest way to form your Alabama LLC online

Assign Member Roles

One of the steps of your Alabama LLC formation is deciding whether you will run this business on your own or with another member’s or organization’s assistance, how small or large you intend for your team to be, and which duties each member will have.

Decide on a Registered Agent

Next, figure out who the Registered Agent for the LLC should be. The State of Alabama requires every LLC in the state to have one. This enables the state to ensure the delivery of legal mail and that court documents can be tracked appropriately. The Registered Agent will also act as the contact point between your LLC and the Alabama Secretary of State’s office. Once you assign someone as your Registered Agent, they can receive official correspondence and documents on behalf of your business.

A Registered Agent can be either an individual who is a resident of Alabama or a business entity that is authorized to conduct business in the state (but not your own business). This can be you or someone else within your company, but keep in mind that this person will be through whom the state has contact with your business. This agent will receive legal documents (known as “Service of Process”) that pertain to your business. You are legally required to have one.

- Possess a physical street address located in Alabama (no P.O. Box address).

- Be available during regular business hours, typically Monday through Friday, 9 am to 5 pm.

Although the most comfortable option for a Registered Agent would be to name yourself, a friend, or a family member, know that this information will be public record. Not only will the information be searchable on the state’s LLC website, it can also be republished on other sites as well. If you work from home and would much rather keep your home address private, this might not be the best choice. An alternative you can look into is hiring a Alabama Registered Agent Service. We also offer a Registered Agent Service for a small charge that you can include as an add-on to your shopping cart.

Easiest way to form your Alabama LLC online

Decide on a Registered Agent

Next, figure out who the Registered Agent for the LLC should be. The State of Alabama requires every LLC in the state to have one. This enables the state to ensure the delivery of legal mail and that court documents can be tracked appropriately.

Submit Your Certificate

of Formation

While forming an LLC in Alabama, you will also need to register your business by submitting a form called the Certificate of Formation--usually called the Articles of Organization in other states--to the Alabama Secretary of State (SOS). This form includes information such as the LLC's name and address, the Registered Agent’s information, whether the LLC is run by managers or members, etc. If you also have an Operating Agreement written out, you would include a copy of it with the Certificate of Formation in your business records. Submitting your Certificate of Formation is one of the Alabama filing requirements.

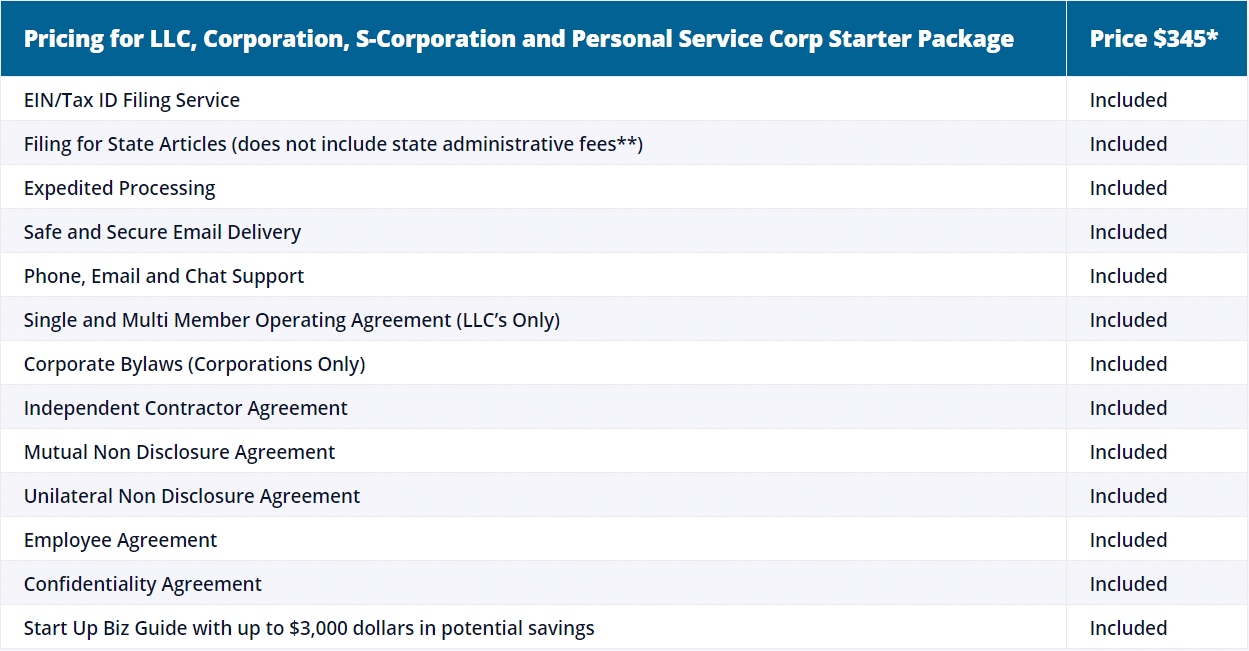

If filing on your own, there are usually non-refundable fees that you have to pay with check or money order, additional fees for hand-delivery of forms, and long wait times whether in person or by mail--especially if you’re filing for an LLC in Alabama during peak season. GovDocFiling can speed up the process for you. We offer an easy online application, expedited pricing, and a free business start-up guide and resources with all filings. You can apply here today.

Once your completed Alabama Certificate of Formation form is accepted, congratulations! Your company now exists as a recognized legal entity that is authorized to conduct business within the State of Alabama.

Easiest way to form your Alabama LLC online

Submit Your Certificate of Formation

While forming an LLC in Alabama, you will also need to register your business by submitting a form called the Certificate of Formation--usually called the Articles of Organization in other states--to the Alabama Secretary of State (SOS).

Obtain an Employer

Identification Number

Next, your LLC will need to file with the IRS for an Employer Identification Number (EIN). This is a nine-digit number assigned to businesses for tax filing and reporting purposes that allows the IRS to identify the taxpayer. (Note: you do not need an SSN to apply for an EIN, so international applicants are welcome.) Corporations, partnerships, and LLCs require an EIN, while sole proprietors do not. Instead, sole proprietors can use their Social Security Number, but that is not recommended as that exposes you to potential identity theft/fraud. In any case, it is a good idea to obtain one in case the company grows or for banking purposes.

Fortunately, you do not have to waste time dealing with the IRS on your own. Going through the IRS directly to get your EIN can be complicated, confusing, and frustrating. GovDocFiling alleviates the angst and aggravation of filing government documents, including applying for an EIN, or Tax ID number. Plus, GovDocFiling has one low price for same-day processing and delivery of your EIN (other Tax ID filing services charge more than $300 for same-day service!). Easily apply for your EIN/Tax ID online here. In addition, if you have any questions about obtaining an EIN, we offer 24/7 email and phone support to help you through the process. Emails are answered quickly at info@govdocfiling.com.

Once you designate how you prefer to be taxed, that decision must remain in effect for five years before being changed without approval from the IRS.

Easiest way to form your Alabama LLC online

Obtain an Employer Identification Number

Next, your LLC will need to file with the IRS for an Employer Identification Number (EIN). This is a nine-digit number assigned to businesses for tax filing and reporting purposes that allows the IRS to identify the taxpayer.

Fill Out an Operating

Agreement

Once you’ve decided on member roles within your LLC, it is time to create a business contract that holds members to their assigned responsibilities. An LLC Operating Agreement in Alabama is a legal document that determines the financial and working relationships among business owners, members, and managers. Member duties would be explained and “what if” scenarios would be covered (such as what happens if a member leaves the LLC). If you do not have an Operating Agreement set up for your business, when something unforeseeable happens, it will be up to the state to decide how to proceed justly, and this may not be what you want.

While it is not a legal requirement to have an LLC Operating Agreement for an Alabama LLC, it is still extremely important to have one in order to protect your business. You can have a lawyer look over your Operating Agreement prior to submitting it. Get the legal advice you need to protect your business and familiarize yourself with Alabama LLC law with the assistance of our partner, Rocket Lawyer. Your company is responsible for maintaining copies of the Operating Agreement.

Easiest way to form your Alabama LLC online

Fill Out an Operating Agreement

Once you’ve decided on member roles within your LLC, it is time to create a business contract that holds members to their assigned responsibilities. An LLC Operating Agreement in Alabama is a legal document that determines the financial and working relationships among business owners, members, and managers.

Familiarize Yourself with the

State’s Taxes and Licenses

Income from pass-through entities such as limited liability companies (LLCs) and S corporations “pass through” the business to the LLC owners, who are required to report this information on their personal tax returns. Each individual LLC member will then have to pay taxes on his or her share of the LLC’s income. The LLC itself does not pay federal income taxes, but some states do charge the LLC other various taxes. For example, Alabama has a sales and use tax, as well as other taxes. See more information here.

Keep in mind that an advantage of having an LLC is its tax flexibility. LLC members can choose how the entity will be taxed--as a sole proprietorship, partnership, or C or S corporation. SMLLCs are treated the same as sole proprietorships. While it is possible to choose to have your LLC classified as a corporation, in that case, the company itself must file a separate tax return and pay a corporation income tax. The corporate tax is prone to change so look it up on the Department of Revenue website.

An Alabama LLC annual fee that every corporation, limited liability entity, and disregarded entity doing business in Alabama is required to file an Alabama Business Privilege Tax Return and Annual Report. This means that all LLCs are subject to an annual Business Privilege Tax (BPT). Plus, Alabama pass-through entities (LLCs and S corps) require an Annual Report form with the yearly tax return. Typically, the BPT is assessed based on the total amount of income passed through to the LLC members. The minimum tax is $100, paid to the Alabama Department of Revenue.

In addition, there may be extra fees for certain insurances, permits, and licenses. For example, you may need worker’s compensation insurance or a building permit, depending on the state’s laws and the type of business you own. Find out the requirements for LLCs in the state you plan to run your business in. A list of Alabama licenses can be found here. Different cities or counties may require certain permits and licenses that other regions do not. Contact your city or county to see if there are any insurances, permits, or licenses you might need to obtain before you begin operating your business.

Easiest way to form your Alabama LLC online

Familiarize Yourself with the State’s Taxes and Licenses

Income from pass-through entities such as limited liability companies (LLCs) and S corporations “pass through” the business to the LLC owners, who are required to report this information on their personal tax returns.

Keep Track of Your

Business Financials

There is no annual report that is required on its own each year, but updated information on all entities is requested annually along with the business privilege tax return that you should submit every calendar year by April 15. This updates the Alabama Secretary of State of LLC structural changes and declares that your business is still in operation.

To prepare for tax season and decipher all gross receipts, dividends, interest, losses, and Alabama LLC fees, you should seek the help of an accountant to ensure that it is all taken care of. Our partner, Bench, will provide you with a team of accountants to help you with your franchise tax reports, as well as general bookkeeping services with monthly financial statements and intuitive software to monitor your business profits and expenses.

Easiest way to form your Alabama LLC online

Keep Track of Your Business Financials

There is no annual report that is required on its own each year, but updated information on all entities is requested annually along with the business privilege tax return that you should submit every calendar year by April 15.

Raise Funds for Your LLC

You can’t start a business with zero capital. There are legal fees, document filing fees, taxes, employees to pay if you are not an SMLLC, as well as the costs of operating a business. Some of the most commonly-used options for obtaining funding for your LLC are:

- Personal savings and assets

- Informal loans from family and friends

- Peer-to-peer lending sites or crowdfunding

- Conventional bank loan

- Short-term credit card loans

- Government-sponsored grants/loan programs

- Adding LLC owners

Personal Saving/Assets

Use your own savings, liquidate your assets, refinance your home, borrow your Roth IRA, etc.

Informal Loans From Family/Friends

Ask friends or family members if they would be willing to invest in your business.

Peer-to-Peer Landing Sites

LLC members might contribute different proportions of capital and sweat equity, and they must determine for themselves what percentage of the profits/losses goes to whom.

Conventional Bank Loan

LLC members might contribute different proportions of capital and sweat equity, and they must determine for themselves what percentage of the profits/losses goes to whom.

Many new LLC owners begin with their savings to fund their new business venture. If your savings are not enough, you may need to look into liquidating your personal assets or use them as collateral for loans. Can you sell your property or refinance your home? Do you have a retirement account such as a Traditional or Roth IRA? Usually, you can withdraw contributions you made to your IRA anytime, tax- and penalty-free, but that is not always the case. Find out what kind of fees your particular retirement plan will hit you with before using your IRA to fund your business.

Next, look into whether you know someone who shares your passion for your business and has the ability to contribute financially to your dream. These personal connections may want to support your startup idea. Although accepting an informal loan from a close friend or relative may feel safe, you should still protect yourself in case your relationship with the friend or family member goes sour. Have an official contract drawn up that all parties agree to. You can choose to have it notarized and have witnesses present for extra protection.

If you prefer not to borrow from friends and family, you can turn to a peer-to-peer (P2P) or social lending website. A P2P site is a place where investors seek out alternative opportunities to invest outside of stocks and bonds. You can apply for a loan and investors can decide whether or not they wish to fund your proposed business through interest-based loans. You can also look into crowdfunding, which is a way for small businesses or startups to raise money online through donations. These options typically require the ability to promote your business well, ensure complete transparency of where the funds go, and sometimes, the possibility of giving up ownership of a piece of your business. Make sure you look into all of the specifics.

You might be hoping to rely on a conventional loan from a bank, credit union or other lending institution for your main source of funds. In this case, you would need a formal business plan to present during your loan application process. If approved, you would be required to sign a legal contract, or a Promissory Note, outlining your obligations to the lender (which would primarily entail regular payments until the loan is paid off). If you are a first-time business owner, it is likely that you may be rejected initially. In that case, you can improve your application and reapply, or look into alternative sources of funding such as short-term financing via credit cards.

Using a credit card as a means of obtaining a fast and easy business loan would grant you use of immediate funds without the hassle and paperwork of loan applications or business plans. This is the best option for a brand new business, and we work with Nav to give our customers access to the credit they need. Visit our financing page and fill out the form for more information.

There are many credit cards that have low or no annual fees, low introductory interest rates, and other rewards depending on your spending. But be careful: make sure you pay back your credit card before the promotional low interest rate expires and skyrockets, or prior to having to pay large annual fees. And don’t make large purchases that can take years to pay back. For example, getting an equipment loan to purchase a piece of equipment is smarter than putting it on a credit card. Credit cards can be a good temporary solution if your business plan will allow you to pay back the debt quickly.

Another option at your disposal is a government-sponsored grant or loan program. Traditional lenders can turn to federal, state, or local governments to finance their business if such a grant or program is available. Typically, these programs consider sponsoring specific type of businesses or certain business owners, so be sure to research what government-sponsored loan your particular business or you might be eligible for.

Lastly, you can invite new members to your team. If you could see your businesses strategy succeeding with a partner or multiple partners, pool together your financial resources with another member to support your startup. An advantage to this funding option is your partner(s) may come with their own social network of business contacts and possibly even their own potential investors. To protect yourself, you can adjust your Operating Agreement and ensure that you are still the primary owner of the LLC.

Easiest way to form your Alabama LLC online

Raise Funds for Your LLC

You can’t start a business with zero capital. There are legal fees, document filing fees, taxes, employees to pay if you are not an SMLLC, as well as the costs of operating a business.

Create a Business Website

Creating a website for your business is not one of the Alabama LLC requirements, but it is recommended to any business owner operating in the modern world. An online presence is important to have and maintain in order to ensure that your customers trust your company and know they will receive good customer service. Having a website gives your business legitimacy; your customers will visit your website and see that you are a real company with an actual website where they can read about the company’s origin and products/services and access contact information. Being able to read up on a company on their website leads to trust between a consumer and an organization. Also, dependable customer service is often offered through a website. By offering an email address, a contact form, and/or live chat with a representative on your website, you are making it easy for a customer to get connected with someone knowledgeable about the product/service. That allows a customer to know that there is a real person who cares about their satisfaction within the company that they are doing business with.

Start LLC formationIf the website is outdated or there is no website, a consumer may feel that you are not a legitimate business but a scam with no licenses to back up your business’ operations. You can avoid losing customers due to not having a professional website by ensuring that you have one. We work with GoNorth Websites to provide new businesses with high quality, cost-effective websites. Find out more about our custom designed, written, and developed websites, plus optional internet marketing add-ons that help you grow your business.

But websites needs maintenance too. You can’t simply have one created and never update it throughout the years. Policies and terms change, companies grow, products/services improve, and all of that (and more) can be reflected on the website. This keeps your customers up-to-date and offers a personal touch that is valued by any consumer.

In addition, you can look into having a blog or utilizing social media as another means of keeping your customers in-the-know and offering them a way to interact with your company. An online and/or social media presence can also lead to responsive customers who can offer you feedback on how you’re doing—plus, it’ll help get your company’s name out there.

If this all sounds like more than you’d like to deal with on your own, know that you can hire someone to maintain your website and social media presence for you—just like you can hire customer representatives to handle all correspondence. You can employ a web agency to monitor your website and/or a social media marketing agency to manage your social media campaign. A social media campaign is a coordinated marketing plan that can assist you with your business goals, which translates into extra advertising for your new business. Marketing your company can help you have a more profitable business and can aid you with paying back your business loans quicker—something any business owner aims for. Regardless of industry, all businesses should consider having a website as part of the first steps of starting a business.

T The Benefits of Having an Online Presence

If you’ve decided that you want to have a website for your business, keep a few things in mind. When coming up with a website name, make sure that the domain contains your business name and is easy to type and remember for future visits. If you come up with a great web domain that you’d like to use for your business but you don’t plan to create a business website today, you may want to buy the URL to prevent others from acquiring it.

While brainstorming website URLs for your website, you’re going to either realize that you already know what your business is going to be named or that you have no idea what or how to name your business. Here are a few quick Alabama LLC name tips:

- Follow LLC naming guidelines. Make sure that the name of your business ends with the phrase “Limited Liability Company” or the abbreviation “LLC.” It’s also important not to use any words or phrases that will make it easy for someone to mistake your company for a federal agency; think “State Department.”

- Find a unique name. If you’re creating an LLC in the State of Alabama, you will need an original name that is not in use by another LLC. To check if a name has already been taken, you can search the Alabama Name Availability Database.

- Make sure it is available as a web domain. This way, you can find out if another company outside of Alabama has a business with the same name. In that case, think of something more original.

Easiest way to form your Alabama LLC online

Create a Business Website

Creating a website for your business is not one of the Alabama LLC requirements, but it is recommended to any business owner operating in the modern world.

Begin Operating Your Business

Once you’re finished getting an LLC in Alabama, make sure you keep your LLC compliant. Remember all important dates and make all necessary payments on time. If you’d rather not do these tasks yourself, you can sign up for a service that will automatically send you alerts ahead of crucial state and federal filing deadlines. Likewise, you can hire an accountant, a tax professional, and/or an attorney to ensure you are not making errors when keeping records, filling out paperwork, and making payments.

You can begin operating your business in Alabama with peace of mind, knowing that you are protected by an LLC in case anything unforeseeable affects your new business venture.

Easiest way to form your Alabama LLC online

Begin Operating Your Business

Once you’re finished getting an LLC in Alabama, make sure you keep your LLC compliant. Remember all important dates and make all necessary payments on time.

Alaska - LLC

Learn the Benefits of an LLC

There are many benefits to setting up an LLC in Alaska. LLCs not only have more tax options, but they also offer decreased liability, reduced record keeping, and sharing of profits. They are simpler to set up and maintain, with much simpler rules and regulations. There is decidedly less registration paperwork and lower-costing startup expenses.

But is an LLC the right business structure for you? Some business types come with suggested business structures. For instance, many small business lawyers recommend you create an LLC for an e-commerce business. Why? With e-commerce businesses, products fall under product liability statutes. This means that anyone involved in the sale and distribution of the product could be held liable—even if the problem lies with the manufacturer. An LLC provides you with limited liability in case you are sued by creating a separate and distinct legal entity and isolating business assets from your assets. Therefore, compensation can only be taken from the LLC’s assets, not your personal assets.

Why is an LLC a good idea for an e-commerce Business?

If there is an issue with a product, an LLC protects you. Compensation can only be taken from the LLC’s assets, not your personal assets.

Start Your LLC Now

Besides protecting you and your assets, creating an LLC in Alaska provides a business owner with more options for federal tax purposes.

- For instance, if an LLC has only one owner, it’s referred to as a single-member LLC or SMLLC. Owners have the option of being taxed as a Sole Proprietorship, an S Corporation, or a C Corporation.

- If an LLC has more than one owner, it’s categorized as a multiple-member LLC. Owners have the option of being taxed as a Partnership, an S Corporation, or a C Corporation.

An advantage to having an Alaska LLC with multiple members is that the members decide how to report profits and losses for tax purposes and have several options as to how they prefer to be taxed.

For federal tax purposes, if you’re the sole member of an LLC, your business is treated as a disregarded entity. This means that although you and your business are separate entities, the SMLLC’s income and expenses are reported on the owner’s personal tax return rather than an SMLLC tax return, and the IRS ignores the SMLLC’s status as a business entity. However, for purposes of employment tax and certain excise taxes, an SMLLC is still considered a separate entity. The way a sole proprietorship is taxed is the IRS’ default option for a single member LLC in Alaska.

In contrast, a corporation only has two choices: S corporation or C corporation. A business operated as a sole proprietorship or a partnership also doesn’t have an option as to how it will be taxed.

The best part of getting an LLC in Alaska is the fact that it combines the liability protection of a C Corporation with the tax treatment of any of the above business entities. Plus, it is easier to set up than a corporation.

But Alaska LLCs have a few disadvantages. If LLC owners do not choose to file for a tax status as a corporation, individual members pay high self-employment taxes. Those taxes often are higher than corporate taxes. Also, if business owners decide they may want to take the company public and sell stock, an LLC does not permit this (unless you file as an S corporation). Despite these disadvantages, creating an LLC for your startup business is usually recommended. It is well worth it to protect your personal assets and simplify the process of starting a business.

Easiest way to form your Alaska LLC online

Learn the Benefits of an LLC

For most folks looking to register an LLC in AK, the best type of company to form is what's known as a Limited Liability Company (LLC). An LLC can:

- Run a business

- Hold assets (such as office equipment/real estate)

- Open a bank account

- Enter into contracts

Assign Member Roles

One of the steps of creating an Alaska LLC is deciding whether you will run this business on your own or with another member’s or organization’s assistance, how small or large you intend for your team to be, and which duties each member will have.

- Member-managed LLC - Member-managed LLC - These may consist of single or multiple members. Each member plays an active role in the management and operation of the business and has the authority to make decisions to bind the LLC. This is ideal if the business is small, has limited resources, and all members have management skills.

- Manager-managed LLC - These may consist of single or multiple members, but members must relinquish the authority to the manager and cannot interfere with the manager's operational decisions. This is ideal if your business is too large or complex to efficiently allow the sharing of management duties among all members, or if some of your members do not have management skills.

Member-managed LLC

All members can make authoritative decisions.

Works best when:

- business is small

- has limited resources

- all members are skilled

Member-managed LLC

Only the manager can make authoritative decisions.

Works best when:

- business is too large/complex

- not all members are skilled

If you know your LLC in Alaska will have employees, you also know that you will have to pay them. Plus, you will need to figure out the amount you should deduct from their wages for tax purposes. Employees will need to fill out a W-4 Form, and you will need to give them pay stubs with their tax information. Before this all gets overwhelming, keep in mind that we offer Payroll, Tax and HR compliance solutions with our partner, ADP. We make it easy to pay your employees, track time, and file taxes effortlessly. Plus, you and your employees can view and update payroll information via an app--accessible anywhere, anytime, backed by 24/7 live customer service support.

Easiest way to form your Alaska LLC online

Assign Member Roles

One of the steps of your Alaska LLC formation is deciding whether you will run this business on your own or with another member’s or organization’s assistance, how small or large you intend for your team to be, and which duties each member will have.

Decide on a Registered Agent

Next, figure out who the Registered Agent for the LLC should be. The State of Alaska requires every LLC in the state to have one. This enables the state to ensure the delivery of legal mail and that court documents can be tracked appropriately. The Registered Agent will also act as the contact point between your LLC and the state. Once you assign someone as your Registered Agent, they can receive official correspondence and documents on behalf of your business.

A Registered Agent can be either an individual who is a resident of Alaska or a business entity that is authorized to conduct business in the state (but not your own business). This can be you or someone else within your company, but keep in mind that this person will be through whom the state has contact with your business. This agent will receive legal documents (known as “Service of Process”) that pertain to your business. You are legally required to have one.

- Possess a physical street address located in Alaska (no P.O. Box address).

- Be available during regular business hours, typically Monday through Friday, 9 am to 5 pm.

Although the most comfortable option for a Registered Agent would be to name yourself, a friend, or a family member, know that this information will be public record. Not only will the information be searchable on the state’s LLC website, it can also be republished on other sites as well. If you work from home and would much rather keep your home address private, this might not be the best choice. An alternative you can look into is hiring a Alaska Registered Agent Service. We also offer a Registered Agent Service for a small charge that you can include as an add-on to your shopping cart.

Easiest way to form your Alaska LLC online

Decide on a Registered Agent

Next, figure out who the Registered Agent for the LLC should be. The State of Alaska requires every LLC in the state to have one. This enables the state to ensure the delivery of legal mail and that court documents can be tracked appropriately.

Submit Your Articles

of Organization

While forming an LLC in Alaska, you will also need to register your business by submitting a form called the Articles of Organization to the State of Alaska Division of Corporations, Business and Professional Licensing. This form includes information such as the LLC's name and address, the Registered Agent’s information, whether the LLC is run by managers or members, etc. If you also have an Operating Agreement written out, you would include a copy of it with the Articles of Organization. Submitting your Articles of Organization is one of the Alaska filing requirements.

If filing on your own, there are usually non-refundable fees that you have to pay with check or money order, additional fees for hand-delivery of forms, and long wait times whether in person or by mail--especially if you’re filing for an LLC in Alaska during peak season. GovDocFiling can speed up the process for you. We offer an easy online application, expedited pricing, and a free business start-up guide and resources with all filings. You can apply here today.

Once your completed Alaska Articles of Organization form is accepted, congratulations! Your company now exists as a recognized legal entity that is authorized to conduct business within the State of Alaska.

Easiest way to form your Alaska LLC online

Submit Your Articles of Organization

While forming an LLC in Alaska, you will also need to register your business by submitting a form called the Articles of Organization to the State of Alaska Division of Corporations, Business and Professional Licensing.

Obtain an Employer

Identification Number

A part of the Alaska LLC formation process is getting an EIN. Your LLC will need to file with the IRS for an Employer Identification Number (EIN), which is a nine-digit number assigned to businesses for tax filing and reporting purposes that allows the IRS to identify the taxpayer. (Note: you do not need an SSN to apply for an EIN, so international applicants are welcome.) Corporations, partnerships, and LLCs require an EIN, while sole proprietors do not. Instead, sole proprietors can use their Social Security Number, but that is not recommended as that exposes you to potential identity theft/fraud. In any case, it is a good idea to obtain an EIN in case the company grows and obtains employees or for banking purposes--in which case one will be required.

Fortunately, you do not have to waste time dealing with the IRS on your own. Going through the IRS directly to get your EIN can be complicated, confusing, and frustrating. GovDocFiling alleviates the angst and aggravation of filing government documents, including applying for an EIN, or Tax ID number. Plus, GovDocFiling has one low price for same-day processing and delivery of your EIN (other Tax ID filing services charge more than $300 for same-day service!). Easily apply for your EIN/Tax ID online here. In addition, if you have any questions about obtaining an EIN, we offer 24/7 email and phone support to help you through the process. Emails are answered quickly at info@govdocfiling.com.

Once you designate how you prefer to be taxed, that decision must remain in effect for five years before being changed without approval from the IRS.

Easiest way to form your Alaska LLC online

Obtain an Employer Identification Number

A part of the Alaska LLC formation process is getting an EIN. Your LLC will need to file with the IRS for an Employer Identification Number (EIN), which is a nine-digit number assigned to businesses for tax filing and reporting purposes that allows the IRS to identify the taxpayer.

Fill Out an Operating

Agreement

Once you’ve decided on member roles within your LLC, it is time to create a business contract that holds members to their assigned responsibilities. An LLC Operating Agreement in Alaska is a legal document that determines the financial and working relationships among business owners, members, and managers. Member duties would be explained and “what if” scenarios would be covered (such as what happens if a member leaves the LLC). If you do not have an Operating Agreement set up for your business, when something unforeseeable happens, it will be up to the state to decide how to proceed justly, and this may not be what you want.

While it is not an Alaska LLC legal requirement to have an Operating Agreement, it is still extremely important to have one in order to protect your business. You can have a lawyer look over your Operating Agreement prior to submitting it. Get the legal advice you need to protect your business and familiarize yourself with Alaska LLC law with the assistance of our partner, Rocket Lawyer. Your company is responsible for maintaining copies of the Operating Agreement.

Easiest way to form your Alaska LLC online

Fill Out an Operating Agreement

Once you’ve decided on member roles within your LLC, it is time to create a business contract that holds members to their assigned responsibilities. An LLC Operating Agreement in Alaska is a legal document that determines the financial and working relationships among business owners, members, and managers.

Familiarize Yourself with the

State’s Taxes and Licenses

Income from pass-through entities such as limited liability companies (LLCs) and S corporations “passes through” the business to the LLC owners, who are required to report this information on their personal tax returns. Each individual LLC member will then have to pay taxes on his or her share of the LLC’s income. The LLC itself does not pay federal income taxes, but some states do charge the LLC other various taxes.

Keep in mind that an advantage of having an LLC is its tax flexibility. LLC members can choose how the entity will be taxed--as a sole proprietorship, partnership, or C or S corporation. SMLLCs are treated the same as sole proprietorships. While it is possible to choose to have your LLC classified as a corporation, in that case, the company itself must file a separate tax return and pay a corporation income tax. The corporate tax is prone to change so look it up on the Department of Revenue website.

One of the Alaska LLC advantages is that there is no statewide income or sales taxes. Instead, residents actually receive annual checks from the state just for living there due to the Permanent Fund Dividend. There are other taxes that are a requirement in the state of Alaska though. Self-employment taxes for an LLC’s net income are paid; plus, employers owe payroll tax on employees wages, and employees pay federal, state and payroll tax on their earnings. Furthermore, it is usually a requirement to pay state unemployment insurance taxes to Alaska's Department of Labor (DOL). More information is on the DOL website. Additional Alaska tax info can be found here.

In addition, there may be extra fees for certain insurances, permits, and licenses. For example, you may need worker’s compensation insurance or a building permit, depending on the state’s laws and the type of business you own. Find out the requirements for LLCs in the state you plan to run your business in. Different cities or counties may require certain permits and licenses that other regions do not. Contact your city or county to see if there are any insurances, permits, or licenses you might need to obtain before you begin operating your business.

Easiest way to form your Alaska LLC online

Familiarize Yourself with the State’s Taxes and Licenses

Income from pass-through entities such as limited liability companies (LLCs) and S corporations “passes through” the business to the LLC owners, who are required to report this information on their personal tax returns.

File a Biennial Report

One of the State of Alaska LLC requirements is having to file an Initial Report within the first six months of creating your LLC. For the Initial Report, there is no fee, but the overall Alaska LLC cost includes a Biennial Report that costs $100 to file. This report is identical to an Annual Report, like most states require, and likewise, it updates the Alaska Secretary of State of LLC structural changes and declares that your business is still in operation. Unlike most states, Alaska does not have an actual Secretary of State though. Instead, these reports must be filed with the Department of Commerce, Community, and Economic Development (DCCED), which can be done on the DCCED website. Biennial reports are due every two years before January 2 of the filing year.

The report can be rather complex–requiring the deciphering of gross receipts, dividends, interest, losses, and all Alaska LLC fees–and you should seek the help of an accountant to ensure that it is filled out properly. Our partner, Bench, will provide you with a team of accountants to help you with your franchise tax reports, as well as general bookkeeping services with monthly financial statements and intuitive software to monitor your business profits and expenses.

Easiest way to form your Alaska LLC online

File a Biennial Report

One of the State of Alaska LLC requirements is having to file an Initial Report within the first six months of creating your LLC.

Raise Funds for Your LLC

You can’t start a business with zero capital. There are legal fees, document filing fees, taxes, employees to pay if you are not an SMLLC, as well as the costs of operating a business. Some of the most commonly-used options for obtaining funding for your LLC are:

- Personal savings and assets

- Informal loans from family and friends

- Peer-to-peer lending sites or crowdfunding

- Conventional bank loan

- Short-term credit card loans

- Government-sponsored grants/loan programs

- Adding LLC owners

Personal Saving/Assets

Use your own savings, liquidate your assets, refinance your home, borrow your Roth IRA, etc.

Informal Loans From Family/Friends

Ask friends or family members if they would be willing to invest in your business.

Peer-to-Peer Landing Sites

LLC members might contribute different proportions of capital and sweat equity, and they must determine for themselves what percentage of the profits/losses goes to whom.

Conventional Bank Loan

LLC members might contribute different proportions of capital and sweat equity, and they must determine for themselves what percentage of the profits/losses goes to whom.

Many new LLC owners begin with their savings to fund their new business venture. If your savings are not enough, you may need to look into liquidating your personal assets or use them as collateral for loans. Can you sell your property or refinance your home? Do you have a retirement account such as a Traditional or Roth IRA? Usually, you can withdraw contributions you made to your IRA anytime, tax- and penalty-free, but that is not always the case. Find out what kind of fees your particular retirement plan will hit you with before using your IRA to fund your business.

Next, look into whether you know someone who shares your passion for your business and has the ability to contribute financially to your dream. These personal connections may want to support your startup idea. Although accepting an informal loan from a close friend or relative may feel safe, you should still protect yourself in case your relationship with the friend or family member goes sour. Have an official contract drawn up that all parties agree to. You can choose to have it notarized and have witnesses present for extra protection.

If you prefer not to borrow from friends and family, you can turn to a peer-to-peer (P2P) or social lending website. A P2P site is a place where investors seek out alternative opportunities to invest outside of stocks and bonds. You can apply for a loan and investors can decide whether or not they wish to fund your proposed business through interest-based loans. You can also look into crowdfunding, which is a way for small businesses or startups to raise money online through donations. These options typically require the ability to promote your business well, ensure complete transparency of where the funds go, and sometimes, the possibility of giving up ownership of a piece of your business. Make sure you look into all of the specifics.

You might be hoping to rely on a conventional loan from a bank, credit union or other lending institution for your main source of funds. In this case, you would need a formal business plan to present during your loan application process. If approved, you would be required to sign a legal contract, or a Promissory Note, outlining your obligations to the lender (which would primarily entail regular payments until the loan is paid off). If you are a first-time business owner, it is likely that you may be rejected initially. In that case, you can improve your application and reapply, or look into alternative sources of funding such as short-term financing via credit cards.

Using a credit card as a means of obtaining a fast and easy business loan would grant you use of immediate funds without the hassle and paperwork of loan applications or business plans. This is the best option for a brand new business, and we work with Nav to give our customers access to the credit they need. Visit our financing page and fill out the form for more information.

There are many credit cards that have low or no annual fees, low introductory interest rates, and other rewards depending on your spending. But be careful: make sure you pay back your credit card before the promotional low interest rate expires and skyrockets, or prior to having to pay large annual fees. And don’t make large purchases that can take years to pay back. For example, getting an equipment loan to purchase a piece of equipment is smarter than putting it on a credit card. Credit cards can be a good temporary solution if your business plan will allow you to pay back the debt quickly.

Another option at your disposal is a government-sponsored grant or loan program. Traditional lenders can turn to federal, state, or local governments to finance their business if such a grant or program is available. Typically, these programs consider sponsoring specific type of businesses or certain business owners, so be sure to research what government-sponsored loan your particular business or you might be eligible for.

Lastly, you can invite new members to your team. If you could see your businesses strategy succeeding with a partner or multiple partners, pool together your financial resources with another member to support your startup. An advantage to this funding option is your partner(s) may come with their own social network of business contacts and possibly even their own potential investors. To protect yourself, you can adjust your Operating Agreement and ensure that you are still the primary owner of the LLC.

Easiest way to form your Alaska LLC online

Raise Funds for Your LLC

You can’t start a business with zero capital. There are legal fees, the Alaska LLC filing fee, taxes, employees to pay if you are not an SMLLC, as well as the general Alaska LLC cost of operating a business.

Create a Business Website

Creating a website for your business is not one of the Alaska LLC requirements, but it is recommended to any business owner operating in the modern world. An online presence is important to have and maintain in order to ensure that your customers trust your company and know they will receive good customer service. Having a website gives your business legitimacy; your customers will visit your website and see that you are a real company with an actual website where they can read about the company’s origin and products/services and access contact information. Being able to read up on a company on their website leads to trust between a consumer and an organization. Also, dependable customer service is often offered through a website. By offering an email address, a contact form, and/or live chat with a representative on your website, you are making it easy for a customer to get connected with someone knowledgeable about the product/service. That allows a customer to know that there is a real person who cares about their satisfaction within the company that they are doing business with.

Start LLC formationIf the website is outdated or there is no website, a consumer may feel that you are not a legitimate business but a scam with no licenses to back up your business’ operations. You can avoid losing customers due to not having a professional website by ensuring that you have one. We work with GoNorth Websites to provide new businesses with high quality, cost-effective websites. Find out more about our custom designed, written, and developed websites, plus optional internet marketing add-ons that help you grow your business.

But websites needs maintenance too. You can’t simply have one created and never update it throughout the years. Policies and terms change, companies grow, products/services improve, and all of that (and more) can be reflected on the website. This keeps your customers up-to-date and offers a personal touch that is valued by any consumer.

In addition, you can look into having a blog or utilizing social media as another means of keeping your customers in-the-know and offering them a way to interact with your company. An online and/or social media presence can also lead to responsive customers who can offer you feedback on how you’re doing—plus, it’ll help get your company’s name out there.

If this all sounds like more than you’d like to deal with on your own, know that you can hire someone to maintain your website and social media presence for you—just like you can hire customer representatives to handle all correspondence. You can employ a web agency to monitor your website and/or a social media marketing agency to manage your social media campaign. A social media campaign is a coordinated marketing plan that can assist you with your business goals, which translates into extra advertising for your new business. Marketing your company can help you have a more profitable business and can aid you with paying back your business loans quicker—something any business owner aims for. Regardless of industry, all businesses should consider having a website as part of the first steps of starting a business.

T The Benefits of Having an Online Presence

If you’ve decided that you want to have a website for your business, keep a few things in mind. When coming up with a website name, make sure that the domain contains your business name and is easy to type and remember for future visits. If you come up with a great web domain that you’d like to use for your business but you don’t plan to create a business website today, you may want to buy the URL to prevent others from acquiring it.

While brainstorming website URLs for your website, you’re going to either realize that you already know what your business is going to be named or that you have no idea what or how to name your business. Here are a few quick tips:

- Follow LLC naming guidelines. Make sure that the name of your business ends with the phrase “Limited Liability Company” or the abbreviation “LLC.” It’s also important not to use any words or phrases that will make it easy for someone to mistake your company for a federal agency; think “State Department.”

- Find a unique name. If you’re creating an LLC in the State of Alaska, you will need an original name that is not in use by another LLC. To check if a name has already been taken, you can search the Alaska Name Availability Database.

- Make sure it is available as a web domain. This way, you can find out if another company outside of Alaska has a business with the same name. In that case, think of something more original.

Easiest way to form your Alaska LLC online

Create a Business Website

Creating a website for your business is not one of the Alaska LLC requirements, but it is recommended to any business owner operating in the modern world.

Begin Operating Your Business

Once you’re finished getting an LLC in Alaska, make sure you keep your LLC compliant. Remember all important dates and make all necessary payments on time. If you’d rather not do these tasks yourself, you can sign up for a service that will automatically send you alerts ahead of crucial state and federal filing deadlines. Likewise, you can hire an accountant, a tax professional, and/or an attorney to ensure you are not making errors when keeping records, filling out paperwork, and making payments.

You can begin operating your business in Alaska with peace of mind, knowing that you are protected by an LLC in case anything unforeseeable affects your new business venture.

Easiest way to form your Alaska LLC online

Begin Operating Your Business

Once you’re finished getting an LLC in Alaska, make sure you keep your LLC compliant. Remember all important dates and make all necessary payments on time.

California - LLC

Learn the Benefits of Creating an LLC

There are many ts to setting up your business as an LLC. LLCs not only have more taxoptions, but they also offer decreased liability, reduced record keeping, and sharing of profits. They are simpler to set up and maintain, with much simpler rules and regulations. There is decidedly less registration paperwork and lower-costing startup expenses

But is an LLC the right business structure for you? Some business types come with suggested business structures. For instance, many small business lawyers recommend you create an LLC for an e-commerce business. Why? With e-commerce businesses, products fall under product liability statutes. This means that anyone involved in the sale and distribution of the product could be held liable—even if the problem lies with the manufacturer. An LLC provides you with limited liability in case you are sued by creating a separate and distinct legal entity and isolating business assets from your assets. Therefore, compensation can only be taken from the LLC’s assets, not your personal assets

Why is an LLC a good idea for an e-commerce Business?

If there is an issue with a product, an LLC protects you. Compensation can only be taken from the LLC’s assets, not your personal assets.

Start Your LLC Now

Besides protecting you and your assets, creating an LLC provides a business owner with more options for federal tax purposes.

- For instance, if an LLC has only one owner, it’s referred to as a single-member LLC or SMLLC. Owners have the option of being taxed as a Sole Proprietorship, an S Corporation, or a C Corporation.

- If an LLC has more than one owner, it’s categorized as a multiple-member LLC. Owners have the option of being taxed as a partnership, an S corporation, or a C corporation

All LLC members will need to pay federal and California income tax plus federal self-employment tax on their share of the profits. Self-employment tax covers the Medicare and Social Security contributions that are not withheld from their paycheck. An advantage to having a CA LLC with multiple members is that the members decide how to report profits and losses for tax purposes and have several options as to how they prefer to be taxed (for example, an S or C corp or a partnership).

For federal tax purposes, if you’re the sole member of an LLC, your business is treated as a disregarded entity. This means that although you and your business are separate entities, the SMLLC’s income and expenses are reported on the owner’s personal tax return rather than an SMLLC tax return, and the IRS ignores the SMLLC’s status as a business entity. However, for purposes of employment tax and certain excise taxes, an SMLLC is still considered a separate entity.

In contrast, a corporation only has two choices: S corporation or C corporation. A business operated as a sole proprietorship or a partnership also doesn’t have an option as to how it will be taxed.

LLCs have one significant disadvantage. The IRS and the State of California’s Franchise Tax Board consider LLC members as self-employed. As a result, they each must pay the self-employment tax contributions towards Medicare and Social Security. The entire net income of the LLC is subject to this tax. Despite this disadvantage, creating an LLC for your startup business is usually recommended. It is well worth it to protect your personal assets and simplify the process of starting a business.

Easiest way to form your California LLC online

Learn the Benefits of Creating an LLC

Forming a Limited Liability Company (LLC) is the easiest and most flexible way to start your business in California. An LLC can offer personal asset protection, management flexibility, pass-through taxation, and minimal compliance requirements.

All of these reasons make LLCs a popular choice for people who are starting a business in California.

Assign Member Roles

Now it’s the time to decide whether you will run this business on your own or with another member’s or organization’s assistance, how small or large you intend for your team to be, and which duties each member will have.

- Member-managed LLC - These may consist of single or multiple members. Each member plays an active role in the management and operation of the business and has the authority to make decisions to bind the LLC. This is ideal if the business is small, has limited resources, and all members have management skills.

- Manager-managed LLC - These may consist of single or multiple members, but members must relinquish the authority to the manager and cannot interfere with the manager's operational decisions. This is ideal if your business is too large or complex to efficiently allow the sharing of management duties among all members, or if some of your members do not have management skills.

Member-managed LLC

All members can make authoritative decisions.

Works best when:

- business is small

- has limited resources

- all members are skilled

Member-managed LLC

Only the manager can make authoritative decisions.

Works best when:

- business is too large/complex

- not all members are skilled

If you know your LLC will have employees, you also know that you will have to pay them. Plus, you will need to figure out the amount you should deduct from their wages for tax purposes. Employees will need to fill out a W-4 Form, and you will need to give them pay stubs with their tax information. Before this all gets overwhelming, keep in mind that we offer Payroll, Tax and HR compliance solutions with our partner, ADP. We make it easy to pay your employees, track time, and file taxes effortlessly. Plus, you and your employees can view and update payroll information via an app--accessible anywhere, anytime, backed by 24/7 live customer service support.

Easiest way to form your California LLC online

Assign Member Roles

You need to decide whether you want to run a single-member LLC or a multi-member LLC and what responsibilities each member will have.

You also need to choose an LLC management structure for your business in California. Do you want to run a member-managed LLC where all members will play active roles in business operations and decision-making? Or, do you want to run a manager-managed LLC where only the manager can make authoritative decisions?

Decide on a Registered Agent

Next, figure out who the Registered Agent for the LLC should be. The California Secretary of State requires every LLC in the state to have one. This enables the state to ensure the delivery of legal mail and that court documents can be tracked appropriately. The Registered Agent will also act as the contact point between your LLC and the Secretary of State’s office. Once you assign someone as your Registered Agent, they can receive official correspondence and documents on behalf of your business.

- Possess a physical street address located in California (no P.O. Box address).

- Be available during regular business hours, typically Monday through Friday, 9 am to 5 pm.

Although the most comfortable option for a Registered Agent would be to name yourself, a friend, or a family member, know that this information will be public record. Not only will the information be searchable on the state’s LLC website, it can also be republished on other sites as well. If you work from home and would much rather keep your home address private, this might not be the best choice. An alternative you can look into is hiring a California Registered Agent Service, also known as a Commercial Registered Agent. We offer a Registered Agent Service for a small charge that you can include as an add-on to your shopping cart.

Easiest way to form your California LLC online

Decide on a Registered Agent for Your LLC

The California Secretary of State requires that every LLC in the state has a Registered Agent. This is to ensure that the state can ensure the delivery of all legal mail and track court documents. We can provide one for a small fee.

Submit Your Articles

of Organization

To create an LLC in California, you will also need to register your business by filing the Articles of Organization form with the California Secretary of State. This form includes information such as the LLC's name and address, the registered agent’s information, whether the LLC is run by managers or members, etc. If you also have an Operating Agreement written out, you would include a copy of it with the Articles of Organization while submitting it.

Submitting your Articles of Organization is a requirement. Failure to register will result in monetary penalties as well as other legal issues. In addition, anyone owing money to the business will not be obligated to pay.

If filing on your own, there are usually non-refundable fees that you have to pay with check or money order, additional fees for hand-delivery of forms, and long wait times whether in person or by mail--especially if you’re filing for an LLC during peak season. GovDocFiling can speed up the process for you. We offer an easy online application, expedited pricing, and a free business start-up guide and resources with all filings. You can apply here today.

Once your completed Articles of Organization are accepted, congratulations! Your company now exists as a recognized legal entity that is authorized to conduct business within the State of California.

Easiest way to form your California LLC online

Submit Your Articles of Organization

You need to submit the Articles of Organization (Form LLC-1) that includes details needed to form your LLC in California - your company’s name, address, structure.

Once your submitted Articles of Organization are accepted, your company will be legally ready to operate and do business within the state of California.

Obtain an Employer

Identification Number

To create an LLC in California, you will also need to register your business by filing the Articles of Organization form with the California Secretary of State. This form includes information such as the LLC's name and address, the registered agent’s information, whether the LLC is run by managers or members, etc. If you also have an Operating Agreement written out, you would include a copy of it with the Articles of Organization while submitting it.

To create an LLC in California, you will also need to register your business by filing the Articles of Organization form with the California Secretary of State. This form includes information such as the LLC's name and address, the registered agent’s information, whether the LLC is run by managers or members, etc. If you also have an Operating Agreement written out, you would include a copy of it with the Articles of Organization while submitting it.

Submitting your Articles of Organization is a requirement. Failure to register will result in monetary penalties as well as other legal issues. In addition, anyone owing money to the business will not be obligated to pay.

If filing on your own, there are usually non-refundable fees that you have to pay with check or money order, additional fees for hand-delivery of forms, and long wait times whether in person or by mail--especially if you’re filing for an LLC during peak season. GovDocFiling can speed up the process for you. We offer an easy online application, expedited pricing, and a free business start-up guide and resources with all filings. You can apply here today.

Once your completed Articles of Organization are accepted, congratulations! Your company now exists as a recognized legal entity that is authorized to conduct business within the State of California.

Easiest way to form your California LLC online

Obtain an Employer Identification Number (EIN)

The Federal Employer Identification Number (EIN) is a 9-digit number assigned to LLCs and other kinds of businesses for tax filing and other operational purposes. Obtaining an EIN is extremely important for paying taxes, hiring employees, and even opening a bank account for your LLC.

Fill Out an Operating

Agreement

Once you’ve decided on member roles within your LLC, it is time to create a business contract that holds members to their assigned responsibilities. An LLC Operating Agreement is a legal document that determines the financial and working relationships among business owners, members, and managers. Member duties would be explained and “what if” scenarios would be covered (such as what happens if a member leaves the LLC).

While it is not one of the California LLC requirements to have an Operating Agreement it is still a good idea to have one. You may be buried with California LLC paperwork, but form is important to have in order to protect your business. You can have a lawyer look over your Operating Agreement prior to submitting it. Get the legal advice you need to protect yourself with our partner Rocket Lawyer. Your company is responsible for maintaining copies of the Operating Agreement.

Easiest way to form your California LLC online

Create an LLC Operating Agreement

This is the foundational backbone of a new business. An LLC Operating Agreement is a necessary legal document that determines the financial and working relationships among owners, managers, and other members.

Familiarize Yourself with the

State’s Taxes and Licenses

The State of California requires all LLCs to pay an annual Franchise Tax of a minimum of $800 (whether or not your LLC had any activity or revenue that year). This payment is not income tax, but rather the price every LLC must pay each year as the cost of doing business in California. Keep in mind that the first payment is due three and a half months after your LLC is approved--which means if your LLC is approved on March 1, your Franchise Tax fee is due on June 15.

Plus, there is an LLC fee, which increases as the LLC’s revenue goes up. There are a few exceptions, such as when an LLC chooses to be taxed as an S corporation. Brush up on CA’s taxes so that you knowledgeable about all fees that you may be required to pay.

In addition, there may be extra fees for certain insurances, permits, and licenses. For example, you may need worker’s compensation insurance or a building permit, depending on the state’s laws and the type of business you own. Find out the requirements for LLCs in the state you plan to run your business in. Keep in mind that different cities or counties may require certain permits and licenses that other regions do not. Contact your city or county to see if there are any insurances, permits, or licenses you might need to obtain before you begin operating your business.

Easiest way to form your California LLC online

Familiarize Yourself with California Taxes & Licenses

The State of California needs all LLCs to pay an annual Franchise tax of a minimum of $800 for doing business in California. Your first tax is due three and a half months after your LLC is approved.

Submit Your Statement

of Information

The State of California requires all LLCs to file a report called a Statement of Information. While most states require an annual report, to be submitted annually, it is different for California. The Statement of Information form must be submitted within 90 days of your LLC being approved, and then every 2 years for the lifetime of your LLC.

This particular form is intended to keep your California LLC’s contact information current with the Secretary of State. You can file the report online at the Secretary of State website. It asks some information on your LLC, particularly regarding any necessary updates that were made during the past year. Keep in mind that all of the information you put on the form is accessible to the public on the Secretary of State’s website.

The report can be rather complex– sometimes requiring the deciphering of gross receipts, dividends, interest, losses etc.–and you should seek the help of an accountant to ensure that it is filled out properly. Our partner, Bench, will provide you with a team of accountants to help you with your franchise tax reports, as well as general bookkeeping services with monthly financial statements and intuitive software to monitor your business profits and expenses. But it’s not over yet.

Easiest way to form your California LLC online

Submit Your Statement of Information

The state of California requires all LLCs to file a Statement of Information form within 90 days of your LLC formation and then every two years thereafter. This is to ensure that your California LLC’s contact information is up-to-date with the Secretary of State.

Raise Funds for Your LLC

You can’t start a business with zero capital. There are legal fees, document filing fees, taxes, employees to pay if you are not an SMLLC, as well as the costs of operating a business. Some of the most commonly-used options for obtaining funding for your LLC are:

- Personal savings and assets

- Informal loans from family and friends

- Peer-to-peer lending sites or crowdfunding

- Conventional bank loan

- Short-term credit card loans

- Government-sponsored grants/loan programs

- Adding LLC owners

Personal Saving/Assets

Use your own savings, liquidate your assets, refinance your home, borrow your Roth IRA, etc.

Informal Loans From Family/Friends

Ask friends or family members if they would be willing to invest in your business.

Peer-to-Peer Landing Sites

LLC members might contribute different proportions of capital and sweat equity, and they must determine for themselves what percentage of the profits/losses goes to whom.

Conventional Bank Loan

LLC members might contribute different proportions of capital and sweat equity, and they must determine for themselves what percentage of the profits/losses goes to whom.

Many new LLC owners begin with their savings to fund their new business venture. If your savings are not enough, you may need to look into liquidating your personal assets or use them as collateral for loans. Can you sell your property or refinance your home? Do you have a retirement account such as a Traditional or Roth IRA? Usually, you can withdraw contributions you made to your IRA anytime, tax- and penalty-free, but that is not always the case. Find out what kind of fees your particular retirement plan will hit you with before using your IRA to fund your business.

Next, look into whether you know someone who shares your passion for your business and has the ability to contribute financially to your dream. These personal connections may want to support your startup idea. Although accepting an informal loan from a close friend or relative may feel safe, you should still protect yourself in case your relationship with the friend or family member goes sour. Have an official contract drawn up that all parties agree to. You can choose to have it notarized and have witnesses present for extra protection.

If you prefer not to borrow from friends and family, you can turn to a peer-to-peer (P2P) or social lending website. A P2P site is a place where investors seek out alternative opportunities to invest outside of stocks and bonds. You can apply for a loan and investors can decide whether or not they wish to fund your proposed business through interest-based loans. You can also look into crowdfunding, which is a way for small businesses or startups to raise money online through donations. These options typically require the ability to promote your business well, ensure complete transparency of where the funds go, and sometimes, the possibility of giving up ownership of a piece of your business. Make sure you look into all of the specifics.