Texas has the second-biggest economy in the US (worth $1.88 trillion), behind only California.

It also has the best growth prospects, which makes it a favorable state for doing business.

Want to learn how to incorporate in Texas?

In this post, you will find everything you need to know about how to incorporate a business in Texas.

The process of forming a Texas corporation, an LLC, or any other business entity in the state involves a variety of steps.

These include choosing a business name, state and federal filing, obtaining the Certificate of Formation, and getting your business up and running.

Let’s go through the process of forming a legal business entity in the state of Texas. We’ll also tell you how our Texas incorporation service packages can help you along the way.

The Step-by-Step Guide for Entrepreneurs Who Want to Incorporate in Texas

Assuming that you’ve already worked on your business idea, planning, and funding, let’s take a look at the steps you need to follow to incorporate in Texas.

Step 1: Choose a Business Structure to Incorporate in Texas

To incorporate in Texas, you first need to decide on a business structure.

You can choose from multiple business structures including a Limited Liability Company (LLC), a Partnership, and a Corporation.

The choice totally depends on how you want to operate your business in Texas.

Here’s what different business entities have to offer:

Limited Liability Company (LLC)

A Texas LLC is a business structure used commonly by small business owners due to the flexibility it offers.

An LLC can have one or more members, including individuals, a Texas Corporation, another Texas LLC, and foreign entities.

What are the features of an LLC in Texas?

1. Tax options

The IRS gives LLCs the flexibility to choose how they’ll be taxed.

An LLC with one member is taxed as a Sole Proprietorship while an LLC with two members or more is taxed as a Partnership unless members, in either case, choose to be taxed as an S-Corporation or a C-Corporation.

2. Limited liability

The members of an LLC, also known as owners, are not held liable for the debts incurred by the business or any lawsuits related to the business.

Members get more asset protection than owners of partnership and sole proprietorship businesses. Their personal bank accounts, real estate, and other assets cannot be seized in case of bankruptcy.

3. Low registration costs

It costs $300 to file a certificate of formation for an LLC, which is lower than that of a Limited Partnership and a Limited Liability Partnership.

The filing fees of a Limited Partnership is $750 and it costs $200 per partner to file for a Limited Liability Partnership.

4. Flexibility in profit sharing

The profit distribution of an LLC is quite flexible.

Members can decide to use a profit allocation method that does not depend on ownership interest. The members need to document the profit distribution method they decide to use on the LLC’s operating agreement.

5. Few restrictions

When it comes to membership, LLCs have no upper limit.

The only exception is an LLC that chooses to be taxed as an S-corporation. In this case, the LLC cannot have more than 100 members.

LLCs can even have one member, which is known as a single-member LLC.

Partnership

A Partnership refers to an incorporated business where two or more owners contribute their time, money, and resources before sharing the company’s profits and losses.

There are three types of partnerships, each with its set of advantages:

General Partnership

This is where two or more people collaborate to do business under a partnership agreement. All partners in a General Partnership have unlimited liability for the company’s financial obligations

There is no registration requirement for a Texas General Partnership and the agreement doesn’t need to be in writing either. It’s quite easy to incorporate.

Limited Partnership

This is where two or more people decide to do business together. In this case, one or more of the partners are general partners and one or more are limited partners.

The general partners are responsible for the management of the business and the company’s financial obligations.

The limited partners only provide capital. They are not liable for debts that exceed their investment in the business.

Limited Liability Partnership

In a Limited Liability Partnership, every partner’s liability is limited to the amount they invest in the partnership.

There is more balance with management control. The assets of all the partners of a limited liability partnership are protected from debts and business lawsuits that exceed their investment.

Partnerships are easy to incorporate and they are relatively affordable business entities.

Corporation

A Texas Corporation, also known as a corp, is the most common type of incorporated business structure.

Forming a Texas Corporation offers infinite growth potential due to its investment-friendly structure, the option to have multiple stakeholders, and stock selling provisions.

Shareholders own the Texas corporation and have limited liability. Their assets are protected from lawsuits, debts, and liabilities of the business.

However, forming a Texas Corporation involves more legal requirements and paperwork.

There are two forms of Texas Corporations, C-Corporations, and S-Corporations.

C-Corporation

This is the most common form of Texas Corporation and operates under the default IRS rules.

The owners in these Corporations pay double tax as a result of the taxation of the business’s profits and later when shareholders receive dividends, it’s taxed again as an income.

C-Corporations have the following features:

- Flexibility to have an unlimited number of investors from the sale of stocks and bonds

- Ownership can be transferred easily through the sale of stocks and bonds

- The Texas Corporation remains operational even after the death of the owners

- There’s no restriction on who can hold shares

S-Corporation

An S-Corporation is basically a C-Corporation with a better tax structure. The profits of the Texas Corporation are not taxed at the corporate level. They’re passed through to shareholders, where they report this income on their individual tax returns

S-Corporations have the following features:

- The Texas Corporation has a perpetual lifetime

- The owners get tax-free benefits

- Only one class of stock is allowed for S-Corporations

- An S-Corporation must have 100 shareholders or less

Want to explore other business entity types? Click here.

If you’re not sure about the type of business entity that will be the best for you, you can fill out our simple entity selection survey to make a decision.

This will help you incorporate a business entity that suits your flexibility, taxation, and profit-sharing requirements.

Step 2: Choose a Name for Your Business

The next step to incorporate in Texas is to select a unique business name. The name you choose should not be too similar to the names of businesses registered with the Texas Secretary of State.

It should contain the words “limited” “company,” “incorporated,” or “corporation”, depending on the business structure you choose. You can also use an abbreviated form of these names.

Brainstorm to come up with at least 4 to 5 potential names that are creative and relate to your niche. Make sure they are easy to read, pronounce, understand, and recall.

Remember, your Texas business name can’t imply a false or illegal purpose else the Texas Secretary of State is not likely to approve it. It should not be offensive as well.

To ensure that your business name is unique and has not been registered already, you should search the web for potential names. Search for misspellings, plurals, variations of spelling, and sound-alikes of your selected names.

Also, conduct a trademark search with the U.S. Patent and Trademark Office (USPTO). If your chosen business name is available, you can apply for a trademark.

Last but not the least, you should look for domain name availability as you’ll be developing a business website sooner or later.

Finding and registering a domain is an important step when you want to incorporate in Texas. You’ll avoid problems with taking your business online at later stages.

If you find a name and would like to preserve it first, you must file a Name Preservation form with the Texas Secretary of State.

You’ll have your name preserved for 120 days at a filing fee of $40, so incorporate your business within that time period.

Step 3: Register Your Business in the State of Texas

Now that you have chosen a business structure and name, you need to register your business.

Each U.S. state has its own requirements for business formation and registration.

Let’s take a look at what you need to do to incorporate in Texas.

Establish a Board of Directors

Select the people who will serve on your company’s board of directors. When you incorporate in Texas, you get a bit of flexibility when establishing a board of directors.

- Directors can be from any state, they don’t need to be residents of Texas

- The minimum number of people that can be on your board of directors is one

- The directors don’t need to be shareholders

Get a Registered Agent Service Provider

Although finding a Registered Agent for your business is a requirement to incorporate in Texas, it also facilitates a smooth process.

The Registered Agent will be the point of contact between your company and the Texas Secretary of State’s office.

They’ll be responsible for receiving government correspondence, service of process, and other corporate records and formation documents on behalf of your business.

Your registered agent must be:

- An entity registered to do business in Texas or a resident of the state who is 18 years and above

- Ready to give consent to give professional service as your Registered Agent, either in written or electronic form

- Available during business hours at their official address

They must also have a physical street address in Texas as they’ll receive all important legal documents on behalf of your business.

Obtain a Blank Certificate of Formation (Articles of Incorporation)

The next step to incorporate in Texas is to file the Certificate of Formation, also known as Articles of Incorporation. You’ll file with the Texas Secretary of State and pay state filing fees.

A blank Certificate of Formation is available on the Texas Secretary of State’s website. You need to download, print, fill out, and submit it to incorporate your business.

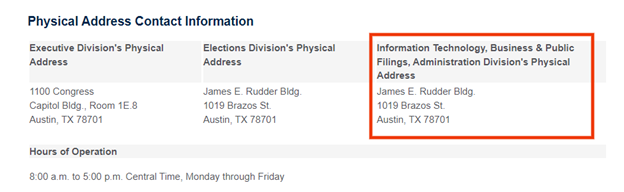

You can also have your representative pick the Certificate of Formation at the Texas Secretary of State’s office. Their physical address is provided on the website.

Image via Texas Secretary of State Website

Fill Out the Certificate of Formation

Before you can file your Certificate of Formation, you will have to fill out a form to ensure compliance with the state’s business formation laws.

Here are some of the details you’ll need to fill in:

- Company name and registered address

- Name and address of your registered agent

- Names and addresses of the company’s directors

- Purpose of forming the business

- Mailing address – post office box or street address where you’ll receive tax information and correspondence concerning the entity

- Name and address of the organizer who is also responsible for signing the Certificate of Formation

File the Certificate of Formation

It may take up to 2-3 business days to process the paperwork for online state filing of the certificate of formation and 3-5 business days for mail filings.

It may take a longer time if you’ve decided to incorporate in Texas during peak times.

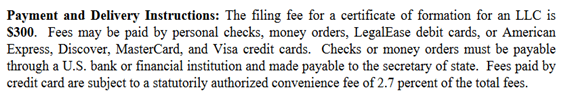

The Texas state fees for a Certificate of Formation is $300. There are plenty of payment options available to make the payment.

Image via Texas Secretary of State Website

Many Texas incorporation service providers also charge extra for expedited processing of your Certificate of Formation application. The good news is — GovDocFiling does not.

If you’re submitting your Certificate of Formation documents using mail, send it to P.O. Box 13697, Austin, Texas 78711-369.

If it’s by courier, address it to James Earl Rudder Office Building, 1019 Brazos, Austin, Texas 7870. Submit it in duplicate.

You’ll get confirmation of filing from the secretary of state and a file-stamped duplicate.

Once your Certificate of Formation application is accepted, you can operate as a recognized legal entity and conduct business within the state of Texas.

Step 4: Form a Company Agreement and Corporate Bylaws

If you’re incorporating an LLC, you need to fill out an LLC Operating Agreement in Texas to determine the financial and working relationships among your LLC owners, managers, and other members.

An LLC Operating Agreement is not a mandatory requirement to incorporate in Texas, but it makes running the company easier.

It creates a basis for creating company procedures and policies.

The LLC Operating Agreement regulates internal affairs of the business, such as how members and managers of the company relate.

Here are some issues the agreement should address:

- Basic information, such as the registered name of the company, DBA names, company address, and details of your Registered Agent

- The management structure and the roles of each member

- Percent of ownership or how profits will be distributed

- How future investors should be treated

- Criteria you’ll use to make decisions

- How ownership interests of members who leave will be treated

- Steps for dissolving the business

- A non-compete clause that bars members from competing with the business of the LLC

Similarly, you need to draft your Corporate Bylaws if you are forming a corporation in Texas.

Corporate bylaws indicate the procedures management must follow in controlling the day-to-day operations of the company. These are also important if you want to incorporate and run a successful business.

They set internal rules and procedures for the functioning of your corporation to ensure that employees, shareholders, and executives know how the business will operate.

Here are a few things that should be included:

- Details of the Corporation, such as company name, whether it’s a public or private company, and so on

- Names and addresses of the board of directors

- Statement of purpose – why you are in business, who are your target customers, what makes your company different from competitors, your plan to reach your business’s goals, etc.

- Procedure for adding new members

- How to elect the board of directors, their qualifications, and the duration of their terms

- How to hold annual and special meetings and quorum needed to take a vote

- How to issue stock certificates, the number of shares each member will receive, and so on

- Indemnification of directors from liability that may result from their exposure due to their association with your business

- The requirement for directors to disclose conflicts of interest, both actual and potential

- Procedure for amending the corporate bylaws

Having corporate bylaws proves to banks, creditors, and the IRS that your company is legitimate.

Step 5: Obtain a Federal Employer Identification Number (EIN)

If you want to incorporate in Texas, you need to meet the federal tax requirements.

You must file with the IRS for a Federal Employer Identification Number (EIN). It’s a unique nine-digit Tax ID assigned to businesses for tax filing and reporting purposes. It is like a Social Security Number for your company.

If you’re incorporating a Texas corporation or an LLC, it’s essential to obtain an EIN.

You can quickly apply for your federal EIN/Tax ID in Texas with us to benefit from expedited filing time without any additional costs.

Step 6: Fulfill Texas’ Annual Tax Requirements, Permits, and Other Requirements

Once you incorporate in Texas, you can start operating your business within the state. However, don’t forget to also fulfill the ongoing legal requirements to remain relevant.

Both LLCs and Corporations in Texas need to file an annual Franchise Tax Report. It’s filed by May 15th.

In addition, you may have to pay extra fees for certain insurance, permits, and licenses.

Some common business licenses and permits that limited liability companies and corporations in Texas may need to apply for include:

- Sales Permit

- Building Permit

- Business License

- Health Permit

- Occupational Permit

- Zoning Permit

However, the profits of an LLC are not taxed at a business level in Texas, unlike those of corporations.

Texas’ LLC tax requirements include self-employment tax on business profits, Federal income tax on profits minus expenses, and the payroll tax for employers and employees.

Step 7: Operate Your Business and Stay Compliant With Texas Law

Once you incorporate in Texas, having completed all initial legal formalities, you can start operating your business.

You should also build a business website to mark your presence online, attract more clients, and generate more leads, sales, and revenue.

Make sure that your business remains compliant with Texas law. Remember to file all necessary reports appropriately and pay taxes on time.

You can also hire the services of an accountant or a tax professional for bookkeeping. They’ll help you with keeping other corporate records as well.

FAQs

1. How much does it cost to incorporate in Texas?

Once you pick a name for your business, you can reserve it for 120 days at a filing fee of $40. Filing your Certificate of Formation will cost you $300.

2. Is it possible to use a company incorporation service?

Yes. If you have a business you want to incorporate in Texas using company incorporation services can help you avoid errors, omissions, and bad decisions that could end up being costly for your Texas business in the long run.

A legal professional can help you choose the right business structure and draft operating agreements and other company formation documents to incorporate in Texas.

A registered agent service provider will help you deal with government correspondence, service of process, and other paperwork required to incorporate in Texas.

3. Texas Corporation vs. Texas LLC: Which one should you incorporate in Texas?

If you’re in a dilemma on which business structure, LLC or Corporation, to incorporate in Texas, understanding their differences can make it easier to decide.

The major difference between Texas LLCs and Texas Corporations is in their ownership structure. LLCs are owned by one or more people, partnership firms, other LLCs, or Corporations, while Texas Corporations are owned by shareholders.

Also, an LLC is easier to incorporate in Texas, than it is to incorporate a Corporation.

4. How do I incorporate an S-corporation?

To incorporate in Texas or any other state as an S-corporation you need to have less than 100 shareholders and only one class of stock.

Submit Form 2553 by IRS, signed by all shareholders, to incorporate in Texas as an S-Corporation.

5. Do I need to form corporate bylaws when I incorporate in Texas?

It is not a requirement for businesses to have corporate bylaws in Texas, but having them is a smart idea. They set the rules for your business operations and prove that you’re a legitimate company.

Ready to Incorporate in Texas?

Forming a business corporation in Texas is a time-consuming but simple process. You just need to follow all of these steps properly to incorporate your business.

Take your first step today to incorporate an LLC, a corporation, or any other legal Texas business entity.

A fully compliant Texas incorporation process is an important part of operating your business smoothly within the state.

It may seem daunting at first but there’s nothing to worry about. You can check out our business formation and startup packages that can help make incorporation in Texas easier for you.

With our reliable Texas incorporation service packages, all you need to do is fill out a simple form and leave the rest to us. We’ll manage the boring but important paperwork (state filing and EIN/Tax ID filing) for you.

What are y’all waiting for?

Work on your business idea and take the plunge to incorporate in Texas.

Do you have questions about choosing the right entity to incorporate in Texas? Feel free to get in touch with our experts.