As a budding entrepreneur, you can’t ignore the legal requirements for starting a small business. You need to ensure that you are authorized to conduct business within your state legally and have all the required permits and licenses.

How can you ensure that all paperwork is done right? And what are the other legal components involved in starting a business in the United States?

Let’s discuss all of the legal requirements you need to know about and fulfill to operate your business smoothly.

Which Are the Most Important Legal Aspects of Starting a Small Business?

Let’s take a closer look at everything you need to take care of ‒ state filings, obtaining a federal tax ID number, opening a business bank account, and getting other business licenses and permits.

1. Register Your Business Name

First things first, the most important legal requirement for starting a small business is thinking of a relevant and unique business name for your startup and registering it. It’s the first thing on the startup checklist.

Registering your business name is not only one of the main legal requirements, but it’s important to ensure that others don’t copy it.

How can you register your business name and where?

There are several ways you can register and protect your business name legally.

Register an Entity Name

If you form a legal entity such as a Limited Liability Company (LLC) or Corporation, you need to register the entity name with the Secretary of the State’s office.

The entity name protects your business’s name at the state level. Once registered, the State won’t allow another business to register under the same name.

Register a Trademark

A trademark protects your small business at the federal level to prevent others from using your business name.

Trademark registration is not a legal requirement to operate a small business. However, it gives you nationwide exclusivity rights to use your name in relation to the goods or services you’ve identified in the trademark registration.

You can register your trademark through the US Patent and Trademark Office.

A Domain Name

Domain name registration protects your small business’s presence online.

It helps you take your business online with a web address no one else can use as long as you continue to use it.

Once you’ve registered your small business, you can buy it from a domain name registrar. The Internet Corporation for Assigned Names and Numbers (ICANN) has a directory of reliable registrars you can use. A few examples are GoDaddy, Domain.com, and Bluehost.

Do Business As (DBA)

Registering a DBA or trade name doesn’t provide any legal protection, but some states require you to register a DBA if you wish to run your small business under another name.

The big difference — multiple businesses can register the same DBA.

A trade name makes it possible to operate your small business under an identity that’s different from your entity name.

Registering a name is only one of the legal requirements you need to fulfill to register your business as a legal entity. The next requirement is to choose a business structure.

2. Form a Legal Business Entity

As a novice, you may want to know: Which is the best business structure?

The truth is: There is no definitive answer to this question.

The best legal entity for your business depends on your industry, business ownership, investment sources, taxation and profit-sharing preferences, and other operational needs.

However, the most common legal business entities that most entrepreneurs choose to form are:

- LLCs (limited liability companies)

- Partnerships

- Corporations

Let’s see what each entity provides.

Limited Liability Companies (LLC)

Forming an LLC protects you from personal liability. It means that creditors can’t go after your personal assets such as your home and personal bank accounts to recover business losses and liabilities.

You need to file Articles of Organization with the Secretary of State to form an LLC. Additionally, you need to create an LLC Operating Agreement to avoid disputes at a later stage.

An easier way to create an LLC is to fill out our LLC formation application online.

Advantages of LLCs

- An LLC offers a flexible management structure

- It comes with pass-through taxation

- Its formation is easy with minimal compliance requirements, compared to Corporations

Partnership

A partnership is also a simple business structure that is as simple as a Sole Proprietorship. It’s where two or more people decide to operate a business as co-owners.

The partnership can be a limited partnership (LP) or limited liability partnership (LLP).

In a limited partnership, one of the partners has unlimited personal liability while the rest have limited liability.

The partner with unlimited liability has full legal responsibility for the business’s debts and liabilities. They also have more control over the business than the partners with limited liability.

If you and your business partners all want liability protection, you can go for a limited liability partnership.

A partnership formation is uncomplicated. Like a Sole Proprietorship, it’s not a separate legal entity.

However, you are legally required to apply for an EIN. It’s also important—not mandatory—to hire legal services to create a partnership agreement. The agreement prevents misunderstandings between you and your partners.

Advantages of Partnerships

- It’s less formal than other business structures and has fewer legal obligations.

- Partnerships have more privacy. You don’t have to disclose your profits to the public.

- Each partner files the business’s profits or losses in their individual personal income tax returns

Corporations

A Corporation is more complicated to form and requires more legal documentation. However, it’s often easier to find investors for a corporation as you can offer stocks in your firm to multiple people.

The legal requirements to form a Corporation involve filing Articles of Incorporation with the Secretary of State. You need to create Corporate Bylaws to define the financial and functional details of your small business.

Why should you use GovDocFiling’s packages to take care of the legal aspects of your small business?

Because our service and packages are much easier than doing all of the legal paperwork manually. Also, it’s much cheaper than having a lawyer or an accountant file the legal documents for you.

There are two types of Corporations you can form, an S-Corporation or a C-Corporation.

An S-Corporation is where you make a special application on the IRS website to have the profits of the company pass through to the owners’ personal income, avoiding corporate taxes.

By forming an S-Corporation, you avoid the double taxation drawback that Corporations carry.

Without applying for this special consideration, your business remains a C-Corporation. That said, S-Corporations have some restrictions when it comes to the number of shareholders that it can have. An S-Corporation can have a maximum of 100 shareholders. Beyond that, you’d need to go for a C-Corporation.

Advantages of Corporations

- Corporations offer the strongest liability protection

- You can raise capital through the selling of shares

- Corporations have an entirely independent life. When one shareholder leaves, the Corporation continues its operations undisturbed

What else do you need when legally starting your business?

3. Apply for a Federal EIN/Tax ID Number

Not all small businesses are required to have an EIN when they start. However, it’s mandatory to have an EIN number if:

- Your business is a Corporation, multi-member limited liability company, or partnership.

- Your business will hire and pay employees, including Sole Proprietorships and single-member LLCs.

- You intend to have a retirement plan like Keogh or solo 401(K).

- You need to file for bankruptcy.

- You inherit or buy a small business

- You are required to pay excise taxes on goods like tobacco, alcohol, or firearms

You need to obtain the Employer Identification Number (EIN) from the IRS. This is a nine-digit, unique number used for taxation purposes.

Filing for the EIN/Tax ID number with the Internal Revenue Service can be time-consuming and tedious, but you don’t have to worry about it.

Our LLC and corporation formation packages include both federal and state filings for $345. You can check out other inclusions here.

And the best part?

You can also use our tax ID application to obtain the EIN only for $195, (expedited processing included).

4. Acquire the Required Business Permits and Licenses

The legal requirements of starting a small business also include obtaining licenses and permits at both the state and federal government levels.

Start by checking the licenses and permits needed at the state level to operate your small business.

It’ll mainly depend on the industry you work in and the state in which you want to set up your business. For example, starting a trucking business involves vehicle registrations and permits.

Additionally, you should check the requirements at the federal level as well. Any business activity regulated by a federal agency, for instance, requires a federal license.

You may be asked to submit the required documentation and fees to acquire the licenses and permits.

To avoid any legal hassle later, make sure that you have all the required paperwork and permits to operate a business within your state.

Take note of any licenses and permits that need to be renewed periodically, and mark the dates to ensure that you’re always complying with them at all times.

5. Open a Business Bank Account

It is important to open a business bank account for your small business so that you can legally separate your personal and small business finances. This will protect your personal assets from your business debts.

In fact, opening a bank account is one of the legal requirements of starting a small business.

Here are some considerations to make to pick the right bank that’ll help your business scale.

Fees and Interest Rates

Choose a bank that supports local and small businesses by offering lower banking fees and interest rates.

Some common fees banks charge include monthly maintenance fees, wire transfer fees, early termination fees, and overdraft fees.

Banks that support small businesses waive some of these fees if you maintain a specific minimum account balance each year. As a new business owner, this is the kind of bank you want for your small business.

Online banks also tend to have lower fees than traditional banks. This is because they don’t have branches to maintain and office staff to pay.

Introductory Offers

As a small business, you’ll want as many financial perks as you can get your hands on.

Some banks will try to incentivize a new business owner with cash bonuses for the initial deposit or lower fees for running the account.

If you have several choices of banks that’d make a great fit for your small business, there’s nothing wrong with going for the one with the best value proposition.

Account Features and Added Services

What added convenience and support does the bank offer?

A bank account that supports online banking and mobile banking, for instance, provides more convenience. You can monitor your business bank account, move funds between accounts, and pay your bills from any location.

Easy requirements to apply for a business loan and access to a business line of credit can also come in handy in accessing funds as the need arises.

Merchant services will also make it possible to receive credit and debit payments from your customers.

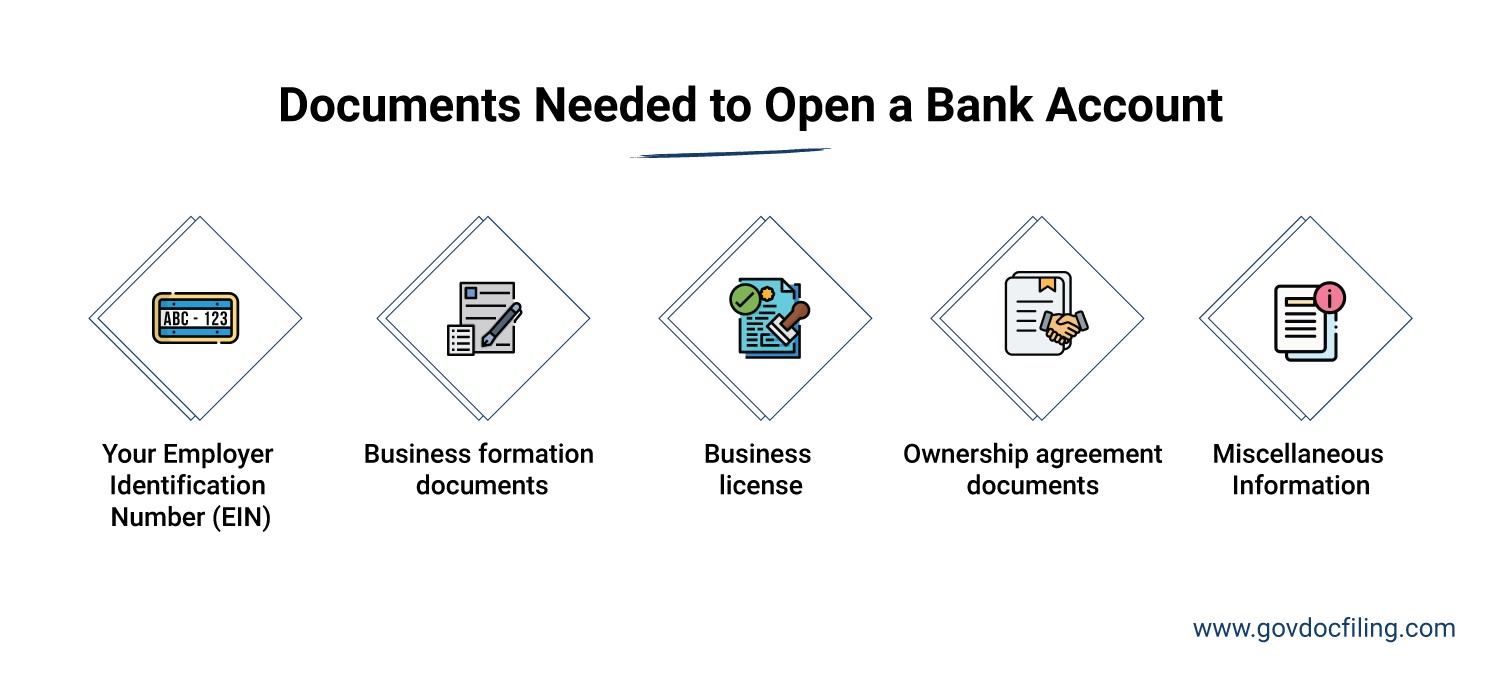

Once you pick the right bank account, you’ll need to submit legal documents and details to open your bank account, including:

- Your Employer Identification Number (EIN)

- Business formation documents

- Business license

- Ownership agreement documents

- Other necessary information, depending on the bank you choose and the state you’re in

6. Protect Your Business with Insurance Plans

Insurance is one of the legal requirements that most small business owners ignore while starting out, but you should not.

Business insurance can help you protect your business’s assets from any untoward incident.

In fact, some types of business insurance such as disability insurance and unemployment insurance are mandatory for doing business.

Additionally, there are many other crucial types of business insurance that can protect your small venture from potential risks.

Some of the most common ones include:

- General liability insurance to protect your business from financial loss, property damage, etc.

- Product liability insurance to protect your business from loss or injuries caused by a defective product

- Commercial property insurance to protect your business from loss or damage to company property caused by a natural disaster or accident

- Professional liability insurance to protect your professional services business against claims initiated by your customers and other legal troubles like negligence

Though buying the above optional insurance covers is not among the essential legal requirements, relevant insurance plans can help protect your business against financial loss.

Pro tip: Before buying any insurance, read all documents carefully to understand which kinds of loss it will cover.

FAQs

1. What are the legal requirements for starting a small business?

Starting a small business requires you to follow the below legal requirements:

- Registering a business name with your local government

- Choosing and forming a legal business structure

- Applying for a tax ID number with the federal government

- Acquiring the necessary business permits and licenses

- Opening a business bank account

- Getting the necessary insurance coverage, such as general liability insurance

2. What is legally a small business?

The U.S. Small Business Administration defines a small business as one with revenue between $1 million and $40 million and an employee count between 100 to about 1,500 employees.

3. Can I run a business without registering?

Yes, you can start a small business without registering. This is possible through the setting up of a Sole Proprietorship or Partnership business entity which have fewer requirements than the rest.

4. How do I register a small business?

Starting a small business legally as an LLC or Corporation requires registering with the state government.

When starting an LLC, you need to file Articles of Organization with the Secretary of State. When starting a Corporation, you need to file Articles of Incorporation with the Secretary of State. There are several other requirements you may have to fulfill too.

5. How do I start my own business at home?

Starting your own small business from home, such as an online business, is possible as long as you meet all the legal requirements.

Once you have a business idea, pick a name and legal structure for your business. You can use GovDocFiling to easily register the business and name and also get a federal tax identification number.

We’ll also help you with the various licenses and permits that your business might need depending on its location and type of operations.

You’ll also need to open a business bank account and get insurance for the business if you’ve got employees.

Are You Ready to Set Up Your Small Business Legally?

Now that you’re aware of the legal requirements of starting a small business, it’s time to set up yours.

GovDocFiling not only makes business formation easier and hassle-free but also offers a comprehensive Business Start Up guide for free with our formation packages. It can help you get your business up and running in no time.

Do you have any questions about the legal requirements for starting a small business? Get in touch with us for help anytime. We’ll be happy to assist you.