“When you’re setting up a small business, you’ll have multiple options for the type of company structure that you can establish. One of the most common ones is a Limited Liability Company (LLC).

What exactly is an LLC and what LLC facts should you know before choosing this entity?

It’s a hybrid company that has features of both Partnerships and Corporations. They have the flow-through taxation feature of partnerships and the limited liability protection of corporations. Additionally, they can have an unlimited number of members who can be individuals, LLCs, or corporations.

These are just some of the many LLC facts that you must know before you choose this business entity.

In this post, we’ll cover more LLC facts, advantages, and disadvantages to help you determine if it’s the right choice for you

LLC Facts: Key Advantages of LLCs

LLCs are inexpensive and easy to form. You can establish them in all 50 states by filing LLC Articles of Organization with the state. The limited liability offered by them means that the members are not personally held liable for debts taken on by the LLC.

The LLC exists as a separate entity, which is why it requires a unique Federal EIN/Tax ID Number from the IRS, as well as the state requirements.

You can also select different types of profit distributions and it doesn’t need to be 50-50. It’s also easy to maintain the company as you don’t need any formal meeting records or resolutions.

Taxation is favorable for LLCs too. Unlike the entities of Corporations or S-Corps, LLCs do not have double taxation, one tax for the entity itself, and again at the individual level. All the income “flows through” to members’ from the company’s personal tax return as an individual. It also provides you with an option to be taxed as an S-Corp

Check out this video to learn more LLC facts and the key benefits of starting an LLC.

Image via YouTube

.

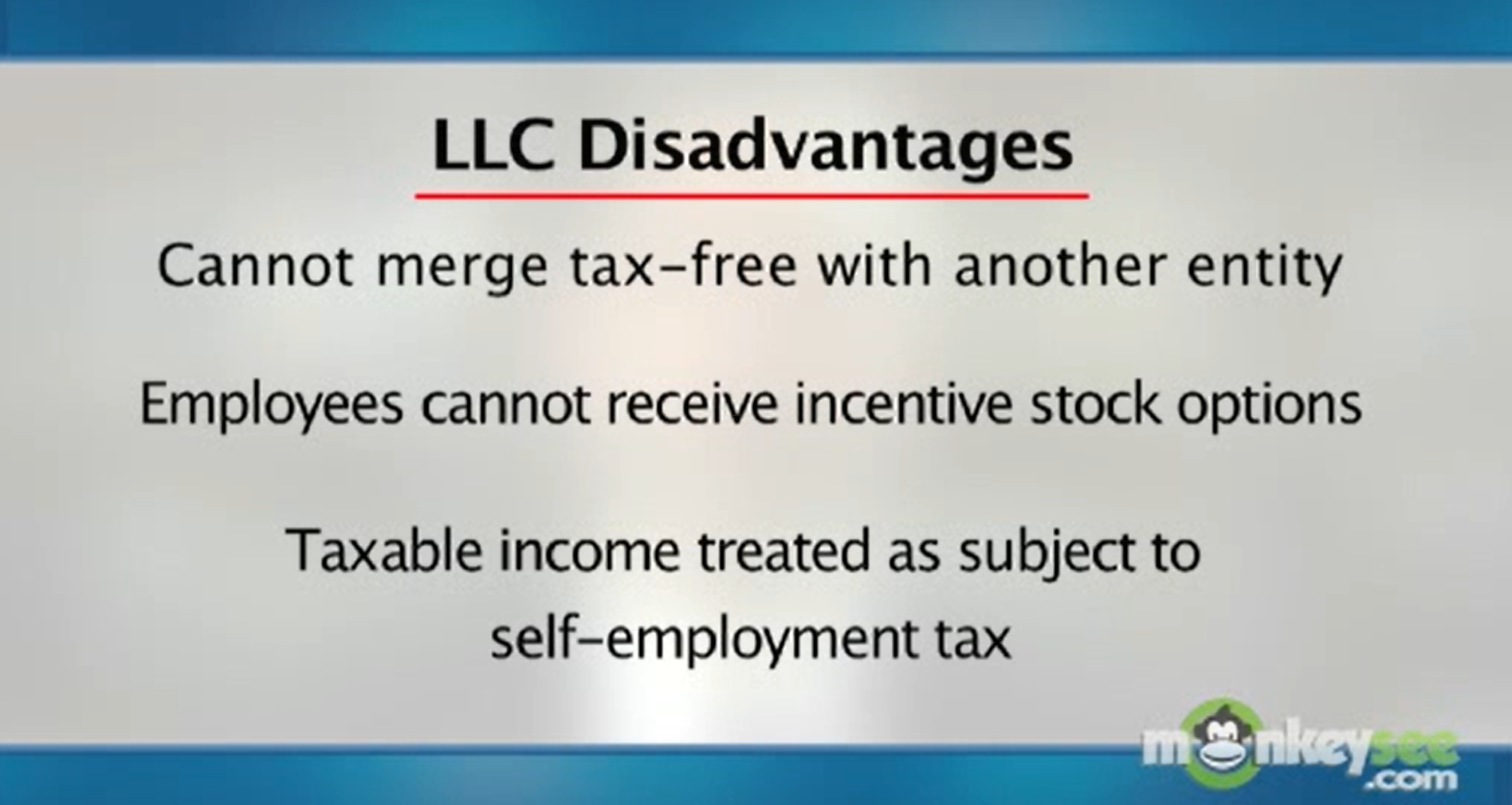

While there are many advantages of LLCs, they do have some disadvantages too.

LLC Facts: Key Disadvantages of LLCs

One disadvantage of LLCs is that they don’t last forever, unlike corporations. When a member dies or the company goes bankrupt, the LLC is dissolved.

While LLCs are easier to form and maintain, it’s simpler to have a sole proprietorship or a partnership firm. This is because LLCs require you to do federal and state-level filings. You also need to pay the state filing fees when you set up your company and every year after that.

Also, if you intend to go public, have investors, or want to issue employee shares, LLCs may not be the best option for you.

Here are some disadvantages of LLCs.

Image Source: Daily Motion

How can you form an LLC? Let’s find out.

How to Form an LLC

To establish an LLC, you need to obtain an LLC EIN Number from the IRS, and file Articles of Organization with the Secretary of State. These filings can be done by you, a lawyer, or a professional filing service like GovDocFiling which is the simplest and most affordable option.

You also need to create an operating agreement and pay the fees for filing the articles. The operating agreement must outline all of the financial and functional decisions of your business.

LLC Facts a Small Business Owner Must Know

When you need to choose a business entity, an LLC is often the most preferred choice.

They are easier to form, have lesser formalities, and offer greater flexibility on the number of owners and management.

Is an LLC the right business entity for you?

We have compiled some essential LLC facts that will help you make an informed decision.

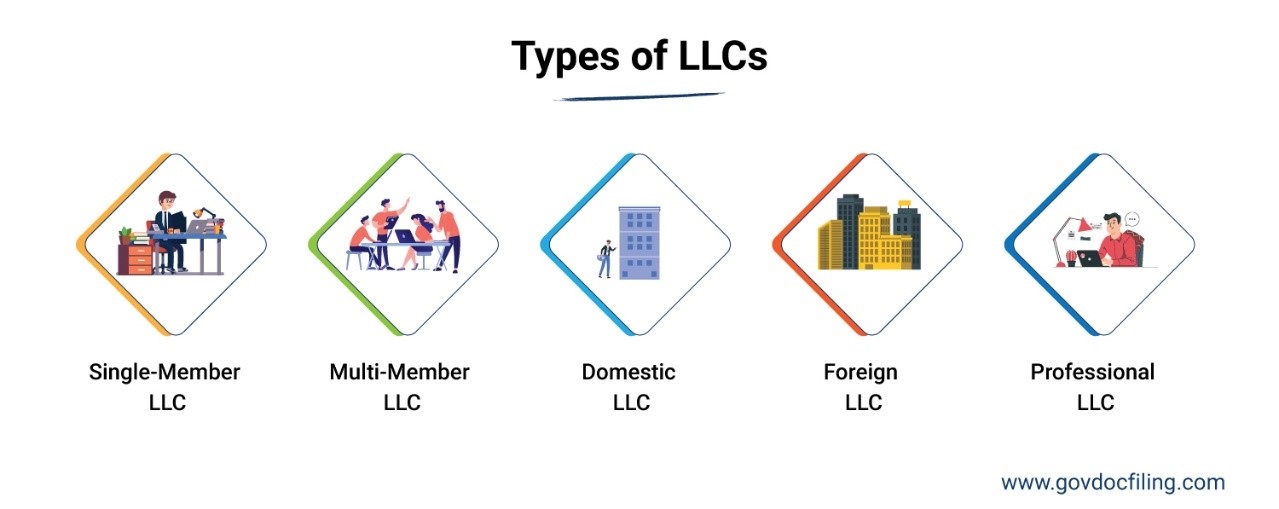

1. LLCs Are of Different Types

One of the facts that most people don’t know about an LLC is that it could be of different types. It basically depends on your business situation. The most common forms of LLC are:

Image Source: GovDocFiling

Let’s discuss each of these briefly.

Single-Member LLC

As the name suggests, a single-member LLC has one owner. Owners are called members in an LLC. The advantages or disadvantages of a single-member LLC are the same as that of LLCs with multiple members.

Multi-Member LLC

When there is more than one member, it is called a multi-member LLC. Although it is a separate legal entity, it is not a separate tax entity. The Internal Revenue Service (IRS) automatically taxes multi-member LLCs as a general partnership.

Domestic LLC

A domestic LLC is a business entity that is formed within its home state. So, it operates in the same state it was formed in. A domestic LLC has to file its Articles of Organization as a Limited Liability Company (LLC).

Foreign LLC

This may be one of those LLC facts that you do not know. An LLC is considered a domestic company in its state of organization. For every other jurisdiction, it is considered a foreign company.

If you want to conduct business in a state other than your state of organization, you will need to register your company as a Foreign LLC.

Professional LLC

Here is a useful LLC fact for people in licensed professions. A professional LLC is one of those business structures that protects the personal assets of business owners in licensed occupations, such as law and medicine.

Professional LLCs offer the same benefits as a regular LLC. The difference is that only professionals recognized in a state through licensing can form one.

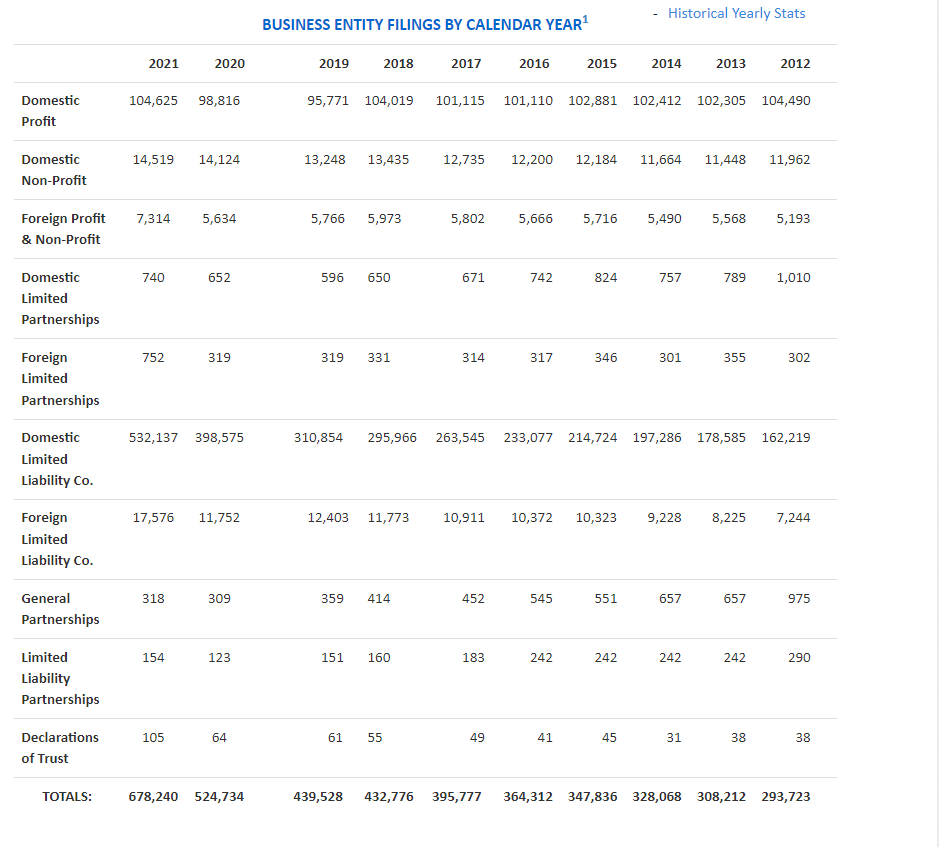

2. LLCs Are Incredibly Popular

Due to the many advantages offered by an LLC, it has become more popular than any other business entity.

The image below shows the business entity filings in Florida for 2021. Limited Liability Companies outnumber other business entities by a huge number.

Image Source: Florida Department of State

The simplicity and flexibility offered by LLCs make them the most preferred business structure out there.

3. It’s Easy to Form

One of the most well-known LLC facts is that it is easy to form an LLC, regardless of the state you live in.

You can form an LLC in any of the states by filing Articles of Organization with the Secretary of State. Of course, the fees and process may differ from state to state, so check your facts before you apply.

There is no restriction on the number of LLC members you can have. You could have one member or many, depending on how you want to structure your business.

One LLC fact you should know before forming one is how important it is to pick a unique name for your business. After all, there can be just one active LLC with the name in a state.

When forming an LLC, we highly recommend creating an LLC operating agreement, to help maintain transparency and avoid disputes.

Here is another one of the LLC facts you should know–compared to corporations, LLCs have fewer compliance requirements. There will also be fewer ongoing and yearly reporting requirements to the Secretary of State.

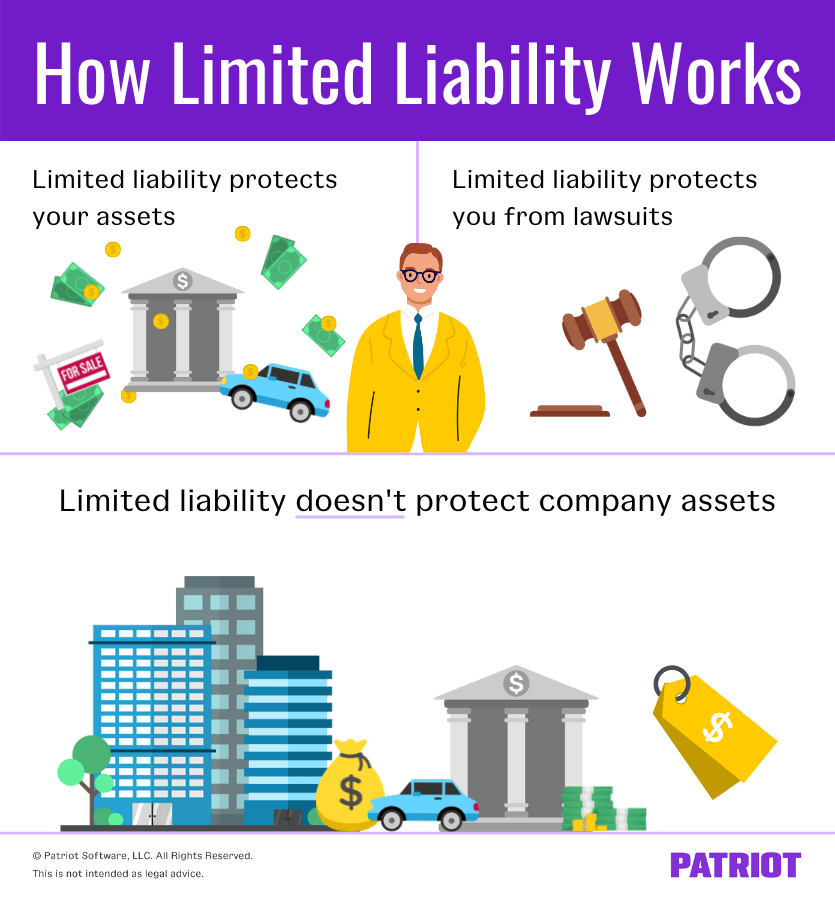

4. Limit Personal Liability

One of the most well-known LLC facts is that the personal assets of members are protected.

As a business owner, you may need to take a loan to keep business operations running smoothly. However, when you have an LLC, you are not personally liable for any business debts.

The term “limited liability” means that the liability of your business is limited to what the LLC’s members have invested in the business. Their assets outside their business are not at stake.

Here’s how limited liability works.

Image Source: Patriot

Another important fact to remember is that limited liability in no way means “no liability.” As a business owner, you will be liable in case of criminal activity, misuse of funds, and fraud.

5. Profit-Sharing is Easy in an LLC

One of the lesser-known LLC facts is that when you own an LLC you can choose different forms of profit distribution. It is not necessary that business profits must be divided equally among all LLC members.

You may share the profits according to the ratio of the investment you have made in the business. For instance, if you have invested 75% in the business and the other member has invested 25%, you can share the profits in the same proportion.

A good idea is to always include how profits and losses will be shared in the LLC’s operating agreement, as shown below.

Image Source: Fit Small Business

6. It Allows Pass-Through Taxation

An important LLC fact you should know as a small business owner is that you need not pay corporate taxes.

What does that mean?

It means that LLC’s profits and losses are passed on to LLC members, who then have to report these earnings on their personal income tax. This is called pass-through taxation.

Image Source: DKC LLP

If an LLC has a single member, the Internal Revenue Service will tax it as a sole proprietorship. For LLCs with more than one member, it will be taxed either as a partnership or a corporation (either C-Corporation or S-Corporation).

FAQs

1. What are the pros and cons of LLC?

The pros of an LLC include:

- Straightforward and simple paperwork

- Offers membership flexibility

- Lower taxes

- Limited personal liability

The cons of an LLC are as follows:

- Costs more to form than a sole proprietorship

- Ownership is harder to transfer than a corporation

- Changes to membership structure may require a refiling of LLC.

2. What are the characteristics of a limited liability company?

The characteristics of a limited liability company are:

- Separate legal existence

- Limited liability

- Simplicity in operation

- Flexibility in taxation

3. Does an LLC protect you?

Yes, having an LLC protects LLC owners from personal liability. By forming an LLC, you establish a legal entity that is separate from its owners. This separation is what provides limited liability protection.

If a limited liability company (LLC) is unable to pay its debts, creditors can go after the business bank accounts and other assets. In such a scenario, the owners’ personal assets are not at risk.

4. What makes an LLC the best business structure for small businesses?

The LLC is the best business structure for e-commerce and other small businesses. That’s because limited liability companies offer asset and liability protection without being subject to double taxation.

5. Are LLC owners subject to self-employment tax?

Self-employment tax is a federal tax levied on the personal income of a self-employed person. An LLC is considered the same entity as its owners for tax purposes. LLC members are not considered employees. That is why LLC owners are required to pay self-employment taxes.

Want to Learn More LLC Facts to Make an Informed Decision?

To learn more about LLCs and how GovDocFiling can help you with them, check out this infographic below.