The U.S. freelance industry has reached an all-time high, with 64 million Americans engaging in freelance work in the past year. This represents 38% of the entire U.S. workforce, marking a significant increase from previous years.

Since 2014, when 53 million Americans were freelancing, an average of 1 million additional people have joined the freelance workforce each year. This trend culminated in a substantial jump of 4 million freelancers from 2022 to 2023.

Now, whether you’re freelancing full-time or doing it part-time to create a side income source, you should consider registering it as a business.

Thinking that you’re not big enough for that yet?

If you’re signing independent work contracts and accepting payments, you’re already big enough. In fact, a freelance LLC would help you take your business to the next level.

The best business formation choice for independent contractors is to form a freelance LLC.

That’s because it will help you:

- Appear more credible and reliable.

- Increase your chances of getting work from large companies with high-value projects.

- Protect your personal assets if someone sues you for issues with your work contracts.

- Potentially save money on business taxes.

Perhaps that’s the reason why new business formation has seen a remarkable surge. Individuals filed nearly 2.7 million applications to start a business in just the first half of 2023, marking a 5 percent increase over the same period in 2022.

It’s time to turn into a business owner. Let’s get started.

Why You Should Form a Freelance LLC for Your Business

Out of all of the legal business entity types, why is a limited liability company (LLC) the best choice for your freelance business?

You should register as a freelance LLC because this entity type has benefits, such as:

1. It is Easy to Set Up

Forming an LLC requires minimal compliance and paperwork when compared to more complex structures like a Corporation.

It’s the least complex to form aside from being a sole proprietor.

In addition, an LLC is not required to have a board of directors and an annual meeting is not mandatory.

2. It Allows You to Get a Business Bank Account

You can open a business bank account to keep your business finances separate from personal finances.

It will make it easier for you to track your business income and keep accurate records of your tax-deductible income.

You can also get a business credit card and use it to pay for business expenses such as paying for work management and productivity software and apps, upgrading your laptop, and buying new furniture for your home office.

3. It Protects Your Personal Assets

Unlike sole proprietorships and general partnerships that do not provide legal protections against business liabilities, the law treats an LLC as a separate legal entity from the business owner.

This means owners cannot be held personally liable for the company’s debts.

When you sign work contracts under your business’ name, an LLC will protect your personal assets from business debts and any lawsuits that occur as a result of your freelance work.

Note that you can lose this corporate shield if you personally guaranteed a debt with your assets.

You can always buy business liability insurance to protect yourself from the worst-case scenarios of doing freelance work.

4. It Gives You More Work Opportunities

Whether you’re designing websites or writing content, having a legally-registered LLC name in place of your own name will make you look more professional in the eyes of your clients.

It can add credibility to your work and help you get business from large companies.

5. It Carries Tax Benefits

As the single owner of an LLC, you will be taxed as a sole proprietorship by default.

This means you’ll report LLC profits and losses on Schedule C and file and submit it with your personal tax returns.

You will also need to pay self-employment taxes (Social Security and Medicare) on your LLC’s net income.

However, you will be entitled to business-related tax deductions, such as travel expenses, home office rent, and equipment costs.

As an LLC owner, you can also opt for corporate taxation.

There are two types of Corporations, C-corporation and S-corporation. S-corps come with tax advantages.

An LLC taxed as a C-corp experiences double taxation in that dividends to shareholders are paid after corporate income tax is deducted, and then the shareholders again pay personal income taxes on the dividends.

An S-corp does not pay corporate taxes.

6. A Freelance LLC Is a Better Choice Than Being a Sole Proprietor

Though becoming a sole proprietor is the simplest way to do business, it might not be the best fit for your overall business needs and goals.

As a sole proprietor, you cannot open a business bank account, build business credit, or protect yourself from lawsuits.

7. It Carries Perpetual Existence

Freelance LLCs are similar to Corporations in the fact that they have perpetual existence.

It continues to exist even after owners die or leave, provided that’s mentioned in the LLC Operating Agreement.

Also Read:

How to Form a Freelance Business LLC

Let’s take a look at the step-by-step process you need to follow to set up your freelance business LLC:

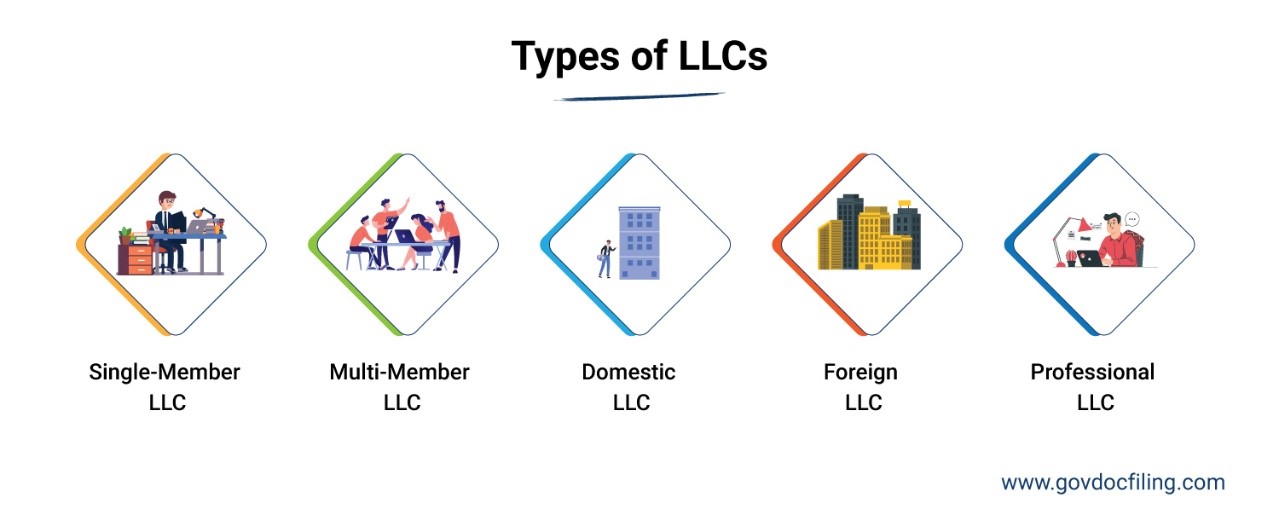

Step 1: Select Your Preferred Freelance LLC

There are plenty of freelance LLC structures you can choose from for your business:

Single-Member Freelance LLC

If you don’t intend to have other freelancers in your LLC, a single-member freelance LLC is the one for you.

A single-member LLC resembles a Sole Proprietorship, but unlike a Sole Proprietorship business structure, you get limited liability and are required to register your business with your state.

Multi-Member Freelance LLC

You can create a multi-member freelance LLC if your business has more than one member.

The members agree to sign an Operating Agreement that outlines the rules and regulations that’ll govern the business.

Additionally, multi-member freelance LLC can be member-managed or manager-managed.

A member-managed setup is where any member can act on behalf of the freelance LLC as long as it’s in adherence to the Operating Agreement.

A manager-managed LLC is where a selected manager handles the day-to-day business decisions of the freelance LLC. If you choose this setup, make it clear in the Operating Agreement.

Why should you consider a multi-member freelance LLC?

- There’s no limit to the number of members you can have

- Members can be U.S or non-U.S. citizens, which is advantageous for a freelance business with clients from around the globe

- You can choose to be taxed as a general partnership or as an S-corporation

Domestic and Foreign Freelance LLC

Domestic LLC is where you register and carry out your business in your home state.

In the case of a foreign freelance LLC, you register and carry out your business in a different state than where it was formed.

You’ll need to have a business address in the state you’re registering your foreign LLC or engage a Registered Agent based in that state.

Why do businesses choose to operate a foreign LLC? To take advantage of the business-friendly laws, lower tax rates and other tax benefits, or cost-effective registration other states may be offering.

If your freelance business niche is not popular in your state, you can also benefit from carrying out business in a state with a larger market for your products or services.

But here’s the thing — you can only register as a foreign LLC if you’re a full-time freelancer in the preferred state. You’ll also need to file Articles of Organization and pay taxes in both states.

Professional Limited Liability Company (PLLC)

If your freelance business involves providing services, such as virtual bookkeeping and legal advice, you need to register as a PLLC.

A freelance PLLC will be similar to any other freelance LLC but is meant for professionals.

Also Read:

- Single-Member LLC vs Multi-Member LLC: The Key Differences

- The Differences Between LLPs and LLCs You Should Know in 2024

Step 2: Pick a Business Name

It goes without saying, you need a business name to register a freelance LLC.

The name you choose for your freelance LLC should be unique and no other business registered in your state should have it. It shouldn’t be the same as a trademarked phrase either.

How can you tell if a name is already taken?

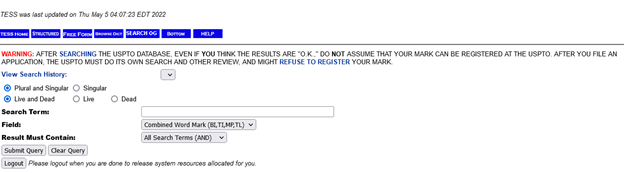

To check if a name has been trademarked, use the U.S. Patent and Trademark Office online database.

Image via U.S. Patent and Trademark Office

Also, check if the name is already registered by another business in your state by doing a search in your local Secretary of State office.

You’ll also need a website for your business. Check if the domain name that matches or represents the name of your freelance LLC is available.

Pick a business name that is:

- Unique and relevant to your freelance business. Try to mention what you do, such as “XYZ Freelance Graphic Designs”

- If you plan to expand your scope in the future, pick a name that’ll accommodate this growth. For instance, instead of “XYZ Copywriting Services LLC”, “XYZ Digital Marketing LLC” leaves room to expand your services to more than copywriting.

- Get a creative and memorable name that is also clear. Use real words. Obscure words will leave your clients wondering what you do.

- Easy to remember and spell

Step 3: Select a Registered Agent

Choose a Registered Agent for your freelance LLC. They’ll be responsible for receiving all legal mail and court documents from the Secretary of State.

This includes documents like:

- Written communication from the Secretary of State

- Service of process documents

- Correspondence from the state and federal government

- Various tax forms

If you have a physical street address (can be your home address) in the state where you want to form an LLC, you can become a Registered Agent yourself.

However, the freelance LLC itself can’t act as its own Registered Agent.

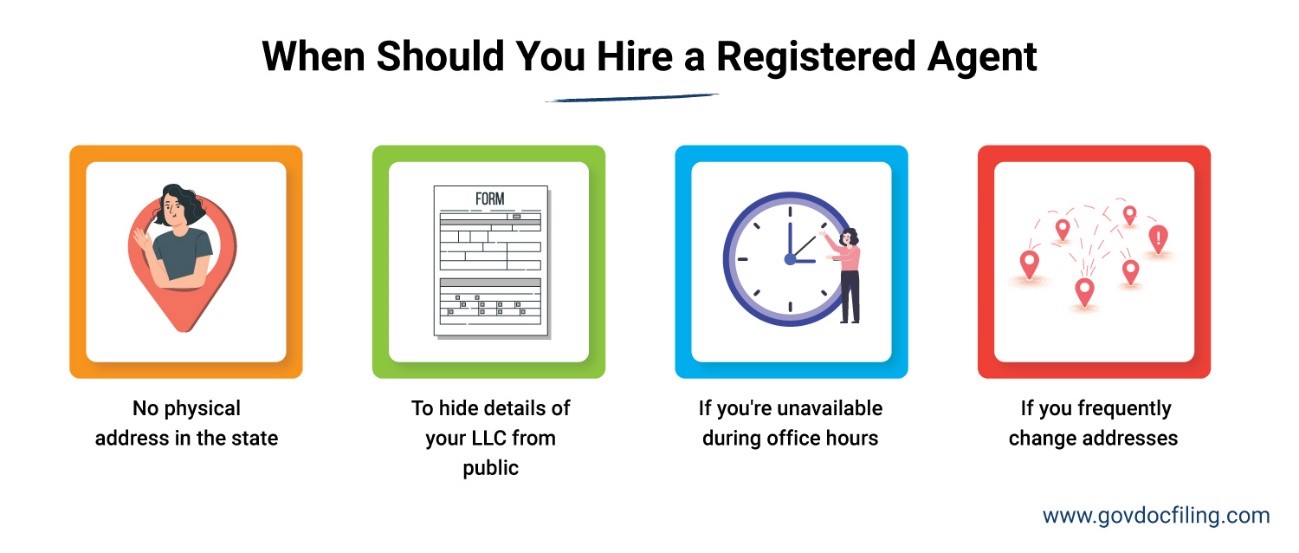

Although being the Registered Agent of your freelance startup is cheaper, there are situations where hiring the services of a Registered Agent is the better option.

- When you don’t have a physical street address in the state you’re registering the freelance LLC

- If you don’t want your name and address to be published on the Secretary of State’s website. Use Registered Agent service if you don’t want your details to be visible to the public

- If you are busy with your online work and are not always available during normal office hours. This could mean you’ll fail to receive and sign for documents

- If you frequently move and change addresses, you’ll need to keep updating your records with the Secretary of State to avoid misdelivery of important correspondence

However, make sure you work with a reputable Registered Agent who has a proven track record of providing reliable services.

Also Read:

- 15 Best Registered Agent Services for Small Businesses

- Best LLC Services: Top 23 Choices for Small Businesses

Step 4: File Articles of Organization

Officially form your freelance LLC by filing the Articles of Organization with the Secretary of State’s office or that of the state agency responsible for business establishments in your state.

There may be specific requirements and procedures regarding filing the Articles of Organization based on your state. You’ll also have to pay a filing fee, which varies between states.

Expect to fill in details, such as:

- The name of your freelance LLC

- Members’ names and addresses

- Business contact information

- Purpose of the freelance LLC

- Name and address of the LLC’s Registered Agent

- Name and address of the individual filing the Articles of Organization

Some states also require that you publish a notice of formation in your local newspaper stating your desire to register an LLC. Be sure to comply.

Once your form is accurately filled, pay the filing fee and submit the form to the state agency.

It can take a week to 10 business days for the Articles of Organization to be processed. Some states will take as little as three days and during periods of heavy filing volume, it can take much longer.

Once your form is approved, you’ll be issued a certificate showing that your freelance LLC is officially registered. The certificate will be of help when setting up business bank accounts, and obtaining a tax ID.

Step 5: Acquire an EIN for Taxation

If your freelance LLC has more than one member, you’ll need to acquire an Employer Identification Number (EIN)/Tax ID from the IRS, even if it doesn’t have any employees.

A one-member freelance LLC is also required to have an EIN if it will have employees or if the owner opts for the business to be taxed as a Corporation. It’s always better to have one.

Getting your tax ID is super easy. If you choose GovDocFiling for your LLC formation, you get an EIN at no extra cost.

Also Read:

- How Do I Prepare My Articles of Organization for my LLC?

- What Are the Benefits to Filing for an EIN As an LLC?

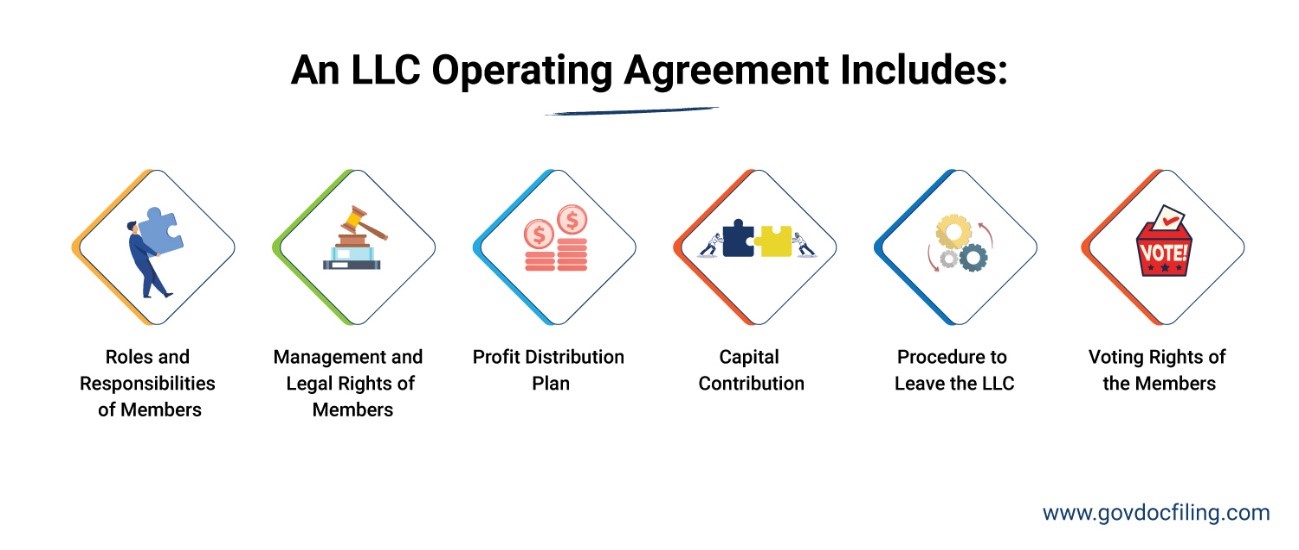

Step 6: Create an LLC Operating Agreement

Creating an Operating Agreement for your freelance LLC business is mandatory, and it makes members aware of their rights and responsibilities.

Both multi-member and single-member LLCs can benefit from drafting an Operating Agreement. This is because it contains all the relevant details that facilitate the smooth running of the LLC.

An LLC Operating Agreement stipulates:

- The roles and responsibilities of each member of your limited liability company.

- Management and legal rights of members of the freelance LLC

- How profits will be distributed among the members of the freelance LLC

- Capital contribution

- Procedure for members who choose to leave the LLC

- Voting rights of members

Wondering where to get started with drafting the Operating Agreement? Get a downloadable and interview-based Operating Agreement as well as legal advice to ensure your agreement incorporates all the critical details of running an LLC.

Step 7: Keep Your Freelance LLC Active and Compliant

You’re now ready to run your freelance business as an LLC owner and start earning money.

It’s important to stay compliant with state and federal laws, especially on matters of tax liability.

Familiarize yourself with state taxes and licensing. Some states require LLCs to file an annual report with the business income, members, and activities.

You may also be required to pay annual state fees also known as reporting fees. However, these requirements vary with state so it’s best to check with your state agency.

Additionally, you should keep track of the corporate tax rate you should use, payroll taxes, and other tax liabilities.

The process of freelance LLC formation may seem daunting at first but don’t worry. Our business formation experts are here to make the process quick, hassle-free, and cost-effective for you.

You just need to fill out one, simplified application and pay $244 as service charges to file for your freelance business LLC with the state and federal governments.

It is cheaper than having an accountant or lawyer form a business for you and easier than doing it yourself.

We also offer expedited application processing at no additional cost.

Also Read:

- What Is Corporate or LLC compliance?

- How Do I Obtain a Certificate of Good Standing to Maintain My LLC?

Taxation for Freelance LLCs

Freelance LLCs are considered “pass-through” entities, meaning the business itself does not pay income tax. Instead, the LLC’s profits and losses are “passed through” to the individual owner(s), who then report them on their personal tax returns.

By default, single-member LLCs are treated as “disregarded entities,” meaning they’re taxed like sole proprietorships. The business income is reported on the owner’s personal tax return using Schedule C.

The owner is responsible for paying self-employment tax, which is currently 15.3% of the LLC’s net income. This covers the contributions to Social Security and Medicare.

If the LLC has multiple members, it is typically taxed as a partnership. In this case, the LLC itself doesn’t pay taxes.

Instead, each member reports their share of income on their personal tax returns. The LLC must file an informational return with the IRS (Form 1065), and each member receives a Schedule K-1 detailing their share of the income or loss.

Freelancers can also elect for their LLC to be taxed as an S-Corporation. This might reduce self-employment tax obligations, but it adds complexity and requires meeting specific IRS criteria.

Regardless of the LLC’s tax classification, eligible business expenses can be deducted from the LLC’s gross income, helping reduce the overall tax burden. Consulting with a tax professional is crucial to ensure compliance and maximize deductions.

Comparing Freelance LLCs to Other Business Structures

To help you make an informed decision about your business structure, let’s compare freelance LLCs to other common business entities: Sole Proprietorships, Partnerships, and S-Corporations.

Freelance LLC vs. Sole Proprietorship

In looking at sole proprietorships vs LLCs, a freelance LLC offers personal liability protection, which a sole proprietorship doesn’t. While both have pass-through taxation, an LLC provides more tax flexibility and can potentially reduce self-employment taxes.

LLCs also tend to appear more professional to clients, which can be beneficial for landing contracts.

Freelance LLC vs. Partnership

Both LLCs and partnerships allow for multiple owners, but LLCs offer personal liability protection that partnerships don’t. LLCs also provide more flexibility in management structure and profit distribution.

For freelancers working with others, an LLC often provides a better balance of protection and flexibility.

Also Read:

- How many people are needed to form an LLC?

- Sole Proprietorship vs Partnership: How Are They Different?

Freelance LLC vs. S-Corporation

Both entities offer personal liability protection and pass-through taxation. However, S-corporations (S-Corps) have more stringent requirements and complex paperwork.

One advantage of starting an S-corporation is the potential for tax savings on self-employment taxes, as owners can pay themselves a reasonable salary and take the rest as distributions.

However, for most freelancers, especially those just starting, an LLC provides a simpler structure with many of the same benefits.

Choosing the Right Structure for Your Freelancing Business

When weighing your options among these business structures, consider factors such as:

- Your personal liability risk

- Tax obligations and potential savings

- Complexity of management and paperwork

- Growth plans for your freelancing business

- Client perception and credibility

For many freelancers, an LLC provides an excellent balance of liability protection, tax benefits, and flexibility. It allows you to separate your personal and business expenses effectively, potentially reducing your tax liability.

Also Read:

- How to Change an LLC to an S-Corp in 3 Simple Steps

- How to Start an S-Corp in 2024: Everything You Need to Know

Challenges of Running a Freelance LLC

Earlier, we explored the benefits or advantages of freelance LLCs. Now, we’ll take a look at some of the challenges you might encounter when you legally establish this business entity.

- Higher Costs: Establishing and maintaining an LLC generally involves more significant costs than a sole proprietorship, including state filing fees, annual report fees, and potential legal expenses.

- Increased Administrative Responsibilities: Running an LLC requires more paperwork, such as filing annual reports, keeping meeting minutes, and maintaining up-to-date records to comply with state regulations.

- Complexity in Management: An LLC’s structure adds layers of complexity, including understanding and adhering to legal and tax obligations, which can be challenging for freelancers unfamiliar with business law.

- Self-Employment Taxes: Depending on the LLC’s tax classification, members may still be required to pay self-employment taxes, reducing potential tax benefits.

Common Mistakes to Avoid When Operating a Freelance LLC

While operating your business as freelance LLC comes with plenty of benefits, there are some mistakes many freelancers make that can have negative implications on the business.

Let’s take a look at them.

1. Commingling Personal and Business Accounts

Your personal and freelance LLC finances shouldn’t mix, or you risk losing the legal distinction between you and the business.

Don’t cash business checks into your personal account or vice-versa. Your business revenue should only go to your business bank account.

Commingling personal and business finances can remove the liability protection an LLC provides against company debts and lawsuits. This could put your personal assets at risk.

2. Failing to Document Your Financial Activity

Always be prepared for an IRS audit.

This means documenting all your financial transactions and keeping an account of all your income and expenses. Investing in bookkeeping services can simplify your work and keep your accounts clean.

3. Failing to Sign Business Documents Using Your Business Title

Using your business title when signing business documents is an indication that you’re signing in your capacity as a business manager and not in a personal capacity.

Doing the latter can make you personally liable for related lawsuits and debts.

Also Read:

- 10 Most Common Startup Mistakes You Need to Avoid

- Why Small Businesses Fail and How to Avoid This Fate

FAQs

1. Do freelancers need an LLC?

A. Though it is not necessary for freelancers to register as a business, forming an LLC can help you get work from large corporations, protect your personal assets from lawsuits, and save on taxes. Therefore, you should consider forming an LLC.

2. Am I self-employed if I own an LLC?

A. Yes, LLC members are considered self-employed. You will also need to pay self-employment tax on your LLC’s income.

3. Do I need an EIN as a freelancer?

A. No, it’s not mandatory, but you will have to file your business income and expenses on your personal tax return if you do not have an EIN.

If you want to grow your freelance business and hire people to work on projects, you will need an EIN. You’ll also need to acquire it if you are a multi-member freelance LLC.

4. Do freelancers need to register as a business?

A. It is not mandatory to register as a business but doing so can offer numerous benefits.

Registering as a business can help you:

- Get a business bank account.

- Separate personal and business finances.

- Build business credit.

- Enjoy tax savings brought about by deductible expenses.

- Protect your personal liability.

- Appear more credible to potential clients, especially, large corporations.

Consider forming an LLC now. It’s simple to get started with our simplified application for both state and federal filings.

5. Is it worth it to form an LLC?

A. Yes, forming an LLC is totally worth it for your freelance business.

Many professionals are turning their side hustle into full-fledged profitable businesses these days. And registering as a business can be your first step toward success.

Form an LLC to Start Your Own Freelance Business Legally

For all sincere freelancers, it is a great choice to form an LLC.

Not only will you be better protected, but potential clients will also see you as a reliable professional running a legitimate business.

Do you need help filing for freelance LLC formation? We’ve got you covered.