Interest rates can play an important role in the lives of traders who invest in financial markets, sure. But did you know that they can affect businesses as well?

But how do interest rates affect businesses?

Well, this post delves into the details and also covers all the ways through which you can overcome the impact or make the most out of it.

This is particularly important now that interest rates are on the rise as the Fed tries to fight inflation. But that also means that the interest rates will soon hit their peaks and soon start a downward move.

So, let’s try to understand how interest rate fluctuations can affect businesses.

Let’s dive in.

What are Interest Rates?

Now, before we start talking about how interest rates affect businesses, it’s important to first understand what interest rates are in the first place.

In simple terms, an interest rate is a fee charged by the lender to the borrower in exchange for the amount borrowed. This fee is represented as a percentage.

So, the higher this interest rate, the higher the repayment would be, and vice-versa. But here’s the thing — this interest rate is controlled by the Federal Reserve (Fed). The Fed sets the federal funds rate, which is the interest rate a bank pays to another bank for a short-term loan. All the other lending rates are based on this federal funds rate.

So, in a nutshell, the Fed plays the role of raising or lowering the federal funds rate based on numerous macroeconomic factors and the country’s current economic conditions.

You May Also Like:

Why Does the Fed Change Interest Rates?

The Fed has the responsibility to control the inflation rates. When the government infuses a lot of cash into the market in the form of community aid or corporate support, it means money is freely available in the market. The government does this when there’s an economic slowdown in a bid to spur economic growth and public spending.

The Fed, too, plays its role here by cutting down the interest rates to make credit more accessible to people and businesses. The idea behind it is to ensure there’s a greater appetite for credit, which can increase overall spending and boost the economy.

This, in turn, increases inflation, especially in a situation where people are left with a lot of money in hand, a lot of credit is available, and there are few spots to spend that money.

And when inflation gets out of control, the Fed starts increasing the interest rates again to cut the demand for credit. This helps cool down the inflation rate.

You May Also Like:

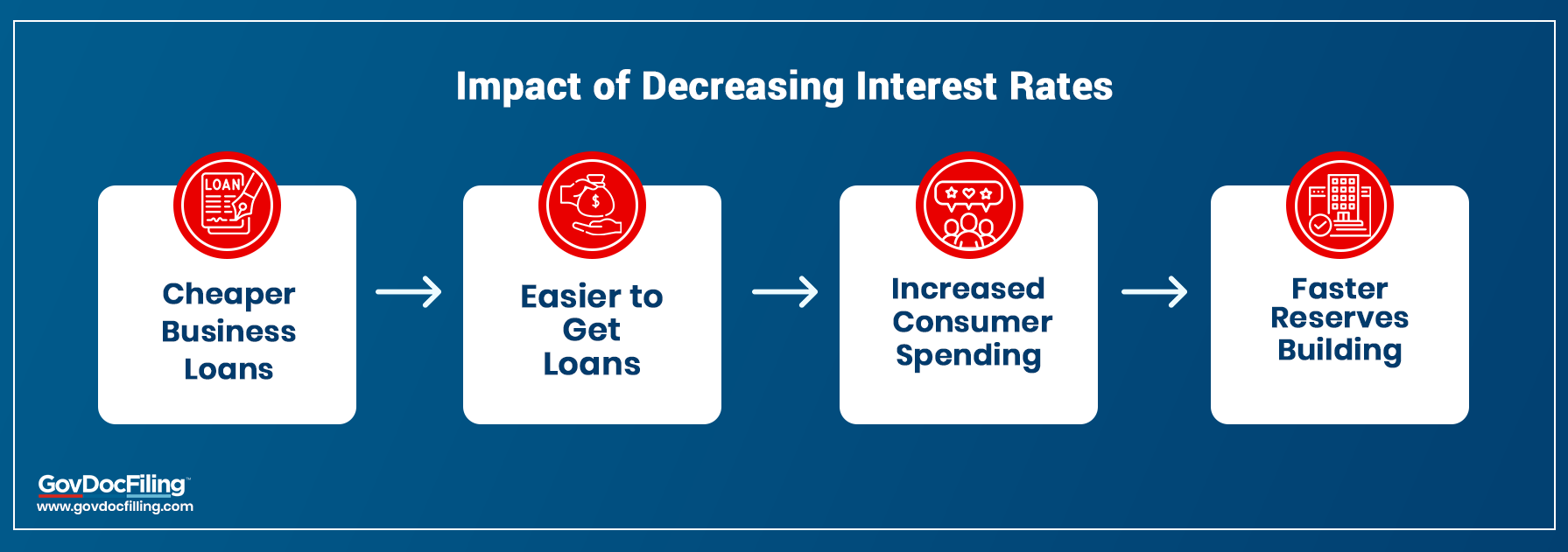

Less Interest, More Opportunities

As mentioned above, when the Fed cuts the interest rates, it means that the overall economic environment isn’t in great shape. Lower interest rates, in turn, make credit more accessible for both individuals and businesses.

But that’s just the tip of the iceberg. Lower interest rates affect businesses in numerous ways. Let’s take a closer look:

Cheaper Business Loans

When the Fed reduces the interest rates, it wants people and businesses to get easier access to credit. And given that the interest rates are low, the interest component of loans will be low too. This means overall loans will be cheaper for businesses to get.

With cheaper and easy access to credit, you’ll be able to deploy funds better for your organization. This, in turn, can play a major role in charting your business growth story.

What’s more?

The other primary advantage of having lower interest rates is that you’d be able to pay off the business loans faster as the principal component payments would be higher in each EMI (Equated monthly installment) that you’ll pay for the loans.

When you’re able to clear off your business loans fast, you’d be eligible for even greater credit, which can then be utilized to amp up your business growth

As the overall outgo for your business to pay off the debt would be lower due to the reduced interest component of the loan, your profitability would likely increase. This, in turn, would mean that you can spend more for:

- Hire another employee (or several)

- Stock more inventory to meet growing demand

- Increase marketing expenditures to attract new customers

These are just three examples. In each case, the result is potential growth of the business that might not be possible without added capital. Cash flow issues are what ultimately derail many businesses, and lowered interest rates present an opportunity to sidestep this hurdle.

Increased Consumer and Business Spending

Businesses aren’t the only ones who benefit from a low-interest regime by the Fed. In fact, consumers are the other beneficiaries of this environment.

The reason?

Like businesses, consumers have loans for a variety of purposes, such as homes, vehicles, etc. When the interest rates are cut, their loan payments will reduce, which means they’ll have access to more disposable income. And they would be willing to spend that additional money to buy new products or services that they would have otherwise avoided in a high-interest environment.

In fact, that’s the whole idea behind the Fed cutting interest rates—to spur up spending and increase the overall demand to boost the economy.

Your business will benefit from this situation as your sales and revenue will skyrocket with the increased customer spending.

Helps Build Reserves

The most important thing to remember when the interest rates drop is that this regime won’t be sustainable and will not last forever. As inflation starts to rise, the Fed will be forced to raise interest rates. And when the Fed changes to this hawkish stance, you’ll have higher borrowing costs.

Additionally, rising inflation will also increase external cost pressures as your vendors will also increase their prices to cover up for their added expenses. Such external shocks combined with a higher outgo for your loans can leave little capital in your hand for expansion and other eventualities.

That’s why it’s critical to build reserves during a low-interest regime. These reserves are essentially meant as a buffer for situations when the business drops or expenses rise.

As mentioned earlier, you’ll have lower expenses when the interests are low, and that makes it a great time to add some additional funds to your reserves. Building up reserves equivalent to 6-12 months of expenses is a great way to ensure your business continuity even during an economic downturn.

You May Also Like:

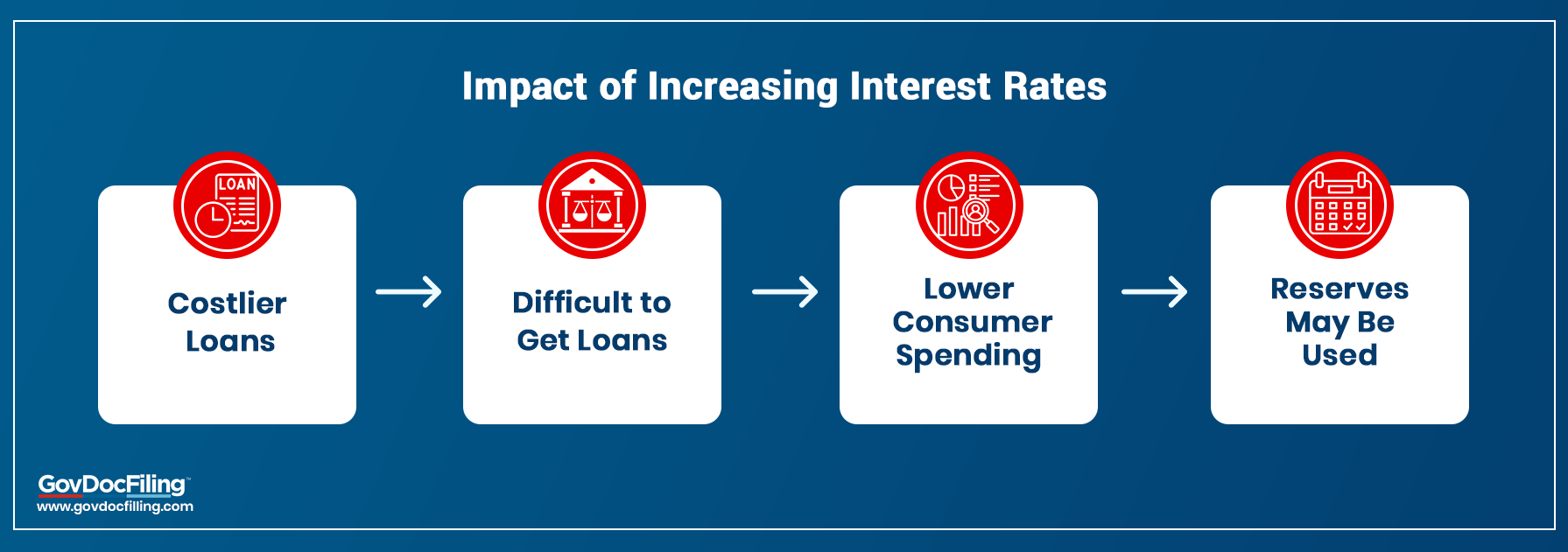

How Do High Interest Rates Affect Your Business?

Unlike low interest rates, higher interest rates are one of the biggest challenges for businesses as they negatively affect your business. In essence, the impact they have is exactly the opposite of what low interest rates have.

To start, when there are interest rate hikes by the Fed, your loans will get costlier with each rise in interest rate.

This means you’ll take longer to repay a loan of the same amount than earlier. To pay off the loans within the same duration, you’ll have to hike your EMI amount, which means you’ll be left with lesser capital to reinvest in the business.

What’s more?

Banks will also start becoming a part of the fiscal tightening process. They won’t disburse loans with ease and will start scrutinizing every application in detail before granting the loan. This means you’ll have to work harder to get capital to expand your business.

And like in the low interest situation, high interest rates affect consumer spending too. The Fed increases the interest rates to discourage consumers from spending too much. As their loans will cost more, consumers will be left with less money to spend, which, in turn, can lead to a drop in your sales and revenue.

That’s where the reserves you’ve built during the low interest regime will come to your rescue. With them, you’ll be better able to tide over these difficult times.

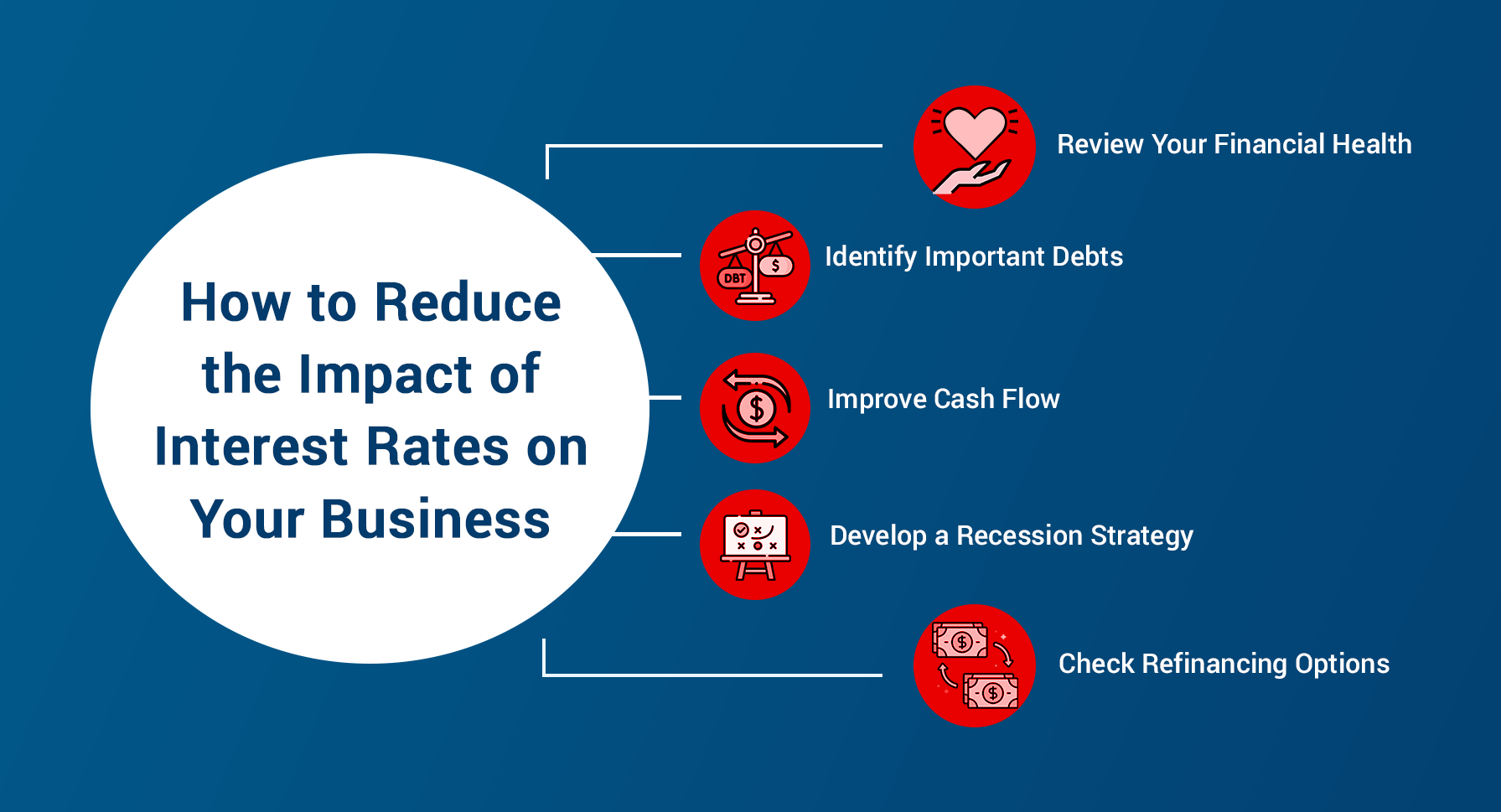

Minimizing Interest Rate Impact on Your Business

Now that you know how interest rates can affect your business, it’s important to figure out how you can minimize this impact on your business.

1. Review Your Financial Health

You should periodically review the financial health of your business to figure out where you stand. This is critical as all your other decisions will be based on this analysis.

For this, you should review your business’s financial statements. They can reveal a lot about the sources of your revenue and where the money is being spent.

By understanding these, you can find out if you need to cut down on your expenses or increase your spending in the right spots to spur business growth.

2. Identify Important Debts

Expansion of any business will most likely require you to take up debt. This could be in the form of business loans, credit cards, or any other form of credit. Now, when the interest rates move, especially in the upward direction, you’ll need to identify the important debt among these.

That’s the debt that you should be looking to clear first.

And how do you identify it?

The most important debt is the one that has the highest interest rate. You should clear that debt first, as rising interest rates would mean these debts will become costlier very quickly.

Similarly, if you’ve got a variable interest rate loan, you should pay it off first. Fixed interest rate loans can wait. This also applies to a case where interest rates drop. You’ll be able to pay off the variable rate loan faster, so the outstanding will drastically decrease when interest rates rise again.

You May Also Like:

3. Improve Cash Flow

Cash flow is the lifeblood of any business. If you don’t have enough income coming in as revenue for your business, you’ll have little working capital left for expansion and expenses. Additionally, lower cash flow means you’ll likely have to spend from your reserves to pay off your debt.

So, how do you improve your cash flow?

One way of going about it is by finding ways to ensure that your payments reach you on time. For instance, you could move to a recurring billing model like SaaS businesses, where customers would have to make payments every month or year. This helps ensure regular cash flow for the business.

4. Develop a Recession Strategy

Recession can be a difficult time for any business to navigate. In all likelihood, you’d be dealing with high inflation and interest rates. To weather this storm, it’s important to have a solid strategy in place beforehand.

While setting up reserves is a great idea, you should also come up with strategies to reduce non-essential expenditures, look for more income sources, and come up with ways to service your debt.

It’s also crucial to have contingency plans that can come into play if your original plans don’t work out well.

5. Check Refinancing Options

When the interest rate spikes, there might come a situation where you may not be in a position to pay off your debt. In such a situation, you’ve to do everything it takes to avoid a default. That’s because it can hurt your credit rating, which may prevent banks and other financial entities from providing loans to you.

To avoid this undesirable situation, you should consider refinancing as an option. It can help you reduce your interest rate, thus lowering your EMIs. This will ensure that your credit score isn’t affected much too. As a result, you’ll still be eligible for loans that offer lower interest rates.

FAQ

Q1. How do low interest rates affect a business?

A. When interest rates are lowered, they give businesses easier access to capital in the form of loans. Additionally, the loans are cheaper due to the lower interest rates, which enables businesses to pay them off quickly. Consumers also have more disposable income which helps drive greater sales and revenue for businesses. Finally, businesses can grow quickly due to increased revenue and lower debt expenses.

Q2. What happens to companies when interest rates rise?

A. When interest rates rise, loans become costlier, which leads to increased debt expenses. The loans will also take longer to be paid off. Additionally, consumers will have lower disposable incomes, which affects their spending capability. This reduces your sales. Finally, getting loans becomes tougher too.

Q3. What problems may a business have if interest rates increase?

A. Some of the ways a business is affected by increased interest rates are:

- Lower sales

- Increased interest component of loans

- Difficulty getting loans

- Potential cash flow issues

Q4. What businesses do well when interest rates rise?

A. The businesses that have planned well in advance for increasing interest rates are the ones that are likely to do well when they rise. They’d have sufficient reserves and will be able to manage their expenses well when interest rates rise. The reserves will help them address any urgent capital needs, and lower expenses will ensure that they aren’t eating into their profits.

Q5. How can a business prepare for increasing interest rates?

A. Some of the things you can do to reduce the impact of increasing interest rates are:

- Prepare your reserves

- Take a look at your financial health

- Identify important debts

- Improve your cash flow

- Come up with a recession strategy

- Check for refinancing options

Get Started With GovDocFiling

While we are not in the lending business, GovDocFiling can assist you in other areas if you are planning to launch a business. Get started today with our easy-to-use EIN filing forms and other business formation services.

About the author

From selling flowers door-to-door at hair salons when he was 16 to starting his own auto detailing business, Brett Shapiro has had an entrepreneurial spirit since he was young. After earning a Bachelor of Arts degree in Global and International Studies from the University of California, Santa Barbara, and years traveling the world planning and executing cause marketing events, Brett decided to test out his entrepreneurial chops with his own medical supply distribution company.

During the formation of this business, Brett made a handful of simple, avoidable mistakes due to lack of experience and guidance. It was then that Brett realized there was a real, consistent need for a company to support businesses as they start, build and grow. He set his sights on creating Easy Doc Filing — an honest, transparent and simple resource center that takes care of the mundane, yet critical, formation documentation. Brett continues to lead Easy Doc Filing in developing services and partnerships that support and encourage entrepreneurship across all industries.