Are you dreaming of being your own boss, or maybe you’re just looking for a profitable side gig to boost your income? Starting a virtual bookkeeping business could be your ticket to a fulfilling career.

With the increasing complexity of financial management, businesses of all sizes are seeking professionals to manage their finances. The best part is that you can start a virtual bookkeeping business in 2024 with little investment.

You just need a laptop, an internet connection, the right bookkeeping software, and a marketing budget to get started. On average, a virtual bookkeeper earns over $43,400 per year and you can do that as well.

Additionally, as a virtual bookkeeper, you can work from home, a cafe, or beautiful travel destinations. Setting up an online business can help you enjoy the benefits of a flexible work schedule and the comfort of working from home.

However, there are things that you need to take care of to get started.

Read this comprehensive step-by-step guide to learn how to start a virtual bookkeeping business in 2024 and start making money.

What is Virtual Bookkeeping?

The digital form of traditional bookkeeping is called virtual bookkeeping. It involves managing a business’s financial records remotely using specialized accounting software.

A virtual bookkeeper handles accounting and record-keeping activities, such as:

- Data entry

- Accounts payable and receivable

- Account reconciliation

- Financial reporting

- Payroll processing

This modern approach to bookkeeping allows for real-time collaboration between bookkeepers and clients from different locations. It also eliminates the need for physical paperwork.

A virtual bookkeeping business offers unparalleled flexibility, enabling bookkeepers to manage their work-life balance effectively. With no physical office and standard working hours, you can attend to family and social obligations while maintaining a successful bookkeeping business.

Also Read:

- What Is a Tax ID? Entrepreneur’s Guide to Employer’s Tax ID

- 5 Financial Challenges That Small Businesses Face

What Skills Do You Need to Start a Virtual Bookkeeping Business?

You need a solid foundation of skills and knowledge to start a virtual bookkeeping business in 2024. Although previous accounting and bookkeeping experience is beneficial, it’s not always a prerequisite. Here’s what you need to get started:

- Computer Skills: Ability to navigate the web, conduct research, and use online tools

- Bookkeeping Proficiency: Expertise in record keeping, data entry, cash flow management, and account reconciliation

- Accounting Software Proficiency: Know-how of accounting software that you’ll use to provide bookkeeping services to your clients

- Communication Skills: Good communication skills to get clients, negotiate with them, and collaborate efficiently

- Attention to Detail: Accurate and precise data handling is crucial for error-free bookkeeping

- Organizational Skills: Ability to manage multiple clients and tasks efficiently

- Credentials (Optional): Passing the CPA exam to become a Certified Public Accountant that people and businesses can trust

As a new business owner, you may also look for a mentor or consultant to guide you through the process of starting a bookkeeping business.

13 Steps to Start a Virtual Bookkeeping Business

Wondering how to start a virtual bookkeeping business? This step-by-step guide outlines 13 steps to help you navigate the process from inception to growth.

Let’s get started:

Step #1: Research and Understand the Market

Before you start a virtual bookkeeping business, you need a comprehensive understanding of the industry. This involves analyzing trends in online bookkeeping services to find out what other bookkeeping businesses are doing differently.

Several industries require bookkeeping services, from construction to retail. However, you need to research which industries pay the highest rates for bookkeeping tasks.

For instance, bookkeepers working in highly regulated industries like healthcare charge more than those working in general retail. This is largely because such industries demand specific knowledge and expertise as well as meticulous recordkeeping to ensure compliance.

Another thing to check out is the kind of services your competitors are offering so you can discover market gaps. Understand the financial challenges faced by businesses and offer solutions. that It’s also important to familiarize yourself with the relevant laws and regulations for bookkeepers, including popular business accounting software, to enhance service delivery.

Step #2: Pick a Business Name

Whether you are starting a freelance business or an LLC, you will have to pick a name for your virtual bookkeeping business. The business name you choose should be relevant to your industry and nature of work and should be available to register.

You can use business name generators online to look for unique and brandable names for your bookkeeping company.

Also Read:

Step #3: Create a Business Plan

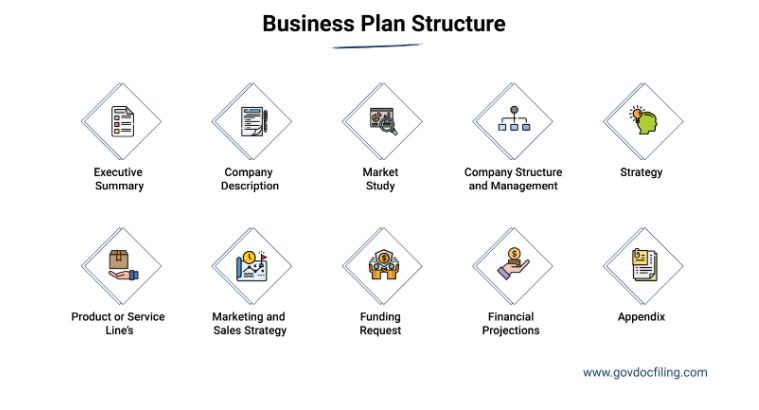

Your business plan should outline your strategy for how to start a virtual bookkeeping business. It serves as a blueprint for your business such that you can clearly see how it’ll kick off and when you can start making profits.

A well-structured business plan should contain the elements shown in the image below.

Image via GovDocFiling

It’s important to note that your business plan isn’t just a document for potential investors or lenders. You need it to clarify your vision, so ensure that your goals and projections are realistic.

Step #4: Register Your Bookkeeping Firm As a Legal Business Entity

The next step in how to start a virtual bookkeeping business is to choose a legal business entity type for your business.

If you’re going to start working as a full-time bookkeeper single-handedly, you can choose to form a sole proprietorship. However, you’ll be liable for all business debts and lawsuits as a sole proprietor.

But the good part is that it’s easy to register your virtual bookkeeping business as a sole proprietor. You just need to fill out a simplified application and we’ll take care of the legal formalities at a much more reasonable rate than hiring a lawyer.

But what if you want to hire other bookkeepers as your team grows? Or, what if you want to reduce your personal liabilities as a business owner?

Many bookkeepers prefer to form limited liability companies (LLCs) to limit personal liabilities and enjoy the benefits of flexible management structures and taxation options.

To form an LLC, you’ll need to file Articles of Organization with the Secretary of State’s office and pay the state filing fee. You will also have to file for an EIN (Employer Identification Number) with the IRS. It is essential for paying taxes, hiring bookkeepers and other employees, and opening a business bank account.

While the rules and fees of forming an LLC differ from state to state, you can easily form an LLC with us in states like California and Texas. All you need to do is to fill out our one simplified application and we’ll do the rest for you.

Also Read:

- How to Register a Business Name in the US: A Guide (Infographic)

- Low-Cost Online Businesses for Beginners to Start

Step #5: Obtain a Business License and Permit

After registering your business, you can’t begin operation until you’ve obtained the necessary license and permit. Although there’s no specific license for bookkeepers, your state may have its requirements.

You should check with your local authorities to know whether you need a general business license or a home occupation permit.

Step #6: Invest in Technology and Tools

Virtual bookkeeping businesses don’t need a lot of office supplies, but you need to invest in the right tools to ensure productivity. These tools include:

- Accounting Software: You need to choose the right tool to serve your clients. Some powerful accounting software solutions in the market include QuickBooks Online, LessAccounting, FreshBooks, and Xero.

- Project Management Software: When managing multiple clients, a project management tool can help you track tasks. Some tools you can consider include Airtable, Asana, and Trello.

- Secure File Sharing System: Your virtual bookkeeping business involves exchanging financial information. So, you need a secure system, like Google Drive or DropBox, for sharing, receiving, and storing files.

- eSignature Tool: Clients need to sign a contract before you start handling their bookkeeping. Having an electronic signature tool showcases professionalism.

- A Reliable Computer: You’ll need a laptop with a fast processor that can accommodate your business software without crashing. Most bookkeeping software is compatible with Mac and Windows operating systems.

- Data Security: Ensure to use strong passwords, encryption, and firewalls to protect client information. Also, compliance with data privacy regulations like the GDPR is necessary.

Also Read:

- S-Corp Checklist: Essential Steps to Set Up Your Business

- How to Start an S-Corp: Everything You Need to Know

Step #7: Acquire Other Business Essentials

Registering your business isn’t enough. You need a number of other business essentials to start offering virtual bookkeeping services to clients and make money.

What are these business essentials for virtual bookkeepers?

Here you go:

- Business Bank Account: It will help you keep personal and business finances separate. Also, it ensures you don’t lose your personal liability protection assuming you’re registered as a limited liability company.

- Business Funding: A virtual bookkeeping business has low startup costs. But you’ll need funds to subscribe to software like Quickbooks online and build a website, among other things.

- Business Cards: When starting out, you should design a business card that helps promote your bookkeeping services. Print a few cards to hand to business owners and other potential clients whom you may come across.

Make sure that it includes your business website URL, the bookkeeping services you offer, your email address, and other contact information.

- Business Insurance: You should protect your business from unexpected liabilities and lawsuits. Virtual bookkeepers may need professional liability insurance and general liability insurance.

We have partnered with the most trusted insurers to help small business owners like you get the right coverage for your business.

Step #8: Build a Professional Website

When starting a virtual bookkeeping business, building a web presence is essential. It’s the first point of contact between you and prospective clients. It often starts with a business website and social media profiles.

Make sure that your website offers all of the information that your potential clients may need. This includes your background, qualifications, bookkeeping services and packages, contacts, and testimonials from previous clients.

Here are other steps you should take when establishing an online presence:

- Select a professional domain name from a trusted domain registrar

- Find a reliable web hosting service

- Use a DIY platform like WordPress or Squarespace to design your website

- Develop compelling content to highlight the benefits of working with a virtual bookkeeper

- Include visible calls to action (CTAs) like “Free Consultation” or “Get a Quote”

Step #9: Set Your Pricing

Deciding a suitable price for your services can be somewhat difficult. But you should place a value on your skills. You can start by identifying how much freelancers charge for similar services on platforms like Upwork and Fiverr.

Additionally, you can set up different pricing strategies and see which one works best in the long run. Examples of pricing strategies include:

- Hourly Rate: Best for project-based clients with fluctuating needs

- Monthly Retainer: Ideal for ongoing relationships with a consistent workload

- Package-Based Pricing: Offer tiered packages with clearly defined services

- Value-Based Pricing: Price is based on the value you’re offering, not just time spent

Remember, the specific amount you charge depends on your experience, certification, and market rates. You’re free to adjust pricing as you establish a reputation and grow your expertise.

Also Read:

- How to Start a Retail Business: Everything You Need to Know

- Business Startup Checklist: What New Businesses Need

Step #10: Find Clients for Your Virtual Bookkeeping Business

The most important step to make money with your bookkeeping business is to find clients. For this, you need to promote your bookkeeping services using multiple advertising strategies.

You should assess your strengths as a virtual bookkeeper and use them as your unique selling point.

The best place to start to find clients is in your network. Tell your friends and family about your business and gather contacts of business owners who could be potential clients. You can also market your services using social media, blogging, guest posting, paid ads, and more.

Step #11: Invest in Continuous Learning and Growth

The bookkeeping industry is dynamic as accounting regulations, technology, and clients’ expectations keep evolving. So, you need to engage in further learning so you can stay updated. Here are some ways to invest in your professional development as a virtual bookkeeper:

- Formal Education and Certifications: Consider taking online or in-person accounting courses to enhance your knowledge. You can also obtain certifications like Certified Bookkeeper to validate your expertise.

- Online Learning and Webinars: Utilize platforms like Udemy and Coursera for training resources. Also, attend webinars hosted by accounting software companies and industry associations.

- Networking and Professional Associations: Attend industry events to learn about new trends. You can also become a member of the American Institute of Professional Bookkeepers (AIPB).

- Online Forums and Communities: Engage in online discussions to share knowledge and learn from others. Here’s an example of a Facebook community for virtual bookkeepers:

Image via Facebook

Also Read:

Step #12: Build a Team of Passionate Professionals

When you start a virtual bookkeeping business, you may be the only employee. But as your business grows, you may need to expand your team to handle the increased workload and offer diverse services.

Besides hiring tax specialists and junior bookkeepers, you should consider hiring a customer service representative to manage client relationships. Also, ensure that the candidates possess the right skill set and share your passion for client service.

Online platforms like LinkedIn and Upwork come in handy when sourcing remote talent. After hiring, create a strong remote work culture through regular communication and team-building activities.

Step #13: Promote Your Business

It’s not enough to have a website and social media accounts for your virtual bookkeeping business. You need to leverage them to advertise your expertise and attract prospective clients.

You can start by creating valuable content related to bookkeeping through blog posts, videos, and podcasts. You can also implement email marketing campaigns to nurture leads and keep your business top-of-mind.

Also, don’t underestimate the power of word-of-mouth. Encourage satisfied clients to recommend your services. You can also request a LinkedIn recommendation so potential clients can trust you with their money.

Since your business is online, you should consider running paid ads on Google, targeting your preferred audience. Remember, consistency is key in digital marketing. So, maintain a regular presence across your promotion channels.

Also Read:

- 10 Most Common Startup Mistakes You Need to Avoid

- Sole Proprietorship vs S Corp: Pros & Cons Of Each

How Much Does it Cost to Start a Virtual Bookkeeping Firm?

Starting a virtual bookkeeping firm can cost less compared to a brick-and-mortar business. That’s because you don’t need fancy equipment like a printer or even rent an office space.

You can work from any location using your laptop or tablet. Here’s a breakdown of your startup costs:

Technology and Equipment Costs

- Computer or Laptop: $500-2,000

- Backup hard drive: $25-200

- High-speed internet: $20-50 per month

Software and Subscription Costs

- Accounting software: $25-150 per month

- Cloud storage: $10-20 per month

- Video conferencing tool: $0-15 per month

- Time tracking software: $0-10 per month

Business Registration Costs

- Business registration fee: $50-500 (varies by state)

- Licenses and permits: $50-500

Marketing and Advertising Costs

- Website domain and hosting: $50-200 per year

- Website design and development: $0-500 (depending on DIY vs professional)

- Business cards: $50-200

Professional Development

- Bookkeeping courses and certifications: $0-1,000

- Software training: $0-500

The total estimated range is between $780 to $5,845. These costs vary widely based on your specific needs, location, and choices. Also, some costs are one time, while others are recurring monthly or annually.

Also Read:

Tips for Finding Prospective Bookkeeping Clients

When you launch your virtual bookkeeping business, you won’t start getting clients immediately. So, we’ve compiled expert tips that can help you land your first client as soon as possible.

Leverage Your Network

Your first few clients would be family and friends, even though this may be a pro bono service. But you should always request referrals and testimonials. These will serve as a stepping stone to paid clients.

Additionally, scout for local events where your target audience might be present. Approach people, talk about your virtual bookkeeping business, and hand them your business cards.

Optimize Your Online Presence

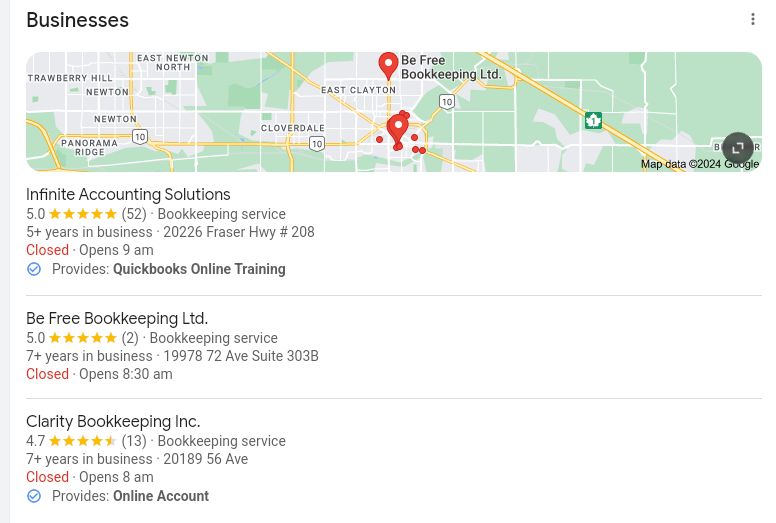

If you’ve created a website for your virtual bookkeeping business, ensure it clearly shows your services and expertise. Also, consider listing your business on Google Business so people can easily find you on search results pages and maps.

A quick search for online bookkeeping businesses in Langley yielded the result below. So, you stand a chance to appear in searches with proper optimization. This can be anything from using the right keywords and inputting your location and niche services.

Image via Google

Utilize LinkedIn

LinkedIn is a great social network for showcasing your bookkeeping expertise and finding clients. You need to have a banner, an about section, and a headline that shows the exact service you’re offering.

Additionally, you should maintain an active account by posting relevant content consistently. Soon, people will regard you as an authority in the bookkeeping industry, which fosters trust and credibility.

Don’t forget to connect with other professionals in your chosen industry. As you build relationships, you’re also building your brand and accessing clients that you’d ordinarily not reach.

Sign Up on Freelance Platforms

Freelancer networks like Upwork can match you with businesses or individuals looking for your services. Most platforms don’t charge a fee for setting up your profile, but they may take a commission once you get paid.

Top freelance websites for bookkeepers include:

- Upwork

- People Per Hour

- Fiverr

- Freelancer

- Toptal

Start a Blog or Get Published

Although this is a long-term strategy for getting clients, you’ll keep reaping the rewards if your content is evergreen. That said, your blog posts should address common bookkeeping problems.

You can also guest post on other blogs to expand your reach and establish yourself as an authority. To get guest posting opportunities, visit accounting and bookkeeping blogs to see whether they accept contributions from guest writers.

Offer Free Consultation

Before clients commit their funds, they want to know how much value you’re offering. And offering a free session can help you showcase your expertise and convert prospects into paying customers. You can post the offer on your website and social media networks.

Challenges of Starting a Virtual Bookkeeping Service

Like every other business, offering bookkeeping services online can be rewarding, but it comes with challenges. Here are some common barriers you may face:

- Acquiring Clients: The online bookkeeping industry has grown rapidly, resulting in an increase in competition. So, it might be difficult to secure your first clients. Also, you may have limited resources to develop an effective digital marketing strategy.

- Establishing Trust Remotely: Clients often feel uneasy about sharing sensitive financial information with someone they’ve never met. They may request several online meetings and screen sharing to feel reassured. This can be time-consuming and disrupt your workflow.

- Technical Difficulties: Poor internet connectivity, power outages, and software malfunctions can lead to delays and potential errors. So, you’ll need backup plans like offline data storage and mobile hotspots.

- Time Management: Balancing the demands of client work, administrative tasks, and business development can be time-consuming. Sometimes, it becomes difficult to set boundaries when working from home. This can lead to excessive workload and burnout.

Also Read:

Best Practices to Start a Successful Virtual Bookkeeping Business

Here are some best practices you should consider implementing when planning how to start a virtual bookkeeping business in 2024:

- Invest in Training: You should possess an in-depth understanding of accounting principles and software proficiency. Also, getting certifications can enhance your credibility.

- Leverage Technology: Utilize cloud-based tools, client management software, and secure communication platforms. This will ensure easy access to files and collaboration.

- Develop a Standard of Operation: Record your workflows for onboarding clients and managing tasks. It facilitates training new employees and maintaining quality control.

- Set Clear Expectations: Your service agreement should be detailed, outlining the scope, deliverables, and timelines. You should also ensure transparency in pricing to foster trust.

- Stay Compliant: It’s essential to adhere to tax laws, data privacy regulations, and industry-specific compliance standards. Also ensure you’ve obtained relevant licenses and permits to operate legally.

- Offer Exceptional Customer Service: Being responsive and accessible to clients builds trust and rapport. Always provide regular and timely updates on work done.

By following these best practices on how to start a virtual bookkeeping business, you should be well on your way to establishing a successful online venture.

Also Read:

FAQs:

1. How do I start my own bookkeeping business from home?

To start your own bookkeeping business from home, you should follow the steps below:

- Learn bookkeeping.

- Create a business plan.

- Register your business with the state.

- Promote your bookkeeping services.

- Find clients.

- Get the right accounting software.

- Set up a home office.

- Deliver great bookkeeping service.

- Grow your business.

2. Is virtual bookkeeping business profitable?

Yes, the virtual bookkeeping business is profitable.

Bookkeepers are in demand as most businesses and freelancers need to keep records to calculate taxes and manage finances.

You can start an online bookkeeping business with as little as a computer, internet connection, and basic knowledge of bookkeeping and accounting. Some virtual bookkeepers also use collaboration tools, accounting software, and bookkeeping software to make work easier.

You can start earning early as a virtual bookkeeper and create multiple sources of income by partnering with various companies, individuals, and freelancers.

3. How do I become a virtual bookkeeper with no experience?

You don’t need to have years of experience as a practicing bookkeeper to start your small business.

To start working from home as a virtual bookkeeper, you should:

- Invest in yourself.

- Get basic bookkeeping training.

- Get yourself the right accounting software and learn how to use it efficiently.

- Consider certification to add to your credibility.

- Launch your own online bookkeeping business.

- Register it with the Secretary of State.

- Build a website to attract clients for your bookkeeping services.

4. Is it hard to start a virtual bookkeeping business?

It isn’t hard to start a virtual bookkeeping business if you’re good at handling finances and maintaining records. You need to maintain record books, manage company finances, and create a proper cash flow statement for your client.

Setting up your online bookkeeping business is easy if you follow all of the steps we’ve discussed above in this article.

5. Are bookkeepers in demand?

Bookkeepers are in great demand in the United States, especially if you’re a certified bookkeeper.

Ready to Start a Virtual Bookkeeping Business?

Now that you have learned how to start a virtual bookkeeping business, you should take the first steps towards becoming a renowned bookkeeper and getting clients.

Start with researching and understanding the market. Afterward, choose a business name, register your business, build a website, and start scouting for your first clients.

We’ve provided adequate information on how you can get potential clients as a virtual bookkeeper. However, you should focus on delivering great service to retain existing clients and attracting referrals. Quality of service will help grow your business in the long run.

Do you need help starting a virtual bookkeeping business? Let us know in the comments below.