Are you struggling to find the best bank for your small business needs in 2024? The best banks for small business owners should offer most of the features of a standard corporate account without costing an arm and a leg.

Not to be alarmist, but choosing the right bank is a critical decision that can significantly impact your small business’s financial health and growth potential.

But with over 4,700 US banks to choose from, selecting the best fit for your business can easily become confusing and overwhelming.

Lucky for you, we’ve done the heavy lifting and researched the best banks for small business operations. In this post, we’ve compiled a detailed list of the 12 best banks for small business owners in 2024, carefully evaluating their offerings, unique selling points, and overall value.

Whether you’re just starting out or looking to switch banks, this post should point you in the right direction.

Let’s get started!

Quick Summary: Best Banks for Small Business Owners by Category

- Best for SBA Loans: Live Oak Bank, Wells Fargo, Celtic Bank, Huntington National Bank

- Best for Interest Rate: Capital One, Bluevine, Huntington National Bank, Celtic Bank, Live Oak Bank

- Best for Merchant Services: Chase, Wells Fargo, Bank of America

- Best for Business Checking: Chase, Bank of America, Wells Fargo

- Best for Business Credit Cards: PNC Bank, Chase, Capital One

- Best for Online and Mobile Banking: Bluevine, Novo, Axos Bank, NBKC Bank

How We Chose the Best Banks for Small Business Owners

We created this robust list of the best banks for small business operations using these key factors as our measuring yardstick:

- Interest rates: We compared the interest rates offered by each bank on their business checking and savings accounts. We find this factor crucial for measuring the best banks for small business owners, as higher interest rates can help small businesses grow their reserves.

- Online and mobile banking: We live in a digital world today, and easy access to banking is super important for small business owners, especially for on-the-go transactions. So, to rank the best banks for small business use, we assessed each bank’s digital platforms, evaluating factors such as user-friendliness and functionality.

- Branch and ATM accessibility: While online and mobile banking have become increasingly popular, many small business owners still prefer the option of in-person banking and cash deposits. So, to rank the best banks for small business owners, we evaluated the distribution of physical branches and ATMs of each bank to ensure the utmost convenience and accessibility.

- Customer service and support: Active customer service is an important feature for any business bank account holder, especially small business owners. So, to rank the best banks for small business owners, we considered each bank’s customer support channels, responsiveness, and overall reputation for client satisfaction.

- Small business products and services: We closely checked for how each bank’s features served small business needs. We examined features such as checking and savings accounts, merchant services, credit cards, and small business loan packages to rank the best banks for small business needs.

- Fees and minimum balance requirements: Understanding that every dollar counts for small businesses, we believe that the best banks for small business owners must be cost-friendly. As such, we evaluated the fees associated with each bank’s products and services. For instance, we looked at the minimum balance requirements for each bank, especially as this factor can impact a business’s cash flow and financial flexibility.

Top 12 Best Banks for Small Business

Here is a list of the best banks for small business owners with their corresponding features, selling points, pricing, and other details to help you make an informed choice in 2024.

1. Axos Bank

Image via Axos Bank

Axos Bank is one of the best banks for small business owners and has widespread recognition as a provider of tailored banking solutions for small-scale needs and use cases.

Axos Bank rebranded as Bank of Internet USA (or BofI) in 2018, which should tell you much about what its aims are. This bank is particularly optimized for online banking, offering a wholly digital banking experience without the need for physical branches.

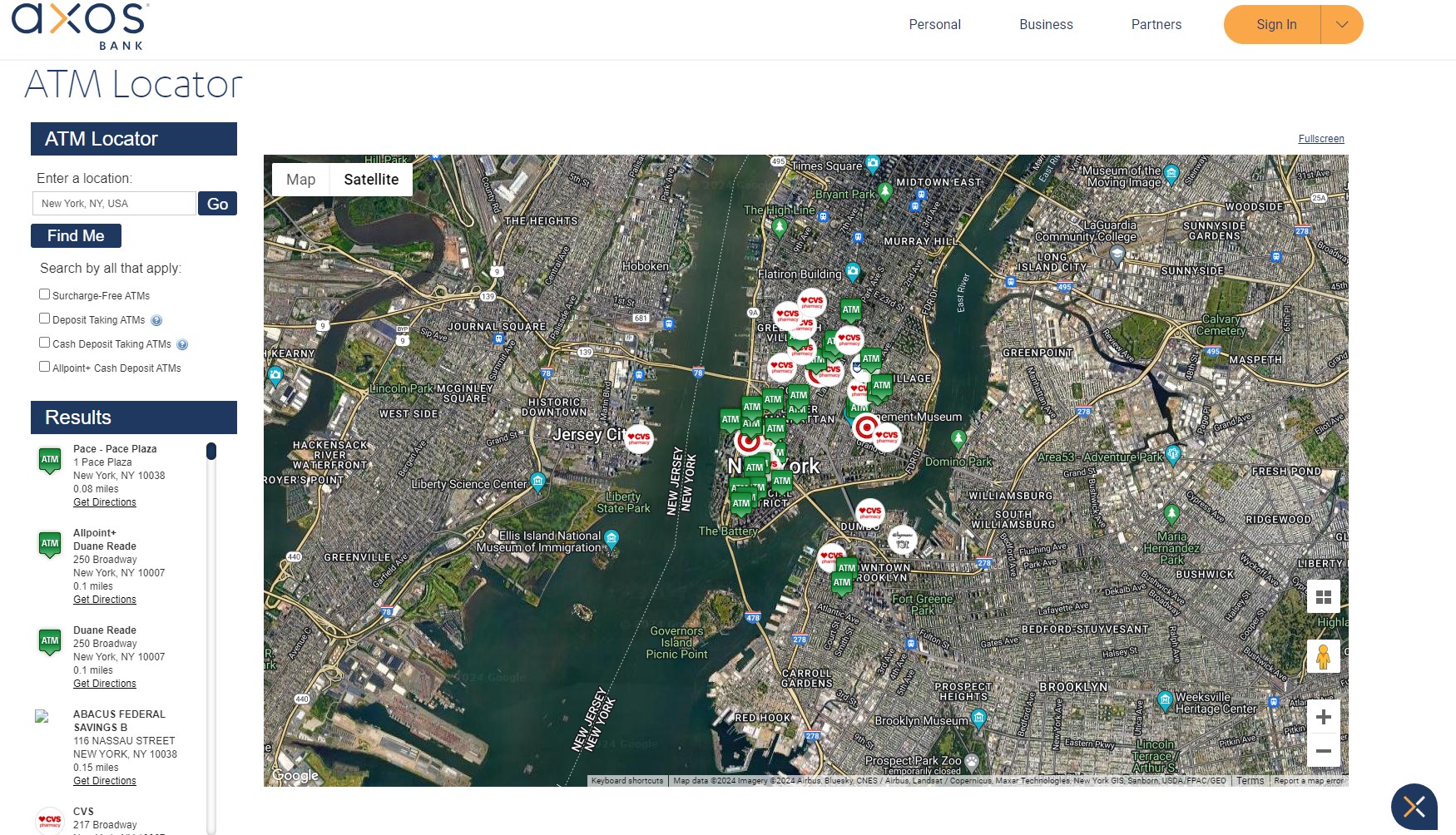

Despite not having physical branches, Axos Bank is a heavyweight when it comes to ATM networks, boasting over 91,000 ATMs well distributed across the US. This makes Axos Bank the largest bank based on ATM network on this list.

Image via Axos Bank

What’s more?

Axos Bank currently offers a $400 sign-up bonus for small business owners and offers a slew of small business account types. These and more put Axos Bank in the clear as one of the best banks for small business owners.

Key Features

- Seamless online and mobile banking: Axos Bank’s robust online and mobile banking capabilities allow small business owners to manage their accounts, transfer funds, and access financial management tools from anywhere, round-the-clock.

- Interest-based checking accounts: Axos Bank’s business checking account is perfect for small business use, offering decent interest rates (up to 1.01% annual percentage yield (APY) and unlimited domestic ATM fee reimbursements.

- Business savings account: Small business owners can also take advantage of Axos Bank’s savings account and earn interest of up to 0.20% APY on their balance.

- Business loans and lines of credit: With Axos Bank, small businesses can access a range of lending solutions, including long-term loans (up to $50,000), lines of credit, and real estate loans.

- Merchant services: Axos Bank provides merchant service solutions, including point-of-sale systems, payment gateways, and fraud protection tools.

- Treasury management services: Small businesses can optimize their cash flow and streamline financial operations with this solution, including features such as:

- Remote deposits

- Better account management capabilities

- A suite of reporting and reconciliation tools

- Sophisticated fraud and risk management solutions

Pros

- Impressive web of ATM network distribution

- Robust online and mobile banking platforms

- No monthly maintenance fees for business checking accounts

- Extensive educational resources and financial management tools

- Decent interest rates on business checking and savings accounts

- Dedicated small business support team for personalized assistance

Cons

- Limited integration with useful third-party accounting software, such as Bench, QuickBooks, or Xero

- Lack of physical branch locations may be inconvenient for small business owners who prefer in-person banking

Pricing

Axos Bank is known for its competitive and transparent pricing structure. Here’s an overview of the pricing for their business banking product:

- Basic Business Checking: No monthly maintenance fees and no minimum deposit required

- Business Interest Checking (1.01% APY): No monthly maintenance fees with an average daily balance of at least $5,000

- Business Premium Savings (0.2% APY): No monthly maintenance fees and a low minimum deposit requirement

- Business Savings (0.2% APY): No monthly maintenance fees with an average daily balance of at least $2,500

- Business Money Market (0.2% APY): No monthly maintenance fees with a minimum average daily balance of $5,000 and minimum opening deposit of $1,000

- Non-Profit Money Market (0.2% APY): No monthly maintenance fees with a minimum balance of $2,500

- Business Certificate of Deposits: Minimum opening deposit of $1,000

- Certificate of Deposit Account Registry Service (CDARS): Minimum opening deposit of $100,000

2. Live Oak Bank

Image via Live Oak Bank

Live Oak Bank is a customer favorite and one of the best banks for small business owners in the US.

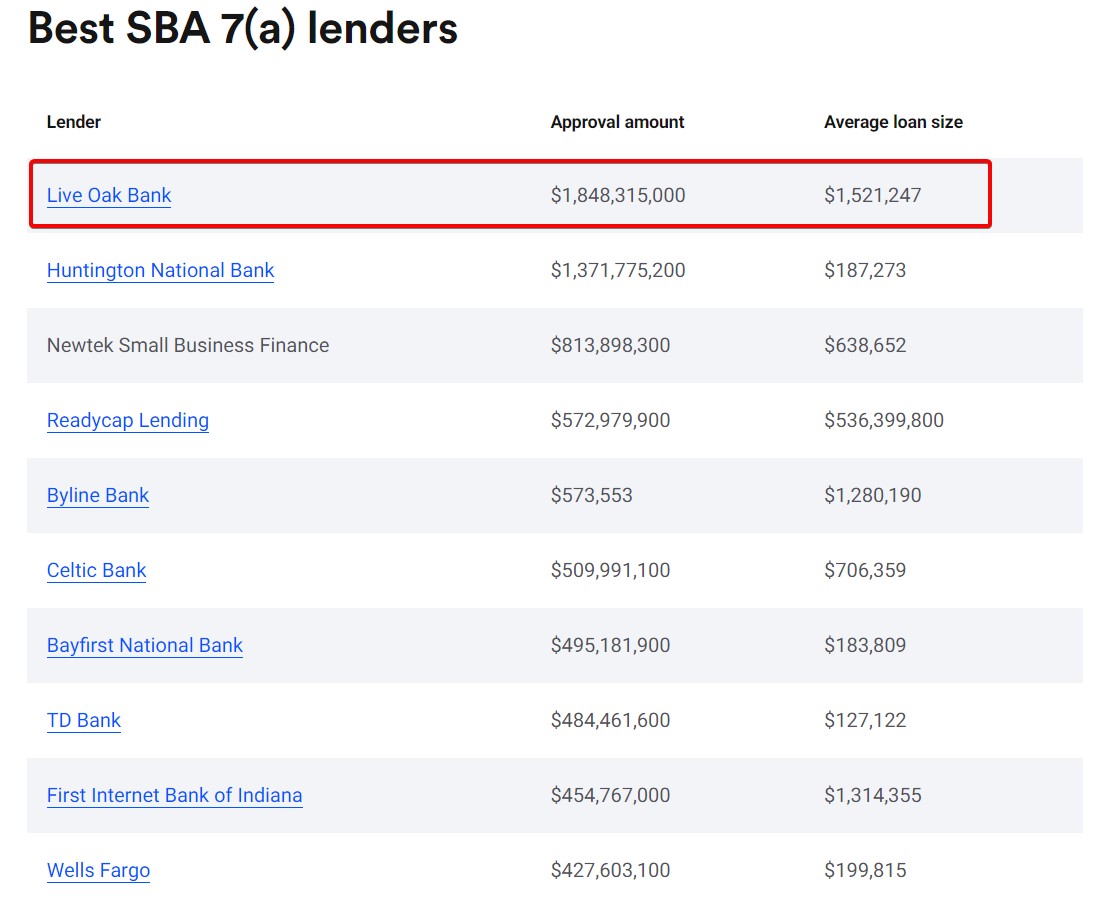

One of its key selling points is its keen focus on providing lending and financing solutions for small businesses. For context, Live Oak Bank is the highest-ranking SBA lender with an average loan size of over $1.5 million, according to a study by Bankrate.

Image via Bankrate

But SBA loans are not its only specialty; Live Oak Bank also focuses on USDA rural development loans for American farms. It finances USDA programs such as:

- USDA 9003 Program

- USDA Community Facilities Program

- USDA Business and Industry Program

- USDA Water and Environmental (WEP) Program

- USDA Rural Energy for America Program (REAP)

Established in 2008, Live Oak Bank has earned a reputation for its expertise in SBA lending and its commitment to supporting entrepreneurial ventures.

Focused mainly on online banking, this bank has only one physical branch and 55,000+ ATMs across the US. Also, Live Oak Bank offers high interest on its business savings accounts (up to 4%) and its CDs (up to 5.2%).

Key Features

- SBA loans: Live Oak Bank is a preferred lender for the Small Business Administration (SBA), offering a range of SBA loan products, including 7(a) loans, 504 loans, and USDA loans.

- Commercial lending: Live Oak Bank also offers various commercial lending solutions tailored specifically for small business needs.

- Online banking: Live Oak Bank’s online banking platform allows small business owners to manage their accounts and access financial reports all in one place.

- Treasury management services: The bank offers treasury management services, including cash management, fraud protection, and payment processing solutions.

- Industry expertise: Live Oak Bank has dedicated lending teams with deep industry knowledge in sectors such as healthcare, franchising, agriculture, and renewable energy.

Pros

- Zero minimum balance requirement

- Offers 8x the national average APY

- Streamlined online banking platform

- Expertise in SBA and USDA loan programs

- Specialized focus on small business lending and financing

- Industry-specific lending teams with specialized knowledge

Cons

- Only one physical branch (focus on online bank)

- Limited product range beyond lending and financing solutions

Pricing

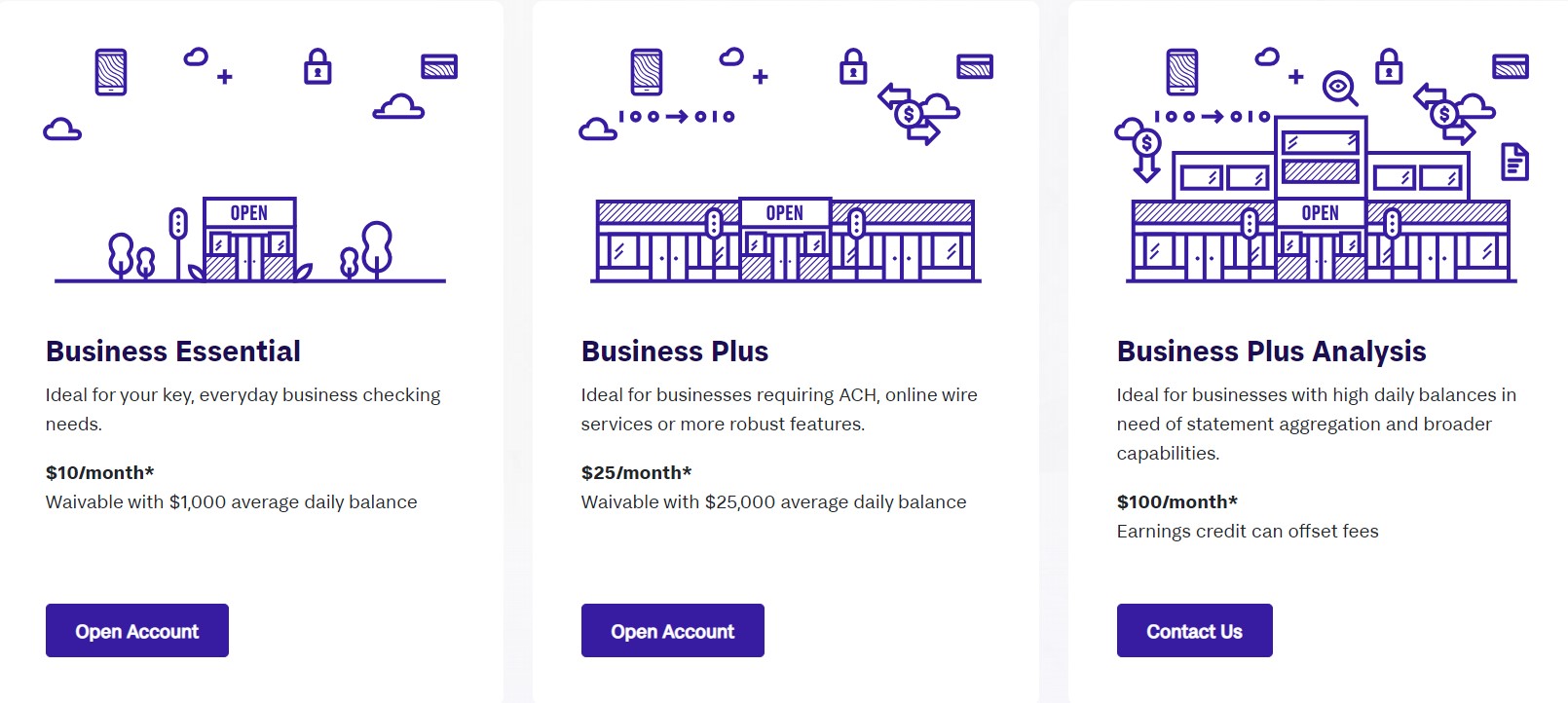

Live Oak Bank has three pricing arrangements for business checking accounts. These accounts support features such as flexible debit card use, dedicated support, and integration with Quickbooks.

- Business Essential: $10 monthly service fee (can be waived with a $1,000 average monthly balance)

- Business Plus: $25 monthly service fee (can be waived with a $25,000 average monthly balance)

- Business Plus Analysis: $100 monthly service fee (can be waived with credit earnings)

Image via Live Oak Bank

3. Bluevine

Image via Bluevine

Though not a bank in the traditional sense, Bluevine takes a spot on our list as one of the best banks for small business owners in the US. This small business-focused banking provider offers unique features that solve many small business pain points.

Unlike many other financial institutions, Bluevine provides FDIC insurance coverage of up to $3 million. Also, you can earn 4.25% APY on balances up to $3 million when you meet certain requirements.

Now, while Bluevine does not operate physical branches or ATMs, it partners with other businesses to provide this function.

As such, you can make deposits into your Bluevine account at 90,000+ Green Dot retail locations. That’s more branches by proxy than all the top traditional banks on this list combined.

Likewise, you can take out cash from your Bluevine account with zero fees at more than 37,000 MoneyPass ATMs across the country.

Innovative practices like this and many others highlight how Bluevine is disrupting the traditional banking industry by heavily leveraging technology.

Apart from that, Bluevine is also no lightweight when it comes to small business loans or financing. This banking service provider offers a line of credit of up to $250,000 with a very short approval window.

Key Features

- Easy-access business checking account: Bluevine’s online business checking account offers unlimited monthly transactions, no monthly fees, and the ability to earn up to 2% interest on balances.

- Bluevine line of credit: Small business owners can access a revolving line of credit with flexible repayment terms and competitive interest rates, designed to support their ongoing working capital needs.

- Interest-yielding business credit card: Small business owners can also make purchases, withdraw cash, and manage their finances with the Bluevine business credit card. Apart from that, they can earn an unlimited 1.5% cash back on every business purchase.

- Educational resources: Bluevine furnishes users with a range of educational resources, including articles, guides, account directories, and a help center.

Pros

- Flexible line of credit

- Extensive educational resources

- FDIC insurance of up to $3 million

- Robust online and mobile banking platforms

- No monthly fees for the business checking account

- Competitive interest rates on business checking balances

- Seamless international payments to 32 countries and 15 currencies

Cons

- No business savings accounts

- No in-person support and assistance compared to traditional banks

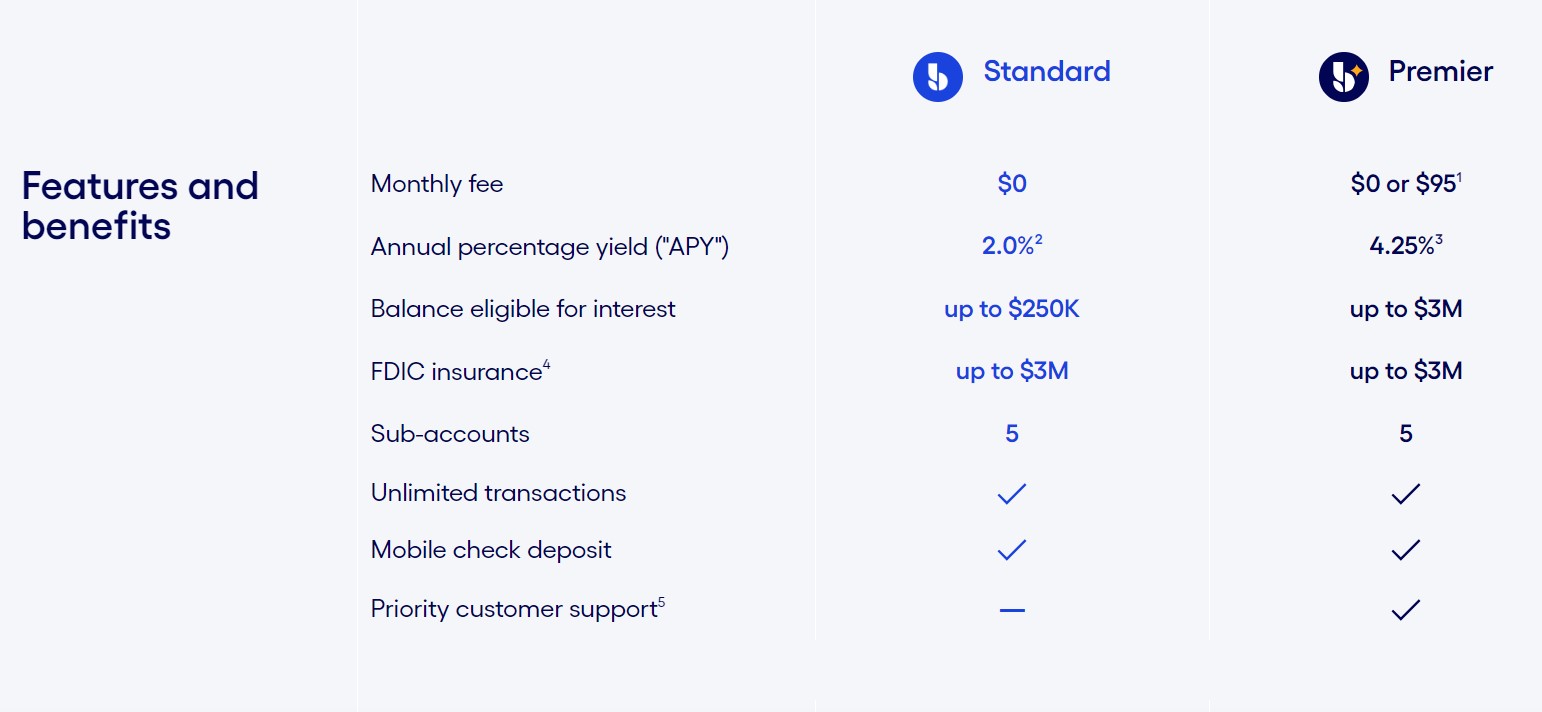

Pricing

Bluevine comes equipped with two small business checking account types with varying capabilities and requirements.

- Standard: Zero monthly maintenance fees and 2% APY on up to $250,000

- Premier: 4.41% APY on up to $3 million and $95 monthly maintenance fees (can be waived with a $100,000 balance) + priority customer support

Image via Bluevine

4. PNC Bank

Image via PNC Bank

PNC Bank is a regional bank with physical locations across half of the United States (28 states), but ranks as one of the best banks for small business needs. Most of its branches are located in the eastern and central parts of the US, particularly in states such as California, Florida, New Jersey, New York, and Pennsylvania, along with Washington, D.C.

Despite its relatively narrow presence, the Federal Reserve previously ranked PNC Bank as the sixth-largest commercial bank in the US by assets, with a total of over $557 billion in assets.

Image via the Federal Reserve

PNC Bank also offers in-person banking at close to 2,400 branches across the available 28 states and 60,000+ ATMs distributed across the nation. But what it lacks in physical branches, it makes up for in a feature-rich online banking platform.

Like most of the best banks for small business owners, PNC Bank offers a wide range of banking functions designed specifically for small business needs.

Not only that, PNC Bank also helps newly launched small businesses find their footing with a slew of functionalities, including startup tools, insights, and guidance.

Meanwhile, we recommend that you kickstart your startup journey with tools like Northwest Registered Agent or Rocket Lawyer for a well-executed launch sequence and better compliance. Or, better yet, use DBA filing services like MyCompanyWorks, LegalZoom, or CoprNet to do all the heavy lifting while you focus on running your business.

Key Features

- Small business checking accounts: PNC Bank offers a long list of small business checking account options, fitted with various features and fees.

- Online and mobile banking: The bank’s online banking platform and mobile apps allow small business owners to manage their accounts, transfer funds, send and receive payments with Zelle, and access financial reports remotely.

- Small business lending: PNC Bank provides a barrage of lending solutions for small businesses, including:

- SBA loans

- Term loans

- Lines of credit

- Commercial real estate and vehicle loans

- Treasury management services: PNC Bank offers a range of Treasury management services, including cash management, fraud protection, liquidity management, and payment processing solutions.

- Business credit cards: For small business owners looking for business credit card loans, PNC Bank has you covered. This bank offers five credit card options, including:

- PNC Cash Rewards Visa Signature business credit card (1.5% cash back on net purchases and up to $400 signup bonus)

- PNC Visa business credit card

- PNC points Visa business credit card

- PNC Travel Rewards Visa business credit card

- PNC BusinessOptions Visa Signature credit card (up to $750 statement credit)

- Multi-industry support: PNC Bank provides coverage for a long list of industries, including healthcare, retail, and manufacturing.

Pros

- Easy-to-use mobile and online banking platform

- Massive list of business bank accounts and credit cards

- Robust ATM network coverage across the United States

- Offers high-yield MMAs with competitive APY in select states

- Wide range of financial products and services for small businesses

- Provides multiple support avenues and learning materials for customers

Cons

- Low APY across most checking accounts

- Limited physical branch presence across the country

Pricing

PNC Bank offers the longest list of business checking account options among any of the banking providers reviewed on this list.

To start with, it offers four main business checking accounts, including:

- Business Checking: Minimum opening deposit of $100 and a $12 monthly service fee (can be waived with a $500 minimum daily balance)

- Business Checking Plus: Minimum opening deposit of $100 and a $22 monthly service fee (can be waived with a $5,000 minimum daily balance)

- Treasury Enterprise Plan: Minimum opening deposit of $100 and a $50 monthly service fee (can be waived with a daily combined minimum balance of $30,000)

- Analysis Business Checking: Minimum opening deposit of $100 and a $25 monthly service fee

Now, coupled with these, PNC Bank also offers four special-purpose business checking accounts, namely:

- MMDA Sweep: $12 monthly service fee (can be waived with a $2,500 minimum daily balance)

- Non-Profit Checking: $12 monthly service fee (can be waived with a $500 minimum daily balance)

- Business Interest Checking: $12 monthly service fee (can be waived with a $5,000 minimum daily balance)

- Interest On Lawyers Trust Accounts (IOLTAs): No minimum balance and no monthly account maintenance fee

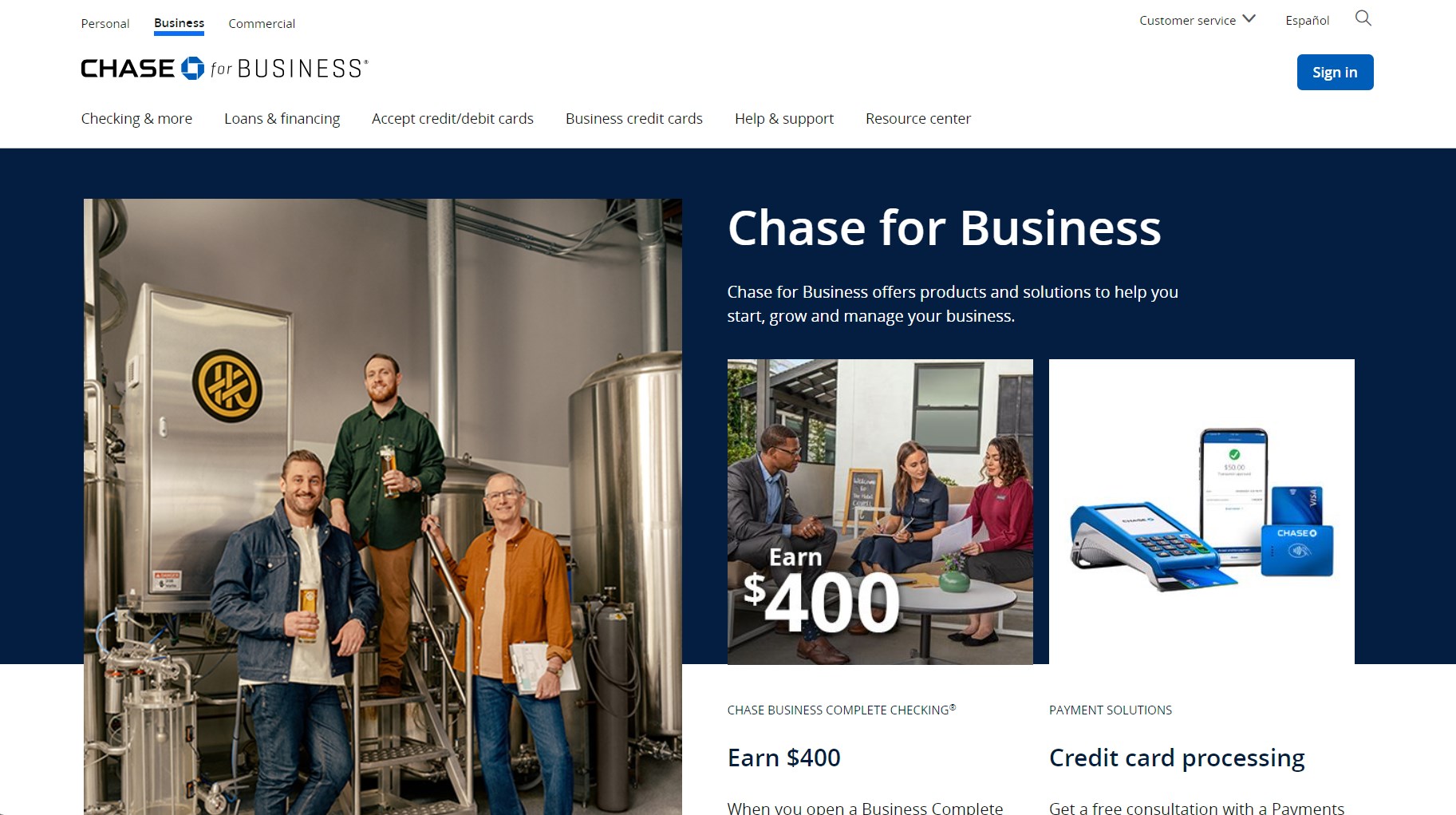

5. Chase

Image via Chase

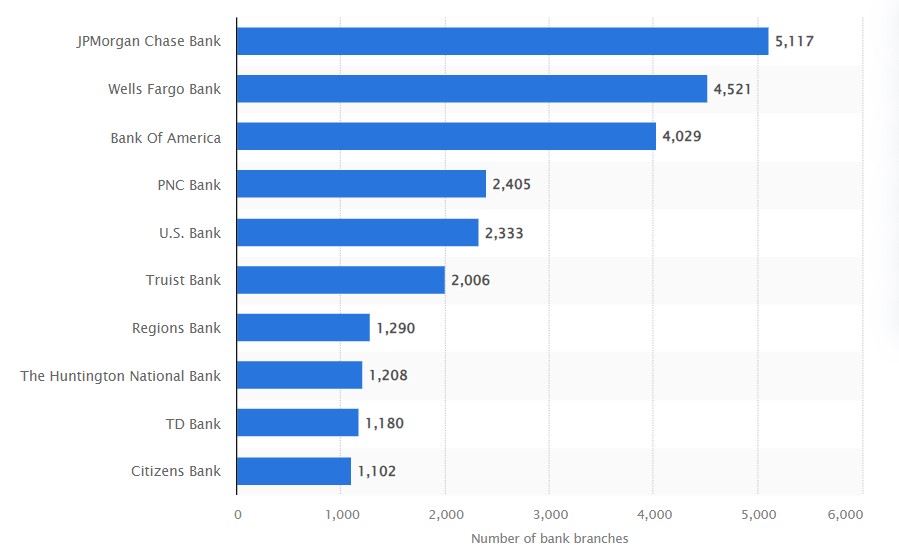

Chase is widely recognized as an enterprise-grade financial institution but easily serves as one of the best banks for small business owners in the US. Unlike Axos Bank or Bluevine, Chase is well-optimized for brick-and-mortar banking, with a network of 5,117 physical branches.

This makes it the bank with the most physical outlets in the entire country, according to Statista data.

Image via Statista

Apart from that, Chase has 15,000+ ATMs scattered across the US.

Meanwhile, unlike most banks, Chase allows you to get access to a line of business credit using only your social security number. This means you can leverage a lot of its banking features without having the usual prerequisite EIN.

But try not to stay without one for too long, as it could limit available banking features for you. Consider using GovDocFiling to get your EIN quickly and effortlessly.

Key Features

- Business-focused checking accounts: Chase offers business checking accounts that combine typical checking account features with a host of other valuable features, such as Chase QuickAccept, unlimited electronic deposits, and purchase protection.

- Business credit cards: Chase offers a range of business credit cards designed to meet the diverse needs of small businesses. The diverse credit card options include:

- Ink Business Unlimited credit card ($750 bonus cash back for starters, 1.5% cash back on every purchase, 5% cash back on Lyft rides, and more)

- Ink Business Cash credit card ($750 bonus cash back for starters, 5% cash back on the first $25,000 spent, 5% cash back on Lyft ride, and more)

- Ink Business Preferred credit card (100,000 bonus points for starters, 3 points per $1 on the first $150,000 spent, 5x points on Lyft rides, and more)

- QuickAccept: This feature allows small businesses to accept card payments securely using a mobile device, making it easier to get paid on the go.

- Online banking: This provides small businesses with a centralized hub for managing accounts and tracking transactions in one place. The online banking feature is split into:

- Chase Business Online (Safeguard your small business with fraud protection services, move money easily and round-the-clock, and more)

- Chase Mobile App (scan and deposit checks with your smartphone, move funds between your accounts, and more)

- Small business lending: Chase grants small businesses a range of lending products to bolster growth and expansion plans, such as term loans, lines of credit, and real estate loans.

Pros

- Active and personalized customer support

- Well-structured digital banking and mobile app platforms

- Largest nationwide network of physical branches of any bank

- Comprehensive suite of lending products for small businesses

- Wide range of business credit cards with valuable rewards and benefits

- Integrated with small business payroll, management, and bookkeeping tools such as Fiskl, Gusto, and Agree

Cons

- Some services, such as wire transfers, may incur additional fees

- Charges monthly service fees on checking accounts unless minimum balance or other requirements are met

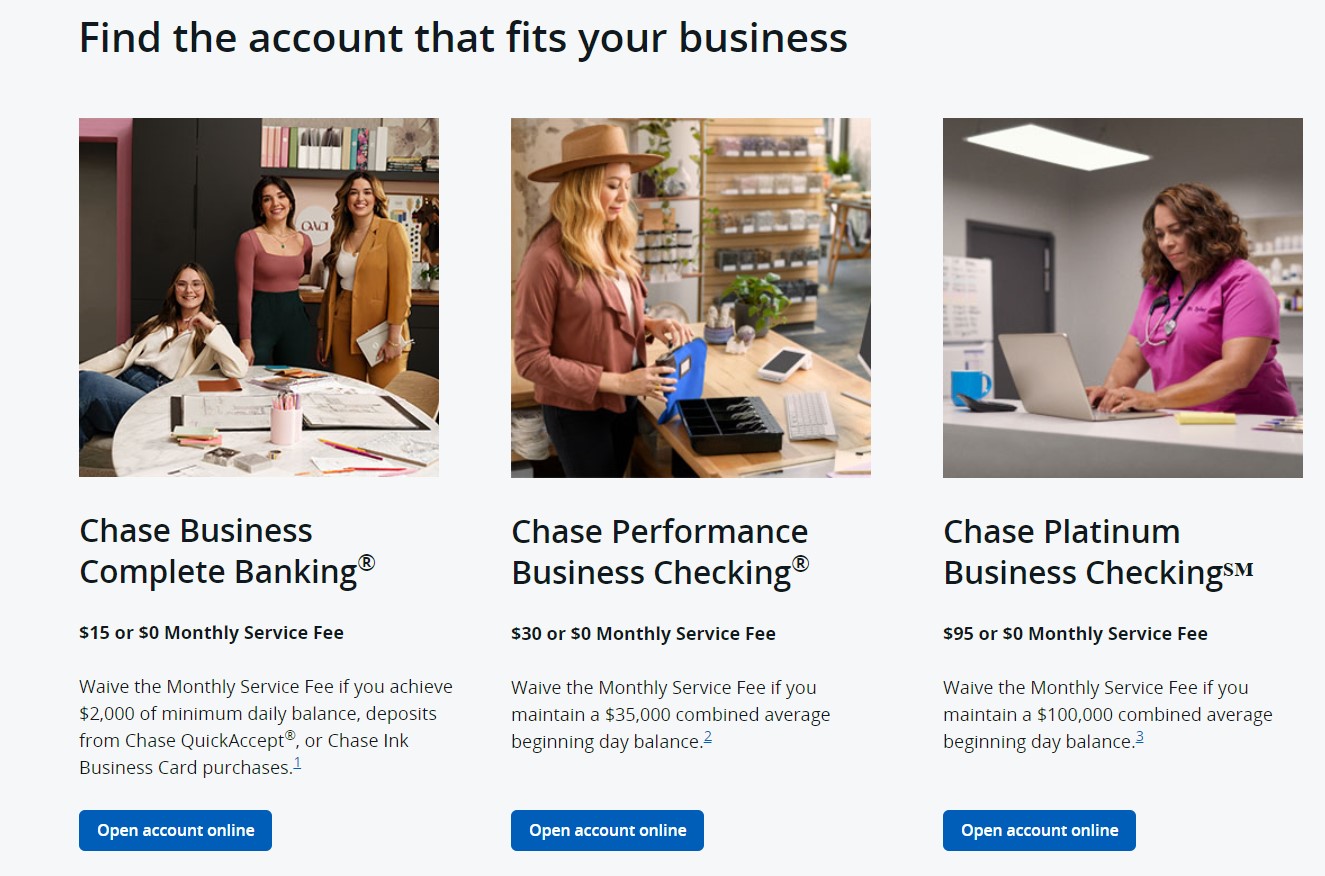

Pricing

Chase offers three business checking account options with varying monthly service and transaction fees.

- Chase Business Complete Checking: $15 monthly service fee (can be waived with a daily minimum balance of $2,000 or other qualifying transactions)

- Chase Performance Business Checking: $30 monthly service fee (can be waived with a daily combined minimum balance of $35,000 or other qualifying transactions)

- Chase Platinum Business Checking: $95 monthly service fee (can be waived with a daily combined minimum balance of $100,000 or other qualifying transactions)

Image via Chase

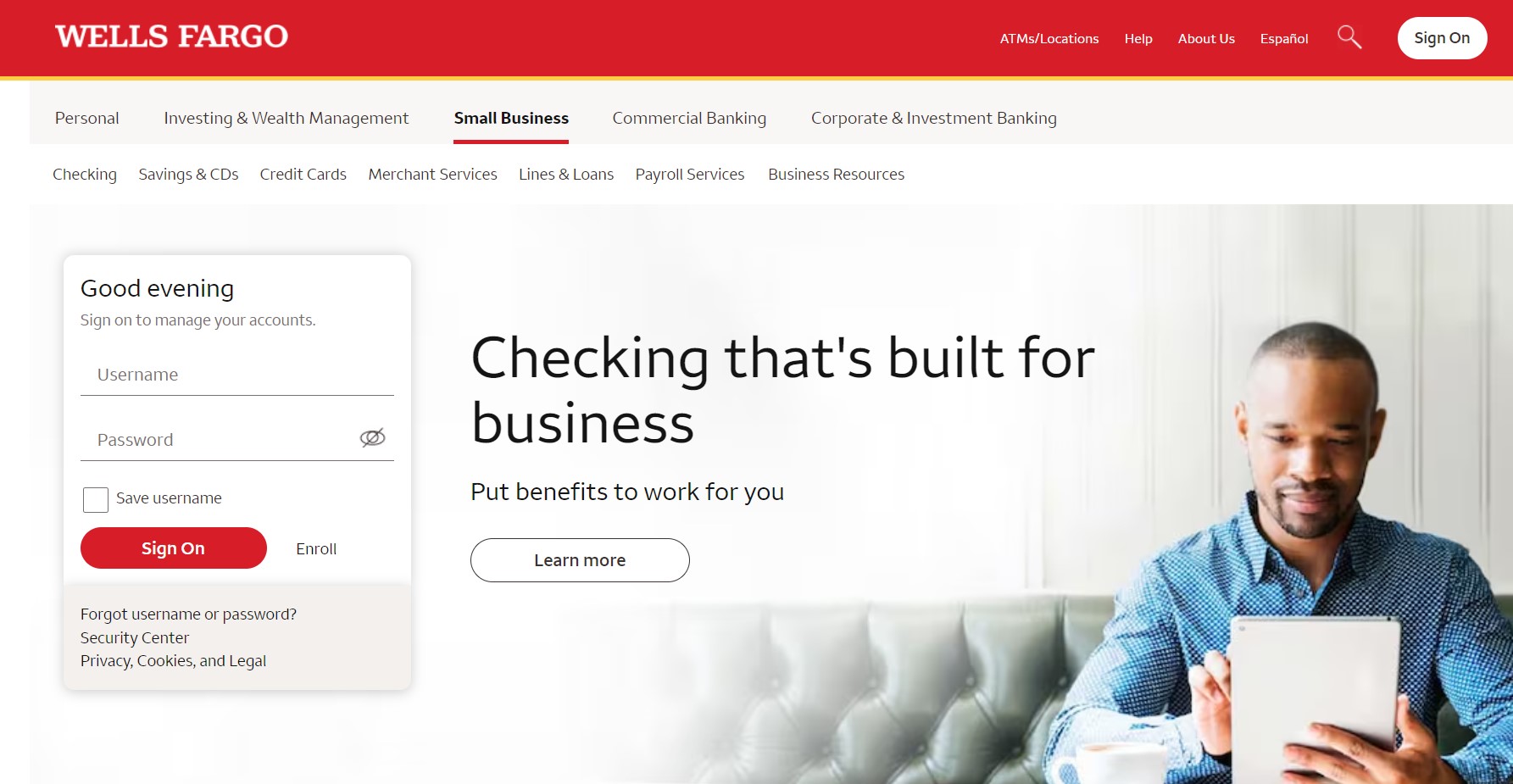

6. Wells Fargo

Image via Wells Fargo

Wells Fargo easily comes in as one of the best banks for small businesses thanks to its lineup of relevant features. Despite being an institutional bank like Chase, Wells Fargo caters to small business needs effectively.

Founded in 1929, Well Fargo is a brick-and-mortar bank with over 4,521 physical branches, per Statista data, and 11,000+ ATMs distributed across 36 states.

What’s more?

Wells Fargo has a long history of serving small business needs and also ranks as one of the best 7 SBA lenders, with an average loan size of almost $200,000, per the Bankrate study.

Key Features

- Business checking accounts: Wells Fargo offers a suite of business checking account options, each designed to accommodate varying transaction volumes and cash-handling needs. They include:

- Initial Business Checking

- Navigate Business Checking

- Optimize Business Checking

- Online and mobile banking: Wells Fargo allows small business owners to manage their accounts and access a suite of financial management tools from any device. Likewise, the bank has a user-friendly mobile app that provides access to all features on the go.

- Merchant services: Wells Fargo offers various merchant services solutions for small businesses, including point-of-sale systems, payment gateways, and fraud protection tools.

- Small business-focused lending: Small businesses can explore a range of lending options for their operational expansion needs, such as:

- SBA loans

- PPP loan forgiveness

- Business line of credit

- Business letters of credit

- Healthcare practice financing

- Small business resources: Wells Fargo comes fitted with a slew of informative resources, including educational materials, a small business product selector tool, and women-focused business materials.

Pros

- Integrated payroll management

- Robust online and mobile banking platforms

- Diverse range of business checking accounts

- Healthy distribution of physical branches and ATM networks

- Comprehensive suite of small business-focused lending products

- Extensive educational resources and financial management tools

Cons

- No business credit card feature yet

- Little to no interest in business checking account

- Limited branch presence in certain states and regions may pose accessibility challenges

Pricing

Wells Fargo offers three business checking account options with varying monthly service fees and transaction allowances. They include:

- Initial Business Checking: Minimum opening deposit of $25 and $10 monthly service fee (can be waived with a $500 minimum daily balance or $1,000 average ledger balance)

- Navigate Business Checking: Minimum opening deposit of $25 and $25 monthly service fee (can be waived with a $10,000 minimum daily balance or $15,000 in average combined business deposit balances)

- Optimize Business Checking: Minimum opening deposit of $25 and $75 monthly service fee (designed for larger businesses)

7. Bank of America

Image via Bank of America

A thoroughly recognized banking brand in the US, Bank of America, or BofA, easily makes the list as one of the best banks for small business use cases. And this is thanks to its strong presence in the small business banking sector, in areas such as specialist support and lending.

In fact, BofA claims to be “the nation’s largest small business lender and also the largest investor in Community Development Financial Institutions (CDFIs) that help startups in low- to moderate-income areas.”

But that’s not all.

BofA links easily to business formation platforms, such as ZenBusiness, Bizee, LegalZoom, LegalNature, and INC Authority, making it super convenient to aggregate and pull your transactions. This way, you can track your expenses, file taxes, and keep your finances in good shape.

Bank of America is the third-largest bank in the US by physical branches, with 4,029 branches, according to Statista data. It also has a robust network of 15,000+ ATMs spread across the country.

Key Features

- Small business-focused checking solutions: BofA offers two specialized checking accounts for small businesses, with options for different monthly fee structures and transaction limits.

- Online Banking: Bank of America’s online banking platform allows small business owners to manage their accounts, transfer funds, pay bills, and access financial reports in one place.

- Mobile banking app: BofA offers an all-inclusive, user-friendly mobile app for all OS.

- Small business credit cards: BofA offers two credit card options tailored for small businesses, with varying rewards programs and expense management tools.

- Small business-targeted loans and lines of credit: Bank of America gives you access to various lending solutions to access capital, including:

- SBA loans

- Franchise financing

- Unsecured lines of credit

- Cash-secured lines of credit

- Commercial real estate loans

- Payroll services: Bank of America partners with recognized payroll providers to offer small businesses payroll processing and tax filing services.

Pros

- Multiple business rewards programs

- Robust online and mobile banking platforms

- Lending options and lines of credit for small business financing

- Wide range of financial products and services for small businesses

- Well-distributed brick-and-mortar banking infrastructure for convenient access

Cons

- Limited integration with third-party business tools and software

- Higher minimum balance requirement to waive account maintenance fees

Pricing

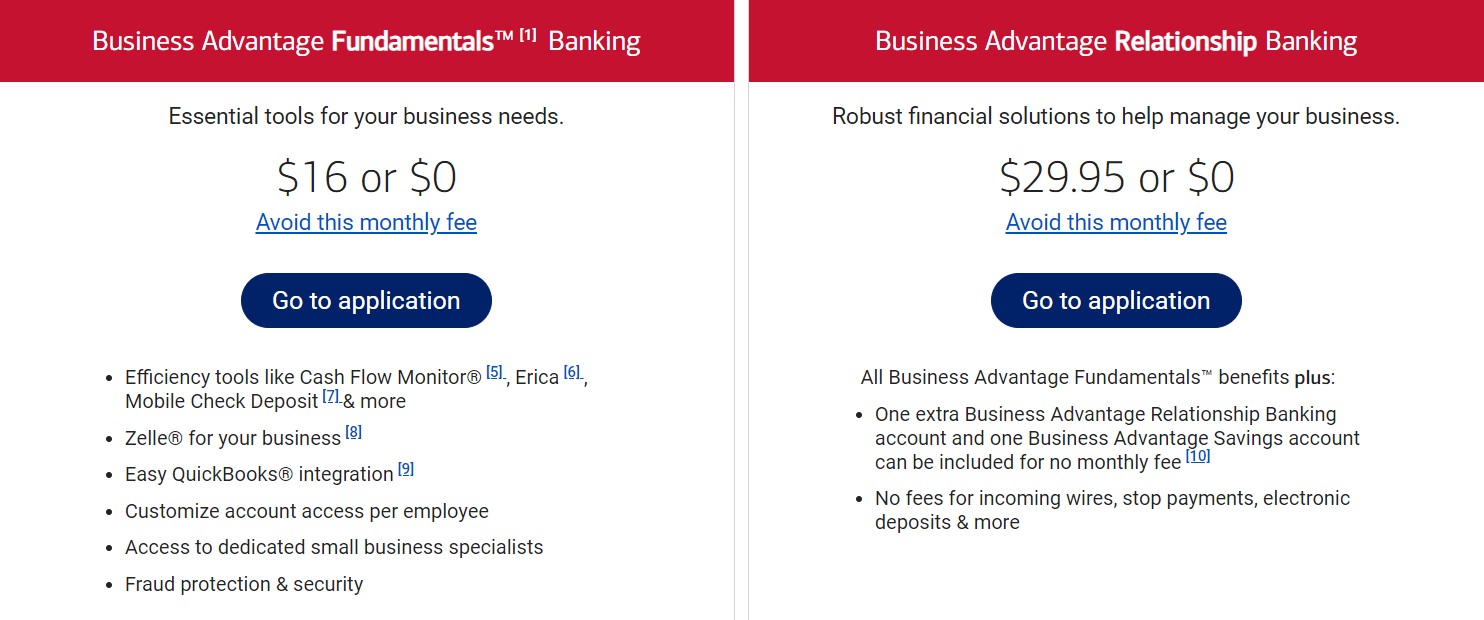

Bank of America has two pricing plans for small business banking:

- Business Advantage Fundamentals Banking: $16 monthly maintenance fee (can be waived with a $5,000 minimum daily)

- Business Advantage Relationship Banking: $29.95 monthly maintenance fee (can be waived with a $25,000 minimum daily)

Image via Bank of America

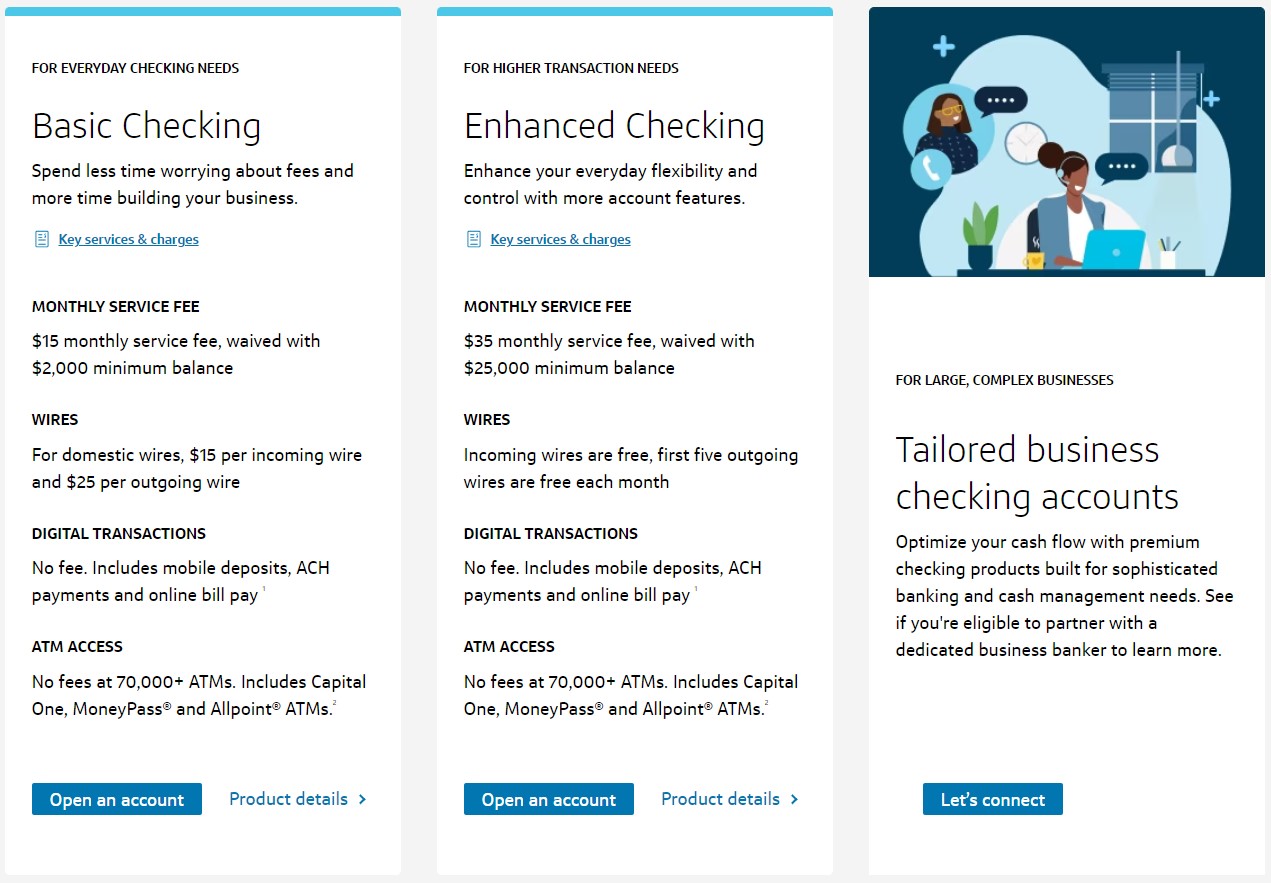

8. Capital One

Image via Capital One

Capital One has earned its stripes as one of the best banks for small businesses in the US.

Unlike heavyweights like Chase and Wells Fargo, Capital One is more optimized for online banking, which explains why it only has 273 physical branches in seven states.

But what it lacks in physical branches, it makes up for with ATMs, as it currently boasts 70,000+ operational machines nationwide—the second-largest ATM network on our list.

Capital One offers small business-focused services. And this dedication can be seen through the bank’s extensive suite of products, dedicated customer support, and business credit cards.

With Capital One, you get access to a range of banking products, such as checking accounts, savings accounts, loans, lines of credit, and other lending options.

Key Features

- Robust business checking accounts: Capital One offers three business checking account options that provide a slew of features and functions, including unlimited transactions, mobile check deposit, ACH payments, and online bill pay.

- Interest-rich business savings account: Capital One also offers a savings account for small business owners that comes with an interest allowance as high as 4.1% for the first six months. This account provides all the standard features of a business savings account, such as overdraft coverage, round-the-clock banking, and tailored support.

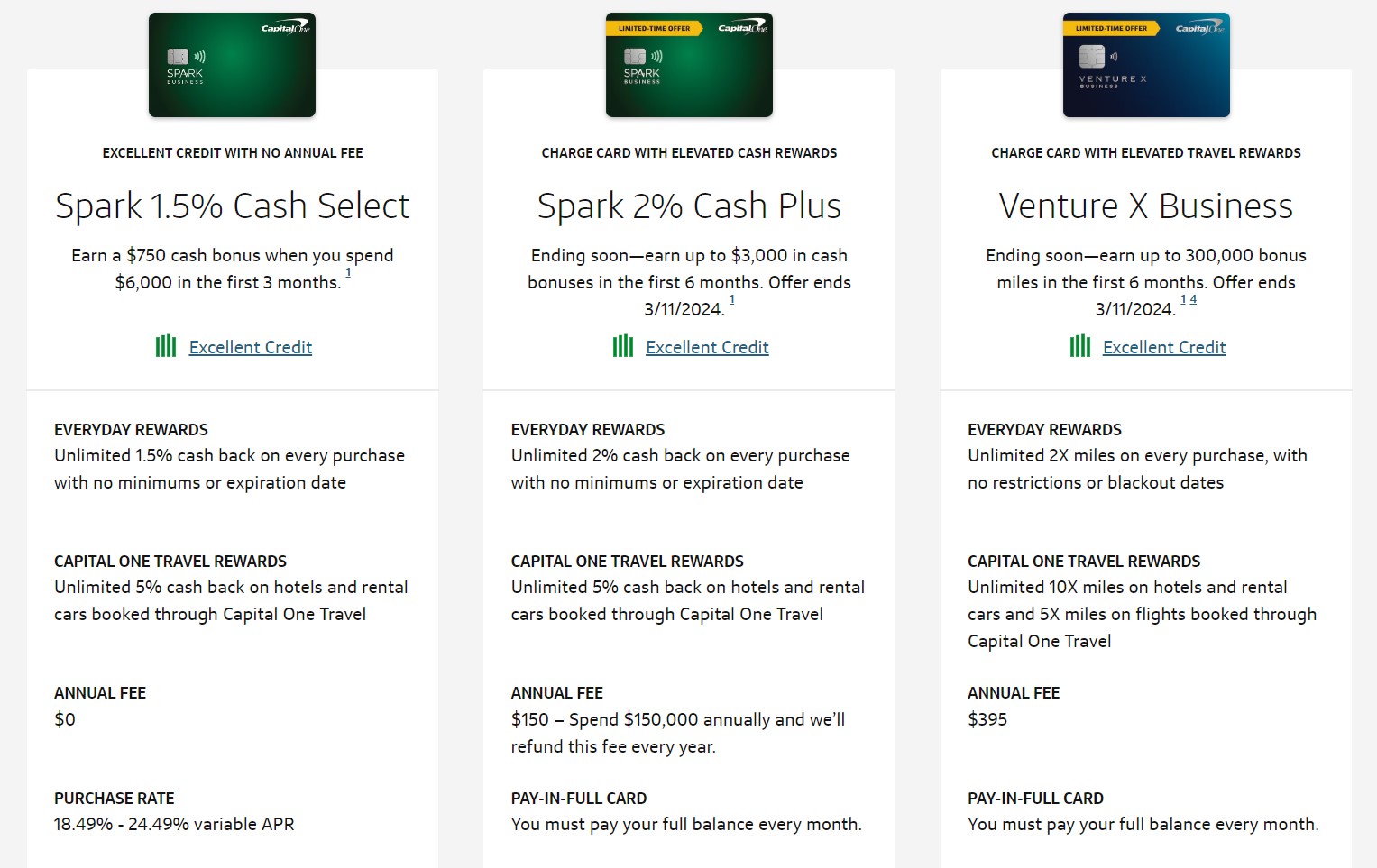

- Business credit cards: Small business owners can choose from a range of credit card options that offer valuable rewards, cashback opportunities, and travel benefits. Capital One’s business credit card suite includes:

- Spark 1% Classic

- Spark 1.5% Cash Select

- Spark 2.0% Cash Plus

- Venture X Business

- Spark 2X Miles

- Spark 1.5X Miles Select

Image via Capital One

- Small business lending: As one of the best banks for small business owners, Capital One provides access to a wide range of lending options. These span items such as term loans, lines of credit, equipment financing, SBA loans, real estate loans, and CIRA loans.

- Merchant services: Capital One offers various merchant services solutions, such as POS systems, payroll, and fraud protection tools.

- Mobile banking: Like other best banks for small business owners, Capital One comes with mobile banking and app capabilities that provide on-the-go access to banking services.

Pros

- Robust online and mobile banking services

- Extensive ATM network for convenient cash access

- In-depth educational resources and financial insights

- Competitive fees and pricing for business checking accounts

- No minimum balance requirements for certain checking accounts

- Comprehensive suite of lending products for small business needs

Cons

- Limited physical branch presence

- Relatively high monthly fees if minimum balances aren’t met

Pricing

Capital One has three pricing arrangements for its business checking, namely:

- Basic Checking: $15 monthly service fee (can be waived with a $2,000 average monthly balance)

- Enhanced Checking: $35 (can be waived with a $25,000 average monthly balance)

- Tailored business checking accounts: Custom pricing (for large, complex business)

Image via Capital One

9. Huntington National Bank

Image via Huntington National Bank

Huntington National Bank is one of the best banks for small business owners operating in the Midwest and southern parts of the country. Though it lacks nationwide spread, Huntington National Bank provides a consumer-friendly offering tailored specifically to small businesses.

Huntington National Bank has only 1,000+ physical branches in 11 states and over 1,600 ATM locations to cater to in-person banking for customers that operate within the southern axis.

The American states where you can walk into a Huntington National Bank branch include Colorado, Florida, Illinois, Indiana, Kentucky, Michigan, Minnesota, Ohio, Pennsylvania, Wisconsin, and West Virginia.

Customers outside this region would have to make do with the online and mobile banking feature, which provides pretty much all the banking functionality you might need.

Likewise, Huntington National Bank’s regional status doesn’t stop it from offering much-needed small business loans nationwide. This bank offers small business-focused loan programs such as:

- Practice finance

- Business line of credit

- SBA-guaranteed business loans

- Business term and real estate loans

What’s more?

Huntington National Bank has the second-highest SBA loan amount, behind Live Oak Bank, with over $1.3 million, according to the Bankrate study.

Key Features

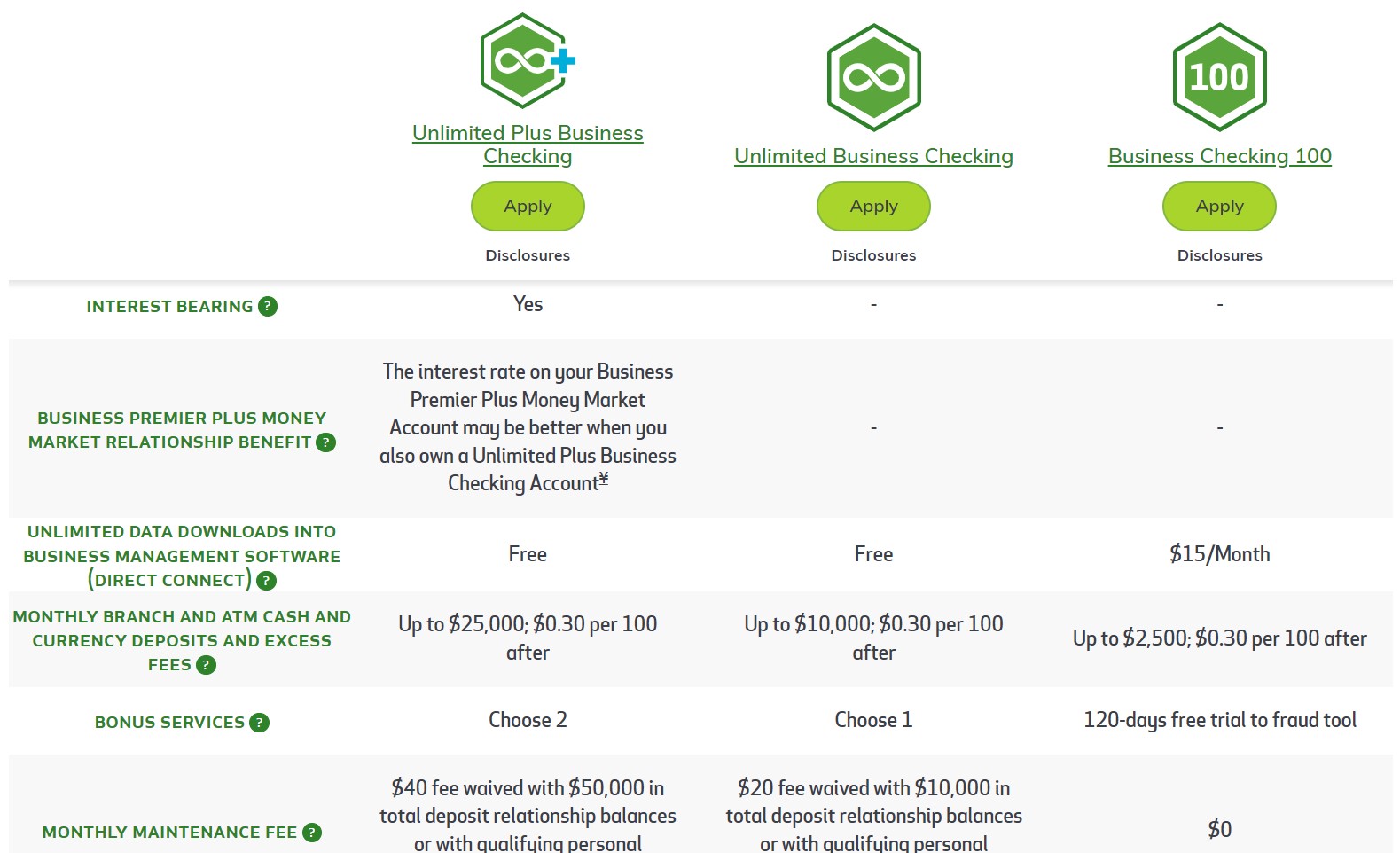

- Business checking accounts: Huntington National Bank offers three business checking account options, with varying specifications for different small business sizes.

- Business savings and money market accounts: Small businesses can open savings and money market accounts to earn interest on their balances and manage their cash flow more effectively.

- Small business lending: As mentioned earlier, this bank provides a range of lending solutions for small businesses, such as lines of credit, SBA loans, and equipment financing.

- Online banking: Huntington National Bank’s online banking platform and mobile apps allow small business owners to manage their accounts, transfer funds, and access financial reports and statements remotely.

- Treasury Management Services: This bank offers a long list of treasury management services, including:

- Smart tax

- Payroll services

- Fraud mitigation

- Lockbox solutions

- Merchant services

- Account reconciliation

- Controlled disbursement

- Insurance: Huntington National Bank also provides much-needed insurance packages such as property and casualty, employee benefits, executive life insurance, and more.

Pros

- User-friendly online banking and mobile apps

- Tailored financial solutions for small businesses

- No monthly fees on the basic checking account option

- Small business-focused lending options, including SBA loans

- Competitive interest rates on savings and money market accounts (up to 4.7%)

Cons

- Limited integrations with third-party business tools and software

- Limited geographic reach and branch network outside the Midwest region

Pricing

Huntington National Bank comes with three pricing models with several varying features:

- Business Checking 100: Zero maintenance fees but no interest yields

- Unlimited Business Checking: $20 monthly maintenance fee (can be waived with $10,000 minimum daily balance)

- Unlimited Plus Business Checking: $40 monthly maintenance fee (can be waived with $50,000 minimum daily balance)

Image via Huntington National Bank

10. Novo

Image via Novo

While Novo is not a bank in the traditional sense, it is an online banking service provider designed specifically for small businesses, freelancers, and entrepreneurs. This earns it a spot on our list as one of the best banks for small business owners.

Since breaking into the scene in 2016, this fintech company has pretty much disrupted traditional banking models by providing modern digital banking solutions, such as:

- Zero monthly maintenance fees

- Consumer-friendly mobile apps

- A host of integrations with popular business tools

Because of its focus on new-age solutions, Novo doesn’t offer brick-and-mortar features such as physical branches or ATM networks. However, it makes up for this with efficient online and mobile banking capabilities, sparing no expense on mobile optimization.

That said, the aim of Novo is simple: to make banking a seamless and even enjoyable process for small business owners and entrepreneurs nationwide.

Key Features

- Free online banking: Novo provides free online banking services with no monthly fees, minimum balance requirements, or hidden charges.

- Integrations: Novo seamlessly integrates with popular business tools and software such as Stripe, Square, Xero, Shopify, and Slack, allowing users to manage their finances more efficiently.

- Mobile apps: Novo’s easy-navigate mobile apps for iOS and Android allow users to access their accounts, send payments, and manage their finances on the go.

- Debit card: Novo issues a unique business debit card for transactions, allowing users to make purchases, withdraw cash, and track expenses easily. Plus, you get reimbursed for any ATM fee exceeding $7 in a month.

- Cashback rewards: Novo offers cashback rewards on eligible purchases made with the Novo debit card, providing additional savings for small business owners.

Pros

- Robust invoicing functionality

- Transparent pricing and no hidden fees

- Seamless integrations with popular business tools

- Cashback rewards on eligible debit card purchases

- Zero monthly fees or minimum balance requirements

- User-friendly mobile apps and online banking interface

Cons

- No physical branch locations or ATM network

- Limited product range (no lending or investing services)

Pricing

As we’ve mentioned, Novo’s pricing structure is straightforward and transparent, with zero monthly fees or minimum balance requirements.

11. NBKC Bank

Image via NBKC Bank

NBKC Bank, formerly the National Bank of Kansas City, is a community bank based in Kansas City, Missouri, and is one of the best banks for small business needs. And as its old name suggests, NBKC Bank only operates in the Kansas City metropolitan area, with four physical branch locations.

But this doesn’t stop NBKC from being one of the best banks for small business owners, especially when you take its full-function online banking feature into account. Testament to its online banking efficiency is the NBKC mobile app rating, which is 4.4 on the Apple App Store and 4.1 on Google Play.

Also, like Bluevine, NBKC partners with the MoneyPass network to allow customers access to 37,000+ ATMs across the US and Puerto Rico.

Key Features

- Zero-fee business checking account: NBKC Bank offers a single-plan fee-free checking account with multiple features, such as the NBKC Business Debit MasterCard, online banking, bill pay, and free incoming domestic wires.

- Online banking and mobile app: NBKC Bank offers an easy-to-use mobile app and an easily navigable online banking platform, allowing customers seamless banking functions on the go.

- Small business lending: NBKC Bank provides a range of lending solutions, such as lines of credit, equipment financing, and SBA loans, for small businesses operating within the Kansas City area.

- Business money market account (MMA): This bank also offers money market accounts for effortless business savings that come with interest of up to 2.75% APY on balances.

- Business solutions: NBKC offers a host of business solutions for better banking optimization, including:

- Fraud protection

- Improved cash management

- ACH funds collection and disbursement

- Tap-to-pay functionality on the mobile app

- Personal Service: NBKC Bank prides itself on providing personalized, one-on-one service and attention to its small business customers, with dedicated relationship managers and support teams.

Pros

- Multiple small business lending solutions

- User-friendly online banking and mobile app

- Competitive yields on some deposit accounts (MMA)

- Free business checking account with zero monthly fees

- Personalized service and attention for small business customers

Cons

- No brick-and-mortar branch outside Kansas City

- Business loans are only available to business owners in the Kansas City area

Pricing

As we’ve mentioned already, NBKC Bank offers a zero-fee checking account called the nbkc Business Account. However, the bank charges varying prices for add-ons, such as:

- Desktop deposit at $15 per month

- Business fraud tools at $5 per month

- ACH credits and debits at $15 per month

NBKC also charges fees for domestic ($5 per transfer) and international ($45 per transfer) wire transfers.

12. Celtic Bank

Image via Celtic Bank

From the get-go, Celtic Bank was designed to focus on serving small businesses and entrepreneurs, making it one of the best banks for small business owners.

While it may not be as well-known as some larger national banks, this small community bank has built a reputation for its personalized service for small businesses.

Meanwhile, Celtic Bank has zero physical branches or ATMs, opting instead to focus on online banking.

One thing that really stuck out for us about this bank was its lending capabilities. Despite only being a small community bank, Celtic is one of the highest SBA lenders, averaging over $700,000 in loan size.

That said, this bank offers a slew of financing programs, including:

- SBA loans (such as SBA 504, SBA 7(a), and Celtic Express)

- Specialty financing (such as asset-based lending, equipment leasing or financing, and construction financing)

- Business loans (such as business acquisition, debt refinance, working capital, and commercial real estate)

Key Features

- Business savings accounts: Small businesses can open savings accounts with competitive interest rates and flexible options for withdrawals and transfers.

- Small business-focused lending: Celtic Bank furnishes small business owners with a range of lending programs, including business debt refinancing, commercial real estate loans, asset-based lines of credit, and SBA loans.

- Online banking and mobile apps: Celtic Bank’s online banking platform and mobile apps allow small business owners to manage their accounts, transfer funds, and access financial reports and statements remotely.

Pros

- Up to 4.41% APY on savings accounts

- User-friendly online banking and mobile apps

- No out-of-network ATM fees with Celtic Bank accounts

- Robust small business lending solutions, including SBA loans

- Personalized service and attention for small business customers

- Cash management tools and services like remote deposit and ACH

Cons

- No physical branch locations (online-only)

- Lack of nationwide recognition and brand awareness

Pricing

Celtic Bank is more optimized for small business lending and financing and doesn’t offer varying account types. That said, the bank offers an interest-bearing business savings account with a $1,000 minimum opening deposit and a $1,000 daily minimum balance to avoid service charges.

FAQs

Q1. Which bank is best to open small business accounts?

The best banks for small business bank accounts can vary depending on your specific needs and priorities. But based on our research, we’ve found what we believe to be the 12 best banks for small business needs, and they include:

- Novo

- Chase

- Bluevine

- PNC Bank

- Axos Bank

- Celtic Bank

- Capital One

- Wells Fargo

- NBKC Bank

- Live Oak Bank

- Bank of America

- Huntington National Bank

Q2. Which bank is best for business purposes?

We like to think that there is no one-size-fits-all answer, as the best banks for small business purposes depend, once again, on your specific requirements.

If you prioritize online and mobile banking, then Axos Bank, Bluevine, NBKC Bank, and Novo are excellent options. For brick-and-mortar banking with a firm nationwide presence, Chase, Wells Fargo, and Bank of America are your best bets. And if you’re seeking small business lending, then Live Oak Bank, Huntington National Bank, and Celtic Bank are our top recommendations.

Q3. Which bank has the best business rates?

Many of the banks on our best banks for small business owner list offer competitive rates for small businesses, but some standouts include:

- Celtic Bank: 4.41% APY on savings accounts

- Huntington National Bank: Up to 4.7% on MMAs

- Bluevine: 4.25% APY on balances up to $3 million

- Capital One: 4.1% on business savings accounts for the first six months

- Live Oak Bank: 4% on business savings accounts and 5.2% APY on business CDs

Q4. What are the benefits of using an online bank for small businesses?

Based on our research on the best banks for small business needs, online banks like Axos Bank, Bluevine, NBKC Bank, and Novo offer several advantages for small businesses, including:

- Lower fees: Online banks generally have lower overhead costs, allowing them to offer lower fees on business accounts.

- Robust digital platforms: Online banks prioritize online and mobile banking, providing user-friendly platforms for seamless account management.

- Wide accessibility: With no physical branches, online banks are accessible from anywhere with an internet connection.

Q5. How do brick-and-mortar banks cater to small businesses?

Our research on the best banks for small business owners shows that traditional brick-and-mortar banks like Chase, Wells Fargo, and Bank of America offer several advantages, such as:

- Nationwide branch networks: These banks have extensive physical branch networks, providing convenient in-person banking and free cash deposits.

- Comprehensive product offerings: Brick-and-mortar banks typically provide more product offerings compared to their online-only counterparts. Expect more comprehensive checking accounts, credit cards, loans, and merchant services from these banks.

- Personalized support: Many brick-and-mortar banks offer dedicated small business support teams and relationship managers for personalized assistance.

Q6. What should I consider when choosing a bank for my small business?

When choosing out of the best banks for small business owners list, consider the following factors:

- Customer service and support

- Online and mobile banking capabilities

- Branch and ATM accessibility (if required)

- Small business lending and financing options

- Account fees and minimum balance requirements

- Integration with third-party business tools and software

- Interest rates on checking, savings, and lending products

To Conclude: 12 Best Banks for Small Business Owners in 2024

The importance of choosing the right bank for your business needs, especially when you’re just starting a new small business, cannot be overemphasized. And that’s why we’ve taken the time to put together this comprehensive list of the best banks for small business operations.

Take a tip—or two—from this post and pick what works best for you and your small business.

Whether you prefer the physical touch of brick-and-mortar banks, online banking convenience, or quick small business loans to keep the gears grinding, there’s something for you.

Are your best banks for small business needs missing from this list? Tell us what you think in the comments below.

About the author

From selling flowers door-to-door at hair salons when he was 16 to starting his own auto detailing business, Brett Shapiro has had an entrepreneurial spirit since he was young. After earning a Bachelor of Arts degree in Global and International Studies from the University of California, Santa Barbara, and years traveling the world planning and executing cause marketing events, Brett decided to test out his entrepreneurial chops with his own medical supply distribution company.

During the formation of this business, Brett made a handful of simple, avoidable mistakes due to lack of experience and guidance. It was then that Brett realized there was a real, consistent need for a company to support businesses as they start, build and grow. He set his sights on creating Easy Doc Filing — an honest, transparent and simple resource center that takes care of the mundane, yet critical, formation documentation. Brett continues to lead Easy Doc Filing in developing services and partnerships that support and encourage entrepreneurship across all industries.