If you own a rental property, you’re most likely to prioritize rental income while seeking ways to reduce costs like repairs, maintenance, and taxes. A popular approach to structuring your rental property business for tax efficiency is to form a limited liability company (LLC).

LLCs offer the liability protection of a Corporation and the pass-through tax benefits of Sole Proprietorships and Partnerships. This makes LLCs a preferred option for many real estate business owners.

In this blog post, we’ll explore the tax benefits of an LLC for rental property owners. Keep reading to gain crucial insights into maximizing your rental income and minimizing legal and financial risks in the real estate rental industry.

4 Tax Benefits of an LLC for Rental Property Owners

Choosing an LLC for your rental property provides an array of tax advantages. Let’s take a look at the top four tax benefits of an LLC for rental property owners.

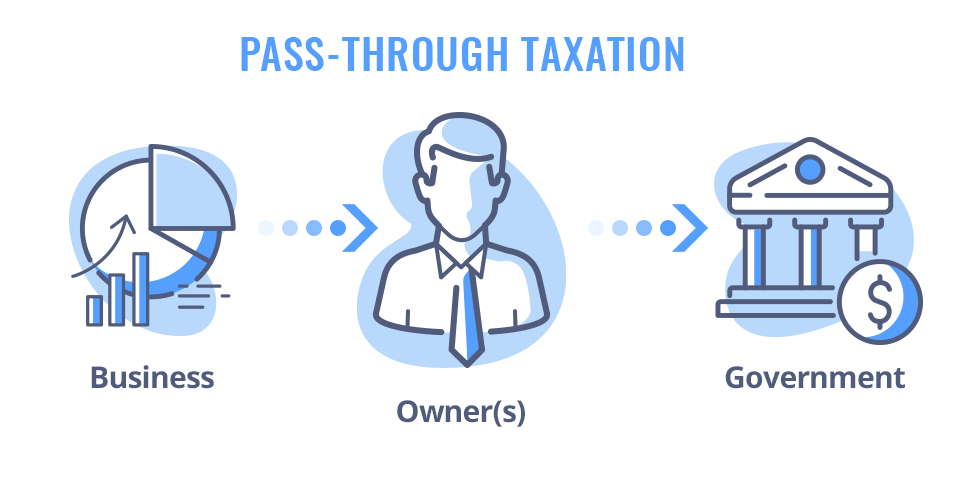

1. Pass-Through Taxation

One of the primary tax benefits of an LLC for rental property owners is pass-through taxation. An LLC is a popular business structure among rental property owners as it offers personal asset protection like a corporation.

It also enjoys the same tax structure as a sole proprietorship if it’s a single-member LLC and that of a partnership if it’s a multi-member LLC. This means that LLC members can report rental income on their personal income tax returns.

Both single-member and multi-member LLCs are categorized as pass-through entities—they can pass business income directly to the owners.

Image via PFS Global

As a result, the company doesn’t need to pay corporate taxes. Below are the advantages of pass-through taxation for your rental property business.

Prevents Double-Taxation

A corporation is subject to double taxation: first on the corporation’s earnings and then at the owner level on the dividends received. However, a pass-through entity like a limited liability company avoids this double tax hit.

It allows rental income and expenses to pass through to the business owners (members) without being taxed at the entity level. As a result, members pay taxes only on their incomes.

For example, if your rental property LLC generated a net income of $150,000, it would be allocated to you and other members based on ownership percentages.

Afterward, you would report your tax based on your total income, including your share of business income, on your individual tax return. The tax you pay on this income depends on your individual marginal rate, which can be between 10-37% in the United States.

If you registered your rental property business as a corporation, the profit would first be subject to a flat 21% corporate tax rate. In this case, it would be $31,500.

After that, any dividends allocated to you as a shareholder would get taxed again at your personal income tax rate. This can result in a higher tax burden for a corporation compared to a pass-through entity like an LLC.

Potentially Lowers Tax Rate

Compared to the flat 21% corporate tax rate, an LLC may qualify for a QBI (qualified business income) deduction. This allows you to deduct up to 20% of your qualified business income from your taxable income, potentially lowering your tax rate.

The 2017 Tax Cuts and Job Acts (TCJA) noted that QBI deduction isn’t available to all pass-through businesses. As a result, there was confusion regarding whether a real estate business qualifies or not because rental income is generally classified as passive.

In 2019, the IRS created a safe harbor for rental properties registered as a pass-through. However, rental property owners must meet certain requirements such as:

- Maintain separate books and records for your rental properties.

- Perform at least 250 hours of rental service if your rental company is less than four years old. Otherwise, you should have performed a minimum of 250 hours in at least three of the last five years.

- Maintain a contemporaneous record, detailing hours, dates, and descriptions of all services performed and who performed those services.

- Attach a statement when filing a tax return, indicating that you’re electing a safe harbor.

Although a safe harbor exists, the law can get complicated as there are other limitations, such as the total taxable income of the rental property owner and the type of property. That’s why it’s recommended that you seek guidance from a professional.

Enables Tax Optimization

LLCs provide flexibility when it comes to determining ownership percentage. Each member’s share of the business is determined based on either the following:

- The amount of money or assets they contributed while forming the LLC or throughout its operation.

- The effort and time each member commits to running the business.

This flexibility in ownership structure can be an excellent strategy for tax optimization, depending on the income levels and tax brackets of the LLC members. Here’s how to achieve this:

- Make special allocations of income and losses, provided they have a significant economic effect. The IRS rule on disproportionate distribution to members can be complex. That’s why it’s better to consult a professional who’s familiar with LLC income distribution rules.

- If a member actively manages the rental property and has met the minimum number of rental service hours, they potentially qualify for a QBI deduction. This can reduce their taxable income and offset some of the self-employment taxes they’ll owe.

2. Tax Deductions

As a landlord operating an LLC, tax deductions are among the key benefits of an LLC for rental property. Your rental company can deduct a wide range of expenses that can reduce your overall taxable income.

Here are some of the major deductible expenses.

Mortgage Interest Deduction

One of the biggest tax deductions is the mortgage interest paid on loans used to acquire or improve the rental property.

You can deduct mortgage interest, especially in the early years of your property ownership when the mortgage interest payments are high. This can amount to tens of thousands in deductions annually.

Let’s say your mortgage interest for the first year of your loan is $20,000. If you realize a rental income of $50,000, deducting your mortgage interest can reduce your taxable rental income to $30,000—a substantial difference.

To qualify for mortgage interest deduction, your rental property must be available for rent. Also, any interest you pay should be recorded as a business expense and reported in Schedule E (Form 1040).

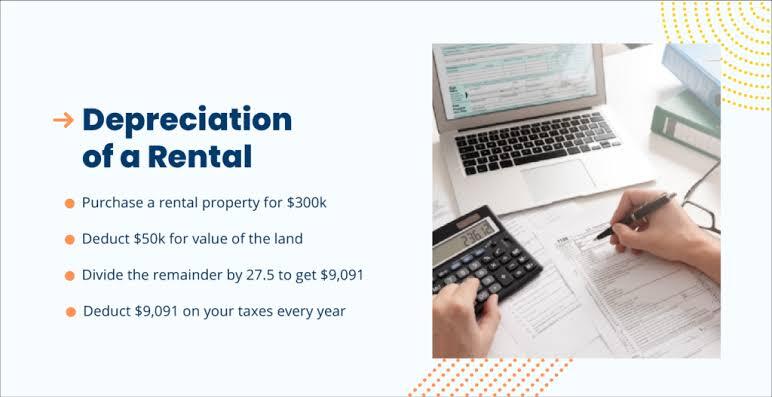

Depreciation Deduction

When a rental property is used to generate income, it begins to depreciate until it no longer serves the purpose of income generation or the owner has fully recovered their initial investment.

According to the IRS, you can start deducting depreciation when your rental property is ready and available for rent.

Let’s say you bought a house for use as a rental property in April. After extensive repairs, the house was made available for rent in July. If you finally rented it at the beginning of September, you can start deducting depreciation from July.

Generally, residential rental properties in the US are depreciated over 27.5 years, while commercial properties have a lifetime of 39 years. This provides an opportunity for you to reduce a significant portion of your taxable rental income and overall tax liability.

To calculate depreciation, subtract the land value from the building purchase price. This will give you the value of the building. Next, divide it by the building’s useful life.

For example, if you purchased a house for residential rental property at $300,000 and the land value is $50,000. The depreciation calculation will be as follows:

Image via Turbo Tenant

This implies that you can reduce your taxable rental income by approximately $9,091 every year.

Property Taxes

Rental business owners pay property taxes as an ongoing ownership expense to the local property tax authorities. The amount you pay is based on the value of the property, and it goes towards funding local services like public schools, roads, and park maintenance.

The good news for LLC rental property business owners is that they can deduct property taxes from rental income before distribution.

This can lower tax payments by placing members in a lower tax bracket. Also, it can significantly reduce your operating cost, thereby, making your rental property business more profitable.

Similar to mortgage interest, you must report property taxes as a business expense to be eligible for deduction. You should also have records of your property tax bills as proof of payment.

Repairs and Maintenance

Tax deductions are possible for the repair and maintenance of rental properties owned by an LLC.

In this case, the expenses should be directed towards fixing or maintaining a rental property without extending its useful life or adding significant value. Examples include fixing a minor roof damage and replacing a broken window.

The IRS classifies any activity that can enhance the value of a rental property as an improvement. Expenses in this category don’t qualify for deductions but can be capitalized and depreciated. Examples include building a deck, wiring upgrades, and kitchen modernization.

Legal/ Professional Fees

An LLC rental property business can deduct fees for legal services and other professional fees as business expenses, provided they’re ordinary and necessary.

This means they should be common and expected in the rental property industry and essential for business operations. Examples of fees that qualify for tax deductions are:

- Accounting fees for tax return preparation

- Legal fees for lease disputes, evictions, and reviewing contracts

- Fees for property management services, such as tenant screening and rent collection

- Expenses geared towards resolving tax underpayment related to your rental business

You should note that legal fees related to defending or acquiring a rental property title are classified as capital expenses. However, some professional fees won’t qualify for deductions.

These include:

- Penalties and fines imposed by the government or court

- Lobbying expenses

- Legal fees that are unrelated to your rental property business

Travel Expenses

LLC members can deduct ordinary and necessary travel expenses if they’re business-related. These include local transportation expenses incurred to collect rent or to maintain, manage, and conserve a rental property.

Examples of deductible travel expenses are:

- Cost of traveling by air, train, car, or bus

- Fares for commuting between the airport or station to the rental property

- Lodging

- Non-entertainment related meals

- Laundry and dry cleaning

- Business calls made during the trip

- Tips paid for any of the services mentioned above

You must keep proper records, such as receipts or mileage count, to be able to claim travel expenses deductions. If you use your personal car or van for rental activities, you can either record the actual expenses or the standard mileage rate (65.5 cents/ mile).

Trips related to rental property improvement or renovation don’t count as deductible travel expenses. Also, transportation costs incurred on travel from your home to your rental property are nondeductible unless your home is also your place of business.

3. Flexible Tax Structure

An LLC can choose to pay taxes as a sole proprietorship, partnership, or S or C Corporation, depending on what’s optimal for your tax situation. This flexible tax structure is one of the main tax benefits of LLC for rental property.

By default, a single-member LLC is taxed like a sole proprietor, where rental income and expenses are passed through and reported on the owner’s tax return. On the other hand, a multi-member LLC is taxed like a partnership. The rental income, deductions, and losses are distributed based on ownership percentages.

Additionally, an LLC can elect to be taxed as an S-corporation, which allows members to deduct 20% of qualified business income. You may also end up paying a lower tax rate overall, depending on your income tax bracket and the S-corp’s profits.

This is because an S-corporation allows you to split rental income between salary (subject to payroll tax) and dividend (not subject to payroll tax). You can strategically set your salary to minimize the overall tax liability for you and your rental property business.

Although electing for C-corporation tax structure isn’t common in the rental property business due to double taxation, it can serve some purposes.

First, it provides better liability protection, shielding your assets from bankruptcy. Second, if your business expenses exceed your rental income in a tax year, you can claim a net operating loss (NOL) deduction to offset income from your other sources.

4. Centralized Record Keeping

Having all your rental property business records consolidated within a limited liability company offers some important tax benefits of LLC for rental property. Here’s how central bookkeeping can benefit your rental property business come tax time.

Separation of Personal and Business Finances

One of the crucial tax benefits of an LLC for rental property owners is that it can have a bank account in the business’s name.

Having a business bank account makes it clear which income, expenses, and deductions belong to your rental property business when filing tax returns. This keeps your business and personal finances separate.

Organized Financial Record

An LLC acts as a separate business entity from its owners. As a result, all rental income and expenses flow through the LLC.

This centralized financial record makes it much easier to comprehensively track receipts, invoices, and other relevant documents related to the rental business.

Supporting Evidence for Tax Deductions

As with most business activities, the IRS demands thorough documentation when seeking deductions related to your rental property business.

Maintaining meticulous records and detailed books within the LLC establishes the necessary evidence required to claim deductions on tax returns. This mitigates the risk of deductions being disallowed.

Improved Communication with Tax Professionals

An LLC business structure can simplify record-keeping for your rental business, which is essential for communicating with a tax professional.

As a result, they can efficiently analyze the business income and expenses, ensuring that you claim all entitled deductions and accurately file your taxes. This translates to saving time, money, and peace of mind during tax season.

Steps to Establish an LLC for Rental Company

When it comes to LLC business formation for rental properties, the ideal time is before you purchase your first rental property. The steps discussed below will guide you to set up a rental property LLC.

Choose a Business Name

Select a unique and memorable name that showcases your LLC as a real estate. Ensure to check the internet, federal trademark database, and the Secretary of State to ascertain name availability.

If your chosen business name is available, you can use a trusted web hosting solution to reserve a domain name. Here’s what to look for when choosing a business name:

Image via GovDocFiling

Select a Registered Agent

The registered agent will serve as your official point of contact for all legal correspondence. They should have an official address within the state of formation and be accessible during work hours.

Draft an Operating Agreement

Although not always required by law, drafting an LLC operating agreement clarifies the structure of the LLC in terms of profit sharing and ownership interests. It also sets down policies for decision-making and dispute resolution.

File Articles of Organization

This legal document is prepared and filed with the concerned department, usually teh Secretary of State’s office, in the state of formation. It contains information such as the business name, description of the business, address, and details of LLC members.

Obtain a Tax Identification Number

A tax identification number, also known as an employer identification number (EIN), is necessary for hiring employees, opening a bank account, or applying for a loan. Get one for your business before you start operations.

Open a Separate Bank Account

Establishing a bank account for your LLC separates your personal and business expenses. This is essential for maintaining the limited liability status of the business as well as the asset protection it offers.

If you already had rental properties under a DBA (doing business as) or personal name before starting an LLC, you should follow the additional steps below.

Transfer Property Titles

You’ll have to transfer the rental property from your name to the LLC. It usually involves signing a deed transfer in the presence of a notary. If there’s an outstanding loan on the property, contact the mortgage lender to know the procedure for title transfer.

Update Rental and Lease Agreements

If you already have tenants, an updated rental and lease agreement will inform them of the new owner and rent payment to the business bank account.

Frequently Asked Questions

Q1. What type of business is best for rental properties?

A. From a legal and tax perspective, a limited liability company (LLC) is the best business structure for rental property businesses. Here are some reasons for this choice:

- An LLC provides liability protection such that if a tenant sues your business or your properties have some issues, your assets are shielded from lawsuits and creditors.

- An LLC’s income is passed through to the members and only taxed once when the members file their income tax returns.

- LLCs can have unlimited members, making it easy to bring in multiple investors for your rental properties.

- Registering an LLC creates a formal business structure for your rental business, providing credibility for real estate investors looking to grow their portfolios.

Q2. What are the cons of owning a property in the form of an LLC?

A. Although there are, below are some drawbacks to consider:

- It involves an initial setup fee that varies by state, including administrative costs and annual fees that can cut into profits.

- A single-member LLC that doesn’t elect to be taxed as a corporation will be subject to a 15.3% self-employment tax.

- Unless your LLC has an excellent credit score, some lenders may be unwilling to lend to you or charge high interest rates.

Q3. Can you write off the mortgage in LLC?

A. Yes, you can deduct mortgage interest for rental properties an LLC owns. This is considered one of the major deductible expenses for rental property owners. Provided the mortgage was properly acquired in the name of the LLC, the business can deduct mortgage interest from its rental income each year.

This deduction applies to loans used to purchase or substantially improve a rental property. Also, there’s no special limit for deducting mortgage interest as a business expense.

Q4. Can an LLC deduct rent?

A. Yes, if an LLC owns and operates rental properties, it can deduct rental expenses under the following circumstances:

- It maintains a home office as the principal place of its rental property business.

- The LLC is renting a commercial facility for its business operations (not the property it owns).

- The business is renting storage units for equipment or materials required for the repair or maintenance of rental properties.

Q5. Do you need liability insurance for your LLC?

A. Though it’s not mandatory, you should purchase liability insurance for your LLC. An LLC protects your assets from liability litigants, but it can’t protect the business itself.

On the other hand, insurance can offer personal asset protection and still protect your business assets from claims like bodily injury to a tenant, property damage caused by tenants, and unforeseen circumstances like natural disasters.

Unlock the Full Potential of Your Rental Property Business with an LLC

As a rental property owner, structuring your business as an LLC can unlock a world of tax advantages and upscale your business profits. We explored the main tax benefits of an LLC for rental property owners, providing insight into how you can avoid the double taxation burden that corporations encounter.

An LLC grants you access to several tax deductions, including a 20% qualified business income deduction that can drastically reduce your tax rate. Moreover, the flexible tax structure of an LLC allows you to optimize tax payment, whether as a sole proprietorship or a corporation.

Ultimately, an LLC equips you to minimize risks and maximize profits despite the complexity of rental property ownership.

About the author

From selling flowers door-to-door at hair salons when he was 16 to starting his own auto detailing business, Brett Shapiro has had an entrepreneurial spirit since he was young. After earning a Bachelor of Arts degree in Global and International Studies from the University of California, Santa Barbara, and years traveling the world planning and executing cause marketing events, Brett decided to test out his entrepreneurial chops with his own medical supply distribution company.

During the formation of this business, Brett made a handful of simple, avoidable mistakes due to lack of experience and guidance. It was then that Brett realized there was a real, consistent need for a company to support businesses as they start, build and grow. He set his sights on creating Easy Doc Filing — an honest, transparent and simple resource center that takes care of the mundane, yet critical, formation documentation. Brett continues to lead Easy Doc Filing in developing services and partnerships that support and encourage entrepreneurship across all industries.