Do you want to change your LLC to an S-Corp? Well, have you considered all the benefits and downsides of making the switch?

If not, then this post is for you.

Here, we’ll not only tell you how to change an LLC to an S-Corp but also discuss why you should or shouldn’t do it. You’ll learn which factors you should consider to ensure it’s indeed beneficial to you. We’ll also list some of the key benefits of S-Corps over LLCs.

Ready to learn everything you need to know to make the right decision?

Let’s get started.

Why Should You Change an LLC to an S-Corp?

LLCs and S-Corps are popular business entities offering their own advantages and disadvantages.

LLCs offer the pass-through taxation offered by Sole Proprietorships while providing the liability protection of Corporations. Still, some small business owners change their LLCs to S-Corps for specific reasons.

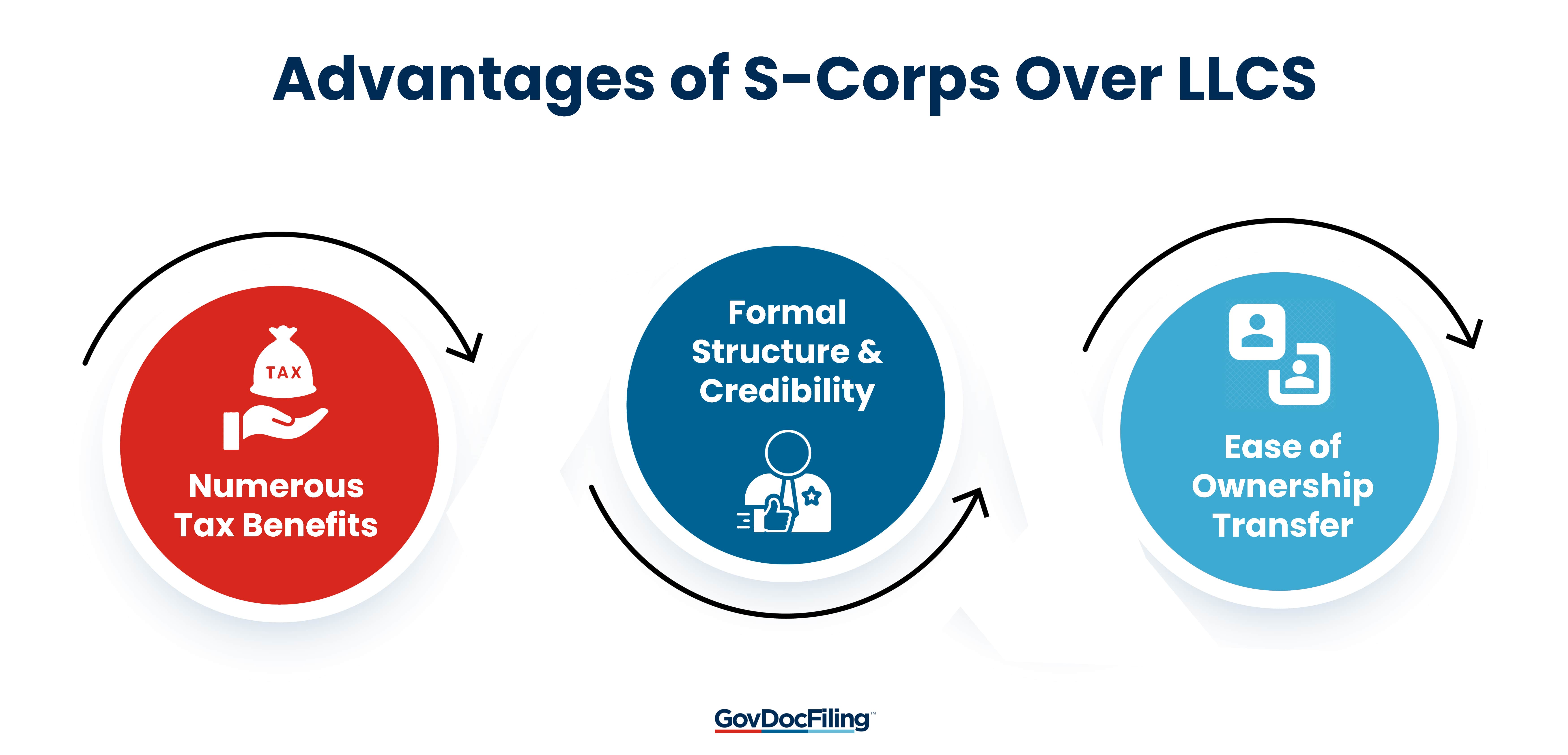

Here, we’ll discuss some of the benefits that S-Corporations offer over LLCs. This will help you decide whether you should or shouldn’t change your new LLC to an S-Corp.

Tax Benefits

One of the key reasons why entrepreneurs choose to change an LLC to an S-Corp is the tax benefits that an S-Corporation offers.

Let’s discuss these tax benefits one by one.

Self-Employment Tax

LLC members are subjected to self-employment tax on the LLCs income. There is no scope for tax savings. In the case of an S-Corp, however, only the salaries of shareholders are considered for self-employment taxes.

The dividends (profit distributions) are not taxed, which can result in considerable tax savings.

Payroll Taxes

As all the LLC’s profits pass to the members, they need to pay payroll taxes on their entire income. S-Corp owners can distribute the income between salaries and profit distributions.

They’ll pay payroll taxes on their salaries, while the company will pay the taxes for the remaining business profits. The company can then write it off as a tax deduction. Basically, by optimizing the structure for salaries and dividends, S-Corporation owners can maximize tax savings.

Contributions for Retirement and Insurance Plans

S-Corp owners have more flexibility to create tax-friendly retirement plans and get tax exemptions on contributions to these plans. Similarly, premiums for health insurance plans can also be written off to get further tax benefits.

Formal Structure, Credibility, and Growth Potential

S-Corps have a more formal business structure, which makes them look more credible than LLCs. This makes it easier for S-Corps to enter into contracts with various stakeholders, as they trust the formal business structure.

It also makes it easier to get investments and loans to grow the business. So, there’s a higher growth potential for S-Corps than LLCs.

Ease of Ownership Transfer

While LLCs offer more flexibility in terms of who can be a member, an S-Corp is better in terms of ownership transfer. You can simply transfer shares to change the ownership structure, as opposed to LLCs, which require more careful succession planning.

So, when you switch from an LLC to an S-Corp, succession planning will be much easier.

Factors to Consider Before Changing an LLC to an S-Corp

Many people think that S-Corps are inherently better than LLCs in every situation. Well, that’s incorrect.

Both have unique characteristics and advantages. You need to consider several factors before you decide to switch from an LLC to an S-Corp.

Evaluate the Need for Conversion

While an S-Corp does offer certain advantages, an LLC has its own set of advantages.

Also, the tax benefits that an S-Corp offers, may not be equally significant in every state. Depending on a state’s tax laws, there might be only marginal tax benefits for S-Corps, so it might not be worth the effort to change an LLC to an S-Corp.

As such, before you make the decision to change your LLC to an S-Corp, conduct a thorough evaluation. Compare the pros and cons of each business structure, keeping your state’s laws in mind.

You should also calculate the estimated cost savings you can expect and whether it’s significant enough to make the change.

Seek Legal and Tax Advice

Evaluating the need for changing an LLC to an S-Corp is not easy and preparing for the conversion is even more difficult. You need to understand the legal requirements, eligibility criteria, and other details.

It’s better to hire professionals and get legal and tax consultations before you go ahead with the change in business structure.

A company like Rocket Lawyer can help you with the legal aspect of things and guide you on the dos and don’ts.

You can also consider leveraging the services of business formation service providers like Inc Authority, Incfile, ZenBusiness, and LegalZoom. Apart from offering advisory services, they will also take care of the S-Corp election process on your behalf.

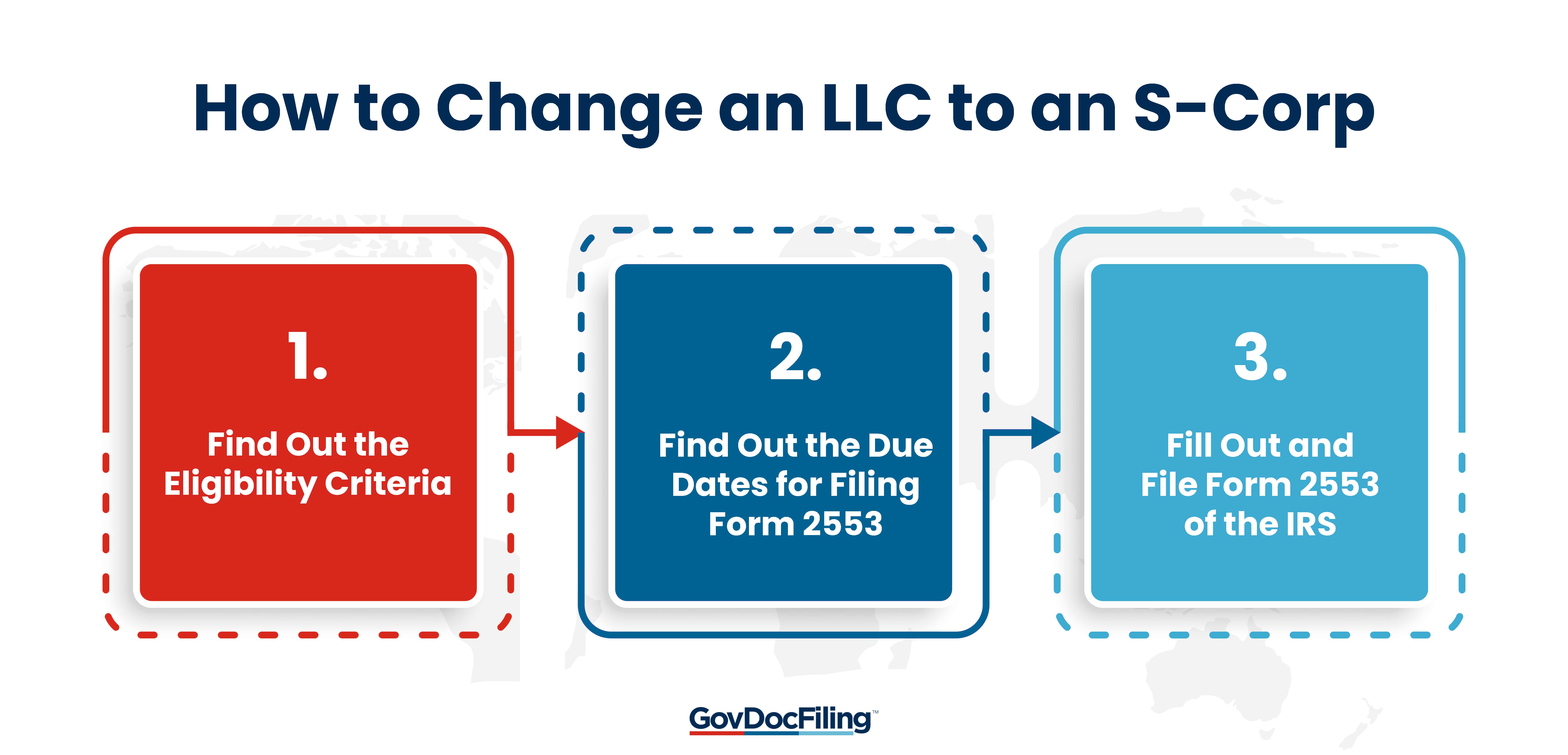

How to Change an LLC to an S-Corp

If you’ve come this far, you’ve probably decided that changing your LLC to an S-Corp is the right move for you. Now, let’s see what steps you need to take to actually make the switch.

Here’s the three-step process you should follow to change an LLC to an S-Corp.

1. Check Eligibility

Not any organization can get the S-Corp special tax status. So, the first step for you is to check whether your LLC meets the eligibility requirements for S-Corps.

According to the Internal Revenue Service, an S-Corp must have the following characteristics:

-

- It should be a US-based business

- It can’t have more than 100 shareholders

- It can have only one class of stock

- Only individuals, estates, or trusts can be shareholders

- Non-residents and businesses can’t be shareholders of an S-Corp

Assess if your Limited Liability Company can meet these requirements once it changes to an S-Corp.

Most importantly, see if any of your LLC members are non-residents or other businesses. This will be the biggest hurdle if you want to change your LLC to an S-Corp.

If your LLC meets the requirements, move to the next step. If not, seek legal counsel to see what options are available for you.

2. Find Out the Due Dates for Filing Form 2553

There are certain deadlines you need to meet if you want your new S-Corp status to be effective as soon as possible.

Here’s an overview:

-

- If you want your S-Corp status to be effective in the same year as you’re filing your Form 2553, you must file it within two and a half months from the start of the tax year.

- If you’re ok with the status being applicable from the next year, then you can file it any time during the year.

3. Fill Out and File Form 2553 of the IRS

Next, you need to fill out Form 2553 of the IRS to get your federal S-Corp status. The form is divided into various parts and requires in-depth information about your business.

This is the part where you’d benefit from the services of a company like Incfile or Inc Authority. They’ll help you fill out the form accurately and also file it on your behalf.

Their team will review the form to ensure there are no mistakes that may get your application rejected.

To file the form, you need to mail it to a designated address, which depends on the state where your business is located. Again, companies like LegalZoom and ZenBusiness can make the process easier for you by taking care of all this.

FAQ

Q1. How much does it cost to convert an LLC to S-corp?

To change your LLC to an S-corp requires you to fill out and file the form 2553 of the IRS, which requires no filing fee. So, technically, it costs nothing to change an LLC to an S-corp.

However, you may need to pay some fees after filing Form 2553. For example, if you check the box Q1 to establish a “business purpose”, you’ll need to pay a fee of $6,200.

Also, if you hire the services of a third-party service provider, such as Incfile, ZenBusiness, or LegalZoom then you may need to their service charges.

If you choose to go with Inc Authority you can get the service for free. All of them will help you fill out Form 2553 accurately, review it, and file it on your behalf.

Q2. When should you convert an LLC to an S-corp?

You should change your LLC to an S-Corp only if the benefits outweigh the costs. Do a cost destination of how much approximate annual taxes you’ll have to pay as an LLC and as an S-Corp.

Also, compare the costs of forming and running an LLC vs an S-Corp. Compare the total costs and then convert to an S-Corp only if there are significant benefits.

Both Limited Liability Companies and S-Corporations have their own sets of benefits. So, S-Corps are not necessarily better than LLCs in every situation. Do your comparison, keeping your state in mind, and then make an informed decision.

Q3. How do I change my LLC to an S-corp with the IRS?

Here are the steps you need to take to change your LLC to an S-Corp:

-

- Assess whether your LLC is eligible for getting the S-Corp status

- Learn about the due dates and deadlines for filing Form 2553

- Fill out and file Form 2553 with the IRS

While the process is seemingly simple, the form itself can be confusing for first-timers. You’ll need to read all the instructions carefully and a single mistake can get your application rejected, causing further delays.

We recommend using the services of one of our partners, who will review your form and ensure there are no errors. They’ll also file it on your behalf and change your LLC to an S-Corp quickly.

Q4. What are the benefits of changing an LLC to an S-corp?

Here are some of the benefits of making the LLC to S-Corp switch:

-

- You don’t need to pay self-employment taxes on your entire income; only on the salary part, not the dividends.

- By giving yourself a reasonable salary and dividends, you can reduce your tax liability on self-employment and payroll taxes. Using a good payroll solution like Gusto and ADP will be further beneficial.

- The formal structure of an S-Corporation lends it more credibility. Investors and other stakeholders trust an S-Corp more and are less hesitant to invest in or do business with an S-Corp, compared to an LLC.

Q5. Which are the ineligible entities for conversion to an S-corp?

Here are some of the companies that are ineligible for S-Corp election:

-

- Banks and thrift organizations

- Insurance companies

- Domestic international sales corporations (DISC)

- Any c-corp with more than 100 shareholders, non-resident shareholders, and more than one class of stock.

Before you apply for the S-Corp election, make sure that your LLC is eligible for it or your application will be rejected. If you need help, get a professional consultation to ensure that your LLC is eligible for and will benefit from the S-Corporation tax status.

Conclusion

Though LLCs are one of the most popular business structures for starting a new business, they aren’t always the best. S-Corps, for instance, can reduce your tax burden and offer other advantages over LLCs that can help you cut costs.

You need to do a thorough analysis and compare the costs and benefits of an LLC vs an S-Corp before you change your LLC to an S-Corp.

Use this post as a reference and guide if you do decide to switch from an LLC to an S-Corp. It covers everything you need to know to make the switch.

What are you waiting for?

Start your analysis now and make an informed decision that will help your business save a lot of money.

About the author

From selling flowers door-to-door at hair salons when he was 16 to starting his own auto detailing business, Brett Shapiro has had an entrepreneurial spirit since he was young. After earning a Bachelor of Arts degree in Global and International Studies from the University of California, Santa Barbara, and years traveling the world planning and executing cause marketing events, Brett decided to test out his entrepreneurial chops with his own medical supply distribution company.

During the formation of this business, Brett made a handful of simple, avoidable mistakes due to lack of experience and guidance. It was then that Brett realized there was a real, consistent need for a company to support businesses as they start, build and grow. He set his sights on creating Easy Doc Filing — an honest, transparent and simple resource center that takes care of the mundane, yet critical, formation documentation. Brett continues to lead Easy Doc Filing in developing services and partnerships that support and encourage entrepreneurship across all industries.