There are numerous steps to starting an LLC that vary for each of the 50 states, even though the process is simple.

To help you through the steps of the process, you can use a business start-up guide for starting an LLC in your preferred state.

But, before we get into how to start an LLC, let’s first discuss why you should opt for an LLC over other types of businesses.

Why Should You Start an LLC?

Limited Liability Companies (LLCs) are the preferred type of business entity for small business owners and new entrepreneurs. This is because they have a flexible business structure and limit the personal liability of the business owner.

LLCs can choose to be taxed as a Sole Proprietorship, Corporation, Partnership, or even as an S-Corp or C-Corp. The owners of the LLC are called members and they can be individuals, corporations, or even other LLCs.

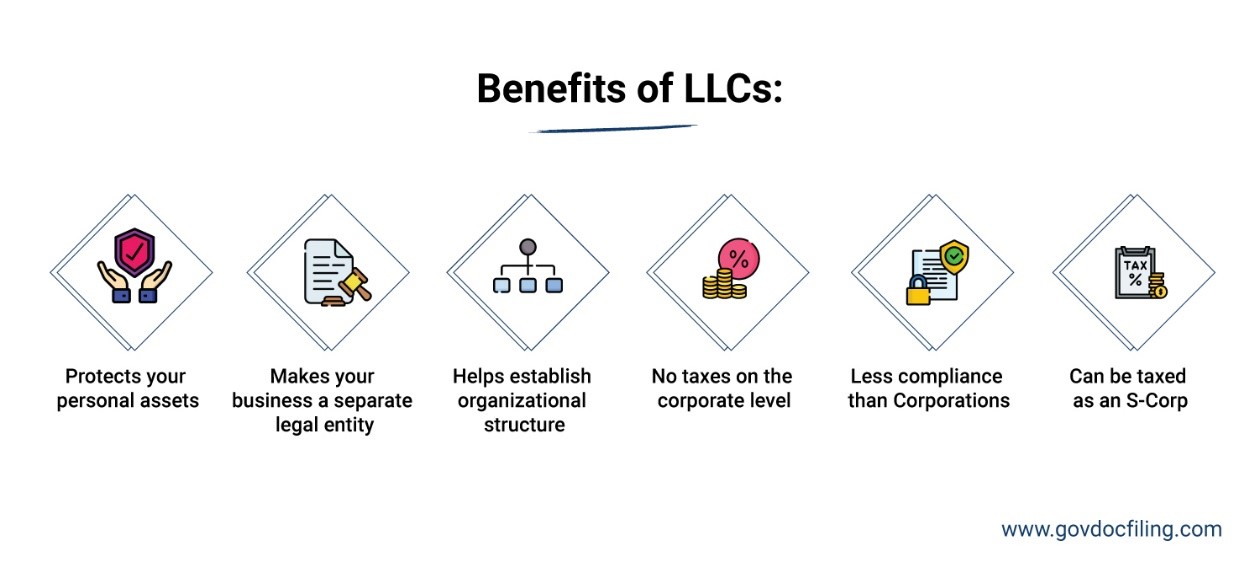

The main benefits of starting an LLC are:

- It protects your personal assets in case of debt or legal action.

- This means that lenders can’t go after your personal accounts to pay off your company’s debts.

- Forming an LLC makes your business a separate legal entity. It also improves its credibility in the eyes of lenders, customers, suppliers, etc.

- You can establish an organizational structure as long as all the LLC members agree to it.

- The LLC does not have to pay taxes on a corporate level.

- All earnings are “passed through” to owners’ personal tax returns to calculate taxes.

- LLCs face less strict compliance requirements and restrictions than corporations.

- You can elect to be taxed as an S-Corp, which allows some other advantages for tax planning for owners and employees.

Overall, LLCs are a great way to establish a business, while limiting your personal liabilities in case the business fails. This reduces your business risk and allows for a flexible organizational structure. Thus, you get the best of both corporations and partnerships. Therefore, it is a good and popular option for new small businesses.

Now that you know the business benefits of starting a limited liability company, let’s discuss the process of starting one. If you want to skip the details and have our service take care of everything for you, you can jump to the LLC application here.

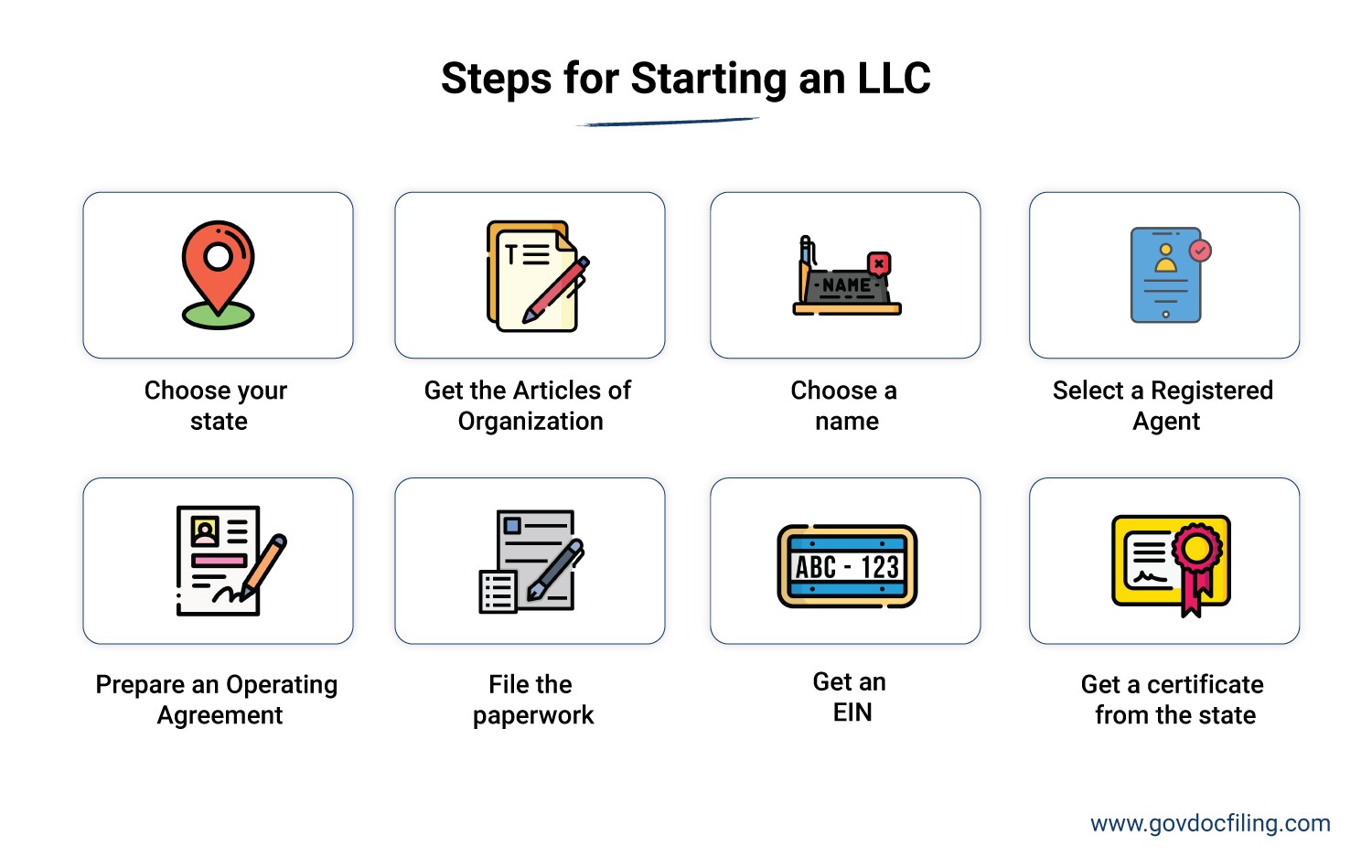

Step-by-Step Process for Starting a Limited Liability Company

First, you need to research the advantages, disadvantages, tax structure, and requirements of forming an LLC in your state. You may want to seek legal advice from a lawyer or accountant before starting a new business, especially if it is your first time.

LLC taxation works differently for single-person, multi-person, and corporation type LLCs. Taxation policies for LLCs also differ from one state to another.

Therefore, you should educate yourself about these and then choose a tax-friendly state to start an LLC. You should also decide whether you want your LLC to be taxed as a sole proprietorship, partnership, corporation, S-Corp, or C-Corp.

Once you have made a decision, you can then follow this step-by-step process for starting an LLC in your chosen state.

1. Choose Your State

You can form an LLC in all 50 states of the United States. However, three states among these offer very favorable conditions for business owners looking to set up their LLCs there.

- Delaware: No tax on out-of-state income.

- Nevada and Wyoming: No tax on your business income

This makes them a great choice for business owners who want to save on taxes when they’re just starting out. It can help increase your profitability too.

That said, there are some caveats to forming your LLC in these states:

- You’ll still pay state taxes in your home state

- You’d have to pay for a Registered Agent, Annual Filings, etc.

Both these factors could escalate the cost of starting and running your LLC in these states if you don’t live there. That’s why the best bet would be to set up your LLC in your home state. While you would have to pay taxes, you won’t have to go through the hassle of having to sustain your business in another state.

In fact, some states would require you to register your LLC as a foreign LLC in your home state if the state deems that you’re doing business in the home state when your LLC is registered in another state.

2. Get the Articles of Organization Form for Your State

This is the most important form that you need to fill to register your LLC in any U.S. state.

You can obtain this form from the website of the office of the Secretary of State for your state. The reason why you need to contact them in the first step is that different states have different guidelines. Some states require you to publish a notice in the local newspaper before you can submit this form.

Start by obtaining this form and learn the specific guidelines for your state before you move on to the next step. This could be difficult to figure out and be a cumbersome, manual process. To make this process easier, you can apply for your LLC with us and we’ll take care of everything for you.

3. Choose a Name for Your Limited Liability Company

The next step to starting an LLC is that of choosing and reserving a name for your business. Select a company name that represents your business and also complies with your state’s guidelines for naming LLCs.

Some states, for example, prohibit the use of words like “corporation” and “incorporated”. Do your research and choose the best LLC name. You’ll also need to check the name availability to ensure that the name is unique.

Also, if you foresee a delay in completing all the requirements for setting up your business, you can reserve your LLC’s name. This way, your LLC name will be safe even if you register your business after a few months.

4. Select a Registered Agent for Your LLC

This is a mandatory requirement for starting an LLC in the U.S., in almost every state. A registered agent is a person who is responsible for receiving all legal notices on behalf of an LLC.

This is an important position, one that requires a certain level of responsibility. You can, therefore, hire a third-party company for registered agent services.

This company will then handle all your legal notices and inform you about what you need to do. The advantage of this is that it can protect your name from public visibility and enable clean record keeping.

You can also elect yourself as a registered agent and seek legal advice if and when you need it.

5. Prepare an Operating Agreement

A written operating agreement is a business plan or roadmap that details how your company will be run. This is especially important if you have business partners who own the company with you.

If you plan to work with business partners, you need to set clear terms and conditions. It should include ownership interests and voting rights. It should also detail how you plan to divide profits, hold meetings, and govern the business.

Basically, an LLC operating agreement will be your plan for how you run your business with your partners. You can skip this step if you are the sole proprietor.

6. File the Paperwork with the State

Ideally, you should create your LLC’s operating agreement before you register your business, but it can come after this step. The order of the previous step and this step can be reversed.

At this stage, you have to fill out and submit the form that you obtained in the first step. In general, the form requires you to mention:

- The name and address of your company

- The name and address of your LLC’s registered agent

- The purpose of forming the LLC

This form should be signed by the person forming the LLC and the registered agent (only in some states). Every state has different filing fees and LLC costs. Many states have yearly fees too.

7. Get a Federal Tax ID Number for the LLC

You will need to get a federal employer identification number (EIN) for the LLC by filing a tax ID online application. This identifies the LLC on the federal level with the IRS and allows you to set up your business licenses and open business bank accounts.

8. Get a Certificate from the State

If you plan to start a local business within your state, then this is the final step for starting an LLC. This is the stage where your documents are submitted and approved by the state.

The state will then issue a certificate saying that your LLC formally exists. Once you receive that certificate, your business is formally registered.

Steps to Take After Starting an LLC

Now that your LLC has been set up, you need to start moving on to the next steps to get your business up and running.

1. Open a Business Bank Account

To start receiving money and pay your bills, you need a business bank account, which you can open once you have an EIN.

It must be separate from your personal bank account to maintain all the legal protections that come with an LLC. The bank account helps you keep the corporate veil up that separates individual assets from the corporate ones.

Additionally, some other advantages of a business bank account are:

- Simplifies accounting

- Makes your LLC more professional

- Proves that you’re running a business

- Easier to get credit

2. Apply for Licenses and Permits

While starting and registering the LLC gives you the permission to run a business under the said name, there are several other licenses and permits that you might have to get. This could be things like a fire safety license or food safety license.

Additionally, if you’re in a federally regulated industry like agriculture, mining and drilling, or aviation, you might have to deal with other permits too.

3. Get a Business Insurance

If you’ve got employees, you would need to have disability and unemployment insurance for your workers along with worker’s compensation insurance. Additionally, you should consider one of the below insurances for your business too:

- Professional liability insurance

- Home-based business insurance

- General liability insurance

- Commercial property insurance

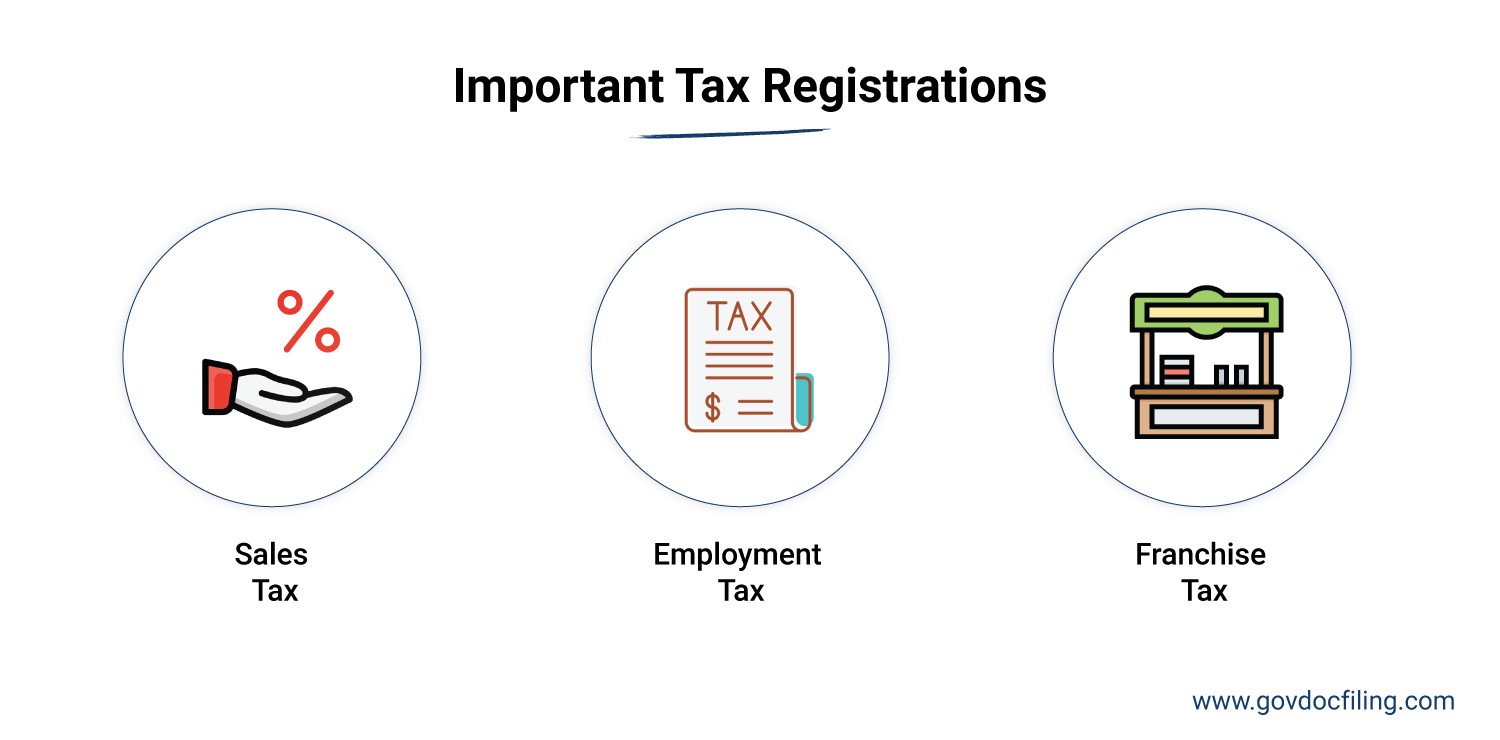

4. State Tax Registration

You may have got your tax ID, but that’s not the only tax that you’d typically have to pay. In fact, you might be required to register for numerous other state taxes. These could include:

Sales Tax

If you’re selling physical products, your state might require you to collect a sales tax, even on online sales. This would especially be the case if there’s a significant economic connection between your business and the state.

Employment Tax

This tax has two components — withholding tax and unemployment insurance tax. The first one is to be paid on behalf of your employees when you pay them. On the other hand, the second one is used to contribute to the unemployment payments that the state makes to unemployed workers.

Franchise Tax

This tax is charged by some states for running your business. And while some states may be charging this tax, not all LLCs have to pay it too. This term, though, shouldn’t be confused with franchising, which is a business strategy.

FAQ

1. What is the first step in the formation of an LLC?

The first step in the process of LLC formation is choosing a state to form your LLC in. This could be your home state or another state.

2. Is starting an LLC easy?

Yes, starting an LLC is easy when you leverage the services of GovDocFiling. We take care of all the filing requirements.

3. What is the downside of an LLC?

The biggest downside of an LLC is that it isn’t as easy to govern as a Sole Proprietorship. And while it does give limited liability protection, it’s not as comprehensive as Corporations. You also can’t raise funds as easily as you can with Corporations.

4. How long does it take to start an LLC?

Typically, the process of starting an LLC takes anywhere between a week and 10 business days. However, the time may be shorter in some cases.

5. What should you do after starting an LLC?

After starting your LLC, you should

- Open a business bank account

- Get licenses and permits

- Get your business insurance

- Register for state tax

Starting an LLC: What Next?

This post lists the seven important steps of starting an LLC in your state. You can follow these easy steps in this exact order to start your own LLC in the right manner.

However, the process of starting an LLC, while straightforward, can be time-consuming and complicated, especially if you are doing it for the first time. Using the services provided by GovDocFiling.com, we take care of all of the 7 steps for you on your behalf.

Our LLC Start-Up Business Package, for example, can take care of the entire process of starting an LLC end-to-end. From filing the documents with the state to creating an LLC operating agreement, we can help you with all aspects of starting an LLC. Buy this package and start your LLC hassle-free.

For the low cost of $345 (plus state filing fee), everything is taken care of for you. You do not need to worry about missing a step or making a mistake that could cost time and money for your new business. It is the easiest, quickest, and most affordable way to officially start a business as an LLC.