As a business owner, you might discover that a single name doesn’t fully capture all the different aspects of your operations. That’s where a DBA (Doing Business As) can help. But you might be asking, how many DBAs can an LLC have?

A DBA allows your limited liability company (LLC) to operate under multiple names while maintaining a single legal entity. However, understanding the specific rules that apply to your business is important.

In this guide, we’ll discuss how many DBAs can an LLC have. We’ll break down everything you need to know about DBAs for LLCs, including how many you can have, and the registration process.

Understanding DBAs and Their Purpose

A DBA (Doing Business As) is also known as a trade name or fictitious business name. It is a registered alias that a business entity, such as an LLC, can use to operate under a name different from its parent company.

While a DBA lets your business use multiple names, it doesn’t create separate legal entities. In other words, all DBAs are still tied to the same LLC, meaning the primary LLC is ultimately responsible for all operations, personal liabilities, and legal obligations.

For example, if a customer sues one of your DBAs, the entire LLC is affected, not just that individual business name.

DBAs are particularly valuable for businesses looking to diversify their operations or better align their branding with specific market segments. But, how many DBAs can an LLC have?

How Many DBAs Can an LLC Have?

An LLC can have multiple DBAs — in fact, there is no federal restriction on how many trade names a single LLC can register.

LLC owners can operate multiple businesses under unlimited DBA names while still maintaining one LLC as the legal entity. This makes DBAs an attractive option when looking to expand without the added costs and complexities of forming separate LLCs.

How many DBAs can an LLC have depends on state regulations. While there is no nationwide limit, state laws and local regulations may influence the number of DBA names you register. Some states have certain requirements that may affect your ability to register multiple DBA names.

For example, California requires a separate DBA filing for each county where you conduct business under that name. Meanwhile, New York requires publication of your DBA name in designated newspapers, which can increase costs for each additional business name you register.

Also Read:

- Can a DBA Be Filed For All Business Types?

- Can You Have Multiple DBAs Under One Sole Proprietorship?

Why You Might Want One or More DBAs

When entrepreneurs ask how many DBAs can an LLC have, they’re essentially exploring the potential to diversify their business operations without the complexity of forming separate companies.

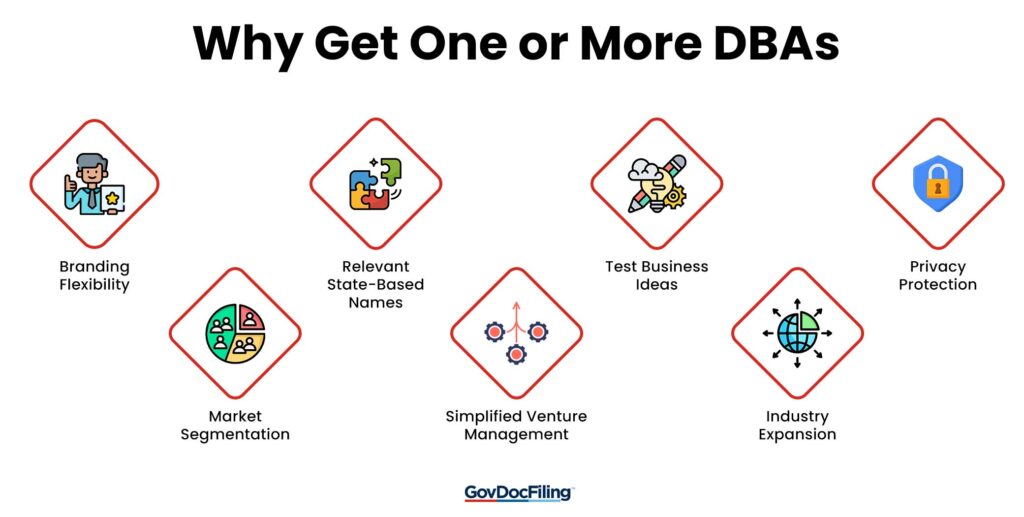

Here are some strategic reasons for choosing to register multiple DBAs, as a single member or multi member LLC:

- Branding Flexibility: Separate legal entities can use different DBAs for different product lines within a single parent LLC. This allows for distinct marketing identities while keeping everything under one corporate umbrella.

- Market Segmentation: You can target different demographics or industries without confusing or diluting your core brand identity. For instance, a law firm might use one DBA for estate planning services and another for corporate law.

- State-Based Names: Foreign LLCs can register DBAs for regional relevance. A home cleaning service might operate “Sparkling Spaces Oregon” in Oregon and “Sparkling Spaces Texas” in Texas, enhancing local appeal under one LLC.

- Privacy Protection: You might not want to use your parent company name for day-to-day business operations, especially if you are a sole proprietor or general partner. A DBA can help maintain anonymity while creating a professional business identity.

- Testing New Business Ideas: Before committing to forming multiple LLCs, you can use a DBA to try a new business venture. If it succeeds, you can later get a DBA registration to formalize it into a standalone business.

- Expanding Into New Industries: A company that sells handmade furniture might use a separate DBA to launch an interior design service, catering to a different client base.

- Simplified Management: With DBAs, businesses can operate multiple ventures under the same legal entity, streamlining tax reporting and reducing administrative tasks.

While DBAs provide convenience, business owners must consider the legal, financial and tax implications. The key question isn’t just how many DBAs can an LLC have, but whether managing multiple DBAs makes sense for their business structure.

Also Read:

Practical Limitations of Managing Multiple DBAs

How many DBAs can an LLC have? Legally speaking, an LLC can register multiple DBAs. However, managing too many can become overwhelming. As a business owner, you must be prepared to handle:

- Increased Administrative Workload: Each DBA must be individually registered, renewed, and maintained according to state or local regulations. Tracking renewal deadlines and staying compliant can become burdensome as the number of DBAs grows.

- Accounting Complexity: While all DBAs operate under the same legal LLC, it’s crucial to keep separate financial records for each to monitor performance. This adds complexity to bookkeeping and may require advanced accounting systems or additional staff.

- Brand Management Challenges: Managing distinct branding efforts for multiple DBAs can strain resources. You need consistent messaging, customer service quality, and marketing strategies across various brands.

- Legal and Compliance Risks: Errors such as failing to renew your DBA on time, can lead to penalties, legal disputes, or loss of the right to use a name in certain jurisdictions. Also, since all DBAs operate under the same limited liability company, any legal action against one DBA affects the entire LLC.

- Tax Reporting Complications: All DBAs share the same LLC’s EIN (Employer Identification Number). Although tax filing is done at the LLC level, maintaining accurate records for each DBA can complicate reporting and increase the risk of filing errors.

Ultimately, rather than asking how many DBAs can an LLC have, it’s more important to consider whether operating multiple DBAs under one LLC is practical, or if forming separate LLCs for different ventures is a better solution. Seeking legal or tax advice can help determine the best approach.

Also Read:

Steps to Registering Multiple DBAs for Your Limited Liability Company

While an LLC can have multiple DBAs, each must be registered separately to comply with state and local laws.

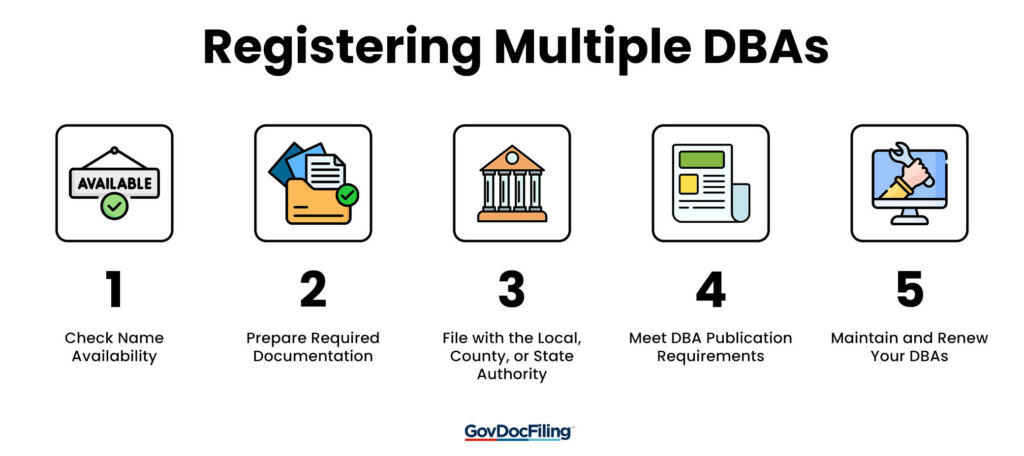

Here are the steps to handle DBA registration:

1. Check Name Availability

Before registering a DBA, confirm that the name you intend to use is unique and not already in use:

- Check your state’s business entity database to ensure your desired DBA names aren’t already in use.

- Search the U.S. Patent and Trademark Office (USPTO) database to avoid potential infringement issues.

- Review domain name availability if you plan to create websites for each business identity.

- Consider checking username availability across social media platforms to ensure consistent branding.

- Confirm that the name complies with state-specific rules (states typically prohibit misleading or restricted words).

Ensuring that your chosen DBA isn’t already taken helps you avoid legal disputes or rejections during registration.

2. Prepare the Required Documentation

Each state has its own process, but generally, you’ll need to provide:

- Legal documents that include your LLC’s legal name and EIN (Employer Identification Number).

- The DBA name you wish to register.

- The business line or purpose associated with the DBA.

- Your principal office address and contact details.

3. File with the Appropriate Authority

Depending on your jurisdiction, the DBA registration process is generally handled at the state, county, or local level.

You’ll need to complete and submit your DBA registration form to the relevant government office, such as the Secretary of State or a local county clerk’s office. You typically need separate filings for each location if operating across multiple counties or states.

4. Meet DBA Publication Requirements

Some states, like New York, may require you to publish a notice of your DBA in a local newspaper to inform the public about your new business name. This ensures transparency and protects consumers.

Some states require you to:

- Publish a notice in approved newspapers for a specified period (typically 4-6 weeks).

- Obtain proof of publication for your records.

- Submit legal documents, such as affidavits of publication, to complete the registration process.

Adhere to all state-specific publication rules to ensure compliance.

5. Maintain and Renew Your DBAs

Having obtained your DBA certificates, you want to take certain steps to maintain your multiple DBAs in good standing:

- Mark renewal dates on your calendar (typically between one and 10 years)

- Update information promptly if your LLC details change

- Maintain separate financial records for each DBA, even though they belong to the same LLC, to simplify accounting and tax preparation

- Ensure ongoing adherence to state and local laws for all DBAs tied to your LLC.

When considering how many DBAs can an LLC have, remember that each additional business name increases administrative responsibilities.

Creating a systematic approach to managing these requirements will help you avoid missed deadlines and compliance issues while operating multiple businesses under one LLC business structure.

Also Read:

FAQ

1. Can you have multiple DBAs under one LLC?

Yes, an LLC can have multiple DBAs. There are no federal limits, but each DBA must be registered separately according to state and local requirements. You can add as many DBAs as needed to operate multiple businesses under a single legal entity.

2. Can I use the same EIN for multiple DBAs?

Yes, all DBAs under an LLC share the same EIN, as they are not different business entities but rather aliases for the same LLC.

3. Does my DBA need a separate bank account from LLC?

No, it’s not legally required — but it is often a good idea. While DBAs operate under the same LLC, having separate accounts can simplify bookkeeping, tax reporting, and financial management for multiple businesses.

4. Is it a good idea to have multiple businesses under one LLC?

Using multiple DBAs under one limited liability company is ideal for related ventures with similar risk profiles. The primary benefits of this approach are to simplify administration and reduce costs compared to forming separate LLCs. However, it means all business lines and company divisions share liabilities, and a legal issue in one area could impact all operations, not just the primary LLC.

For businesses with significantly different risk levels or requiring distinct liability protection, separate LLCs might be more appropriate despite higher maintenance costs.

5. Do I need a separate business license for each DBA?

No, you usually don’t need a separate business license for each DBA. A single license can cover all DBA names under the same legal entity, provided you list them when applying. Always confirm with your local government, however, as regulations may vary by area.

Also Read:

- Essential Legal Documents Every Startup Must Have

- Business Legal Name vs. Trade Name: What Is the Difference?

Wrapping Up

While there’s typically no legal limit to the number of DBAs you can register, understanding how many DBAs can an LLC have empowers you to make strategic decisions about expanding your business while managing administrative complexity.

If you’re ready to register multiple DBAs for your LLC, professional services like MyCompanyWorks can significantly streamline the process and help you avoid common pitfalls and delays that often occur with DIY registrations.