Today, more than ever, branding is everything. But what if your legal business name doesn’t align with your vision? However, a company’s legal business name may not always capture the essence or vision of the brand it strives to represent. That’s where a DBA (Doing Business As) can make a significant difference.

If you’re starting a business, you might have come across the term “DBA” and wondered, What is a DBA?

Simply put, a DBA allows businesses to operate under a different name without forming a new legal entity.

Whether you’re a freelancer, a sole proprietor, or a corporation looking to expand into new markets, a DBA provides the flexibility to build a recognizable brand while keeping legal and tax structures intact.

In this guide, we’ll answer the question, What is a DBA? We’ll also explore why businesses use it, how to register, associated costs, and the legal considerations. We’ll also answer common questions to help you decide if a DBA is the right move for your business.

Let’s get started!

Table of Contents

What Is a DBA?

A “Doing Business As” (DBA) is a fictitious business name, trade name, or assumed name that a business uses to operate under a different name than its legal, registered name.

Image via GovDocFiling

It allows sole proprietors, partnerships, and even corporations to present themselves to the public in a more approachable, memorable, or industry-specific manner. While a DBA doesn’t provide legal protection or alter a business’s tax structure, it is a powerful tool for branding and operational flexibility.

For example, if John Smith operates a sole proprietorship and offers graphic design services under his personal name but wants to market himself as Smith Creative Studio. He would file a DBA to legally conduct business under that name.

Similarly, a corporation like GreenTech Solutions LLC could register a DBA under the name GreenTech Solar to market a specific service while maintaining its legal entity.

When considering, “What is a DBA?” It’s important to note that a DBA doesn’t create a separate business entity. It simply allows an existing entity to use a different name.

Also Read:

DBA vs Business Entity Formation

What is a DBA, and how does it differ from business entity formation? While DBAs and business entities enable businesses to operate under a chosen name, key differences exist. These include:

- A DBA Doesn’t Provide Liability Protection: Unlike a limited liability company (LLC) or corporation, a DBA does not create a legal distinction between the business and its owner. This means the owner remains personally liable for debts and legal issues in a sole proprietorship or partnership.

- A DBA Doesn’t Change Tax Obligations: The business remains taxed based on its existing structure. A sole proprietor using a DBA still reports taxes on their personal tax return, while an LLC or corporation with a DBA continues to be taxed as per its entity classification.

- A DBA Is Easier and Cheaper to Register: While forming an LLC or corporation involves filing articles of organization/incorporation and complying with ongoing legal requirements, a DBA often only requires a simple registration process and a modest fee.

In short, what is a DBA? It’s a branding tool, not a legal structure. Meanwhile, an LLC or corporation provides legal protection but must use its registered name unless a DBA is filed.

Differentiating DBAs from Trademarks and Copyrights

What is a DBA, and how does it differ from trademarks and copyrights?

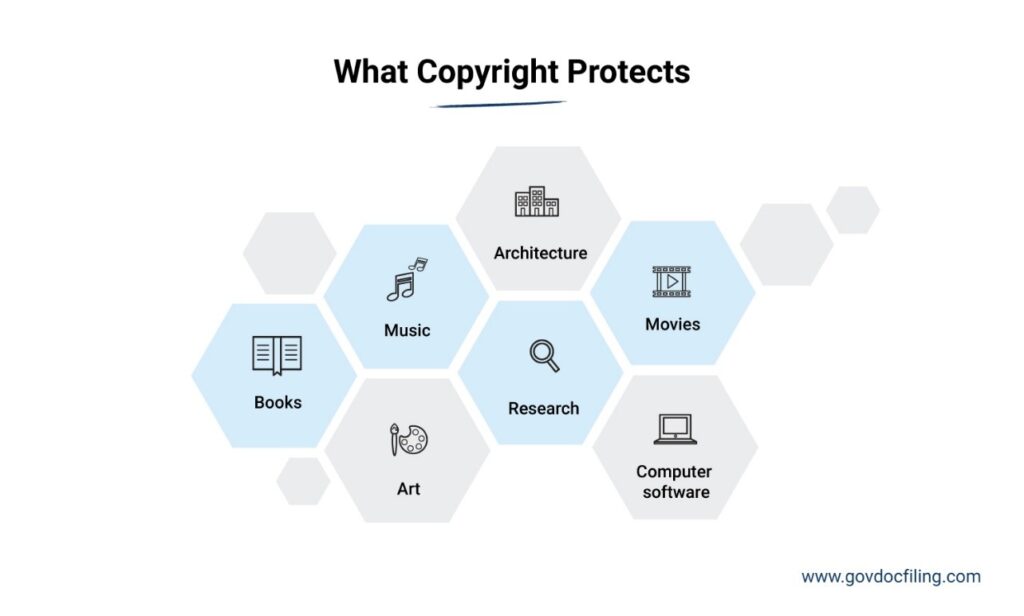

It’s easy to confuse a DBA with trademarks and copyright, but they protect different aspects of business identity:

- Doing Business As (DBA): Allows a business to operate under a different name but does not grant exclusive rights to that name. It provides local name protection, but typically requires periodic renewal. Other businesses in different states or industries may use the same DBA unless it’s trademarked.

- Trademark: Provides legal protection for a brand name, logo, design, or slogan, preventing others from using it in similar industries. A business can register a trademark with the U.S. Patent and Trademark Office (USPTO) to secure nationwide exclusive rights.

- Copyright: Protects original or creative works, such as written content, music, art, or software. It gives the creator exclusive rights to reproduce, distribute, and display the work. Unlike a DBA or trademark, a copyright doesn’t apply to a business name.

Image via GovDocFiling

For example, if a bakery files a DBA as Sweet Delights, another business in a different state could legally use the same name unless Sweet Delights is trademarked. However, if the bakery copyrighted a cookbook, that specific content would be protected under copyright law.

State-Level Variations in DBA Requirements

What is a DBA, and what are the different state variations? DBA requirements can vary significantly from state to state. While the general process involves selecting a unique trade name and filing the appropriate paperwork with the relevant state or local government office, specific requirements and fees differ:

- Filing Requirements: Some states require businesses to register a DBA with the state government, while others mandate registration at the county or city level.

- Publication Requirements: Certain states, such as California and New York, require businesses to publish a DBA announcement in a local newspaper for a specified period.

- Renewal Policies: Some states require businesses to renew a DBA every few years, while others offer indefinite validity unless the business dissolves or changes its name.

- Fee Structures: Filing costs vary dramatically between states and even between counties within the same state. For instance, it costs $10 to file for and renew a DBA in Arizona. Meanwhile, it costs $100 in Wyoming, while a renewal is $50.

Understanding these variations helps businesses understand “What is a DBA” and navigate the DBA registration process smoothly. It also ensures compliance with local regulations.

Also Read:

- How to Register a Business Name in the US

- Business Legal Name vs. Trade Name: What Is the Difference?

How to File a DBA

Understanding what is a DBA is just the first step. Knowing how to properly file one ensures your business remains compliant while reaping all the branding benefits.

This step-by-step guide will walk you through the entire process of obtaining and maintaining your DBA registration.

1. Determine If You Need a DBA

Before diving into paperwork, it’s essential to determine whether your business requires a DBA filing.

As an entrepreneur, what is a DBA requirement that applies to your business? The answer depends on several factors:

Who Needs a DBA

Different business types or structures have varying needs for DBA registration:

- Sole Proprietors and General Partnerships: If an individual or a group of partners runs a business without forming an LLC or corporation, the legal name of the business defaults to their personal names. A DBA allows them to create a more marketable business identity.

- Limited Liability Companies (LLCs): If an LLC wants to operate under a different brand name without forming a separate LLC, filing a DBA is a simple solution.

- Corporations: A corporation might file a DBA to introduce multiple brands under the same legal entity without the hassle of setting up new corporations.

Common Scenarios Where Businesses Benefit from a DBA

Beyond legal requirements, businesses often find strategic value in DBA filings:

- Rebranding Situations: A business wanting to refresh its image without changing its legal structure.

- New Product Lines: A company launching distinctive offerings that warrant separate branding.

- Location-Specific Operations: Businesses adapting names for different geographical markets.

- Online vs Physical Presence: Companies maintaining different identities for digital and brick-and-mortar operations.

When evaluating what is a DBA’s potential benefit is to your business, consider both compliance requirements and strategic advantages. This dual perspective ensures you’re not just meeting legal obligations but also maximizing the marketing potential of your filing.

Also Read:

- Can a DBA Be Filed For All Business Types?

- Can You Have Multiple DBAs Under One Sole Proprietorship?

2. Check DBA Name Availability

Once you’ve determined that a DBA is necessary, the next crucial step is verifying that your chosen name is available for use. Selecting a name that’s already in use or restricted can cause legal conflicts, rejection of your application, or rebranding costs in the future.

Why Name Availability Matters

Choosing a name that’s already in use or too similar to an existing business could lead to:

- Registration Rejection: Your DBA application may be denied if the name is already registered in your jurisdiction.

- Potential Legal Disputes: Operating under a name too similar to an existing business could result in confusion and legal challenges.

- Branding Setbacks: If you have to change names, investing in marketing materials before confirming availability could result in resource waste.

How to Conduct a Name Search

Now you fully understand what is a DBA, it’s important to ensure your DBA name is unique. Follow these steps to get started:

- Check State or County Business Name Database: Most states have an online search tool where you can look up registered DBAs.

- Search the U.S. Patent and Trademark Office (USPTO) Database: A name may not be taken at the state level, but could be trademarked at the federal level, restricting its use.

- Check Domain Name Availability: If your DBA name will be used for online branding, ensure the domain is available.

- Search Social Media Handles: Securing matching usernames across platforms strengthens your brand’s online presence.

Note any prohibited naming conventions and restrictions in your jurisdiction. Some states have specific rules about using certain words or phrases in business names without proper authorization.

These include misleading names (like “LLC” for a sole proprietorship’s DBA), ones that resemble government entities like “State Department,” and restricted industry names (like “bank”).

3. Register Your DBA with the Appropriate Authority

After confirming your desired DBA name is available, the next step is registering it with the appropriate authority. Depending on your jurisdiction, this might be the state, county, or city office.

Where to File Your DBA

The correct filing authority depends on your state and locality:

- State Level: Some states, like Florida and Alaska, require DBA registrations to be filed with the Secretary of State or a similar state-level agency.

- County Level: Other states like California and Texas require DBA registrations at the county level, typically with the County Clerk’s office in the county where you conduct business. This usually means filing in each relevant county where you operate.

- City Level: Some municipalities, like those in Massachusetts, have additional requirements for businesses operating within city limits. These requirements usually supplement county or state filings rather than replace them.

- Multi-Jurisdiction Considerations: A business that operates in multiple states must file a DBA in each state where the name will be used. These can vary dramatically in process, documentation, and renewal periods.

What is a DBA and what are your filing options as a business owner? Many states and localities offer various filing options for convenience.

You can often file your DBA application online through the relevant government website, which can be quicker and more efficient. Alternatively, you can visit the appropriate office in person or submit your application via mail.

Each method has its processing time and requirements, so choose the one that best suits your needs.

Required Forms and Documentation

While specific requirements vary by location, most DBA applications will ask for:

- The DBA name you wish to register

- The legal name of the business owner or entity

- The business structure (sole proprietorship, LLC, corporation, etc.)

- Notarized signatures (required in some states)

- Business address and contact information

- Nature of business

What is a DBA filing’s most common complication? Incomplete documentation typically causes the most filing delays and rejections. Double-checking requirements before submission can prevent costly and inconvenient setbacks.

Also Read:

4. Pay the Filing Fee

Once your DBA registration form is completed, the next step is to submit the required payment. The cost of filing a DBA varies depending on the state, county, or city where the business is registered.

On average, fees range from $10 to $100. Therefore, checking the exact cost for your jurisdiction is essential to ensure you submit the correct amount.

Most filing offices accept various payment methods, including credit/debit cards, checks, and money orders.

When submitting your application online, you can typically pay the fee electronically. Processing times can vary, but you can often expect confirmation within a few weeks. Always retain proof of payment for your records.

What is a DBA’s value proposition versus its cost? For most businesses, the benefits of branding flexibility and legal compliance far outweigh the relatively modest filing fees.

5. Publish Your DBA

Certain states require businesses to publish a notice of their DBA registration in a local newspaper. This step informs the public that a business is operating under a new name and provides transparency.

While not all states mandate this step, those that commonly do include California, Florida, Georgia, Illinois, Minnesota, Nebraska, and Pennsylvania. It’s essential to check the specific requirements for your state or county, as publication rules can differ.

Steps to Fulfil Publication Requirements

If your state requires DBA publication, follow these steps:

- Choose an Approved Publication: Choose an approved local newspaper where legal notices are regularly published. Your state or local office may provide a list of eligible publications that meet circulation requirements.

- Publish the DBA Notice: The notice typically needs to run for a specific duration, such as once a week for several consecutive weeks. Ensure you comply with the duration specified by your jurisdiction.

- Obtain Proof of Publication: The newspaper will issue an affidavit or proof of publication once the required time frame has passed. This document certifies that your notice appeared as required, including publication dates.

- File Proof with the Registration Authority: Some states require businesses to send this affidavit to the county clerk or state office to complete the DBA registration process. File your proof within the specified timeframe.

What is a DBA’s status during the publication period? In most jurisdictions, your DBA registration is considered provisional until the publication requirement is completed and verified. This provisional status may limit certain activities, such as banking under your new business name.

Also Read:

6. Complete Post-Filing Procedures

After successfully registering a DBA, business owners must take additional steps to fully integrate the new business name into their operations.

Many entrepreneurs who ask, What is a DBA, assume that filing alone is enough. However, several post-filing actions are essential to ensure smooth business operations.

- Obtain Your DBA Certificate: Once your DBA application is approved and the filing fee is paid, you’ll receive a DBA certificate or confirmation notice. This document is essential for legal and administrative purposes. Keep your certificate in a secure location, as you may need to present it for various business activities.

- Set Up Banking Relationships with Your DBA: With your DBA certificate, visit your bank to set up a business bank account under your new trade name. Typically, banks set up accounts under your legal business name, adding your DBA as an additional business name or “doing business as” designation.

- Update Business Documentation and Materials: Ensure your new DBA name is reflected across business materials like contracts, invoices, marketing materials, signage, and your website. Consistency across all platforms ensures customers and clients recognize and trust your business under its new trade name.

- Implement Your DBA in Marketing and Operations: Integrate your DBA into your marketing strategies and day-to-day operations. Ensure it’s prominently displayed on your website, social media profiles, and advertising campaigns. This helps build brand recognition and reinforces your business identity.

What is a DBA transition plan’s most overlooked element? Many businesses fail to update third-party listings and directory information, creating confusion when customers encounter inconsistent naming across different platforms. Be sure to integrate your DBA into your brand identity.

7. Renew and Maintain Your DBA

The final component of DBA management involves understanding what your DBA renewal requirements are and implementing systems to maintain compliance over time. Business owners who initially ask, “What is a DBA?” may not realize that failing to renew a DBA could lead to legal and operational issues.

DBA registrations are not permanent and require periodic renewal:

- State and Local Regulations Vary: DBA renewals are typically required every 1 to 10 years, depending on the jurisdiction.

- Expiration Dates Matter: If a business fails to renew on time, the DBA may become inactive, potentially losing your trade name rights.

- Renewal Notifications: Few jurisdictions send automatic renewal reminders, placing the responsibility on business owners to track expiration dates.

If there are significant changes in your business, such as a change of address, ownership, or business structure, update your DBA registration accordingly. Inform the relevant authorities to avoid legal issues and ensure your trade name remains valid.

If your DBA expires or you decide to change your trade name, you’ll need to file a new DBA application or amend the existing one.

You want to implement a system to track your DBA compliance and renewal deadlines. Set reminders well before the renewal dates to ensure you submit the necessary paperwork and fees on time.

What is a DBA’s status after expiration? In most jurisdictions, operating under an expired DBA puts you in non-compliance. It potentially exposes your business to penalties and complications with contracts, banking, and other business activities.

Also Read:

Why Is a DBA Important?

Many entrepreneurs ask, What is a DBA, and why is it important? A DBA (Doing Business As) is more than just a registration. It’s a powerful tool that provides businesses with branding flexibility, legal compliance, and operational advantages.

Understanding the following advantages can help you decide whether a DBA aligns with your business objectives.

1. Branding and Marketing Flexibility

Understanding what is a DBA can help businesses unlock greater branding potential. With a DBA, companies can create market-friendly business names that resonate with customers.

Image via GovDocFiling

Without a DBA, sole proprietors and partnerships are legally required to operate under their personal names (e.g., John Smith Consulting). However, this might not be ideal for attracting clients or conveying professionalism.

A distinct brand identity can be effective for marketing and customer engagement.

- Example: If a company called SunTech Solutions LLC offers multiple services. By filing DBAs like SunTech Web Services and SunTech IT Consulting, the company can market each service separately while operating under the same legal entity.

The marketing advantages of this flexibility cannot be overstated. Businesses can craft names that are more memorable, descriptive of their services, or emotionally resonant with customers, all without sacrificing their original legal structure.

2. Compliance with State and Local Regulations

Many states and local governments require businesses to file a DBA if they intend to operate under any name other than their legal one. This registration ensures transparency and provides legal recognition for the trade name.

DBA filings often serve as critical compliance mechanisms:

- Mandatory Requirements: States legally require businesses operating under any name other than their legal name to register a DBA. This requirement applies even to subtle variations. A sole proprietor named “John Smith” who advertises as “Smith Consulting” typically needs a DBA.

- Contracting and Legal Document Validity: Without a properly registered DBA, contracts signed under a business’s alternative name may be unenforceable in certain jurisdictions. This could potentially invalidate client agreements, vendor contracts, or other crucial business arrangements.

- Tax Reporting Alignment: DBAs help ensure consistency between business operations and tax filings, preventing discrepancies that might trigger audits or compliance concerns.

Failure to register a DBA can result in penalties, fines, and even restrictions on conducting business. For businesses operating across multiple jurisdictions, navigating these varying requirements can be complex but knowing what is a DBA and the compliance requirements are essential for legal operation.

Also Read:

- Business Legal Name vs. Trade Name: What Is the Difference?

- Important Legal Requirements for Starting a Small Business

3. Privacy Considerations for Sole Proprietors

For sole proprietors, operating under a personal name can create privacy concerns, especially when dealing with clients, vendors, and public records. If you’re one, a DBA allows you significant privacy advantages:

- Personal Identity Protection: Without a DBA, sole proprietors must conduct business under their legal names, exposing their personal identity in all business transactions. A DBA creates a layer of separation between personal and business identities.

- Professional Presentation: A well-chosen DBA can help sole proprietors present a more established business image without forming a complex business entity. It helps entrepreneurs strike a balance between professionalism and operational simplicity.

The privacy buffer a DBA affords is especially useful for those who value anonymity or want to project a more professional image without exposing personal details.

4. Partnership Considerations

Partnerships can also benefit from registering a DBA. When two or more individuals form a partnership, they might want to operate under a name that reflects their combined services or expertise. Here’s why:

- Simplified Naming: Without a DBA, partnerships must legally operate under the combined names of the partners (for example, “Smith and Johnson Financial Consultants”). A DBA, such as SJ Financial Solutions, allows for adopting more practical, concise business names.

- Partner Change Accommodation: When partners join or leave the business, a DBA provides continuity in market identity despite changes in the underlying partnership structure. The business can maintain its established name recognition even as ownership evolves.

- Brand Consistency During Transitions: During partnership reorganizations, a DBA allows the business to maintain its external identity while internal legal structures are adjusted. This ensures customer relationships remain uninterrupted.

These advantages help partnerships build sustainable brand equity independent of individual partner involvement. They also simplify business transactions, enhance credibility, and make branding more effective.

5. Expanding Business Offerings

When you understand what a DBA is, you can expand your business’s offerings under different trade names without creating new legal entities. Businesses often evolve, and a DBA provides an easy way to pivot into new markets by:

- Operating Multiple Brands Under One Entity: A single business entity can register multiple DBAs, allowing it to operate distinct brands or product lines without creating separate legal structures. This significantly reduces administrative overhead while enabling market segmentation.

- Testing New Business Concepts: Businesses can use DBAs to launch and test new concepts with limited investment. If a new direction proves unsuccessful, the company can simply discontinue using that particular DBA without impacting the core business entity.

- Tailoring Services to Different Demographics: Companies can create specifically targeted offerings for different customer segments under separate DBAs, allowing for precise positioning while maintaining unified back-end operations.

For example, Gourmet Events LLC’s local catering business wants to open a meal delivery service. Instead of forming a new LLC, it registers a DBA as Gourmet To-Go. This clarifies that the new service is related but distinct from its main catering business.

With this strategy, you can test new markets without the legal burden of registering a new business entity.

Also Read:

- Sole Proprietorship vs Partnership: How Are They Different?

- How to Register a Business Name in the US: A Guide

6. Legal Protection and Professionalism

While a DBA doesn’t provide the liability protection of formal business structures like LLCs or corporations, it offers other important legal and professional advantages:

- Name Usage Rights: Registering a DBA typically establishes a business’ right to use that name within the jurisdiction of registration, preventing others from registering the identical name in the same location.

- Professional Credibility: Operating under a registered business name rather than a personal name enhances credibility with clients, vendors, and partners by projecting a more established, professional image.

- Contractual Clarity: A DBA provides legal clarity in contracts and agreements, explicitly connecting the operating name to the underlying legal entity and reducing potential contractual disputes.

These protections help businesses establish themselves as legitimate market participants with recognized operational standing.

7. Meeting Banking and Financial Requirements

Most banks require a DBA before allowing businesses to open a bank account under their trade name. Without a DBA, sole proprietors and partnerships must use their personal names for banking, which can complicate financial management.

Here are some of the critical functions a DBA serves in financial operations:

- Account Establishment Requirements: Most financial institutions require businesses to present DBA registration documentation before opening accounts under any name other than the legal business name. This requirement exists to prevent fraud and ensure proper financial tracking.

- Check and Payment Processing: With a registered DBA, businesses can accept and process payments made out to their trade name rather than their legal name. This streamlines financial transactions and helps you avoid potential payment processing complications.

- Transparent Financial Identity: DBA registration creates a clear link between a business’s marketing identity and its financial operations. It ensures the trade name aligns with financial documentation, enabling businesses to maintain clean audit trails. This is essential for transparent bookkeeping and tax compliance.

This banking functionality represents one of the most practical, day-to-day benefits of DBA registration for many small businesses.

Also Read:

FAQ

1. What does having a DBA mean?

Having a DBA, or “Doing Business As,” means your business operates under a trade or assumed name different from its legal name. This allows for greater branding flexibility and can make your business more recognizable and professional to your target audience.

2. What are the steps to file for a DBA?

Filing for a DBA (“doing business as”) involves several important steps that business owners need to complete:

- Determine If You Need a DBA: Assess whether your business structure and branding goals require a DBA filing to operate legally under a different name.

- Check DBA Name Availability: Research state and local databases to ensure your desired business name isn’t already in use by another company.

- Register Your DBA: Submit the required registration forms to the appropriate government authority, which varies depending on your state, county, or city.

- Pay the Filing Fee: Budget for and pay the required registration fees, which typically range from $10 to $100, depending on your location.

- Publish Your DBA: Fulfill any mandatory public notice requirements by publishing your DBA information in approved local newspapers.

- Complete Post-Filing Procedures: Obtain your DBA certificate and update your business documents to reflect your new operating name.

- Renew as Needed: Mark your calendar for renewal deadlines, usually every one to 10 years, as most DBAs expire after a set period and require timely renewal.

3. Is a DBA or LLC better?

Neither a DBA nor LLC is inherently “better” as they serve different purposes. A DBA is simply a name registration that allows you to conduct business under a different name. Meanwhile, an LLC is a legal business structure that provides liability protection.

If you need legal protection for your personal assets plus tax benefits, an LLC is better. If you just need a trade name, a DBA is sufficient. However, an LLC with DBAs for multiple brand names can use both. Filing DBAs may be more cost-effective than forming multiple LLCs.

4. What are some common mistakes to avoid when filing a DBA?

Some common, but easily avoidable mistakes when filing a DBA include:

- Failing to Check Name Availability: A DBA that conflicts with another business can be rejected, delaying the registration process.

- Not Renewing on Time: Letting a DBA expire can cause business disruptions, requiring reapplication and potential name loss.

- Skipping State-Specific Requirements: Some states require a public notice, and failure to comply can invalidate your registration.

- Assuming a DBA Provides Legal Protection: A DBA does not shield personal assets like an LLC or corporation does or provide trademark protection.

5. What does a DBA actually do?

A DBA allows a business to legally conduct operations, advertise, and open bank accounts under a trade name different from its registered legal name. It doesn’t provide legal protection or ownership rights, but helps in branding and market presence.

Also Read:

Wrapping Up

Understanding what is a DBA is crucial for businesses aiming to operate under a different name while maintaining their legal structure.

A DBA offers numerous benefits, including brand flexibility, legal compliance, and enhanced professionalism. By following the outlined steps, businesses can smoothly navigate the DBA filing process and leverage their new trade name for success.

If interested in streamlining the DBA filing process, professional services like MyCompanyWorks can simplify the paperwork and ensure accuracy. MyCompanyWorks helps business owners file correctly, reducing the risk of errors that could delay approval.