So you want to start a business? Or maybe you’re already in business but want to take the next step and make it official. Either way, an S-Corp is a great business entity to choose if you want significant tax savings.

But, how do you start an S-Corp or elect S-Corp status?

In this all-inclusive guide, we’ll walk you through the process of S-Corp election to get the S-Corporation tax status.

Make sure to save this guide in your bookmarks. You’ll need it as you begin the process of electing the S-Corp tax status.

Let’s get into it.

What is an S-Corp?

An S-Corporation (S-Corp, for short) is a legal entity that is characterized by the protection of the owner’s personal assets. It’s a special type of domestic Corporation, which offers better income tax savings and is great for small businesses.

This corporate structure is favored by business owners because it avoids double taxation—where you pay income tax on personal income in addition to corporate income tax on qualified business income.

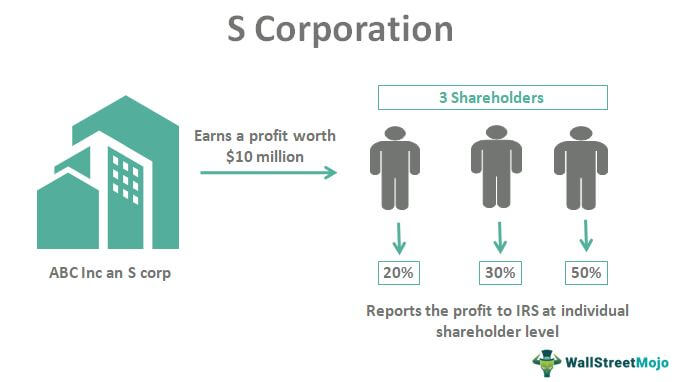

One of the biggest benefits of an S-Corp is pass-through taxation. This simply means that the company is exempt from paying federal income tax on business profits.

What happens instead is, profit and losses are “passed through” to shareholders of the company. The shareholders then report these taxes on their individual tax returns.

S-Corps avoid double taxation. Shareholders individually pay personal income tax on profits shared. This is known as pass-through taxation, explained visually in the image below.

For a company to be classified as an S-Corp:

- It must not have more than a hundred shareholders

- All the shareholders must be US citizens or residents

- It must have only one class of stock

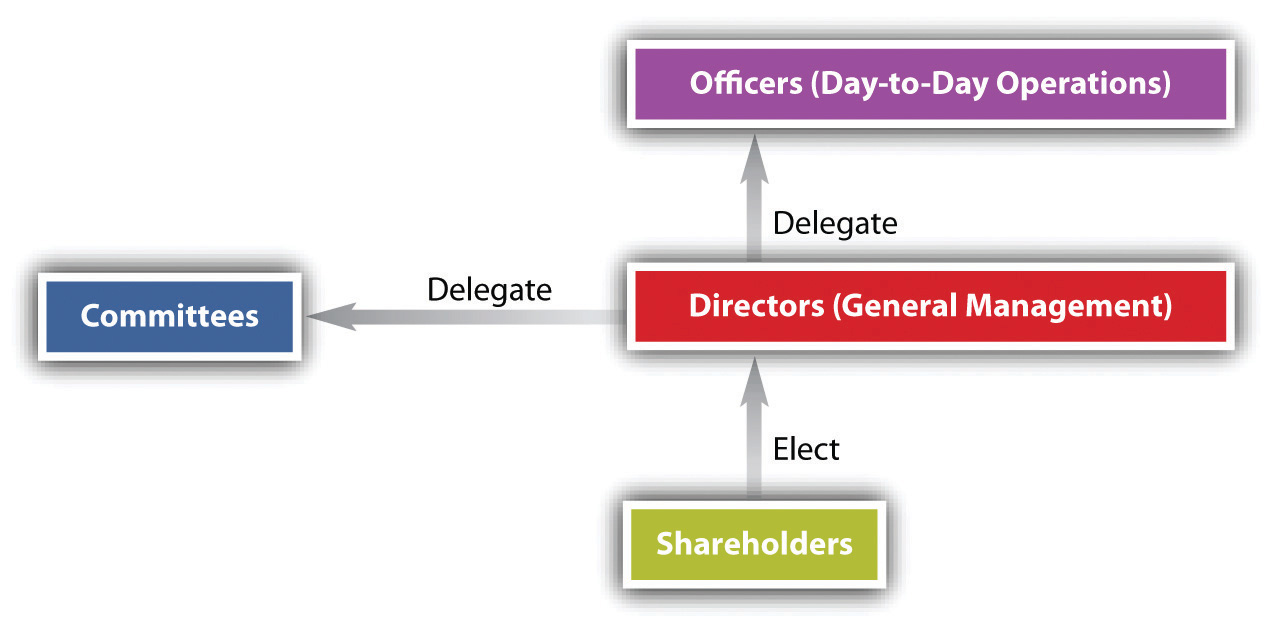

Structure-wise, S-Corporations follow a traditional corporate hierarchy. It’s composed of shareholders, directors, and officers.

Shareholders own the company. They hold shares of stock that represent their ownership interest. Directors are elected by shareholders and they oversee the overall direction of the company. And last but not least, officers, who handle the daily operations of the company and are appointed by directors.

Overall, S-Corps offer entrepreneurs like you the best of both worlds. You get to protect your assets while enjoying the tax benefits typically associated with Partnerships or Sole proprietorships.

Pros & Cons of Choosing an S-Corporation

It’s hard to go wrong with an S-Corp. The pros are more than the cons. In this section, we’ll take four solid pros and two equally solid cons.

Pros

- Personal liability protection shields the shareholders’ personal assets from the company’s debts and liabilities, offering peace of mind and a safeguard against financial risks.

- Pass-through taxation allows S-Corporations to avoid double taxation. By passing profits and losses directly to shareholders, the company’s income is taxed only at the individual level, potentially resulting in substantial income tax savings.

- Additionally, an S-Corporation is considered more credible and formal than most other entities, attracting investors, partners, and customers.

- It also offers flexibility in distributing profits, allowing shareholders to receive dividends based on their ownership percentage.

Cons

- Forming and maintaining an S-Corporation requires compliance with complex legal and regulatory requirements. This can involve higher administrative and legal costs compared to simpler business structures.

- Furthermore, the eligibility criteria and limitations on shareholders may restrict the potential for growth and raising capital, especially if you plan to expand the business extensively or seek funding from several investors.

LLC vs S-Corp: A Comparison

Not sure if you should go for an LLC or an S-Corp?

No doubt, the two business entities have their similarities. Still, the difference lies in their structure, taxation, ownership requirements, and governance. Here’s a breakdown to help you understand.

Structure: An LLC is a flexible business structure that combines elements of a Partnership and a Corporation. It provides limited liability protection to owners (called members) and has a more informal management structure.

On the other hand, an S-Corp is a specific type of Corporation that meets certain IRS requirements to obtain a special tax status.

Taxation: LLCs and S-Corps have different ways of being taxed. In an LLC, company profits and losses pass through to the owners’ personal income tax returns. They pay taxes on their share of the income. However, LLCs can also choose to be taxed as a Corporation if they prefer.

The image below shows the difference between an S-Corp and an LLC.

S-Corps also offer pass through taxation like an LLC. Company profits and losses flow through to the shareholders’ personal tax returns, and they pay taxes on their share of the income. This can save on taxes compared to the double taxation that can happen with regular C-Corporations.

Ownership Requirements: LLCs have more ownership flexibility. They can have unlimited members, including individuals, corporations, and other LLCs. Also, there are no restrictions on the citizenship or residency status of the members.

S-Corps, however, have stricter ownership rules. They can have a maximum of 100 shareholders (corp owners), who must be individuals (with some exceptions) and US residents or citizens.

Governance: LLCs have fewer formalities and less strict governance structures compared to S-Corps. LLCs have more freedom to define their operating agreement, which outlines ownership, management, and decision-making.

S-Corps, on the other hand, must follow formal corporate governance requirements, like holding annual shareholder meetings, keeping minutes of meetings, and electing a board of directors.

Deciding between an LLC and an S-Corp depends on your specific business needs, goals, and tax considerations. Talking to legal and tax experts can help you choose the right structure for your business.

How to Start an S-Corp in 8 Steps

In this section, we’ll cover the step-by-step process of how to start an S-Corp.

Step 1: Select a Business Name

Choose a unique and memorable business name for small business Corporation. Make sure the name you select is not taken and doesn’t infringe upon existing trademarks or copyrights.

To be sure, check with the U.S. Patent and Trademark Office and your state’s business name database. Even better, you can use a business formation services provider like Inc Authority. It offers free business name searches to help you ensure your chosen name is unique.

At the same time, secure a domain name for your business using a service provider like GoDaddy. We recommend choosing a domain that is identical to your official legal name or DBA name.

Registering a domain that matches your business name makes it easier for customers to find you online.

Pro Tip: Don’t dwell on a name for too long. You can always operate with a different name. All you have to do is file a DBA to make the name legal.

Step 2: Choose a Registered Agent

Also called an agent for service of process or statutory agent, a registered agent (RA) serves as the official point of contact for your S-Corporation.

They accept “summons” and receive important legal and tax documents on behalf of the company. The registered agent must have a physical address within the state where your S-Corporation is registered.

Selecting a reliable registered agent is crucial to maintain compliance and ensure that important notices and legal documents are received promptly.

INC Authority’s S-Corp formation package comes with a year-long registered agent service. After a year, you can appoint an individual within your company who is responsible and available during business hours.

Source: South Florida Law

Step 3: File Articles of Incorporation

To legitimize your S-Corporation, you must register it with the Secretary of State’s office.

Typically, this involves filing the Articles of Incorporation, which establishes your business as a legal entity. This document includes essential information about your company, such as:

- The name of your company

- It’s purpose

- Your business address

- The share structure

- Shareholder details (single-owner S-Corp or multiple shareholders? The roles and responsibilities each shareholder will hold and their level of involvement in decision-making).

Draft your Articles of Incorporation accurately, pay filing fees, and ensure that you comply with state-specific requirements and fees.

Include all necessary information and follow the prescribed format. Once prepared, file the Articles of Incorporation with the appropriate state agency, usually the Secretary of State.

This can be a tedious process, so we recommend that you use the services of a company like Inc Authority or Incfile.

Step 4: Obtain Necessary Permits and Licenses

To maintain compliance as an S-Corporation, it’s essential to fulfill various state-specific requirements in addition to filing the Articles of Incorporation. These obligations may involve acquiring a state business license and adhering to local zoning regulations.

Research and understand the particular requirements imposed by your state. Follow the prescribed steps to ensure you meet these obligations. If you fail to comply, you can lose your S-Corp status at worst. At best, you’ll pay a fine.

With the help of a legal partner, keep abreast of the permits and licenses necessary for your business at the federal, state, and local levels. These usually vary based on several factors. Your industry, location and specific products/services you offer will determine the types of permits required for your S-Corp. Examples of common permits and licenses include:

- Professional licenses

- Health permits

- Building permits

- Environmental permits

Failure to obtain required permits and licenses can have serious legal ramifications that can disrupt your company’s operations.

Step 5: Elect Directors and Appoint Officers

Once you assemble your shareholders, the next step is to elect your board of directors. It’s mandatory for S-Corps to have at least one director.

The board can then appoint officers who will be in charge of running the firm day in, day out. Clearly define the responsibilities of each stakeholder and make sure communication is prompt, fluid, and easy.

Here’s an illustration of the roles played by various stakeholders in an S-Corporation:

Step 6: Identify Sources of Funding

To finance your S-Corporation, it’s important to identify suitable sources of business funding. Here are some options you can consider.

Personal savings: Utilize your personal savings or contributions from family and friends to provide initial capital for your S-Corporation. However, ensure that you have a clear repayment plan and consider the potential impact on personal relationships.

Crowdfunding: Leverage online crowdfunding platforms to raise funds from a large number of individuals who believe in your business concept. Kickstarter and Patreon are two popular examples. Prepare a compelling pitch and offer lucrative incentives to attract backers.

Government grants and incentives: These can provide valuable funding opportunities for S-Corporations. Research federal, state, and local programs that offer grants or tax incentives specific to your industry or business objectives. Consult government websites, economic development agencies, and business support organizations for information on available programs and eligibility criteria.

Loans: Explore traditional bank loans, Small Business Administration (SBA) loans, or certain financial institutions that offer small business capital solutions. Prepare a strong business plan and financial projections to increase your chances of approval.

When obtaining loans, you’ll be responsible for repaying the borrowed amount with interest. Ensure that you have a realistic repayment plan and understand the potential impact on your future cash flow.

Investors: Seek out potential investors who are interested in your industry or have a vested interest in supporting small businesses. Pitch your business idea and demonstrate the potential for growth and profitability.

If you choose to raise funds through equity financing, such as selling shares to investors, be prepared to dilute your ownership stake. Consider the long-term implications and carefully evaluate potential investors.

Step 7: Set Up a Payroll System

Establishing an efficient payroll system is essential for accurately compensating your employees and fulfilling your payroll obligations. Take the following steps to do that.

Obtain an Employer Identification Number (EIN)

An EIN is the official identity of your company in the eyes of the Internal Revenue Service (IRS). It’s used to track and manage tax-related activities of your S-Corp, particularly concerning payroll taxes.

What is an EIN? The visual below gives a simple definition.

The Internal Revenue Service (IRS) is responsible for issuing EINs. When filing for an EIN, you’ll be asked to provide some important information about your business. The IRS asks for:

- The legal name of your S-Corporation

- The nature of its business activities

- Your business address

The IRS then reviews your application and assigns an EIN to your Corporation upon successful completion. We recommend Inc Authority for EIN processing. It’s much easier than doing it yourself since the process is intricate and you’re most likely not an expert. The other, pricier option is having a lawyer or accountant file it for you.

After getting your EIN, you can open a business bank account. Then, register with the appropriate tax authorities at the federal, state, and local levels. This includes filing the necessary forms to report and pay payroll taxes.

Choose a Payroll Processing Method

Decide whether to handle payroll in-house using payroll software like Gusto or ADP or outsource it to a professional payroll service provider. Consider factors like cost, complexity, and your comfort level with payroll administration before making a decision.

Decide how often you will process payroll, whether it’s weekly, bi-weekly, or monthly. Ensure compliance with state laws regarding pay frequency.

Step 8: Draft Your S-Corp Bylaws

Corporate bylaws are the rules and regulations that govern the internal operations of an S-Corporation. They outline the procedures for:

- Holding meetings

- Electing directors

- Appointing officers

- Handling stock ownership and stock transfers

- Other key governance matters

Drafting comprehensive and clear bylaws is crucial for avoiding conflicts and ensuring the smooth functioning of your S-Corporation.

Consider hiring a legal professional with experience in corporate law to assist you in creating the bylaws that align with your business goals and comply with state and federal regulations.

How to Effectively Run Your S-Corp

Congratulations, you have officially created an S-Corporation.

In this section, we’ll discuss everything related to taxation, insurance, risk management, and hiring to help you successfully run your company.

To really cement your S-Corp as a legal business entity, we’ll give you 6 tips that focus on all important aspects of running an S-Corp.

1. Maximize Your S-Corp Tax Advantages

S-Corporations offer tax advantages that can help you retain more profits. To make the most of these benefits, follow the following steps.

Understand Pass-Through Taxation

Unlike a C-Corp, S-Corporations avoid double taxation. Profits and losses are passed through to shareholders and reported on owners’ personal income tax returns.

Ensure you pay yourself a reasonable salary to comply with IRS regulations.

Maximize Tax-Deductible Expenses

With an S-Corp, you can further reduce your taxable income by taking advantage of deductible business expenses. These expenses include:

- Marketing expenses

- Office supplies

- Travel costs

- Salaries

- Benefits

- Utilities

- Rent

Keep proper records and consult a tax professional for guidance.

Elect S-Corporation Status and File Tax Returns

File Form 2553 for S-Corporation election with the Internal Revenue Service (IRS). Then, annually file Form 1120S to report income, deductions, and distributions to shareholders. Remember, timely and accurate filing is crucial.

Seek Professional Tax Advice

Due to the complexities of S-Corporation taxation, it’s wise to consult a qualified tax professional specializing in small businesses and S-Corporations. They can provide tailored guidance and ensure compliance with tax laws.

While on the topic of taxes, it’s important to stay up to date with changes in tax laws and regulations.

Tax laws and regulations are subject to change, and it’s essential to stay informed and adapt your tax strategies accordingly. Conduct periodic reviews of tax laws and regulations that affect your S-Corporation. Stay updated on changes in federal, state, and local tax requirements to ensure accurate and timely tax compliance.

Also, engage in proactive tax planning to optimize your company’s tax position. Consider seeking advice from tax professionals who can provide guidance on deductions, credits, and strategies to minimize your tax liability.

2. Buy Insurance for Your S-Corporation

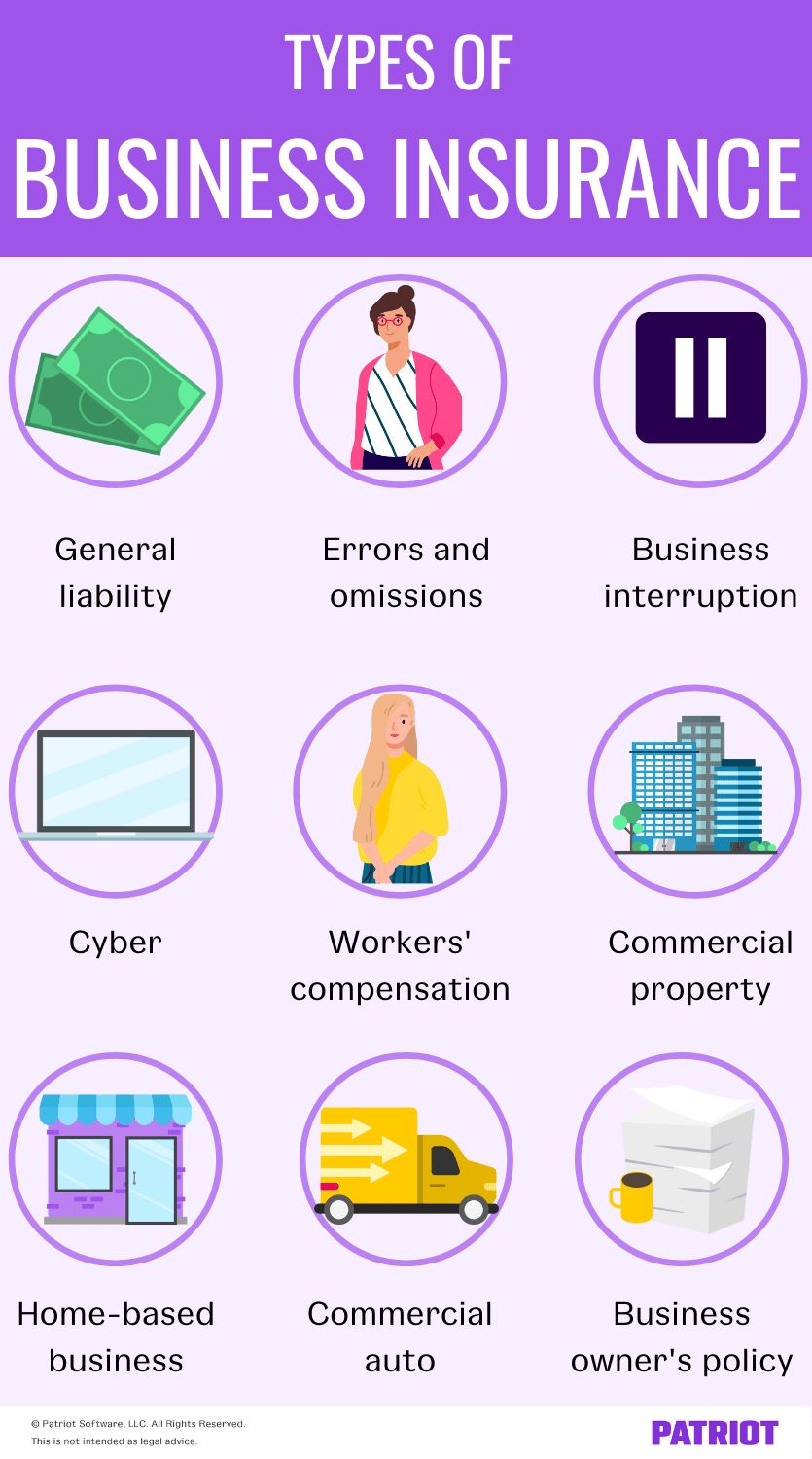

Insurance coverage plays a crucial role in protecting your S-Corporation from various risks.

Source: Patriot

Of the many options available, here are some insurance policies that are often relevant to S-Corporations:

- General liability insurance

- Workers compensation insurance

- Professional liability insurance

- Property insurance

Let’s discuss each briefly.

General Liability Insurance: This covers accidents, injury, and property damage within your business premises or as a result of business operations.

A general liability insurance policy protects your S-Corporation against third-party lawsuits and related legal expenses.

Workers’ Compensation Insurance: If you have employees, workers’ compensation insurance is typically required by law. This insurance policy protects employees in case of work-related injuries or illnesses. It covers medical expenses, loss of wages, and rehabilitation costs.

Professional Liability Insurance: This is also known as errors and omissions (E&O) insurance. An E&O protects your S-Corp against claims of professional negligence or inadequate performance of services. It’s particularly important for businesses that offer specialized services or advice (coaches for example).

Property Insurance: Property insurance covers damage or loss to your business property, including buildings, equipment, inventory, and furnishings. It protects your S-Corporation against mishaps, such as fire, theft, vandalism, or natural disasters.

3. Set Up Risk Management Practices

Managing risks and protecting your S-Corporation against unforeseen events is essential for long-term stability and success.

Insurance is just one component of effective risk management for your S-Corporation. Look into the following practices to further mitigate risks:

- Risk assessment

- Contract review

- Safety protocols and training

- Disaster preparedness

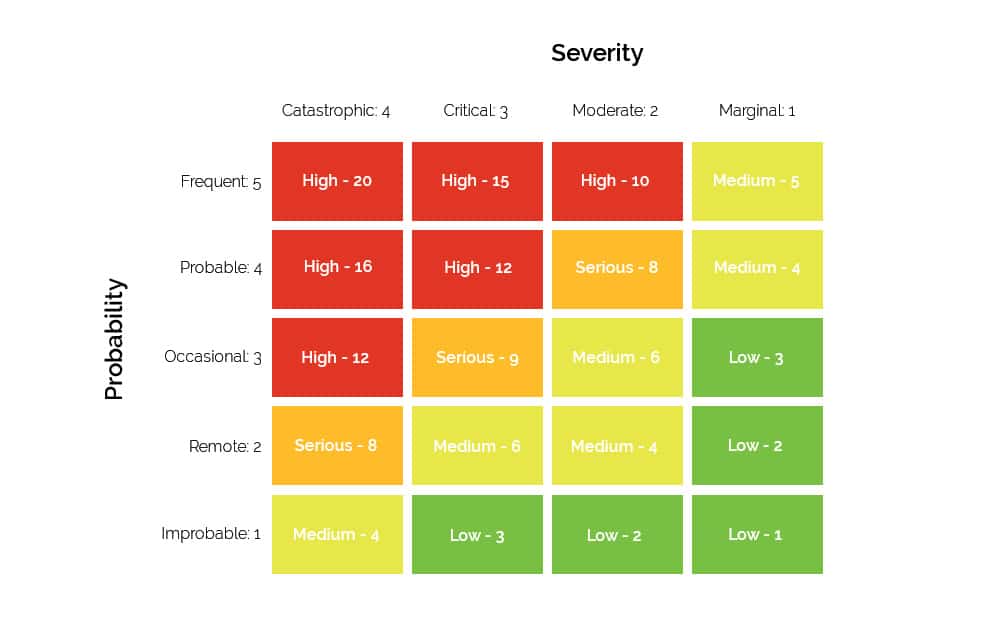

Risk Assessment: Employ the services of a trusted risk assessment and management firm to identify potential risks and vulnerabilities in your business operations.

Evaluate popular problem areas like cybersecurity, data protection, employee safety, and compliance with industry regulations.

Below is a standard risk assessment chart that shows the relationship between risk severity and risk probability. For examples, if something is “probable” and “critical”, then it is high risk. If another is “critical” but “improbable”, then it is low risk.

Contract Review: Review contracts and agreements with clients, vendors, and partners to ensure adequate risk allocation and protection for your S-Corporation. Consult legal professionals to assess potential liabilities and negotiate favorable terms.

Safety Protocols and Training Programs: Promote a culture of safety among your employees by creating a safety policy and updating it regularly. Implement safety protocols and provide training programs to minimize workplace accidents and injuries.

Disaster Preparedness: Develop a disaster preparedness strategy that includes measures to lessen the impact of natural disasters, technological failures, or other unforeseen events. Implement backup systems, data recovery plans, and business continuity strategies.

Regularly reassess your risk management strategies and practices as your S-Corporation grows and evolves. Seek the advice of insurance professionals and risk management experts to tailor your approach based on your specific industry and business needs.

4. Employment Laws and Regulations

As your S-Corporation continues to grow, you may consider hiring employees. To stay on the good side of the law, here are some things to consider:

Verify employment eligibility of potential hires: Not everyone is eligible by law to work in the United States. Ensure that all new hires complete Form I-9 to verify their identity and employment authorization.

Uphold anti-discrimination laws: Your hiring practices should be fair and non-discriminatory. Work with your legal advisor to get up to speed on federal and state laws that prohibit discrimination based on various factors, such as:

- National origin

- Disability

- Religion

- Color

- Race

- Sex

- Age

Keep to wage and hour laws: Do not pay below the minimum wage. Pay your employees if they work overtime and keep appropriate records. Again, work with your legal partner to get acquainted with the content of The Fair Labor Standards Act (FLSA) and adhere to any applicable state-specific wage and hour laws.

Classify your employees properly: Understand the difference between employees and independent contractors to ensure proper classification. Misclassifying workers can result in legal and financial consequences.

Issue health insurance and other benefits: Explore health insurance options for your employees. You can do this through group plans or by partnering with a health insurance provider. Additionally, consider other benefits to boost employee satisfaction, such as:

- Flexible work arrangements

- Retirement plans

- Paid time off

Withhold and remit payroll taxes: This includes social security, medicare, federal and state income taxes. Be sure that your employees complete Form W-4 to indicate their withholding preferences for federal tax purposes. Build familiarity with state-specific tax withholding forms as well.

5. Meetings and Record-keeping

Hold annual meetings with Corporation shareholders to discuss important matters, make decisions, and document corporate actions.

If your S-Corporation has a board of directors, conduct regular board meetings to address governance matters, review financial performance, and make strategic decisions. Document these meetings with accurate minutes.

Asides from meeting minutes, there are other company documents you must secure and organize in an easily accessible manner. They include:

- Shareholder agreements

- Articles of Incorporation

- Financial records

- Tax returns

- Contracts

- Bylaws

Regular meetings and effective record-keeping are fundamental to maintaining compliance and managing your S-Corporation’s affairs.

6. Annual Reporting and Renewal Requirements

Many states require S-Corporations to file annual reports that provide updated information about the business, such as changes in ownership, directors, or business address.

Be aware of the filing deadlines and requirements specific to your state and ensure timely submission. This is part of the duties of a Registered Agent.

Also, Identify and maintain any necessary business licenses and permits required by federal, state, or local authorities. Stay informed about renewal deadlines and compliance obligations to avoid penalties or disruptions to your operations.

How to Grow & Scale Your S-Corporation

You’ve created your S-Corp and you’re in the loop with all it takes to run it smoothly.

Now what?

It’s time to grow your company and take it to the next level. To do this, you’ll have to:

- Assess growth opportunities and strategies

- Expand your market reach and customer base

- Implement effective marketing and sales strategies

- Develop strategic partnerships and collaborations

- Attract top talent

Let’s discuss each in detail.

1. Assess Growth Opportunities and Strategies

Conduct thorough market research to identify potential growth opportunities, emerging trends, and customer demands. Understand your target market and assess the competitive landscape to determine where your S-Corporation can excel.

Consider different growth strategies, such as market penetration, market development, product diversification, or vertical integration. Select strategies that align with your business goals, resources, and market dynamics.

SWOT Analysis

Perform a comprehensive SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis to evaluate your S-Corporation’s internal capabilities and external factors that can impact growth.

Leverage your strengths, address weaknesses, capitalize on opportunities, and mitigate threats. Here’s a visualization of SWOT so you don’t forget:

2. Expand Your Market Reach and Customer Base

To scale your company, you need to reach more customers in new markets. Targeted marketing campaigns, customer segmentation, and geographical expansion can help you do this.

Targeted Marketing Campaigns

Develop targeted marketing campaigns to reach new customers and expand your market reach. Utilize various channels, such as digital marketing, social media, content marketing, and search engine optimization (SEO) to increase brand visibility and attract potential customers.

Customer Segmentation

Analyze your existing customer base and identify key customer segments. Tailor your marketing efforts and messaging to resonate with each segment’s specific needs and preferences.

Geographical Expansion

Explore opportunities to expand your operations geographically. Assess market potential in new regions or countries, adapt your products or services to local preferences, and establish strategic partnerships or distribution networks to facilitate expansion.

3. Develop Strategic Partnerships and Collaborations

Strategic partnerships are important to scale your S-Corp.

So much so that in 2022, 82% of B2B business leaders expressed their intention to expand their existing partnerships. Concurrently, nearly 70% of these leaders had plans to increase the budgets allocated to their channel programs.

There are a number of ways to go about business partnerships, such as:

- Strategic alliances

- Supplier partnerships

- Industry collaborations

Strategic Alliances

When identifying potential strategic partners for your S-Corporation, it is important to consider companies that can complement your offerings or provide access to new markets or customer segments.

Look for organizations that have strengths and resources that align with your business objectives. For example, if your S-Corporation specializes in software development, you may seek partnerships with hardware manufacturers to bundle your software with their devices.

Establishing mutually beneficial partnerships involves creating a win-win situation where both parties can leverage each other’s strengths and resources.

This could include sharing expertise, technology, distribution channels, or even co-marketing efforts. The key is to find partners who can enhance your brand’s value proposition and expand your market reach.

Supplier Partnerships

Cultivating strong relationships with reliable suppliers is crucial for the growth and success of your S-Corporation. Dependable suppliers ensure a steady supply of high-quality products or materials, which is essential for maintaining customer satisfaction and meeting demand.

When selecting suppliers, consider factors like track record, quality control processes, delivery capabilities, and cost-effectiveness. Look for suppliers who share your commitment to excellence and are willing to collaborate closely with you.

Building a strong rapport with your suppliers can lead to better negotiation terms, preferential treatment, and even potential cost savings through bulk purchasing or long-term agreements.

Industry Collaborations

Participating in industry associations, networks, or collaborative projects is a great way to stay connected with industry trends, share knowledge, and explore opportunities for joint initiatives.

These collaborations allow you to learn from your industry peers, gain insights into best practices, and stay updated on emerging technologies or market shifts.

Industry collaborations can take various forms, including attending conferences, joining trade associations, participating in research projects, or engaging in cooperative marketing campaigns.

By actively participating in these collaborations, your S-Corporation can strengthen its position in the industry, enhance its reputation, and potentially access new business opportunities.

4. Implement Effective Marketing and Sales Strategies

In order to expand your S-Corporation, it’s essential to market your products or services to a wider audience. Additionally, closing sales deals successfully plays a vital role in achieving growth and sustainability.

Branding and Positioning

Develop a strong brand identity and position your brand in a way that differentiates it from competitors. Clearly communicate your unique value proposition to target customers.

What is a brand? The graphic below sums it up:

Sales Strategies

Leverage effective sales strategies that align with your target market and customer preferences. Train your sales team to effectively communicate the value of your products or services and build long-lasting customer relationships.

By assessing growth opportunities and strategies, expanding your market reach, developing strategic partnerships, and implementing effective marketing and sales strategies, you can position your S-Corporation for sustainable growth and profitability.

Customer Relationship Management

According to HubSpot, 40% of sales professionals say their CRM platform is highly effective at improving the alignment of their sales & marketing departments.

Scaling your S-Corp will require excellent relationships with customers. With the help of a reliable CRM system, keep track of customer interactions and manage leads.

Providing excellent customer service is crucial to gaining customer loyalty and encouraging repeat business.

5. Attract Top Talent

Attracting top talent and integrating them effectively into your S-Corporation is crucial to the growth and success of your organization.

Here are some key considerations to focus on.

Job Descriptions and Recruitment

Here are some things you should do:

- Craft clear and accurate job descriptions that highlight the skills, qualifications, and responsibilities required for the position.

- Utilize various recruitment methods to expand your candidate pool. This can include posting job openings on online job boards, leveraging social media platforms, tapping into professional networks, and encouraging employee referrals.

- Tailor your recruitment strategies to reach the specific talent pool you’re targeting. For example, if you’re looking for tech professionals, consider participating in relevant tech conferences or organizing tech-focused networking events.

Interviewing and Selection

Here’s what you should do:

- Conduct thorough interviews to assess candidates’ suitability for the role and cultural fit within your organization.

- Prepare a set of well-thought-out questions, including behavioral-based inquiries that encourage candidates to share examples of their past experiences, problem-solving skills, and accomplishments.

- Involve multiple stakeholders in the interview process, such as department heads or potential team members, to gain different perspectives and ensure a comprehensive evaluation.

The image below shows some more tips for conducting a good interview.

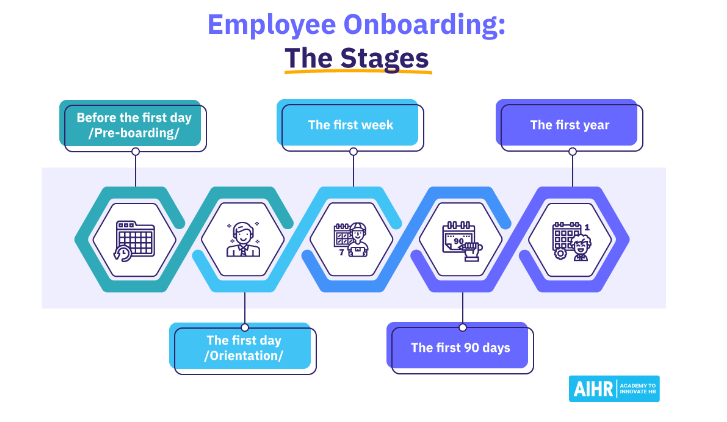

Onboarding and Training

- Develop a structured onboarding process to help new employees acclimate to their roles and the company culture smoothly.

- Provide a comprehensive orientation that covers important information about the company, its mission, values, policies, and procedures.

- Assign mentors or buddies to new employees who can guide them through their initial days and serve as a point of contact for any questions or concerns.

- Offer relevant training programs and resources to enhance their skills and knowledge, enabling them to perform their roles effectively.

Cultural Integration

Here’s what you need to do:

- Emphasize your company’s values and work culture during the recruitment and onboarding processes to attract candidates who align with your organization’s vision.

- Foster a welcoming and inclusive environment where new employees feel valued and encouraged to contribute their unique perspectives.

- Organize team-building activities, social events, and opportunities for cross-departmental collaboration to foster positive relationships and a sense of belonging among employees.

Remember: attracting top talent and integrating them effectively requires a proactive and strategic approach.

By focusing on clear job descriptions, thorough interviewing processes, structured onboarding, and fostering a positive work culture, you can attract and retain talented individuals who will contribute to the growth and success of your S-Corporation.

S-Corp FAQ

Q1. How much does it cost to form an S-Corp and run it?

The cost of forming and owning an S-Corp varies. Legal fees, state filing fees, and ongoing compliance costs are different for different states and service providers.

On average, combined costs can range from a few hundred to several thousand dollars per annum.

Q2. Is it better to start an LLC or an S-Corp?

It completely depends. A Limited Liability Company (LLC) has fewer formal requirements and less administrative burden compared to an S-Corp.

On the other hand, S-Corps provide self-employment tax savings for the owners, as LLC members have to pay self-employment taxes. S-Corps also allow for the distribution of profits to shareholders as dividends, which are not subject to self-employment taxes.

Q3. What type of stock is an S-Corp allowed to issue?

An S-Corporation issues only one type of stock. This stock is commonly referred to as “common stock.” Unlike C-Corporations, which have different classes of stock, S-Corps have only one class of stock.

There is no preferred stock like in a C-Corporation. The ownership and voting rights of the shareholders in an S-Corp are generally based on the number of shares they hold, rather than different classes of stock.

Q4. Should I switch from an S-Corp to an LLC?

The decision to switch from an S-Corp to an LLC depends on your specific circumstances and business needs. There may be valid reasons to make such a switch. For example, you might want a change in ownership structure, business liability, or even tax planning.

Q5. Who are the shareholders of an S-Corp?

In an S-Corporation, the shareholders are the individuals or entities who own shares of the company’s stock. The shareholders of an S-Corp can vary and may include founders, employees, investors, or other stakeholders.

The specific individuals or entities holding shares in an S-Corp depend on the company’s ownership structure and any agreements or arrangements made among the shareholders.

Final Thoughts on Starting an S-Corp

Starting an S-Corporation is no walk in the park. There is a lot of paperwork and specific considerations for this business structure.

As such, the significant tax savings it offers makes it worth it. Our trusted partners, such as Inc Authority, Incfile, ZenBusiness, and LegalZoom, are available to ease up the entire process.

Hire their services to make the process of starting and growing an S-Corp a breeze. They’ll not only help you through the entire S-Corp formation process, but also provide expert assistance on other business-related areas.

What are you waiting for?

Make your entrepreneurial dreams come true and start your own business right away. Good luck!