Are you starting a new business or converting your existing business entity into a S-Corp?

This S-Corp checklist will walk you through the step-by-step process of forming your S-Corporation.

It’s crucial to stay updated with the latest requirements and regulations that govern the formation of an S-Corp. We also understand that business formation can be overwhelming, especially if you are unfamiliar with the legal and administrative aspects.

That’s why we have compiled this S-Corp checklist to simplify the journey for you. You can simply complete each task and check things off your checklist.

So, let’s get started.

What is An S-Corporation?

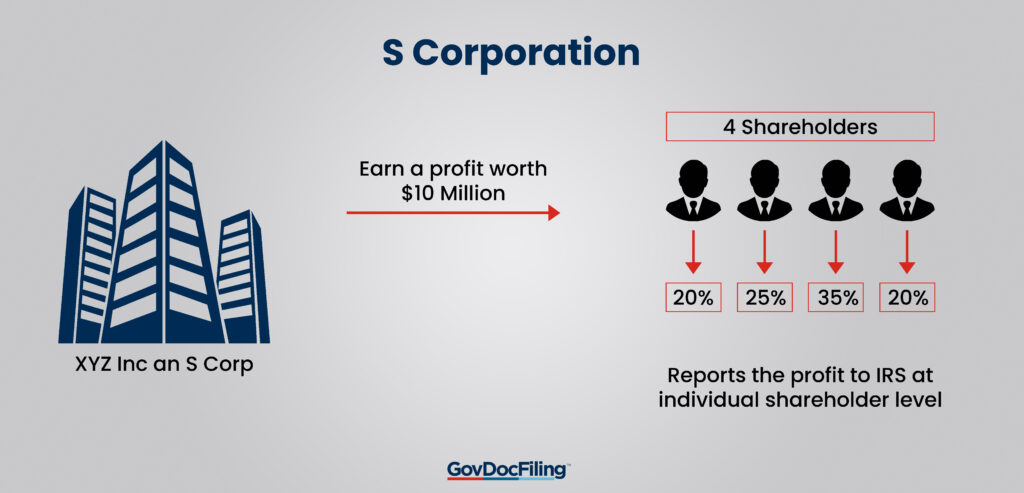

An S-Corporation (S-Corp) is a business structure that has elected a special tax status with the IRS. Similar to an LLC or sole proprietorship, an S-Corp is treated as a pass-through entity for federal tax payments. As a result, the business income, losses, credits, and deductions are passed to shareholders.

Each shareholder will then report the company’s income or losses on their personal tax return. Afterward, they’ll pay taxes based on their individual tax rates as shown in the image below. This prevents double taxation — one at the company level and another at the individual shareholder level.

S-Corporations are named from the Internal Revenue Code (IRC) subchapter “S.” This code makes provision for businesses to decide how to pay federal taxes. In the case of subchapter S, a business elects to pass its profits or losses directly to the owners.

Before electing an S-Corporation, you should note that the business must be incorporated in the United States. Also, it can only have one class of stock and not more than 100 shareholders, who must be US citizens.

Also Read:

Considerations for Choosing an S-Corporation Status

Although the tax benefits of an S-Corporation may be appealing, you need to evaluate your business’s specific circumstances. Below are some key factors to consider before opting for an S-Corporation.

Cost of Forming and Maintaining the Business Structure

An S-Corporation election involves actual expenses that can impact your bottom line. So, you should be sure that you can easily absorb them. Here’s a breakdown of what to expect when forming and maintaining an S-Corporation:

Formation Costs

- Legal fees: You need to hire an attorney to draft corporate documents and ensure compliance with state laws, which can be costly

- Filing fees: The charges for incorporating your business and obtaining necessary permits vary by state

- Accounting fees: You’ll need professional assistance during initial setup and ongoing tax preparation, incurring additional expenses

Ongoing Costs

- Annual franchise tax or corporate tax: Some states like Rhode Island, California, and Alabama impose taxes specifically on S-corps

- Payroll taxes: As an employer, you’ll be responsible for federal and state payroll taxes, including Social Security, Medicare, and unemployment taxes

- Professional fees: You’ll have to maintain compliance, which calls for ongoing legal, accounting, and tax preparation services

- Potential tax penalties: If you don’t meet tax deadlines or report requirements, it can attract penalties and interest charges

Cash Flow Considerations

One of the most common challenges newly formed S-Corporations face is managing cash flow, especially when it comes to payroll. Unlike sole proprietorships, S-Corporations require separate bank accounts for the business and the owner, which can impact cash availability.

For one, establishing separate accounts often requires initial deposits, which can strain cash flow for new businesses. Also, managing cash flow across two accounts can be more complex and time-consuming.

As an S-Corporation owner who is also an employee, you’re responsible for both the employee portion and employer portion of payroll taxes. This means the business needs sufficient funds to cover both the owner’s salary and the associated tax obligations.

To avoid cash flow shortages, careful budgeting and financial planning are crucial. You should also have a clear understanding of your business income and expenses to ensure you can meet payroll obligations and cover other operational costs.

Also Read:

Taxable Income

Before your business can maximize the tax benefits of an S-Corporation, it should generate sufficient taxable income. This is because after paying taxes and legal fees, your taxable income may not be enough to offset against personal income taxes.

It can even become worse for businesses with low net income or startups generating losses. After accounting for owner salaries and other expenses, the tax savings from S-Corp status might be minimal.

Moreover, a business with fluctuating income may find it challenging to predict the tax implications of S-Corporation status. For example, a business with consistent annual profits of $100,000 is more likely to benefit from S-Corp status compared to one with fluctuating income ranging from $20,000 to $150,000.

Estimated Tax

An S-Corporation is expected to make quarterly estimated tax payments all through the year to cover anticipated tax liability. This system eases your tax burden at the end of the year.

Estimated tax is calculated by estimating your adjusted gross income, credits, taxable income, taxes, and deductions for the year. If you’re calculating for the current tax year, consider your S corporation’s business use of expenses and income for the previous tax year as a guide.

The due date for estimated tax payment is divided into four seasons:

- April 15

- June 15

- September 15

- January 15 of the next year

It’s important to note that underpaying your estimated tax can lead to a penalty. However, S-Corporation owners can avoid this penalty if:

- Their tax liability is less than $1,000 after deducting credits and withholding

- They paid a minimum of 90% of the tax for the current tax year

- They paid 100% of the amount shown on the tax return for the previous tax year

You need to consult with a tax professional to help you calculate and manage your tax estimates to avoid penalties.

In conclusion, you should consider forming an S-Corporation if:

- Your business generates consistent income to cover payroll, taxes, and other operating expenses

- You anticipate substantial tax savings due to your business’s income level

- Your business has a limited number of owners (100 or fewer) who meet the eligibility requirements

- Protecting your personal assets from business liabilities is a priority

- You anticipate steady growth without the need for a large number of shareholders or complex ownership structures

- You’re prepared to handle increased paperwork, recordkeeping, and tax compliance

Remember, forming an S-Corporation involves additional costs and complexities. We recommend consulting a tax professional or business attorney to assess your specific situation and determine if this structure aligns with your business goals.

Also Read:

- Difference Between Copyright and Trademark: Which One Is Right for Your Business in 2024?

- 15 Best Registered Agent Services for Small Businesses in 2024

S-Corp Checklist to Form an S-Corp in 2024

Forming an S-Corporation can provide significant tax benefits and legal protections for small businesses. However, the process requires careful planning to ensure you fulfill the necessary requirements.

This S-Corporation checklist will guide you through the essential steps of forming an S-Corp by meeting all legal and regulatory obligations.

1. Choose a State of Incorporation

When forming an S-Corp, the first task on your S-Corp checklist is to choose the state where you want to establish your business.

Most people choose to incorporate in the state where they conduct their primary business operations, but that is not a strict requirement.

Each state has its own set of laws and regulations governing corporations, including S-Corporations. Therefore, it’s important to research and understand the specific legal requirements of the state you’re considering.

You may go through the information on the website of the Secretary of State for more information.

Image via US Department of State

2. Select a Corporate Name

The next thing on our S-Corp checklist is choosing an appropriate business name.

When selecting a business name, there are a few things to consider.

First, ensure that the name you choose complies with your state’s corporate naming rules. These rules typically require the name to be unique and distinguishable from other registered businesses in the state.

You can usually check the availability of your chosen name through the Secretary of State’s website.

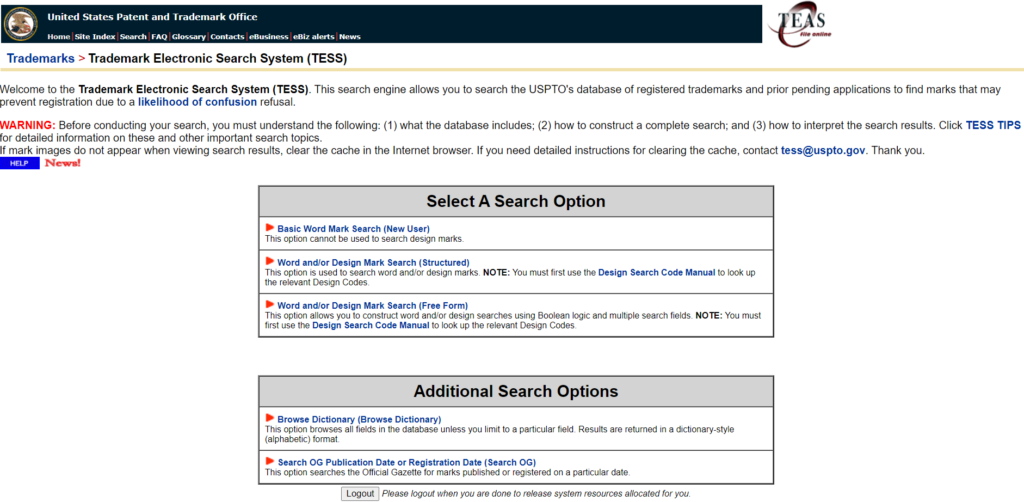

You may also use online databases, such as the United States Patent and Trademark Office, ICANN Domain Name Registration Data Lookup, Trademark Electronic Search System, and so on.

These databases will help you figure out if any other entity is already using the corporate name you’ve chosen.

Image via USPTO

3. Select a Registered Agent

A registered agent (RA) is an individual or entity that will receive legal documents on behalf of your S-Corp. When selecting one, you should ensure that they have a physical address within the state of incorporation.

Note that this step is crucial in the S-Corp checklist. Hence, the agent’s address can’t be a P.O. box.

Additionally, the agent you choose should be reliable; one that you can trust to handle important documents properly. They must be available to receive legal documents during regular business hours.

Now, you have two options for choosing a registered agent:

First, you can appoint a person who resides within the state of incorporation to act as your registered agent.

Second, you can use a third-party registered agent. Many professional corporations offer registered agent services. These services can provide added convenience and reliability. However, you need to compare their fees and services before settling for one.

Also Read:

- 16 Essential Legal Documents Every Startup Must Have (2024)

- 12 Best Online Incorporations Services for Small Businesses

4. Prepare and File Articles of Incorporation

Now that you have chosen a name for your small business Corporation and a registered agent, it’s time to move on to the next important step on this S-Corp checklist.

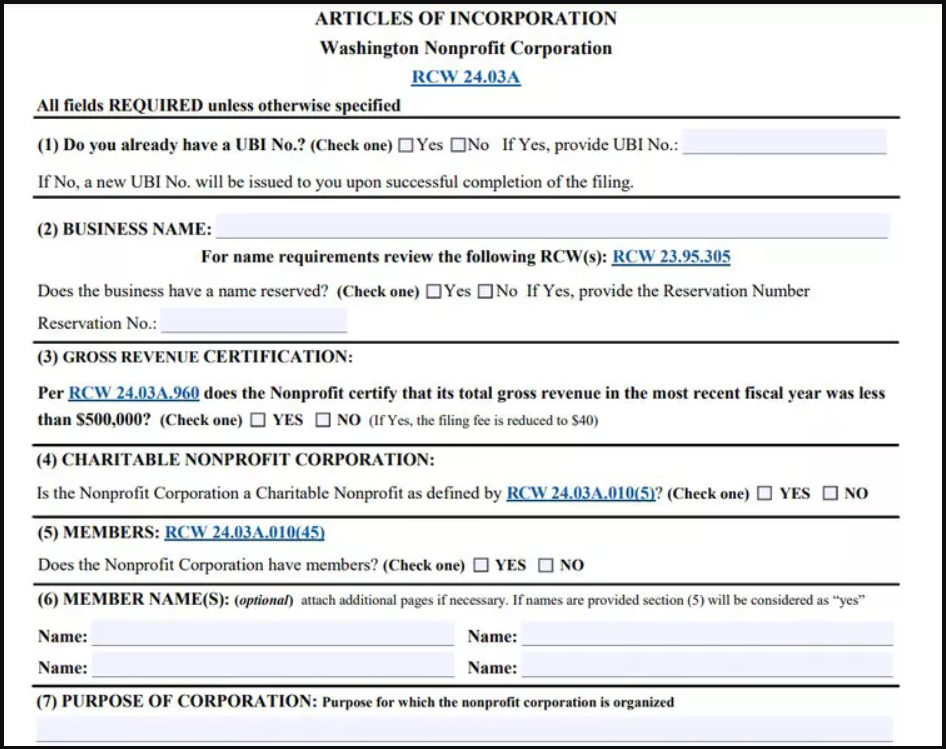

You must prepare and file the Articles of Incorporation, also known as the Certificate of Incorporation or Corporate Charter. This document is crucial as it establishes your S-Corporation and legally registers your business.

Go through your state’s filing office or the Secretary of State’s website to obtain the appropriate form for filing the Certificate of Incorporation.

Here is a sample from the State of Washington.

Image via Investopedia

Pay the required filing fee and submit the completed form to the appropriate state department. The filing fee varies from state to state.

5. Obtain Necessary Permits and Licenses

The next important item on our S-Corp checklist is obtaining proper permits and licenses for your business. There are several types of licenses and permits, depending on your industry and the state where you’ll conduct business:

- Federal Business License/Permit: You’ll need this if a federal agency supervises or regulates your business activities. Businesses in this category include agriculture, aviation, firearms, broadcasting, and mining.

- State License/Permit: Corporations, LLCs, and non-profit organizations are expected to obtain licenses and permits at the state level. The license here is renewable, so you need to keep track of that to avoid penalties.

- Zoning/Building Permit: This is necessary if you’re making significant structural changes on your office building. It also determines which property you can use for business operations.

- Health Department Permit: Businesses that involve food handling and preparation, including contact with the human body require a health permit. Examples of such businesses are restaurants, massage parlors, and nail salons.

- Sales Tax License: This is also called a seller’s permit, and you’ll need it whether you’re doing business online or offline.

- Occupational License: Professionals require a license showing their skills or level of training. These include Doctors, Nurses, Accountants, Cosmetologists, Plumbers, and Electricians.

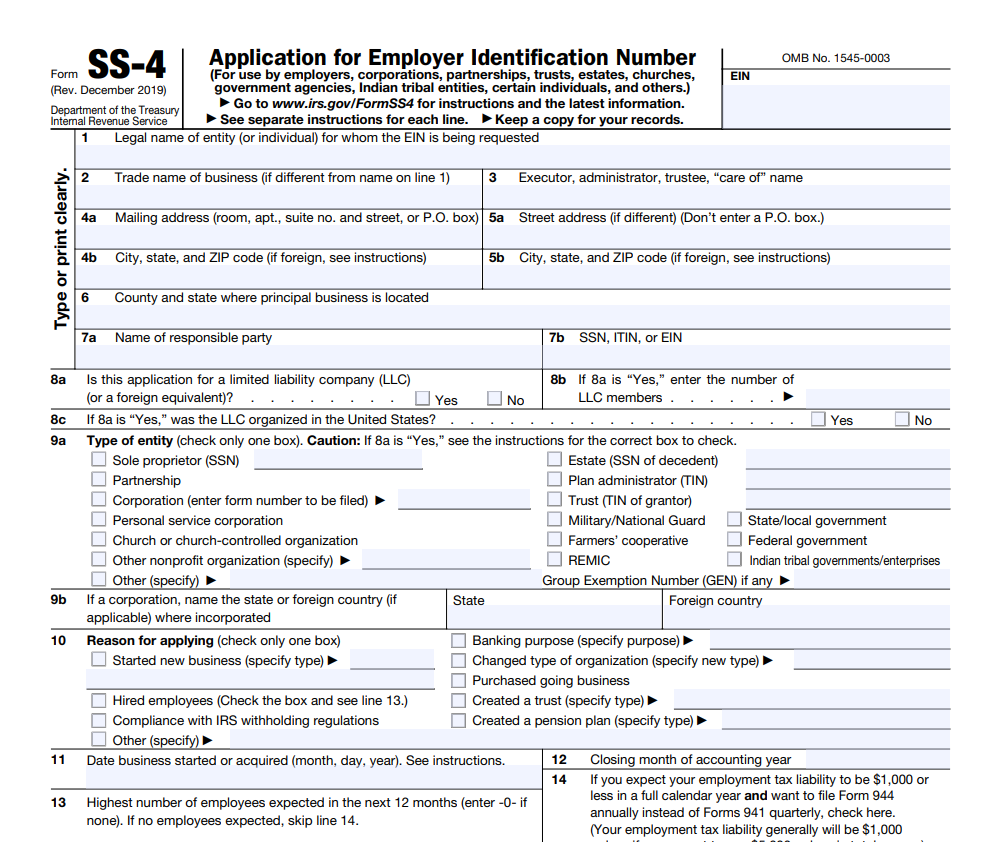

6. Obtain an Employer Identification Number (EIN)

Getting an EIN or Tax ID is an important step in your S-Corp checklist. An EIN is a unique nine-digit number assigned by the IRS to identify your S-Corporation for tax purposes.

You can apply for an EIN online on the IRS website or by mail using Form SS-4.

Image via IRS

The EIN is generally issued immediately upon successful completion of the online application. It will be used for various tax-related purposes, including filing tax returns and opening a business bank account.

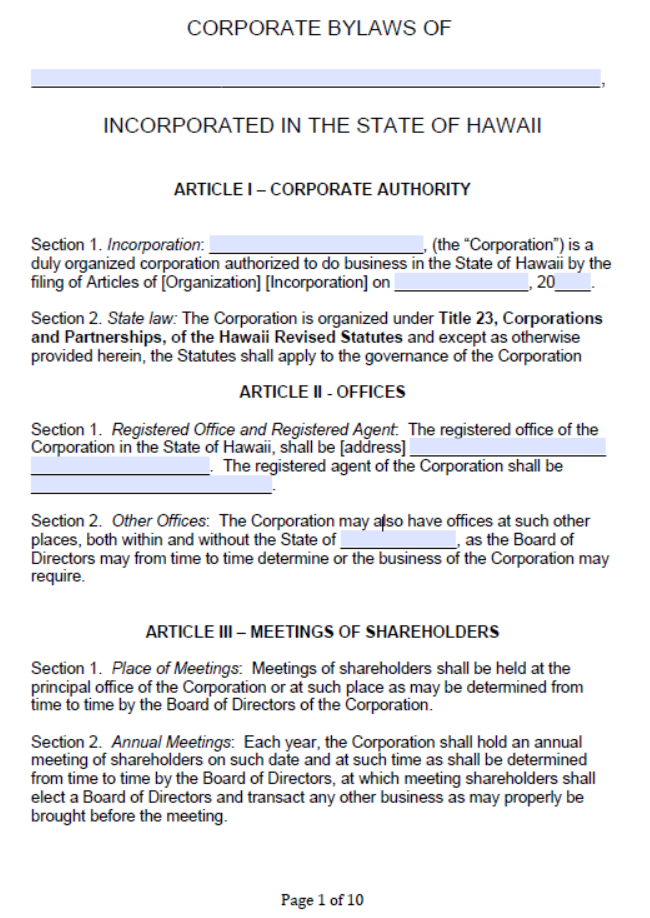

7. Draft Corporate Bylaws

The next step in your S-Corp checklist is to draft corporate bylaws, which lays down the internal rules and regulations that govern your S-Corporation’s operations and management.

Here is a sample.

Image via CFI

Your bylaws should include the rights and responsibilities of shareholders, directors, and officers. You should also include procedures for meetings, voting, and corporate decision-making.

The bylaws are typically adopted by the initial board of directors and should be kept with the corporate records.

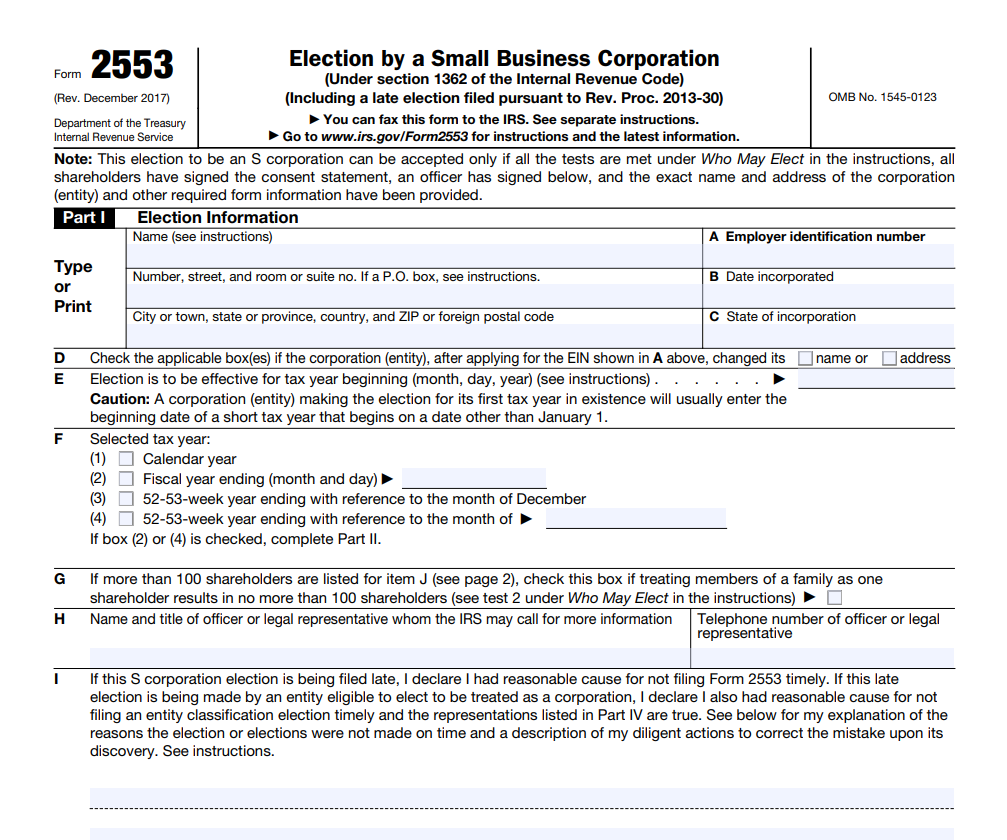

8. File Form 2553 for S-Corporation Election

Form 2553 is used to elect the S-Corporation status for a qualifying Corporation.

Filing this form is an essential step in your S-Corp checklist because it notifies the IRS that your business intends to be treated as an S-Corporation for tax purposes.

Here’s what the form looks like.

Image via IRS

Form 2553 requires the signatures of all shareholders. Make sure that each shareholder signs and dates the form accordingly. Some exceptions apply for certain eligible trusts and estates.

Once you have completed the form, submit it to the Internal Revenue Service. Don’t forget to retain a copy for yourself.

9. Comply with Ongoing Requirements

Make sure your S-Corp complies with ongoing requirements to maintain its special tax status. This includes holding regular shareholder and director meetings, maintaining proper corporate records, and filing annual reports with the state.

It’s essential to consult with a qualified attorney or tax advisor to understand and fulfill all ongoing compliance obligations.

Also Read:

- Business Legal Name vs. Trade Name: What is the Difference?

- Steps to Starting an LLC in 2024 (Limited Liability Company)

Tips for a Smooth Transition from an LLC/C-Corp to an S-Corp

Converting your existing business from a C-Corp or LLC to an S-Corporation can be a strategic move to optimize your tax benefits. However, it requires careful planning and adherence to specific guidelines as seen in the S-Corp checklist. Here’s a detailed guide for a smooth transition:

- Verify Your Eligibility: Your business must meet the requirements of forming an S-Corporation. Ensure to go over our S-Corp checklist again to confirm that your business qualifies.

- Consult with Professionals: You need to work with experts to navigate the transition process successfully. Tax professionals can help you evaluate the tax implications, while an attorney can assist with the legal aspects of the conversion.

- Notify Stakeholders: Inform all relevant parties, explaining any change that may affect their relationship with your business. These include employees, clients, suppliers, banks, and insurance providers.

- Adjust Payroll: If you don’t already have one, now’s the time to set up a payroll system. It should be based on a fair market salary for employees.

- Prepare for Increased Scrutiny: The IRS will closely assess your business after the conversion. So, ensure to maintain meticulous records of your S-Corp business use of assets to support tax deductions.

- Develop a Compliance Reminder: Create a schedule to track important dates and deadlines. These include annual meetings, tax filing deadlines, and license renewals.

What Are the Advantages and Limitations of Choosing an S-Corporation?

Choosing an S-Corporation status has benefits and drawbacks, which you should be aware of before setting up your business.

Advantages of Forming an S-Corporation

Following the S-Corp checklist we provided can lead to substantial benefits for your business. Let’s examine the advantages of choosing an S-Corporation status:

Pass-Through Taxation

The profits or losses of an S-Corp are passed on to the business owners. This implies that the business won’t pay taxes at the federal level. Not only does this prevent double taxation, but the business can also offset its losses against personal income.

Let’s say the business loses $20,000 in a given tax year. The owners will share the losses based on the agreed ownership percentage as they would do for profits.

So, if there are two equal owners, each will record $10,000 in their personal tax return. This loss can significantly lower your overall tax bill. It’s also helpful for new businesses during their startup phase when losses are common.

It’s important to note that there are specific rules guiding loss deductions. However, an accountant or tax professional can help you work around these complexities.

Self-Employment Tax Reduction

For many business owners, self-employment tax can be a burden as it combines Social Security and Medicare tax. However, forming an S-Corp can potentially reduce this tax based on income characterization: salary vs distributions.

As an S-Corp owner, you can also be an employee in the business and receive a reasonable salary. As a result, you’ll pay self-employment tax on your salary.

Any remaining profits are distributed to you as a shareholder. Generally, S-Corp distributions aren’t subject to self-employment tax. Here’s an example of how self-employment taxes work for an S-Corporation vs a sole proprietorship:

Image via Formations

Asset Protection

Another key benefit of forming an S-Corporation is limited liability. This means that your personal assets (e.g. house, car, or savings) are protected from business debts and liabilities.

If your business faces a lawsuit or is unable to pay its debt, creditors can only go after the business assets. This distinction between personal and business finances provides a layer of protection for your personal wealth.

Easy Transfer of Ownership

Unlike other business structures, selling or transferring your S-Corp shares doesn’t lead to complex tax issues for the company. This allows you to bring in new investors, plan for retirement, or pass on the business to family members without causing disruptions to the business.

Business Credibility

Forming an S-Corp, especially as a new business, implies a level of professionalism and commitment that can impress investors and clients. This perception can attract potential investors, providing the capital you need for business growth and expansion.

Additionally, the business structure demonstrates a proactiveness towards risk management. This suggests that your business is stable and responsible, enabling lenders to grant your request for funds.

In essence, choosing an S-Corporation status shows that you’re serious about your business. Also, it indicates that you’ve taken steps to protect your assets while positioning your company for success.

Also Read:

- Starting a Consulting Business Checklist: Everything You Need to Know

- How to Start Your Freelance Business in 2024: A Quick Guide

Limitations of Forming an S-Corporation

Using an S-Corp checklist when forming your S-Corporation ensures you enjoy the benefits of this business structure. However, you need to weigh them against the potential limitations. Let’s discuss some of the challenges you may encounter:

Close IRS Scrutiny

The tax benefits associated with S-Corporations have made them a target of the IRS. The salaries paid to shareholders, who double as employees, are closely examined to be sure they’re reasonable.

If the salary is deemed too low compared to the services rendered, the IRS may reclassify a portion of the distribution as wages. As a result, you’ll pay self-employment tax on the reclassified portion.

Restrictions on Shareholders

An S-Corp can’t have more than 100 shareholders, which can limit growth and investment options. Also, only individuals, estates, and certain trusts can be shareholders.

They must either be US citizens or legally residing in the States. As such, non-resident foreign shareholders, partners, and corporations don’t qualify.

Stock Restrictions

S-Corporations have only one class of stock. This means that all shares must have equal rights and privileges, including voting rights and dividend entitlements.

When seeking investors, offering different classes of stock with varying rights and privileges can be attractive. For instance, a class of stock can come with higher voting rights and dividends, making it more appealing to certain investors. But since S-Corp can’t do this, it limits the business’ flexibility in raising funds.

Rigid Distribution Structure

Unlike partnerships, S-Corporations have limited flexibility in how profits and losses are distributed among owners. In an S-Corp, they’re typically allocated based on ownership percentages. This means that shareholders can’t customize the allocation to suit specific needs or agreements.

For instance, a founding partner who has contributed significantly to a business’s success may desire a larger share of the profits in the early years. However, in an S-Corp, this won’t be possible without adjusting the ownership percentage. This rigidity can hinder compensation arrangements.

Increased Compliance Costs

S-Corporations often involve greater administrative burdens and financial costs compared to other business structures. The business is required to fill out additional tax forms, such as employment taxes and state-specific tax forms. These forms and calculations can increase the time and effort required for tax preparation and compliance.

Additionally, the business must maintain detailed financial records and meeting minutes to meet IRS requirements. It should also comply with payroll and employment tax regulations, which can add to the administrative overhead.

Lastly, not every state recognizes the S-Corp status and may require you to pay taxes like a C-Corp, leading to double taxation. Others may have excise taxes or franchises that apply to S-Corps. These additional expenses can increase your overall costs.

Also Read:

- Single Member LLC vs. Multi Member LLC: How to Choose in 2024

- 4 Key Tax Benefits of an LLC for Your Rental Property (2024)

S-Corporation vs. C-Corporation: What’s the Difference?

Here are the key differences between an S-corporation and a C-corporation to help you make an informed decision:

- Legal Structure: S-Corporation is a pass through entity while the C-Corporation is a separate legal entity

- Taxation: In an S-Corporation, only shareholders pay tax, but in a C-Corporation, there’s double taxation — corporate income tax and shareholder-level taxes

- Ownership: An S-Corporation is limited to 100 shareholders, while there are no restrictions for a C-Corporation

- Stock Class: Only one class of stock is permitted in an S-Corporation, but a C-Corporation permits multiple stock classes

- Formation: An S-corporation requires filing Form 2553 with the IRS, but no additional election is required for a C-Corporation

- Tax Benefits: There are potentials for lower taxes in an S-Corp due to its pass-through system. However, a C-Corporation may benefit from deductions and credits available to corporations.

- Flexibility: An S-Corporation has limited flexibility in ownership structure and fundraising. On the flip side, a C-Corporation offers more flexibility.

Generally, a C-Corp is suitable for:

- Larger businesses with complex ownership structures or plans for significant growth

- Businesses that need to raise capital through public offerings

- Businesses that want to take advantage of tax advantages like medical reimbursements

Also Read:

- Partnership vs S Corp: Everything You Need to Know

- LLC vs. Corporation: Which One is the Best Choice for Your Business?

FAQs

Q1. What are the requirements of an S-Corp?

A. The requirements of an S-Corp are as follows:

- Only certain business entities can elect the S-Corp status, such as domestic corporations, LLCs, and entities under qualified subchapter S subsidiaries.

- S-Corps can have no more than 100 shareholders.

- An S-Corp can have only one class of stock.

- Each shareholder of an S-Corp must be a US resident or citizen.

- S-Corps generally operate on a calendar year basis but they can adopt a fiscal tax year after obtaining IRS approval.

Q2. What is the difference between a C-Corp and a S-Corp?

A. A Corporation generally is considered a separate entity, distinct from its owners or shareholders. This includes both C-Corps and S-Corps.

However, a C-Corporation files its own tax returns and pays taxes on its profits at the corporate level. If the C-Corp issues dividends to its shareholders, those dividends are also taxable income for the shareholders. So, C-Corps go through double taxation.

An S-Corp, on the other hand, is a pass-through entity for tax purposes. It does not pay federal income tax at the corporate level. Instead, the income, deductions, and credits of the S-Corp “pass through” to the shareholders, who report them on their personal income tax returns.

Q3. What is the 2-year rule for S-Corp?

A. The 2-year rule for S-Corps refers to the time requirement that shareholders must adhere to before certain tax benefits can be realized.

Q4. What is the 80 rule for S-Corps?

A. The 80 rule says that an S-Corp cannot own more than 80% of the stock of another Corporation. This rule prevents S-Corps from becoming too large and complex.

Q5. What requirements does an S-Corp need to meet yearly?

A. Here are the yearly requirements of an S-Corp:

- File Form 1120-S with the IRS

- Issue Schedule K-1s to shareholders

- Pay estimated taxes on behalf of shareholders

- Maintain accurate records

- File state tax returns

Follow the S-Corp Checklist to Ensure Success

Forming an S-Corporation in 2024 requires careful attention to various requirements and considerations.

By following a comprehensive S-Corp checklist, you can navigate the process efficiently and ensure compliance with legal and tax obligations.

If you need help forming an S-Corp, GovDocFiling makes the business formation process easy.

Form your S-Corp today with GovDocFiling.