For a majority of Americans, the days of carrying wads of cash or writing a check to pay for purchases are long gone. Despite the credit card processing fees involved, debit cards are still taking a back seat to credit cards.

In fact, the number of credit cards in use in the US was projected to increase by a CAGR of 3.22% between 2022 and 2028.

Why is that?

For one, credit card usage comes with an endless variety of points, bonuses, and travel incentives for users.

While we are far from becoming a cashless society, if your business doesn’t accept payment via credit cards, you’re missing out on a lucrative opportunity to increase both the volume and sum of your sales.

These next sections discuss how credit card payments grew popular, how credit card processing works, credit card processing fees, and so much more.

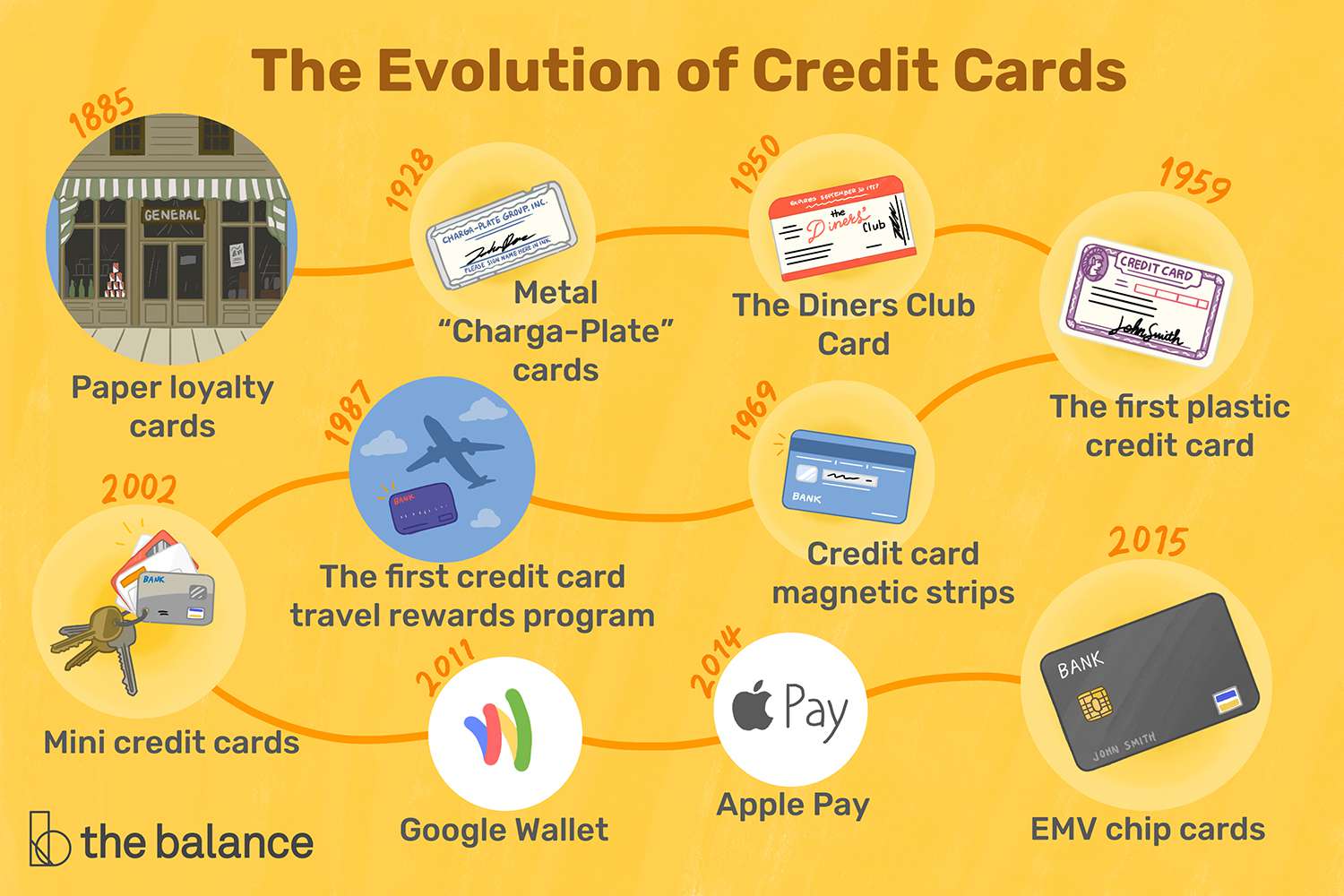

Brief History of Credit Card Payments

Credit card processing wasn’t always as popular as a means of payment as it is now. While people have always bought goods on credit and paid later since the days of barter trade, it took years for credit payments to take root.

Image via The Balance

Here are some notable milestones.

The 1950s – The Diners Club Card

This credit card payment idea was the closest form of what we have today. The Diners Club card first gained popularity in the ‘50s and was widely accepted among the restaurant’s clientele.

It was a charge card at the Diners Club that required people to pay their bills at the end of every month.

The idea was born when Frank Namara forgot his wallet while going for a business dinner.

This charge card kickstarted the credit card processing culture for merchants in different industries, including other restaurants and the entertainment industry.

At the Diners Club, this concept became so successful, that there were 20,000 cardholders within one year. This attracted competition and soon American Express created its own card in 1958.

The ‘60s & ‘70s – Credit Cards

With Bank of America and American Express now rolling their own credit cards, consumers would pay bills on credit and get charged an annual fee. Merchants would also process credit payments for a fee.

This is how credit card processing interchange and assessment fees were born.

Bank of America soon elevated their practice by issuing BankAmericard, a credit card with a preset limit, to their customers in California. They extended this practice countrywide by 1966 after a Supreme Court decision allowed lending across states.

BankAmericard later changed its brand name to Visa in 1976. The success of their invention inspired the Interbank Card Association (ITC), now MasterCard, to join the market as well.

This countrywide rollout raised issues like fraud and customer complaints about high-interest rates and credit card processing fees. This led to the creation of policies and regulations to govern credit card practices, and minimize fraud and credit card processing fees.

This continued throughout the ‘60s and ‘70s.

Beyond the ‘70s

In the ‘80s, Sears rolled out the Discover card and offered rebates on purchases. It was among the first US credit cards to offer incentives to users. As a result, the credit card processing market became even more competitive.

To keep up, most credit card issuers also started offering low-interest discounts, bonuses, and other incentives to their customers.

In the 2000s, the Credit Card Accountability Responsibility and Disclosure Act was passed in Congress. This act put a cap on the credit card processing fees that banks were allowed to charge.

Also, credit card payments became an international practice. Today, Visa and MasterCard are globally accepted major credit card networks with members from different banks all over the world.

With that brief history, it’s now time to learn how credit card processing works.

How Credit Card Processing Works

Whether you’re a Sole Proprietor, or owner of an LLC or a large Corporation, the credit card payment process is the same. This section explains what goes on from the moment you receive the customer’s credit card to when you get paid.

Here are the main entities involved in this process.

Entities Involved in Credit Card Processing

To understand how credit card processing works, first you’ll need to know the parties involved. Here are the important ones you need to know.

- Customer/Cardholder: The person buying a product or service.

- Merchant: The business selling to the customer.

- Payment gateway: The frontend platform that connects the merchant to the payment processor. It allows merchants to enter their credit card information online and send that information to their payment processor or a bank for approval or denial.

- Payment processor: This refers to the company that links merchants to their credit card network and the cardholder’s bank, making payments possible.

- Credit card associations: These are the bodies that regulate banks, merchant service providers or payment processors, and independent sales organizations. They set standards for merchants and the requirements they need to meet to accept credit card payments. These associations also set interchange fees for credit card transactions.

- Credit card network: They are part of credit associations that act as middlemen. They help send payment requests and responses between the issuing and the acquiring banks.

- Acquiring bank: It’s also known as the merchant bank. It’s where businesses store the funds they receive from credit card transactions. These banks can provide merchants with card readers, allowing them to accept and process payment. Acquiring banks can also be members of credit card associations.

- Issuing bank: Refers to the consumer bank. They provide customers with credit cards and determine if customer funds are enough to offset transaction costs. The issuing bank is also responsible for releasing funds to merchants to settle the cost of purchases.

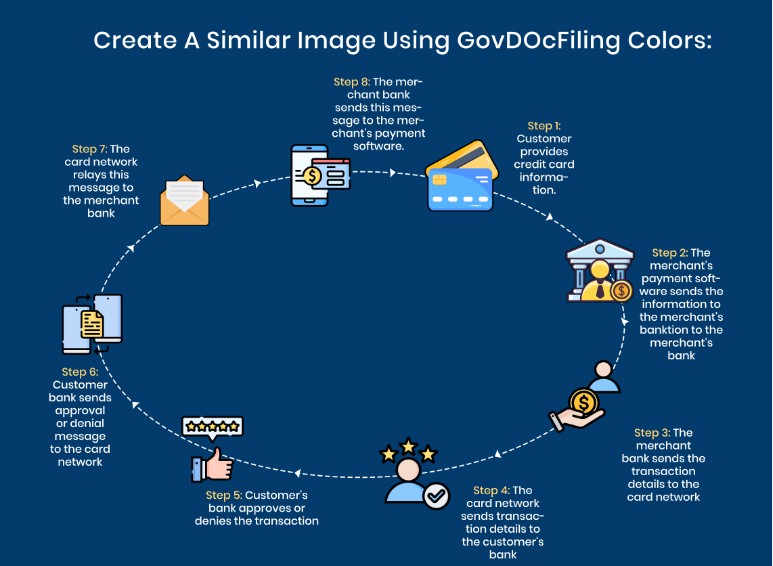

Credit Card Payment Process

The payment process for merchant credit card transactions isn’t complex. The credit card payment process can be divided into 3 parts—authorization, batching, and funding.

Let’s understand each of these briefly.

Authorization

Image vis PDCFlow

Step 1: The customer provides credit card information to the merchant. They may do this in one of two ways:

- Card transaction: If the customer has their card physically, they can swipe, tap, or insert it at the Point-of-Sale terminal.

- Cardless transaction: The consumer may verbally give their credit card information over the phone or enter their credit card information into an online platform, usually a payment gateway.

Step 2: The payment gateway then sends this credit card information and the transaction details to a payment processor or a merchant bank.

Step 3: The payment processor or merchant bank sends credit card and transaction details to the responsible credit card network.

Step 4: The credit card network sends this transaction request to the issuing bank or the customer’s bank.

Step 5: The customer’s bank can either approve or deny the transaction request based on two things. One, the bank authenticates the credit card details and if there’s suspicious activity, flags the request which could lead to a denial.

The bank also confirms if the funds in the buyer’s account are sufficient. It then denies if there are insufficient funds or approves if everything checks out.

Step 6: The issuing bank sends the denial or approval message back to the credit network.

Step 7: The credit card network relays this message to the merchant bank or payment processor.

Step 8: The merchant bank or payment processor sends the same message to the merchant’s payment gateway. If it’s an approval message, payment is made, goods or services are issued and a receipt is sent to the cardholder.

Batching Process ad Funding

After the authorization step is done, the merchant sends the day’s approved transactions to have the money deposited into their merchant bank account. Here’s the step-by-step process for that.

Step 1: The payment processor gathers approved credit card payments accepted throughout the day and sends them as a batch to the acquiring bank.

Step 2: Your payment processor or merchant bank then sends these batches to the relevant credit card network e.g. Visa and MasterCard.

Step 3: The card network then sends the batches to the issuing bank.

Step 4: The issuing bank withdraws funds for the approved transactions and sends these funds to the credit card network.

Step 5: The credit card network charges their interchange fees and then sends the remaining amount to the merchant bank or payment processor.

Step 6: Lastly, the acquiring bank or merchant service provider deposits these funds into the merchant bank account. They may charge their discount fees for the batch or wait and charge them as monthly discount fees.

During this process, your merchant bank, credit card network, and payment processing partner charge some credit card processing fees for their services. Here’s a closer look at the credit card processing fees involved when processing credit card payments.

Understanding Credit Card Processing Fees

With credit card payments, business owners must fork over a percentage of each purchase to middlemen.

For some small businesses, especially those that sell a high volume of lower-priced items, these ‘convenience’ fees can quickly add up and cut their profit margins.

What are the Different Types of Credit Card Processing Fees?

Simply put, credit card processing fees are charges merchants pay to accept credit card payments. They typically pay these credit card processing fees to:

- The payment card company that processes the transaction

- Credit card association (ex. Visa, MasterCard, etc.)

- The credit card issuer (i.e. the bank that issued the card).

These credit card fees depend on the type of credit card you have. Here are details of the three most common types of credit card processing fees.

Interchange Fees

These are credit card processing fees paid to the credit card company, e.g. banks, for every transaction processed.

Basically, they’re fees merchants pay for the convenience of receiving payments via credit cards. They cover business costs for the risks associated with providing electronic payment, e.g. fraud and cybercrime.

Because of such risks, interchange fees could vary. For instance, they may be higher for transactions carried out online since those are more susceptible to fraud.

Payment Processor Fees

This is how merchant service providers make their money as they do not get a share of the interchange fees. Payment processor fees may include setup fees, monthly fees, fees per transaction, equipment lease fees, and so on.

Assessment Fees

These are credit card processing fees charged by credit card networks so the business can accept particular credit cards like Visa or MasterCard cards.

Unlike an interchange fee, an assessment fee is not charged per transaction. Rather, it’s based on a merchant’s monthly credit card sales.

Other credit card payment processing fees that you can get charged for include:

- Monthly Minimum Fees: These may be charged by your payment processing partner if you process payments below your set monthly volume.

- PCI Service Fees: Merchant service providers that offer PCI compliance assistance may charge this fee.

- PCI Non-Compliance Fees: If you fail to comply with the required PCI regulations for your company, you will be charged a PCI non-compliance fee. This may range from $10-$30 a month or more. We’ll discuss these regulations in detail later in the article.

- Address Verification Service: These may be charged for merchants accepting their credit card payments online or over the phone.

- Chargeback Fee: This credit card processing fee is charged when a customer gets refunded for a transaction. It’s usually $20 to $40 per dispute.

- Non-Sufficient Funds Fee: It’s charged when there is not enough money in the merchant’s bank account to settle monthly merchant fee deductions.

While processing fees for credit cards are unavoidable, merchants can keep these credit card processing costs low by choosing the right pricing model for their business and negotiating better rates based on the volume of transactions.

Pricing Models for Credit Card Processing

Below is a breakdown of the four most common pricing models for credit card processing. (Note: While reading, keep in mind that many markup fees are negotiable, while wholesale fees are not.)

1. Interchange Plus

Interchange Plus is the most common pricing model — and the most transparent. The “Interchange” portion of this model refers to a wholesale credit card processing fee charged by the credit card association (Visa, Discover, etc.) for every wholesale purchase.

These credit card processing fees are set up by each credit card association as a fixed rate; generally, the greater the rewards of the credit card, the higher the fixed rate will be.

This is because the credit card association has to pay for the rewards earned by card members. It’s also the reason why businesses often refuse to accept a specific credit card — because it’s simply too expensive and not worth the ROI for the business owner.

The “Plus” portion of this pricing model refers to the credit card processor’s markup (either a percentage of per-transaction fee) that is applied to each credit card transaction.

The true cost will depend on the markups, but Interchange Plus typically offers substantial savings compared to other pricing models. Additionally, wholesale fees and markups are itemized and listed on your monthly statement, so you know exactly what you’re paying for.

2. Subscription

With a subscription-based pricing model, the credit card processing company charges a small fixed cost for each transaction, rather than a percentage of sales volume (as in the Interchange Plus model).

In addition, the business owner will pay a flat monthly subscription fee in order to take advantage of the fixed-cost perk. This model is the only pricing structure where a processor’s markup is not based on a percentage of sales, making it a great option for companies with large ticket items.

Because the subscription fee is separate from the per-transaction fee, this structure also offers a good deal of transparency for the business owner.

It’s important to note that many of these membership models cap the number of transactions that can be processed at each membership level; if you process more than that amount, the price of your monthly membership may increase.

3. Tiered

Tiered or “bundled” pricing plans categorize each credit card transaction into one of three categories — qualified, mid-qualified, or non-qualified. Credit card processors will charge a different fee for each transaction based on which category it falls within. Fees are the lowest for qualified purchases and increase for mid-qualified and non-qualified transactions.

What makes a purchase qualified versus mid or non-qualified is the type of credit card used to make the transaction. Factors such as the brand of the credit card, whether it’s a private or business card, and the types of rewards it offers, play a role in which tier the transaction falls into.

This option — while currently the most common pricing model — can be inconsistent, nontransparent, and expensive. Processors don’t often disclose which tiers transactions are falling into, concealing the real cost.

The amount of money paid in credit card processing fees by a business owner can vary greatly each month, depending on the type of sales completed during that timeframe.

Additionally, business owners don’t get to decide which credit cards their customers use. So they have no choice but to pay a greater fee every time a customer pays with a card that does not fall into the qualified tier.

4. Flat Rate

The flat rate pricing model is similar to tiered pricing — but without the tiers. All transactions incur the same blended fee, somewhere around three percent, regardless of the cost of the purchase.

Some processors also charge a small per-transaction fee, but most of the cost comes from the blended fee, which is typically more expensive than other models.

However, most processors (especially PayPal, Venmo, Stripe, Square, etc.) do not charge a monthly fee. Flat rate pricing may be right for low-volume or low-ticket businesses, or if a majority of your customer base takes advantage of or is willing to use a service like PayPal or Venmo.

By working with these processors, you can get approved online and take credit within about 10-15 minutes.

Things To Consider When Choosing a Credit Card Processor

Your payment processor takes care of your credit card payment processing and moves your funds around.

As such, you’ll need a payment processing system that deposits money safely into your merchant bank account and safeguards your confidential information.

You also want a system that charges just enough credit card processing fees that allows you to maintain or increase your profit margins.

Here are things to consider before choosing a credit card processor.

1. Customer Support

You want a credit card processing system with a customer support team that’s proactive. For instance, your customer service representative or account manager needs to be available when you need help through a call or live chat so they won’t keep you waiting.

Some payment processing companies outsource their customer service functions. In such cases, you may need to wait for long on call, experience constant redirects, or deal with agents whose decision-making authority is limited.

The best payment processors assign personal account representatives to their merchant accounts. This way, you can always approach a member of their team who has a vested interest in your business and cares about building a relationship with your team.

To ensure you’ll have the right support, try out their customer service beforehand and see how quickly you get a response both via email and phone.

2. Reputation and Reviews

This involves checking what other businesses say about a payment processing tool. You could check for online reviews or ask their existing business clients directly about their experience.

You should also check the company’s ownership history and make sure that hasn’t changed frequently over the past few years. A change in ownership could mean that the company’s policies and work environment are unstable, which could affect customer relationships negatively.

Customer support also involves how proactive the company is during the setup process. For instance, they should be able to send a technician to install and set up your Point-of-Sale terminal and follow up to ensure it’s working well.

3. PCI Compliance Process

The PCI compliance process can sometimes be a complex one, especially for businesses that are new to credit card payments.

Therefore, you need a proactive credit card processing partner that has policies in place to protect your business and customer information.

They need to have a vested interest in how you handle your PCI policy. Their team should be able to guide you through the compliance requirements and guidelines and offer legal services if needed. They should also coach you on PCI best practices.

4. Pricing

You need a pricing option that saves your business money. Your payment processor’s credit card processing fees structure should fit your business.

They should look at the number of credit card transactions you process, credit card type, etc, understand your business structure, and offer a cost-effective solution.

Consider how much money you’ll have to pay in credit card processing fees. Compared to the value provided and make sure the costs add up.

5. Technology That Easily Integrates

The system should work with your business to reduce your workload and take things off your table.

It should be able to connect with different aspects of your business, for instance, integrate with your business’s accounting system, online payroll services, and reporting functions.

Your business should be able to make customized plans and processes that work for it. The system should also provide extra advantages and insights like competitor analysis.

Find a processing system that works for and not against your business.

Traditional vs. Integrated Payment Systems

In a traditional payment system, your point of sale terminal is different from your credit card scanner or reader. Therefore, during a transaction, there are several steps involved.

- You create a new sale in your POS system and scan the items your customer is buying.

- Get your card reader, swipe or insert it, then manually key in the amount.

- Wait for the transaction to be authorized.

- If approved, print your receipt on the card reader terminal.

- Mark the transaction as paid on your POS system and complete checkout.

With an integrated system on the other hand, most of the above functions are automated. These systems combine the payment processing system with the credit card verification system to simplify the payment process.

In this case, a new sale is automatically registered in the terminal instead of being manually input. It’s also automatically reconciled as paid, once the payment is authorized.

Traditional payment systems are time-consuming and tedious and not preferred by most merchants today.

Here are some benefits your business will gain from using an integrated payment system:

- Saves you time: It does away with redundant data entry tasks, such as entering manual transactions and matching payments to the right invoices.

- Improves customer experience: When your payment processor and POS are integrated, you’re able to serve your customers better. You’ll be able to transfer data smoothly between these systems and provide a faster checkout experience.

- Improves your cash flow: With traditional systems, there are more delays at the end of each day before you get your money transferred to your merchant bank account. But with integrated systems, there are real-time payment updates and faster deposits

- Cut your costs: Moving between one device or terminal to the other can take a lot of time. If you run a busy store, this could mean long queues and delays.

Besides charges associated with these numerous tools, you’ll also incur human resource management costs. An integrated system does away with these costs and saves you money.

Credit Card Compliance

The Payment Card Industry (PCI) has rules and regulations every merchant should be familiar with. Failure to comply with these regulations attracts non-compliance fines.

They may be difficult to understand for some merchants, that’s why its’ always advisable to work with your payment processor on the same.

PCI compliance standards were set up with the following goals:

- Ensuring payments are processed over a secure network and system

- Protecting cardholders’ personal information to prevent hacking or fraud

- Restricting access to sensitive information stored in systems during operations.

- Building and maintaining policies related to information security e.g merchant cardholder information, etc.

- Ensuring security measures are constantly effective.

How PCI Compliance Works

The Payment Card Industry Security Standard Council (PCI SSC) is a global body that regulates credit card processing. It protects customer and merchant data ensuring consumers’ safety against credit card fraud.

Merchants that want to accept credit cards need to comply with these standards. Your compliance requirements will depend on:

- The number of payments your business processes every year.

- Whether your business physically stores sensitive data.

- Whether your business stores sensitive information on your servers or if your credit card processor stores it for you.

Here are the four levels of PCI Data Security Standard compliance.

PCI Level 1

This is for merchants who process over 6 million debit card transactions every year. Here are the requirements for level 1 compliance:

- Get a qualified security assessor (QSA) every year to audit your credit card transactions and prepare a report. This could be an internal or external security assessor.

- Get approved vendors every quarter to scan your computers, servers, and cloud for sensitive information. Their job would be to report to you in case they spot any potential vulnerabilities in your system.

- Get a penetration test done every year. This refers to a cybersecurity assessment of your infrastructure to check for potential threats.

- Submit an Attestation of Compliance (AOC) document that shows you’ve complied with all the PCI DSS requirements.

PCI Level 2

This level of compliance is for businesses that process between 1 million to 6 million credit card transactions per year. In this case, you don’t need an on-site PCI audit.

Requirements for this level include:

- Complete a Self Assessment Questionnaire (SAQ) every year.

- Prepare an annual penetration test.

- Complete and submit the AOC form every year.

- Perform a quarterly scan of the network by an approved vendor.

PCI Level 3

This one is for merchants that process between 20,000 to 1 million credit card transactions every year. Here are their compliance requirements:

- Annual Self Assessment Questionnaire

- Annual Attestation of Compliance document submission

For these merchants no annual penetration tests are needed.

PCI Level 4

This applies to merchants with less than 20,000 transactions per year. Here are the requirements:

- Self-Assessment Questionnaire per year

- Attestation of Compliance every year

- Quarterly vulnerability scans

Ensuring Credit Card Payment Security

Threats to credit card security are more common with card-not-present credit card transactions as opposed to Point-of-Sale payment terminals. Here is how your business can ensure the safety of daily business operations.

1. Data Encryption and SSL Protocol

Data encryption keys ensure your data remains safe as it’s transferred between the card reader and processing platform and its destination. Secure Socket Layers (SSL) protocol adds a layer of protection to encrypted data to prevent hacking.

2. Tokenization

With credit card tokenization, your sensitive data is replaced with randomly generated characters called tokens. These tokens then can only be linked back to your original data by an authorized person.

This way, you don’t have to collect or store any sensitive data in your system, making your systems less vulnerable to cybercrime.

3. Biometrics

This system uses unique biological identity features like fingerprints, face, retina, and voice. Fingerprints are already a common feature in use by most merchants and banks as well as different payment gateways.

Payment Processor Versus Payment Gateway

It may be difficult to differentiate between a payment processor and a payment gateway as they’re all words that come up when talking about online credit card transactions. However, there are slight differences that are easy to understand.

A payment gateway is a platform that collects and verifies customer information for online payments. It then transmits these transaction details to the payment processor. An example of such a tool is Stripe.

Conversely, a payment processor facilitates communication between the merchant, credit card company, and banks, managing fund transfers between these entities. One popular example is Square’s payment processing solution.

Here is a summary of the major differences between these credit card processing tools.

| Payment Gateway | Payment Processor |

| Collects customer credit card information online, verifies it, and encrypts it for safety | Communicates with the merchant, acquiring bank, and issuing bank to ensure smooth fund transfer |

| Online Point-of-Sale terminal for verifying card validity | In-person Point-of-Sale terminal for verifying the card validity |

| Links the customer with the business | Links the merchant with the customer and merchant banks |

| Needs a payment processor to function | Can function as a stand-alone service. |

| Best suited for online credit card transactions | Best suited for in-person credit card transactions. |

Frequently Asked Questions

1. Who pays credit card processing fees?

The merchant pays the credit card processing fees, usually, and not the consumer. These are paid to the credit card networks, and payment processing companies. Credit card processing fees can range from 1.5 to 3.5% of every transaction.

2. Why are there credit card processing fees?

Credit card networks charge interchange fees for the risk they take on against fraud, and for the costs of providing the services. Payment processors also charge fees for managing funds, setup, administration, etc.

3. Can I charge customers credit card processing fees?

You can charge customers convenience fees but you’d have to let them know upfront. Also, these charges are only applicable if your business offers other preferred payment options as well.

4. What are the three steps to process payment card transactions?

The first step is authorization, which starts with the customer providing their details and the issuing bank approving the transaction.

The next step is batching where the merchant sends the days authorized transactions for payment. Finally, there is the funding stage where issuing bank deposits money into the merchant’s bank account.

5. What are the main factors to consider before choosing a merchant credit card processor?

Here are some main factors to consider when choosing a credit card payment processor:

- Customer support

- Reputation reviews

- PCI compliance process

- Pricing

- Technology that easily integrates

To Accept or Not to Accept…

The credit card industry has changed over time; today there is more transparency, and merchants are getting smarter about their options.

Hopefully, this post has educated you on different rates/pricing models and helped you understand all you need to know about credit card processing fees. This should make it easier to decide which option is best for you.

Allowing customers to pay with credit cards can increase your sales by up to 23%. If you choose to take advantage of this option for your business, our payment processing solutions partner CardConnect can assist in getting you set up with free terminals, low fixed rates, and mobile device plug-ins.

About the author

From selling flowers door-to-door at hair salons when he was 16 to starting his own auto detailing business, Brett Shapiro has had an entrepreneurial spirit since he was young. After earning a Bachelor of Arts degree in Global and International Studies from the University of California, Santa Barbara, and years traveling the world planning and executing cause marketing events, Brett decided to test out his entrepreneurial chops with his own medical supply distribution company.

During the formation of this business, Brett made a handful of simple, avoidable mistakes due to lack of experience and guidance. It was then that Brett realized there was a real, consistent need for a company to support businesses as they start, build and grow. He set his sights on creating Easy Doc Filing — an honest, transparent and simple resource center that takes care of the mundane, yet critical, formation documentation. Brett continues to lead Easy Doc Filing in developing services and partnerships that support and encourage entrepreneurship across all industries.