Have you ever set up a company before? Or, is it your first time starting your own small business?

Regardless of the case, this comprehensive guide on how to open a small business in Florida has everything you need to know.

You’ll learn about:

- Important statistics about small businesses in Florida

- The step-by-step process to open a small business

- How to name your small business

- The legal documentation, licenses, and permits required to do business in Florida

- The easiest way to handle all of the required federal and state filings – by leveraging our services

- Other startup tips for small business owners

Are you ready to open a small business in Florida and turn it into a profitable venture?

Let’s get started.

Things to Know Before Opening a Small Business in Florida

Florida is the third most populous state in the U.S. with 21.3M people living there. The per capita personal income is $49K+.

The state offers remarkable business opportunities and supports emerging businesses. It is known for its industrial capabilities and is one of the largest exporters of trade goods. There is no dearth of the right talent and connections within the state.

And the best part?

The cost of doing business in Florida is less as compared to other states in the U.S. This includes the cost of land, labor, and other operational expenses.

Sounds good?

Then it’s about time that you start thinking about opening your own business.

Start by finalizing a business idea after evaluating its pros and cons. Shape your business idea into a well-written business plan. It should include details about your products/service, competitors, audience, capital investment, operational processes, and everything in between.

Which Steps Should You Follow to Set Up and Run Your Small Business?

Let’s take a look at the step-by-step process to start your new business in Florida.

Step 1: Choose a Business Structure and Name

Name is an essential component of the branding of a business. However, it can be tricky at the same time.

You should look for a business name that is:

- Unique (It shouldn’t be trademarked by anyone else.)

- Relevant to your industry and type of business

- Available as a domain (You will need a web address to take your business online and accelerate its growth.)

- Brandable (It should be easy to remember and should offer scalability.)

Next, you need to choose a business structure. The popular choices for opening a small business in Florida include limited liability companies (LLCs), limited liability partnerships (LLPs), Sole Proprietorships, Corporations, and Partnerships.

What are the differences between all these types of business structures?

Limited Liability Company or Partnership

An LLC or LLP (Limited Liability Partnership) is formed when you start a business with other co-owners. Your personal assets are protected if the company goes bankrupt or is sued.

An LLC or LLP is easier to form and offers minimal compliance, more flexibility, pass-through taxation, and flexible management structures when compared to Corporations. Also, the startup costs for LLCs and LLPs are lower than those of Corporations.

Sole Proprietorships

To open and operate a business as a Sole Proprietorship is the easiest of all options. You can start running it under your name and all the income and liabilities will solely be your responsibility.

As a result, this business structure is the most dangerous because you will be personally responsible for the firm’s debts and legal issues.

Partnership

A Partnership is similar to a Sole Proprietorship, except that there is more than one owner. An Operating Agreement (aka, partners’ agreement) for this business type usually structures the business relationship.

Additionally, legal and financial obligations are divided between the partners, and profits are also shared based on each partner’s stake.

Corporations

A Corporation is a separate legal entity that owns all of the company’s assets and liabilities. Corporations offer the best form of liability protection and also pave the way for businesses to raise funds and give out employee shares.

Forming a Corporation involves more legal documentation and imposes double taxation. But it offers infinite growth potential by allowing you to sell stocks in the company and attract wealthy investors. There is no limit to the number of shareholders a corporation can have.

Hence, choose to open your small business in Florida wisely depending on your individual business needs and preferences.

Step 2: Open and Register Your Small Business in Florida

Regardless of the business structure you choose to form, you need to register your business with the Florida Department of State’s office. This is essential to get authorized to conduct business within the state.

Registering your business involves documentation and administrative fees. The Department of State’s office may take up to 3-6 days to process the paperwork. This may increase during peak season. Florida’s fee for the formation of LLCs is $125, and $70 for incorporation.

Which documents do you need to file to open a limited liability company or a corporation in Florida?

Let’s take a look at the requirements:

- First, you need to choose a Registered Agent to form either an LLC or a corporation in Florida. A Registered Agent is a person that has a physical street address within the state as they will receive all legal documents on the behalf of your company.

- To open an LLC, you need to file Articles of Organization with the Florida Department of State’s office. Forming a corporation requires that you file Articles of Incorporation with the same.

- You should hold an Organizational Meeting to properly organize your company’s processes. Though many small business owners ignore this step, you should not. It can help you save time and money by preventing disputes about legal, taxation, and compliance issues.

- You should also create a legal document to define the financial and functional rights and processes of your company. An LLC Operating Agreement lists the roles, responsibilities, and rights of all members of an LLC while Corporate Bylaws mention the roles, responsibilities, and rights of all shareholders of a corporation.

Step 3: Get a Fictitious Business Name (FBN)

As per the Fictitious Name Act (s.865.09, F.S.), the state of Florida requires businesses to register a “fictitious name,” aka, “Doing Business As” name if you want to do business under a name other than what you’ve registered.

For instance, in case you’ve filed as a Sole Proprietorship and are doing business using a name other than yours, you must register this as a fictitious business name.

You can visit the Florida DOS website to know the specific requirements for registering a fictitious business name with the state of Florida.

Step 4: Acquire Your Federal Employer Identification Number (EIN)

To open a business bank account, establish business credit, hire employees, and apply for business licenses, you need an Employer Identification Number (EIN).

EIN serves the same function for a company as a Social Security number does for an individual. You can apply for an EIN by filing Form SS-4 with the IRS.

EIN or tax ID number is required for LLCs, Partnerships, Corporations, or any type of small business that wants to hire employees. You even need it for opening a business bank account. You need to file for an EIN with the Internal Revenue Service (IRS) to acquire a unique tax ID for your company.

Pro tip: Instead of going through the tedious process of obtaining an EIN from the IRS, you can fill out this simple EIN application with GovDocFiling online to get BOTH your EIN and state formation/incorporation done quickly.

Step 5: Get Necessary Business Licenses and Permits

If your company is involved in a skilled trade, you’re probably required to acquire a business permit or license to open your business in Florida.

The Florida Department of Business & Professional Regulation (DBPR) issues licenses for a variety of professions, including community association managers, geologists, and restaurants.

Moreover, the Florida Department of Agriculture & Consumer Services (DACS) issues licenses for businesses like private investigators and agricultural dealers.

Some types of businesses require special licenses and permits to operate in Florida, including:

- Alcoholic beverages and tobacco products-based businesses

- Architects

- Talent agencies

- Yacht and ship brokers

- Restaurants, caterers, and mobile food vendors

- And more.

You should apply for the required business license with the Florida Department of Business & Professional Regulation. This depends on the type of business entity you choose to open and conduct within the state.

You should also register for state taxes and get permits to do business in Florida. The Florida Department of Revenue (DOR) is the place where you register for the state tax.

Here are the details:

Sales & Use Tax

The DOR requires you to register as a Sales and Use Tax dealer if you want to collect sales tax on goods, certain services, and commercial property sales and leases.

Sales and Use Tax must be collected at the time of each sale and paid to the DOR at the end of each reporting period.

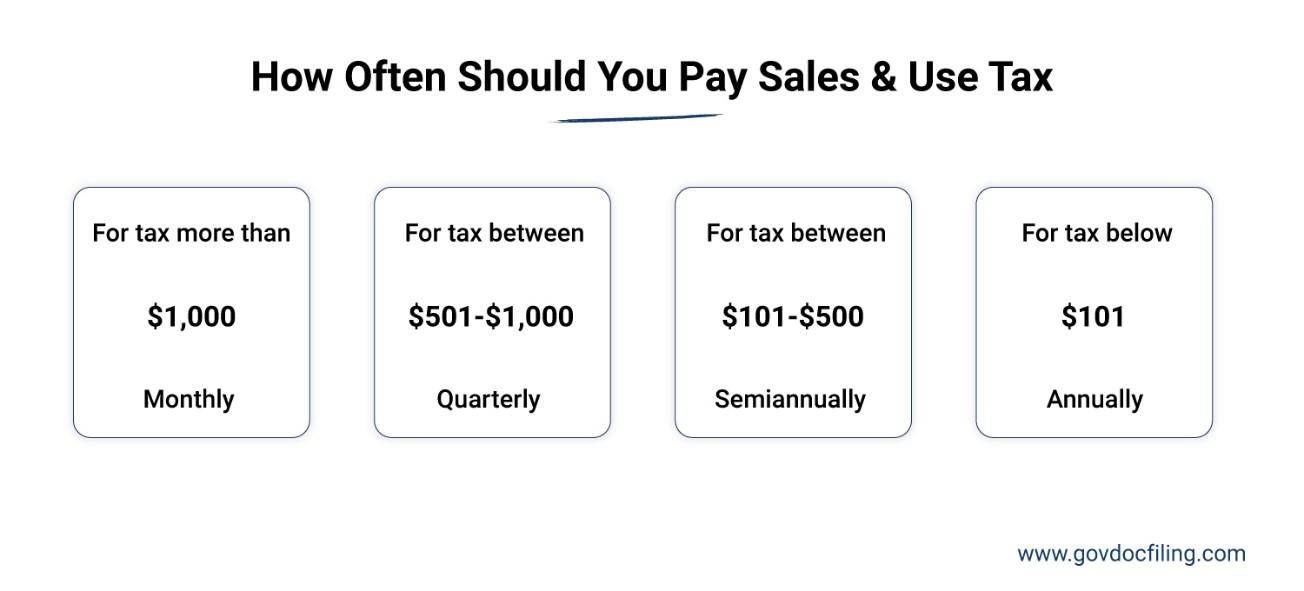

How often your small business must file for the tax and pay solely depends on the amount of sales tax you collect annually:

- For tax more than $1,000 – Monthly

- For tax between $501-$1,000 – Quarterly

- For tax between $101-$500 – Semiannually

- For tax below $101 – Annually

Corporate Income Tax

All Corporations operating in Florida must pay the Corporate income tax. However, LLCs that are classified as Corporations must also do so.

You can, however, reduce the tax expenses by employing tax incentives such as operating within a rural county, producing renewable energy, and cleaning up a brownfield site or a site contaminated with dry-cleaning solvent.

Generally, you must file Florida Form F-1120 to file Corporate Income Tax on or before the first day of the fourth month after your business’ tax year ends.

You may pay estimated taxes if your business owes more than $2,500, which are due at the end of your business’ tax year’s quarter.

Step 6: Open a Business Bank Account

This is another important step involved in opening a small business in Florida.

What are the benefits of opening a business bank account?

It allows you to keep your personal and business expenses separate. Having a business bank account also helps protect your personal assets from any business debts and liabilities.

Lenders, creditors, and banks will not be able to come after your personal assets such as your home, car, personal bank accounts, or other properties for business liabilities.

In addition, you can also apply for business credit cards to build and enhance your company’s credit profile as an LLC or a corporation. This will help improve your credibility for larger business loans.

The question is: How can you open a business bank account?

To open a business bank account, you’ll need:

- Your business formation paperwork

- Your EIN (Employer Identification Number) or Tax ID number

- A resolution signed by either the owners, members, or directors that authorizes the company to open a bank account

Step 7: Build Your Business Website

Once your business is legally set up and ready to open, it’s time for you to go all in by building your small business’s presence in Florida.

Creating a website to gain market share is a great option to get started.

Creating a website is crucial, but you may feel that it is out of your reach if you lack website-building experience.

While this was a reasonable worry back in 2014-15, web technology has advanced over the past few years to make the lives of small business owners much easier.

You can avail GoDaddy’s complete web solutions to get everything you need to go digital.

The solution offers website, marketing, hosting, and support services to help you make your business more visible.

Step 8: List Your Business on Google My Business

If you want the people of Florida to find your business location and other information easily, you should claim your Google My Business listing.

Google My Business (GMB) is a handy tool that allows businesses to manage how their business appears on Google’s search engine result pages (SERPs) and Google Maps.

Here are the benefits of listing your business on Google My Business:

- You can showcase important information related to your business, such as your website, physical address, phone number, hours of operation, and customer reviews

- GMB boosts your brand awareness by improving local SEO to drive traffic to your website

- Increases authenticity of your small business

Step 9: Outsource Critical Business Operations

Having a small business means you won’t be able to do everything on your own. The reasons could be wide-ranging. You may not have the bandwidth to focus on the specific business activity or might not have the skills for it.

So how do you make sure that these business operations are taken care of?

The answer lies in outsourcing them.

Following are the services you should consider outsourcing once you open your business in Florida:

Bookkeeping

Hiring a full-time accountant might not be the best idea if your business hasn’t become big enough. At the same time, accounting by yourself isn’t the best bet as you might not be able to keep up with all the entries. In such a case, it’s best to outsource bookkeeping to other firms who can help you out with it.

Website

While you could very well start your website, it’s best to leave it to experts who can develop high-performing websites for your business. They can also help you with website maintenance and security.

FAQs

1. What is required to start a business in Florida?

Here is how you can open a small business in Florida:

- Choose a business structure and name

- Open and register your small business

- Register a fictitious name

- Acquire your EIN

- Get necessary business licenses and permits

- Open a business bank account

- Build your business website

- List your business on Google My Business

- Outsource critical business services

2. How much does it cost to open a small business in Florida?

The cost to open a small business in Florida depends on the type of business entity you’re going with. To get a clear idea and breakdown of costs, you can visit the Florida Department of State website.

3. Can I run my business from home in Florida?

Yes, you can. The Florida House Bill 403 allows businesses to operate in a residential neighborhood.

4. What are the easiest small business ideas to start in Florida?

Here are the top 5 small business ideas for towns in Florida:

- Food trucks and stalls

- Coffee shops

- Cleaning business

- Landscaping and lawn care business

- Bed and breakfast

5. What is the best business structure for small businesses in Florida?

Sole Proprietorships and Partnerships are the best business structures for small businesses because:

- Easy to form

- Fewer government regulations

- Easy tax setup and less paperwork

- Simplified business ownership

Ready to Open a Small Business in Florida?

Whether you want to form an LLC or a Corporation in Florida, our business formation packages can help you complete all of the paperwork smoothly. Along with state and federal filings, you’ll also get essential legal documents for doing business within the state.

Trust us, it will be really helpful to have everything ready in hand. Additionally, when you engage our services, you’ll be able to concentrate on the one thing you need to — opening and scaling your business. Check out our pricing plans here and choose the service that you need.

Do you have other questions about opening a business in Florida? Tell us in the comments below. We’ll get back to you with the most satisfying solutions as soon as possible.