The decision to dissolve an S-Corp is not one to be taken lightly. Whether driven by financial considerations, strategic shifts, or changes in the business landscape, the process of S-Corp dissolution requires careful attention to detail.

It’s not the same as winding down an ordinary business; it entails adhering to specific procedures and legal requirements to ensure a smooth and lawful closure.

So, how do you dissolve an S-Corp? We’ll answer that in a bit.

But before we go down the details, let me help you understand what an S-Corp is.

What is an S-Corp?

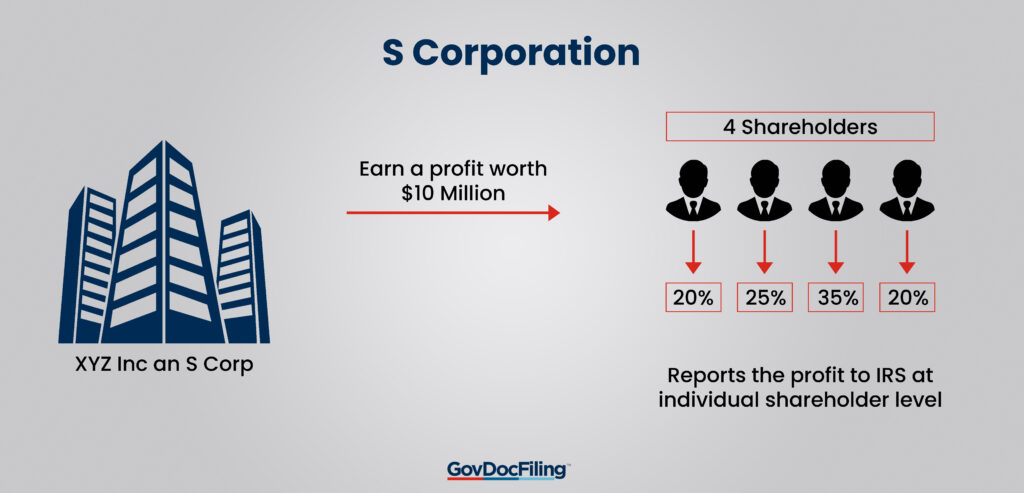

An S-Corp is a business structure that blends the advantages of an S-Corp with pass-through taxation.

What’s more?

It offers limited liability protection to shareholders while allowing income, losses, deductions, and credits to pass through to them for tax purposes. They’re often favored by small and mid-sized businesses seeking tax efficiency and liability protection.

Unlike a Sole Proprietorship or Limited Liability Company, S-Corporations file their tax returns, and shareholders report their share of the income on their returns.

When it’s time to dissolve the business, specific procedures and legal requirements must be followed to ensure a proper corporate dissolution.

Let’s get to know how to dissolve an S-Corp.

How to Dissolve an S-Corp in 8 Steps

Unlike other business structures such as Sole Proprietorships or Limited Liability Companies, dissolving an S-Corporation involves distinct procedures due to its separate legal entity status.

Failing to dissolve an S-Corp properly can lead to lingering liabilities and legal complications. Several steps must be taken to ensure a lawful dissolution of an S-Corp.

This guide will walk you through every step you must follow if you need to know how to dissolve an S-Corp business.

1. Vote to Dissolve the S-Corp

If you solely own a S-Corporation as a sole owner, dissolving it is rather easy.

However, if you have more than one shareholder, Articles of Organization may mandate that shareholders hold a meeting, and vote to dissolve the S-Corporation.

The S-Corporation may need to put a decision on the majority of the votes. Each state has its own rules on what number may constitute the majority.

For some states, it may be just the simple majority. But in other, it may require two-thirds of the votes for majority.

It‘s essential to document the vote properly—maintain records to demonstrate compliance with corporate governance protocols.

After obtaining the required shareholder approval, the S-Corp can proceed with the subsequent steps of dissolution. This may include notifying employees, settling debts, and distributing remaining assets.

Adhering to the established procedures and legal guidelines throughout the dissolution process helps maintain the integrity of the business closure and ensures compliance with applicable laws.

It’s recommended to consult with legal professionals to ensure that all necessary steps are taken and that the vote to dissolve the S-Corp is conducted in accordance with the company’s governing documents and legal requirements. We recommend RocketLawyer for their legal services.

This helps protect the interests of shareholders and promotes a smooth and compliant business closure.

You May Also Like:

2. Cease Operating the Business

You can’t continue operating your business once you vote to dissolve it.

Therefore, it’s important to inform your clients, customers, suppliers, and any other relevant parties about the impending S-Corp dissolution.

The communication allows everyone involved to prepare for the transition and helps minimize disruptions or confusion during the process.

Next, you’ll need to address any open contracts, outstanding obligations, or pending legal matters.

Take the necessary steps to fulfill these obligations and resolve any remaining issues.

By doing so, you can ensure that you’re tying up loose ends and avoiding potential liabilities down the road.

(We recommend the services of RocketLawyer to help you dissolve your S-Corp.)

3. Wrap-Up Employee Obligations

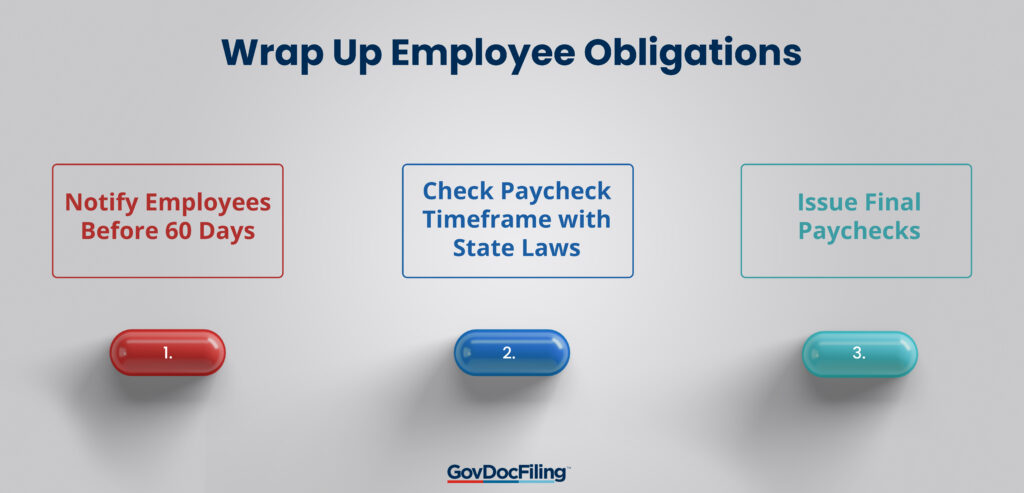

When you decide to dissolve your S-Corporation, you need to fulfill certain obligations toward your employees.

These obligations may include providing employees with proper notice about the closure of the business and issuing final paychecks. Also, you may need to ensure federal payroll taxes are paid to the IRS.

Notifying employees about the business closure is an ethical responsibility. This may be legally required based on your business’s size and state laws.

Additionally, federal law mandates that businesses with over 100 employees must provide written notice at least 60 days before closing.

S-Corps are also responsible for issuing final paychecks to their employees and remitting all payroll taxes to the IRS. You can use Gusto or ADP for this.

The timeframe for distributing final paychecks may be determined by state law, which varies across different jurisdictions.

It’s essential to familiarize yourself with the relevant state and federal regulations regarding employee obligations before starting the dissolution process.

Compliance with these obligations ensures fairness to your employees and prevents potential legal issues.

4. Sort Liabilities and Debts

It’s important to settle any liabilities and debts before finalizing your S-Corporation dissolution.

How can you do that?

First, you need to assess your S-Corporation’s outstanding liabilities. That includes any unpaid bills, loans, leases, or other financial obligations that need to be addressed.

You May Also Like:

Take the time to review your S-Corporation’s records and reach out to creditors or vendors to determine the outstanding amounts and negotiate repayment or settlement arrangements.

When settling these liabilities, it’s crucial to prioritize payments based on their importance and urgency. Start with essential obligations such as employee wages, payroll taxes, and other statutory payments.

Then, work your way through other outstanding debts, considering your terms and agreements with each creditor.

Maintain your business records of all payments, correspondence with creditors, and settlement agreements.

This documentation will help ensure transparency and clearly record your efforts to settle your S-Corporation’s financial obligations.

(We recommend the services of RocketLawyer to help you dissolve your S-Corp. They offer a free trial too!)

5. Liquidate and Distribute Assets Among Stakeholders

S-Corporations pass their profits and losses through to their shareholders. Therefore, before you close your business, you need to distribute assets among your shareholders.

If you’re selling the business, the process may be rather easy. You can make sure your S-Corporation sells at a fair market value, and then distribute the sale proceeds among shareholders.

But if you’re just dissolving, you may need to follow bylaws in the Articles of Organization. In some states, you may need to follow default rules of the state where the company is incorporated to distribute assets. If you’re not aware of the specific state laws, you can confirm with the secretary of state.

Distribution of assets is always proportional to a shareholder’s share of the company.

To initiate this process, you need to identify and assess all the assets owned by your S-Corp, which may include cash, investments, business property, and other valuable items.

With a comprehensive understanding of the company assets, you can liquidate assets through selling or auctions at a fair market value.

From the total sale proceeds, you can distribute the assets accordingly. For instance, a shareholder owning 30% of the S-Corporation would be entitled to 30% of the distributed assets.

During this stage, consulting with legal professionals is recommended to navigate the complexities when liquidating assets and distributing them. They can guide on capital gains implications and proper handling of company assets. Our recommendation is RocketLawyer—they’re among the best in business.

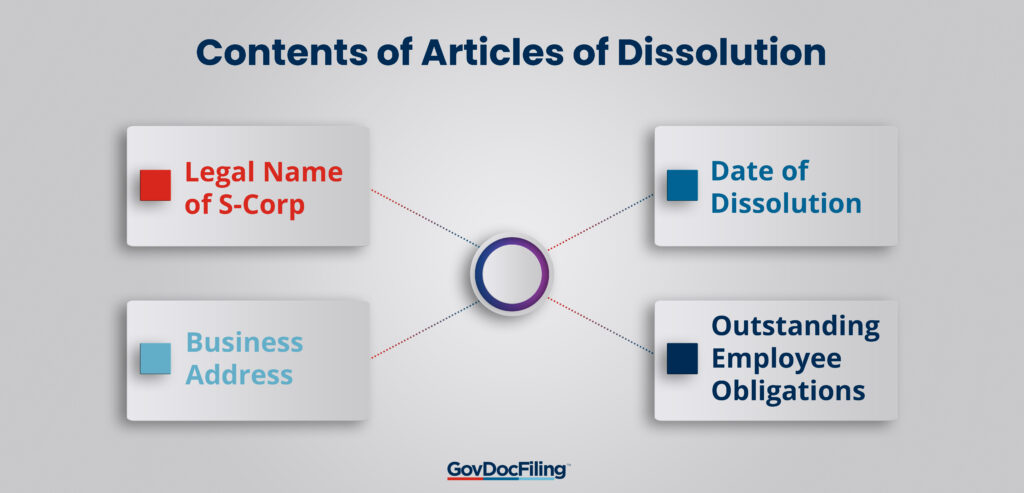

6. File Articles of Dissolution

Filing the Articles of Dissolution is necessary to comply with state law and officially terminate the existence of your S-Corporation.

To begin, you’ll need to gather the required information and documentation from the secretary of state.

That typically includes details such as the legal name of your S-Corporation, its business address, and the date of the dissolution. You may also need to provide information about outstanding employee obligations, such as final payroll and tax clearance.

Once you’ve gathered the necessary information, you can prepare the Articles of Dissolution.

This legal document outlines the intent to dissolve your S-Corporation. Also, it serves as an official notification to the secretary of state.

You May Also Like:

It’s important to accurately complete the Articles of Dissolution and provide all required information to avoid any hiccups.

Any errors or omissions could lead to delays or complications in the dissolution process.

After completing the Articles of Dissolution, you must file them with the appropriate state agency responsible for business registrations.

This filing officially notifies the state that your S-Corp is being dissolved and triggers the legal process of winding down your business.

By filing the Articles of Dissolution, you fulfill your legal obligation to dissolve your S-Corp in accordance with state law formally. This step is essential to ensure your business entity’s proper and lawful termination.

(We recommend the services of RocketLawyer to help you dissolve your S-Corp. They offer a free trial too!)

8. Dissolve your S-Corporation with IRS

Dissolving an S-Corporation with the IRS involves specific steps to fulfill tax filing obligations and officially terminate the business.

Here’s what you need to do:

First, ensure all final local, state, and federal taxes are filed, and any outstanding taxes are paid using your business bank accounts.

That includes filing your S-Corp’s final income taxes using Form 1120-S, and completing and filing a final Schedule K-1 for each shareholder. Also, you need to submit the final S-Corp payroll taxes.

Prepare and file Form W-2 for employees and Form 1099 MISC for contractors and subcontractors.

Alongside tax filings, filing Form 966 (Corporate Dissolution or Liquidation) must be filed within 30 days of the S-Corp dissolution or liquidation. This form notifies the IRS of the company’s closure.

Lastly, close your IRS business account and cancel your Employer Identification Number (EIN).

Write a letter to the IRS, including your S-Corp’s full legal business name, address, EIN, and the reason for closing the account. Mail this request to the Internal Revenue Service.

Closing an S-Corp with the IRS involves intricate tax procedures. To ensure accurate tax preparation, consider hiring an accountant or tax professional who can navigate these processes and functions effectively.

(We recommend the services of RocketLawyer to help you dissolve your S-Corp. They offer a free trial too!)

FAQs

Q1. What is S-Corporation dissolution?

S-Corp dissolution is the legal process of formally terminating an S-Corporation, effectively closing down the business entity.

Q2. What happens to the S-Corporation’s contracts and agreements during dissolution?

During S-Corp dissolution, it’s crucial to review and address the company’s contracts and agreements.

Depending on the terms, you may need to negotiate contract termination or transfer agreements with counterparties, ensuring a smooth transition and minimizing any potential legal disputes.

It’s advisable to seek legal counsel from RocketLawyer to navigate these contractual obligations and ensure compliance with the terms and conditions set forth in your agreements.

Q3. What are the steps involved in dissolving an S-Corporation?

The steps typically include conducting a shareholder vote to approve dissolution, ceasing business operations, settling outstanding debts and liabilities, liquidating assets, filing Articles of Dissolution with the state, closing the IRS business account, and complying with any state-specific requirements.

Q4. How long does it take to dissolve an S-Corporation?

The duration of S-Corp dissolution depends on various factors, including the complexity of the business, the number of outstanding obligations, and the efficiency of completing required tasks. Typically, the process takes several months to complete.

Q5. What are the tax implications of S-Corps dissolution?

Dissolving S-Corporations triggers various tax considerations that require careful attention. It involves filing final tax returns for the S-Corp and reporting any income, deductions, and credits for the last tax year. Additionally, addressing outstanding tax liabilities is crucial.

This may involve settling any unpaid taxes, penalties, or interest that have accrued. Moreover, distributing assets during dissolution can have tax implications, such as potential capital gains tax.

Q6. Can an S-Corporation be dissolved without a shareholder vote?

Unless it’s a single-owner S-Corp, dissolving it requires a formal vote by the shareholders, as outlined in the corporate bylaws or Operating Agreement. This vote is essential to authorize the dissolution and move forward with the process.

Q7. Is legal assistance necessary for S-Corporation dissolution?

While legal assistance isn’t mandatory, it’s highly recommended to ensure compliance with legal requirements, navigate complex procedures, and protect the interests of the shareholders during the dissolution process. Consulting an attorney experienced in business law can provide valuable guidance.

Q8. What are the implications of employee obligations during S-Corporation dissolution?

When dissolving an S-Corp, it’s crucial to address employee obligations. This includes providing proper notice of business closure and issuing final paychecks to employees.

The notice requirement may vary depending on state laws and the size of your business. It’s important to consult with legal professionals to ensure compliance with these obligations. By fulfilling your responsibilities toward employees, you demonstrate respect for your workforce and maintain a positive relationship with them.

Q9. Are there any specific requirements for notifying creditors during S-Corporation dissolution?

Yes, when dissolving an S-Corp, it’s important to notify creditors about the impending closure. This allows them to make any necessary arrangements and provides transparency in the process.

While specific requirements may vary by state, it typically involves sending written notice to known creditors, publishing a notice in a local newspaper, and possibly filing a notice with the Secretary of State or other relevant authority.

Final Thoughts

Dissolving an S-Corp requires careful planning and execution.

It’s a transformative process that involves various stages, from conducting a shareholder vote to ceasing business operations, settling debts, liquidating assets, filing necessary paperwork, closing the IRS business account, and even wrapping up employee obligations.

You may be wondering, is all this necessary?

Dissolving your S-Corp business is different from Limited Liability Company and Sole Proprietorships. And that’s why these steps are necessary.

While S-Corp dissolution may seem daunting, understanding the steps involved and approaching the process with diligence and attention to detail will help you navigate this with confidence.

Each step plays a vital role in ensuring a smooth transition and tying up loose ends.

Aside from that, it’s important to seek professional guidance from attorneys, accountants, and tax professionals when closing your S-Corp.

So, follow these steps and ensure a successful closure of your business.