Partnership vs S-Corp: which is the right business structure for you? Choosing the right business structure is one of the most crucial decisions you need to make when starting a business.

Each business entity comes with its own set of advantages and considerations, making the decision a critical one.

In this blog post, we will explore the key differences between Partnership vs S-Corp business structures.

Let’s delve into more details.

Understanding Partnerships

A Partnership is a business entity where two or more individuals or entities come together to jointly operate a business. The owners are called partners and they contribute resources, and skills, and share profits and losses.

A Partnership is generally not viewed as a separate legal entity.

Characteristics of a Partnership

Here are the key characteristics of a Partnership.

- Shared Ownership: Partnerships have shared ownership and decisions are made through mutual agreement or Partnership Agreement.

- Pass-Through Taxation: Partnerships have pass-through taxation, with profits and losses reported on the partners’ individual income tax returns.

- Joint Liability: In a Partnership, partners can be individually held responsible for the Partnership’s debts and obligations.

- Flexibility and Simplicity: Partnerships have flexible and simple formation requirements with fewer formalities and regulations.

- Limited Life: Partnerships typically have a limited lifespan tied to the partners’ agreement or specific events outlined in the Partnership Agreement.

Pros and Cons of a Partnership

To make the right choice between Partnership vs S-Corp, it’s important to learn the advantages and disadvantages of each business structure.

Here are a pros and cons of a Partnership.

Pros

- Ease of Formation: A Partnership is easier to form with fewer legal requirements and upfront costs. It’s also not mandatory to register the firm to create a Partnership. However, you must have a Partnership Agreement.

- Flexibility: A Partnership offers more flexibility in decision-making as partners can make decisions with mutual discussion and agreement.

- Privacy: Partnerships are not required to publish their accounts. The decision-making is entirely up to the partners, so trade secrets and financial information is protected, maintaining privacy.

- Shared Risks and Losses: Partnerships distribute the financial risks and losses among the partners. This can provide a certain level of security and cushioning in case the business experiences losses.

- Ease of Dissolution: There is no legal procedure involved in the dissolution of a Partnership. Insolvency could lead to a Partnership being dissolved.

Cons

- Unlimited Liability: Each partner is personally liable for the debts and obligations of the Partnership. As such, if the Partnership faces legal issues or financial difficulties, the personal assets of the partners may be at risk.

- Limited Access to Capital: Partnerships primarily rely on the partners’ personal funds and contributions or bank loans. Accessing larger amounts of capital is difficult without converting the Partnership to a different structure.

- Potential for Conflict: Partnerships require open communication, trust, and mutual understanding among partners. However, disagreements and conflicts can arise, potentially leading to strained relationships and disputes.

Exploring S-Corps

An S-Corporation or S-Corp is a specific type of Corporation that offers certain tax advantages while providing limited liability protection to its shareholders.

While all S-Corps share the same basic characteristics and tax advantages, individual S-Corps can vary widely. For example, one S-Corp may be a web design business, while another may be a family-owned restaurant.

Since S-Corps have more complex legal requirements than Partnerships, it is best to consult with a legal expert like Rocket Lawyer to fully understand the requirements.

In this section, we’ll cover the key characteristics, pros, and cons of S-Corps.

Characteristics of an S-Corporation

Here are the key characteristics of an S-Corporation:

- Limited Liability Protection: Like a regular Corporation (C-Corporation), an S-Corp provides limited liability protection to its shareholders.

- Pass-Through Taxation: S-Corps, like partnerships, bypass federal corporate taxes, allowing income to be taxed only at the shareholder level.

- Ownership Restrictions: S-Corps can have no more than 100 shareholders, and S-Corp shareholders can be individuals or certain trusts and estates.

- Preferred Stock Limitations: S-Corps are restricted from issuing multiple classes of stock, ensuring equal shareholder rights.

- Strict Compliance Requirements: S-Corporations have strict compliance requirements, including maintaining proper corporate records, holding regular shareholder and director meetings, etc.

Business formation service providers like Inc Authority, Incfile, ZenBusiness, and LegalZoom can offer ongoing compliance support to ensure that businesses meet their legal obligations and maintain their status as S-Corporations.

Pros and Cons of an S-Corporation

Let’s now look at the pros and cons of an S-Corporation to understand which is better in Partnership vs S-Corp.

Pros

- No Double Taxation: The Corporation’s profits and losses “pass through” to the shareholders’ personal tax returns. An S-Corporation does not pay corporate taxes, avoiding the double taxation that occurs in C-Corporations.

- Lower Self-Employment Taxes: Shareholders can distribute some part of profits as dividends, which are not subject to self-employment taxes.

- Tax Flexibility: S-Corporations allow for greater flexibility in allocating income and losses among shareholders. Shareholders can distribute income in a way that minimizes their overall tax burden. You can work with a company like Roll by ADP for your tax planning.

- Ownership Transferability: Shares in an S-Corporation are typically easier to transfer compared to Sole Proprietorships or Partnerships. Ownership interests can be sold or transferred using shares without affecting the corporation’s legal structure or tax status.

- Credibility and Trust: An S-Corporation establishes a formal legal structure that signals professionalism and stability. This allows all stakeholders to trust the business and enter into contracts, give funding, etc.

Cons

- Eligibility Restrictions: S-Corporations have several eligibility requirements. For example, there can only be a maximum of 100 shareholders, all of whom must be US citizens or residents.

- Limited Growth Potential: S-Corporations may face limitations in attracting investment capital because they cannot have more than one class of stock.

- Higher Administrative Costs: An S-Corporation has higher administrative costs and complexity compared to other business structures due to the requirement of maintaining and filing separate corporate tax returns.

Partnership vs S-Corp: Key Differences

When choosing between Partnership vs S-Corp, it is important to understand the differences between both structures.

Let’s discuss some of the key Partnership vs S-Corp differences briefly.

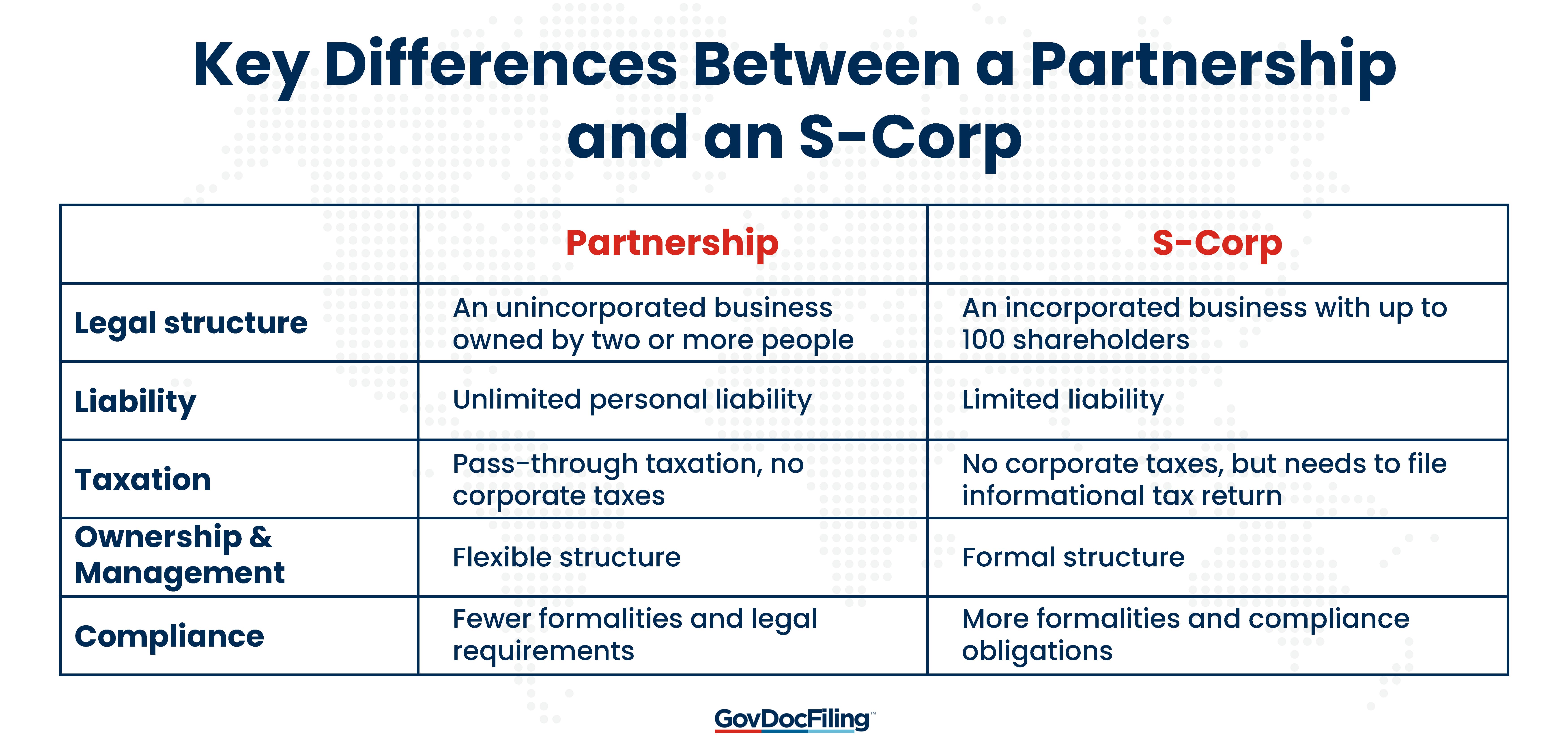

Legal Structure

A Partnership is an unincorporated business entity where two or more individuals or entities come together.

An S-Corporation is a specific type of Corporation that is formed by filing Articles of Incorporation with the state.

Liability

In a General Partnership, all partners have unlimited personal liability for the debts and obligations of the Partnership. In a Limited Partnership, there are general partners who have unlimited liability and limited partners who have limited liability.

S-Corporation owners generally have limited liability for the Corporation’s debts and obligations. Their personal assets are protected, except in cases of fraud or illegal activities.

Taxation

A Partnership is a pass-through entity, which means that the profits and losses of the Partnership flow through to the individual partners’ personal income taxes.

Like a Partnership, an S-Corporation is also a pass-through entity. However, there are some differences in taxation.

The S-Corporation files an informational tax return (Form 1120S), but it does not pay federal income tax. Instead, the S-Corp’s income, deductions, credits, etc. are passed to the shareholders, who report them on their personal income tax returns.

Ownership and Management

Partnerships can have flexible ownership structures, and the partners generally have equal decision-making authority, unless otherwise specified in the Partnership Agreement.

S-Corporations have a more formalized management structure with a board of directors, officers, and shareholders. Shareholders elect the board of directors, who make major decisions and appoint officers to handle day-to-day operations.

Formalities and Compliance

Partnerships generally have fewer formalities and compliance requirements than a C-Corp or an S-Corp. However, they must obtain necessary licenses, and comply with specific local regulations.

S-Corporations have more formalities and compliance obligations. They must file Articles of Incorporation, adopt bylaws, hold regular meetings of shareholders and directors, maintain corporate records, and comply with state reporting requirements.

Companies like Inc Authority, Inc File, ZenBusiness, and LegalZoom can help both Partnerships and S-Corps fulfill their compliance obligations.

When Should You Choose a Partnership?

When choosing between Partnership vs S-Corp, go for a Partnership if the number of people involved is low. Also, if you do not require limited liability protection, then Partnership is a good choice.

A Partnership may be suitable for the following businesses:

- Professional service firms, such as law firms, accounting firms, and so on.

- Small retail businesses, restaurants, and cafes

- Creative ventures, such as artists collaborating on a project

- Real estate firms

- Family businesses

When Should You Choose an S-Corp?

When comparing the liability protection of a Partnership vs an S-Corp, an S-Corp is always a better choice. Both new and existing companies can see significant tax advantages by choosing an S-Corp.

However, you must be prepared to keep up with administrative costs, and other federal and state requirements.

An S-Corp could be a suitable business structure for:

- Starting a startup with venture capital funding

- Real estate investment companies

- Family-owned businesses

- Small businesses with multiple owners

- Companies planning for succession

FAQ

Q1. Why is an S-Corp better than a Partnership?

An S-Corp is better than a Partnership because it provides limited liability protection while offering potential tax advantages. S-Corps also provide more flexibility when it comes to transferring ownership interests, unlike Partnerships.

However, the choice between an S-Corp and a Partnership should be based on a thorough analysis of your specific circumstances, including legal, tax, and accounting considerations.

It’s advisable to consult with a legal expert or hire a company like Rocket Lawyer to provide guidance tailored to your situation.

Q2. Is it better for an LLC to be taxed as an S-Corp or a Partnership?

Whether a Limited Liability Company should choose to be taxed as an S-Corp or Partnership depends on:

- The owners’ tax preferences

- The distribution of profits

- The desired level of self-employment taxes

It is best to consult with a professional to choose the best option. Our trusted partners LegalZoom and Incfile offer a free tax consultation, which can help you make an informed decision.

Q3. What is the difference between an LLC Partnership and an S-Corp?

An LLC Partnership is a flexible business structure with shared ownership and personal liability, while an S-Corp is a separate legal entity with limited liability and potential tax advantages.

Q4. Is an S-Corp considered a Partnership?

No, an S-Corp is not considered a Partnership. It is a distinct legal entity that is separate from its owners, whereas a Partnership is a business structure where the owners share the profits, losses, and liabilities of the business directly.

Q5. Partnership vs S-Corp: which has to pay corporate tax?

Corporate tax refers to the tax imposed on the profits earned by Corporations. A Partnership does not pay corporate taxes as it’s not a separate legal entity.

On the other hand, an S-Corp is a separate legal entity, and it is responsible for paying corporate taxes on its profits.

Partnership vs S-Corp: Final Thoughts

Partnership vs S-Corp: the choice depends on various factors, such as liability, taxation, and management structure.

Partnerships offer flexibility and pass-through taxation, while S-Corps provide limited liability and potential tax advantages.

Establishing a business, whether it is a Partnership or an S-Corp, requires compliance with various legal requirements at the federal, state, and local levels. You will also need to consider the tax implications and address potential risks and liabilities.

Our trusted partners Inc Authority, Incfile, ZenBusiness, and LegalZoom can simplify the business formation process for you. So, you can take care of your business while they handle the rest.