So, you’ve been thinking about how to start a retail business? In today’s digital world, where customers can buy a product online and receive it the same day, ecommerce is undoubtedly one of the industries that’s expected to grow steadily over the coming years.

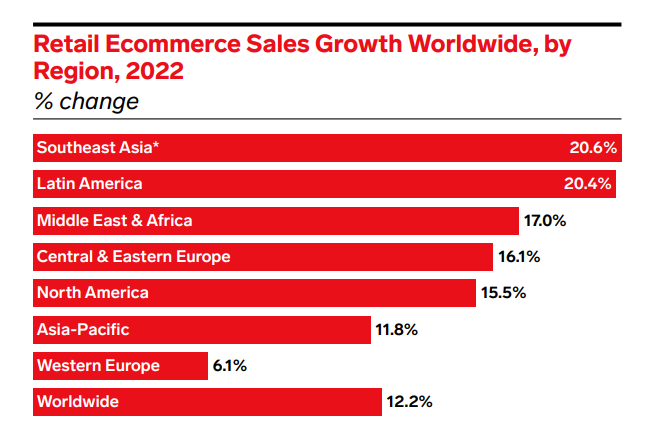

In fact, retail ecommerce sales grew by 15.5% in the US in 2022, mirroring positive growth rates witnessed in other parts of the world.

But retail sales don’t just happen online. The internet simply enhances the retail business by making it easy for customers to buy products from ecommerce stores.

So, what exactly is a retail business?

In the simplest terms, a retail business is a business that buys products from a wholesaler or manufacturer and sells them to customers for a profit. The industry is quite vast and covers everything from food and clothing to pet products and auto.

And while the retail industry is fast growing and providing many opportunities to entrepreneurs, it is very competitive and could be a risky endeavor for any budding business owner.

However, with the right attitude, you can learn how to start a retail business that generates a commendable revenue.

Here’s everything you need to keep in mind when learning to start a retail business.

Step 1: Find Your Niche & Choose Your Products

The first thing you need to do as you figure out how to start a retail business is to find your company’s niche.

A niche is a portion of the market that you want to appeal to with your products or services. This part of the market can be defined by its identity, unique needs, or preferences that differentiate it from the market at large.

For example, high-end fashion is a niche within the apparel market.

The niche you operate in will determine the products you sell, the price and quality of those products, as well as the marketing activities you’ll deploy. That’s because it’ll have to be specific to your audience.

For instance, businesses in the high-end fashion niche will need to start selling top-quality luxury fashion items at a high price. To market their products, they can display their designs during events such as the New York Fashion Week.

When you start finding your niche, you want to keep it as narrow as possible. This is because the narrower your niche is, the easier it is to become the preferred destination for customers in that space.

It also allows you to charge a higher price for your products since you don’t have too many competitors to deal with.

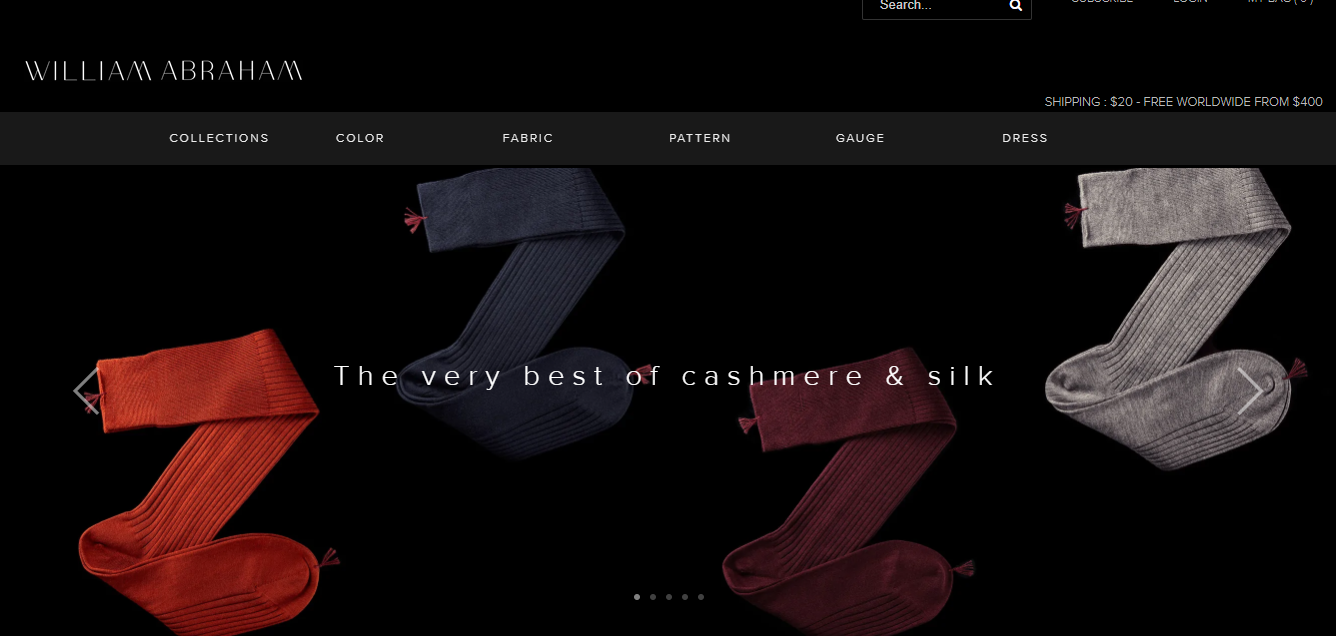

Take William Abraham, for example. The brand only deals in men’s socks. And they don’t just sell men’s socks; they sell men’s luxury socks.

Image via William Abraham

Besides allowing you to charge slightly more for your products, a niche also narrows down your audience compared to a retail store that sells everything to anyone.

This makes it easier for your brand to find its target audience and build a connection with them when it starts.

Product management and supply issues also become less complicated since you are dealing with a few products.

If you are struggling to find a niche and products to start your retail store, we recommend the following:

- Explore your interests – Find out what you’re passionate about and turn that into a retail business. For example, if you are passionate about skincare products made from organic materials, you can source organic skin care products and sell them in your retail store.

- Consider potential conflicts – There’s no perfect industry or market to operate in. Market research informs you of the challenges you may encounter in your target market going forward. This way, you can plan ahead and find ways to counter any issues that can harm your business.

- Study the potential of your desired niche – Research your target market online to see if there’s enough interest in your products. Google Trends is a valuable tool for studying the interest of specific terms online.

- Consider profitability – Every entrepreneur wants to know how to start a retail business so they can make money. For this reason, study your niche to see if there’s enough demand for the products you intend to sell.

- Research your competitors – Once you identify a niche using the above four steps, take time to research the competition. Find out what they are selling and how they are going about marketing. This will help you learn what you can do to improve your retail business.

Also Read:

Source Products from Suppliers

After narrowing down your niche, the next step is to start finding a reliable supplier for the products you’ll be selling.

This is probably the most important step as you learn to start a retail business because you need a consistent supply of quality products to keep your new business running. Otherwise, no products, no retail business for you.

As you start finding products for your retail store, you first need to understand your options:

- Manufacturer – You can go directly to the manufacturer and buy your products from them. Alternatively, you can develop a concept for your products and outsource the creation to a manufacturer.

- This is the cheapest option for sourcing products since it bypasses middlemen who raise the prices of essential goods you need for your retail business.

- Wholesaler – Wholesalers buy products from a manufacturer and sell them to retailers at discounted prices. Buying products from a wholesaler is a great option if the original manufacturer is located far from your physical retail store.

- Dropshipping – Dropshipping is the process of selling products directly to consumers but outsourcing product fulfillment to another business. This is the most hands-off way to run a retail business. However, it also has the least profit since it involves too many people.

As you research your vendor, get samples from several suppliers and test them to see which ones suit your business. Examine the quality of the product clearly before deciding which products you want to source.

From there, build a thriving relationship with your chosen vendor through effective communication and prompt payment. Eventually, you can negotiate for a discount, especially for large orders.

Step 2: Create a Business Plan

The next thing you need to do as you work to start a retail business is to create a business plan.

A business plan is a document that outlines the goals and objectives of your business. There’s no doubt that you have an amazing idea for your retail business, but that idea alone isn’t enough to make your business successful

With a business plan, you provide yourself (and future investors) with a roadmap of how you will start and run your retail business. Think of it as a guide that details what you need to do to make the business profitable, as well as how you will deal with any potential setbacks.

When creating your business plan, ensure you include specific milestones that you will use as a measure of success.

That said, here’s an overview of a business plan that you can use as a guide.

- Executive summary – A high-level description of the retail business. The summary outlines your company’s mission, purpose, and how you are going to achieve your goals.

- Business description – Specific details about the company. Make sure you state the problem you want to solve, how you intend to solve it, and your team.

- Market analysis – A brief description of the current market landscape. Make sure you capture all the important industry details such as the market opportunity that exists, how you intend to position yourself in the market, your target customers, and competitors.

- Product line – What will you be selling in your retail store? Give specific details about the products you intend to sell and why they are needed in the market.

- Organizational structure – Outline the key members of your team and their experience with retail businesses. Also, include your plan for hiring employees and the roles they will play in the business.

- Marketing and sales – Describe the measures you’ll implement to attract and retain customers. For example, you can say that you’ll use social media marketing to appeal to young consumers.

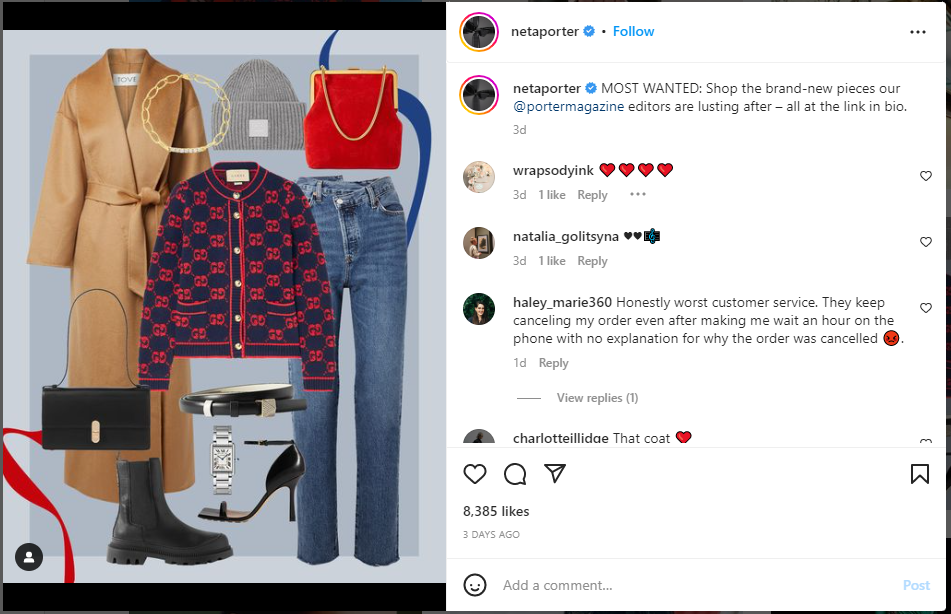

NET-A-PORTER, a luxury fashion, beauty, and lifestyle brand for women uses Instagram to connect with its clientele. Their posts on IG have a confident tone to highlight the kind of brand they are.

Image via Instagram

- Financial projections – Outline how your retail business will become financially stable and profitable. Create a projected financial timeline for the next five years.

- Funding requests – If you need external financing to start the business, outline how you will apply for and use your business loan.

This looks like a lot of information, but you need to cover everything to make your business plan functional. Ensure you keep each section brief to make it easy for other readers to go through the whole document.

Also Read:

Step 3: Create a Business Budget

With your business plan set, the next thing you need to do as you work to start a retail business is to create a budget.

Having a great idea and creating a good business plan is great, but your retail business will not flourish without enough funds. That’s why it’s important to create a budget that will guide how you’ll use your resources to set up your retail business and grow it.

Creating a budget can be overwhelming, but when you know where the huge expenses are coming from, it becomes easier to plan your business.

Below, we share eight costs you need to be aware of as you figure out how to start a retail business.

Location

If you will be selling your products from a physical store, you need to carefully choose the location of your retail business. A good retail location means more traffic to your store, hence more potential customers.

However, that optimal location comes at a price. So, keep in mind that you’ll have to pay more to secure a prime spot for your retail business.

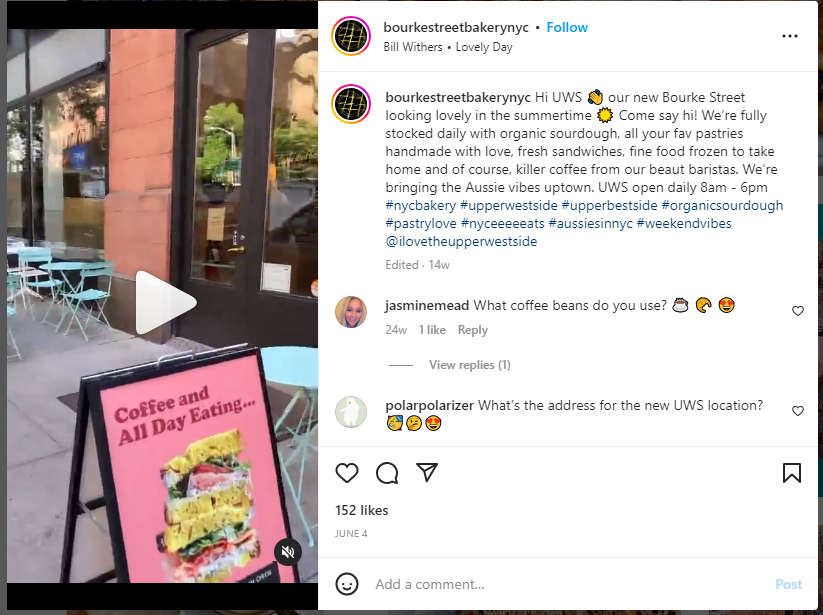

Bourke Street Bakery has a retail store on the streets of New York. Such a prime retail space in New York must have cost a fortune, but what they are getting in return is high foot traffic into their store.

Image via Instagram

You should also consider the cost of remodeling the space to suit your taste. Renovation costs can get quite high, especially if you want to install high-end decorative pieces.

Rent

In addition to the initial deposit for your location, you also need to consider monthly rent for your store location. The rent you’ll pay for the store will depend on the size of the store in square feet and the location of the premise.

Stores in high-traffic locations have higher rents. However, you can opt for a location with less foot traffic and invest heavily in marketing to get people to your store.

Utilities

Don’t forget about utility payments as you go ahead to start your retail business. Depending on the business you operate, utility payments may not be a lot but you still need to pay them on time to avoid disconnection.

Some of the utility expenses your business may incur include:

- Water

- Heating/cooling

- Electricity/gas

- Trash/recycling

- Landline phone

- Internet connectivity

Business Insurance

As a small business owner, it’s crucial that you consider business insurance as you work to start your retail business. Business insurance protects your business from losses that may occur as you run your operations.

You will invest a lot of money to set up your retail store, but can lose it all if you don’t insure your business. Businesses evaluate their insurance needs based on the amount of risk they face.

For example, a restaurant has a higher risk of fire breakout than a retail business that sells clothes. As such, they will pay more in insurance premiums to cover their business.

Some of the business insurances you may consider for your retail business include:

- Professional liability insurance

- Property insurance

- Vehicle insurance

- Business interruption insurance

Need insurance for your business? Our trusted partner Hiscox provides business insurance tailored to your needs. Contact an agent today!

Inventory Costs

Small retail businesses buy products from a manufacturer or wholesalers and sell them to the final customer for a profit.

As you start your retail business, you must consider how much it will cost to acquire the products you need for your target customers.

Negotiate a lower price with your supplier to increase your profit margins. Otherwise, your operating costs will be too high and your business will struggle to become profitable.

Other inventory costs you have to be aware of include:

- Transportation costs

- Cost of finding appropriate suppliers and expediting orders

- Receiving orders

- Storage costs

- Inventory spoilage costs

Employee Costs

To start and scale your retail business, you may have to hire employees for your day-to-day operations. Besides their salaries and benefits, you should also consider other costs such as employee training and payroll management. Take all of them into consideration.

Technology

To start and run your retail business effectively, you must invest in the right technology from the beginning. Technology enhances many business processes and helps entrepreneurs save on business costs.

For example, you must choose a reliable point-of-sale (POS) system that integrates with other tools you use for your business.

You must also invest in a robust security system to protect your business from theft, burglary, and other crimes.

Marketing

Most people often ignore marketing costs as they start their retail business. However, this is the wrong way to go about things, because it’s only through marketing that people will discover your business.

Some startup marketing costs you may incur include designing your logo, creating a website, and physical promotional materials such as your store banner.

You want to come up with an affordable marketing strategy that highlights what you stand for as a brand when you start your business.

Also Read:

Step 4: Register Your Business

Starting a retail business is exceptionally challenging for new business owners.

The reason for this is that you need to get everything done correctly and in order, from finding and sourcing the products to running your daily operations.

Among all of this, it’s important to understand which business legal structure is the right fit for you.

Legal entities can define your business, its rights, operational requirements, and more.

What’s more?

These business entities also come with their set of pros and cons. So, it’s absolutely critical that you select the right one for your business.

To help you make the right choice, we’ve shared the pros and cons for each entity.

1. Sole Proprietorship

Sole Proprietorships work best when you want to start a retail business on a small scale. One of the major reasons for this is that there’s little paperwork involved.

Also, they’re relatively easy to form and maintain. You don’t need to pay corporate taxes either.

And the best part is that all the income is passed through to the personal income of the business owner.

However, if you want to start multiple stores, this may not be the best bet for you. Additionally, your personal assets aren’t protected from liabilities.

2. Limited Liability Company (LLC)

LLCs, as the name suggests, are companies where your personal assets are protected from business liability.

Additionally, unlike Sole Proprietorships, it’s a separate legal entity. Your income is also passed on to your personal income tax returns just like Sole Proprietorships. This effectively saves you from double taxation.

However, the process of starting an LLC is slightly more complicated. Additionally, you might find it difficult to go public or distribute employee shares.

You’d also have to pay self-employment taxes, even though you’d be saved from corporate taxes.

3. Corporations

Corporations are separate legal entities, just like LLCs. One of the reasons why you should pick a corporation as the go-to entity for your retail business is the fact that they provide the best liability protection.

Additionally, scaling your business up is the easiest in Corporations. Be it raising funds or distributing employee shares, Corporations have provisions for it all.

Starting a retail business and growing it can also open the doors to creating franchises. That’s where Corporations help too.

But there are several drawbacks to Corporations as well. They’re difficult to operate and require a significant time and monetary investment.

Also, your income can get bogged down by the high corporate taxes.

You also need to hold annual general meetings and have comprehensive records. This can make it challenging to operate a Corporation.

Step 5: Sort Out Your Finances

Regardless of the legal structure you choose for your retail business, it’s crucial to have a dedicated business bank account for it. Separating your business income from your personal finances makes it easier to track your business income and expenses, thus helping you stay on track financially. It also ensures your liability protection remains intact if you start an LLC.

Additionally, it becomes easier to file your taxes since you’ll know exactly how much the business made. On the contrary, combining your personal and business income could put your personal finances at risk if things go wrong and the business is sued.

Choose a Business Bank Account

When it comes to choosing a bank account for your retail business, your options are generally unlimited. However, you want to choose a bank that’s friendly to small businesses like Chase Bank.

The bank you choose should also provide you with convenient features such as online check deposit and mobile banking. Also check if the bank has features to help your business grow, such as location accessibility, loans, and business credit accounts.

Secure Funding for Your Retail Business

After computing your startup costs and opening a business bank account, the next thing you need to do when you start your retail business is to secure funding for your business.

If you don’t have enough funds set aside to start your business, you can consider a loan offer from your bank. However, before you approach your bank for a loan, it’s important to perform a financial analysis to forecast the profitability of your business.

This is important because lenders want to know how you’ll repay the loan before they fund your business. By sharing your business plan and financial forecast, you help your lenders understand how you’ll make enough money to repay the loan.

But before you accept a loan offer from a lender, there are a few things you need to consider. These include:

- Interest rate

- Total payback amount

- Convenience of application

- Speed of funding

- Repayment period

- Ease of repayment

- Reputation of the lender

With all these things to consider, it can be scary to apply for a loan for your retail store. However, business credit can take your business to the next level by providing you with the funds to pay for crucial business expenses such as store deposit and costly renovations.

Step 6: Find a Prime Location for Your Business & Build an Online Store

If you’ll be selling your products from a physical location, then finding the best location for your retail store is arguably the most important aspect as you work to start your retail business.

The location you choose can make or break your business. If your store is located in a high-traffic area, then attracting customers becomes easy. But if it’s in a hard-to-find location, then you’ll struggle to get people to your storefront.

Because of the significance it holds in the success of your retail business, finding the right retail location can be a time-consuming process. To simplify the process, ask yourself these questions when conducting the search:

Where will customers find you?

Think about your target customers and where they reside.

Do they stay in specific neighborhoods and hang out in selective places? If so, then you should find a location for your retail store in those places.

For example, if you want to start an upscale boutique, you should look for retail space in an affluent neighborhood where the residents have more discretionary income to burn. Starting such a store in a neighborhood with cash-strapped millennials is setting yourself up for failure since your target customers don’t live nearby.

Take Uniqlo, for example. The Japanese retailer wanted to enter the US market. Considering the brand targets a high-end clientele, the choice of New York as the location for its flagship retail store was a no-brainer.

They landed in the country and started a clothing store in Soho, New York. Since then, the retail store has amassed a huge following, with many locals picking high-quality clothing items from there.

Who is My Competition?

Once you narrow down your location to a specific neighborhood, you also want to find out how many competitors exist in the area.

Are there other stores that sell similar products nearby?

If yes, you have to decide if you can start to handle the competition. Too much competition can cripple your young business. That’s why it’s important to find a location that doesn’t have too many competing stores to give yourself a chance to thrive.

How Much Space Do I Need?

After identifying the right location for your retail business, you can proceed to rent out a retail space. The size of the store has a direct impact on your startup costs.

As such, you need to carefully think about the amount of space you need to ensure you don’t spend all your money on store rent.

Consider the following issues when determining the amount of space you need:

- Merchandise display area

- Dressing rooms

- Inventory storage

- Back office space

Build an Ecommerce Store

Even if your dream has been to start a physical store with in-person transactions, you’ll also want to create an accompanying ecommerce store for your retail business for online shopping.

An ecommerce store will positively enhance your bottom line since it allows you to reach a large audience geographically. It also gives you another channel for nurturing customer relationships through deals, discounts, and personalized communication.

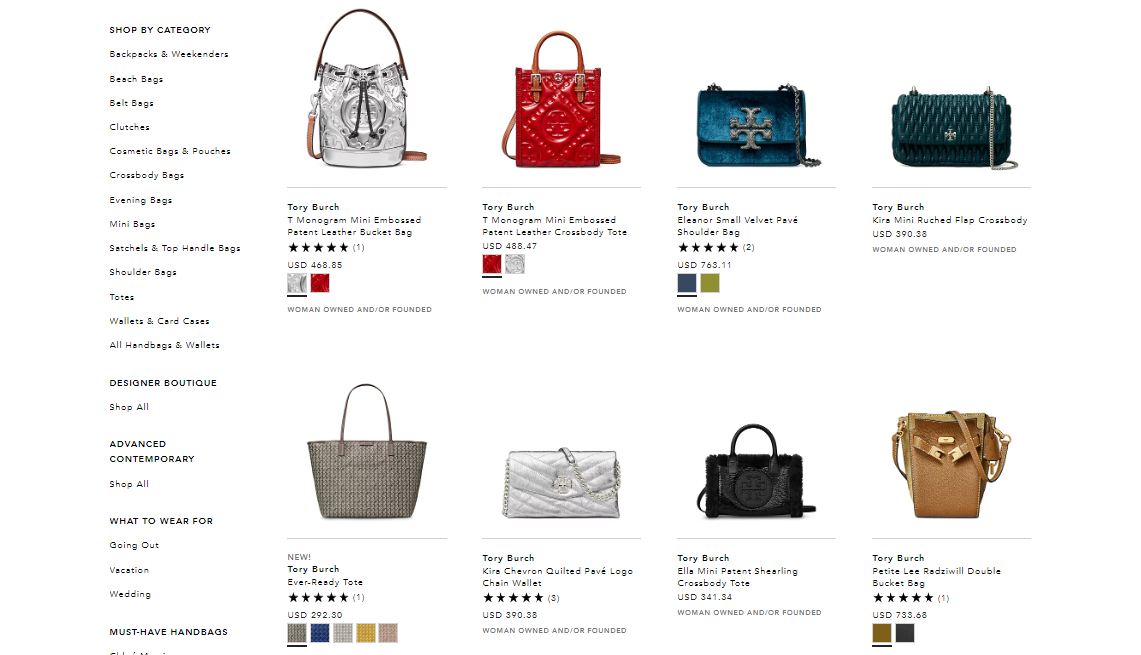

For instance, besides having a physical store in New York, Bloomingdales also has an online store where customers can order the products they need and have them delivered to their homes.

Image via Instagram

Image via Bloomingdales

To create an online store for your retail business, you first have to choose an ecommerce platform to host your products. The ecommerce platform must integrate with your accounting software to make it easy for you to process payments and file taxes.

Some of the popular ecommerce platforms you can use to start your online store include Shopify, BigCommerce, and Squarespace.

From here, you’ll have to figure out your order fulfillment and shipping so the customers can get their orders on time. Ensure your target customer gets their orders quickly and in the best condition, otherwise, they will not order from you again.

Step 7: Develop Your Brand

After deciding on a legal business structure and registering your business, creating a brand is the next important thing you need to do is figure out how to brand your business.

Great products are essential for your retail business to thrive, but you also need to develop a great brand identity to help you attract customers.

A unique brand identity will help you differentiate yourself from other local businesses that sell the same products. It also makes your business memorable and breeds familiarity among your target audience.

When developing your brand, think about the feelings you want your company to evoke. Look back into the market research you did and assess some of your biggest competitors.

Take a look at what their brands look like and find ways to differentiate your retail business from all that. You don’t want customers to confuse you with any of your competitors, and that’s why you want to take time to build a unique brand identity.

Once that is done, you can now go ahead to build a brand for your retail business with the following elements:

Also Read:

Store Name

One of the important branding elements you need to pay attention to when starting your retail business is choosing a name for your store.

Your store name must be unique to make it easy for customers to recognize your retail business. Also, ensure you have your store name on your storefront to help new customers find your business. Make it your domain name for the website too.

For example, Covet, a jewelry store in Palm Springs California has its name on the storefront to attract customers.

If you have a tagline, add it to the storefront as well to further differentiate your retail business.

Visual Branding

These are the elements that are visible to the human eye and serve as the visual representation of your brand. Some of the visual branding elements you’ll need to define when starting a retail business include:

- Logo

- Storefront

- Colors

- Signage

Take a look at Saks Fifth Avenue, for example. The luxury fashion brand has a retail store in Long Island. The storefront features the brand’s logo and colors to enhance the brand’s identity.

Image via Saks Fifth Avenue

Mission and Vision Statement

Your retail business’s mission and vision are two intangible assets that make your brand unique. No one can see your mission, but they can feel it when they interact with your brand.

Your mission plays an important role in helping you build an emotional connection with shoppers. Customers want to know that the brands they are buying from care about the issues that are important to them, and the mission builds this connection.

This concise mission statement can help you state why you started the business in the first place. However, your mission shouldn’t just live on your website and company documents.

You need to practice what you preach and demonstrate that you uphold the values and beliefs captured in your mission statement.

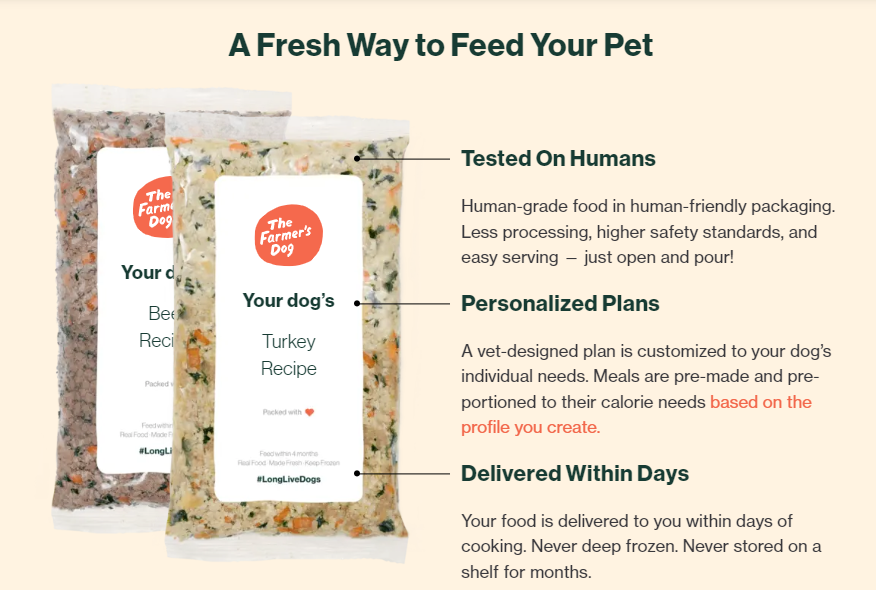

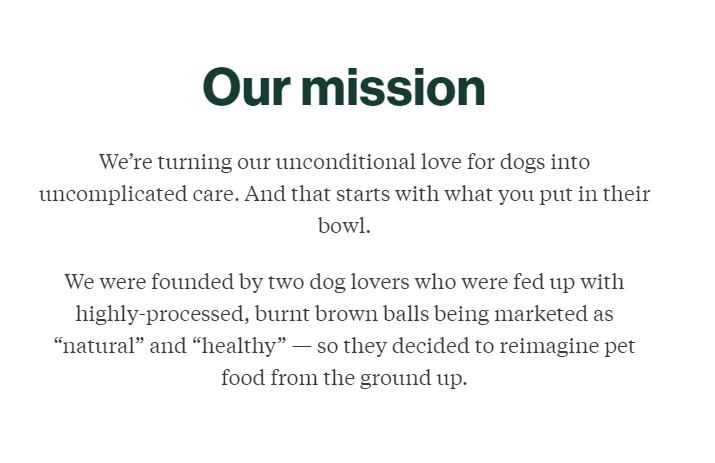

Take The Farmer’s Dog, for example. The company prepares and delivers healthy, freshly-made pet food guided by science and driven by their love for dogs.

Their brand’s mission is to turn their unconditional love for dogs into great care, starting with a bowl of healthy food.

By reading their brand story, you will see how passionate they are about the business. They also live and breathe their mission by working with vets to develop pet nutrition that exceeds industry standards.

Any pet owner would not hesitate to buy pet food from them since they can see how much the brand cares about pets.

Positioning

Branding also involves how you are going to position yourself in the market. With many retailers competing for the same customers in your niche, you will only succeed if you can differentiate your brand from the rest.

The Farmer’s Dog differentiates itself from other pet food stores by offering human-grade pet food developed by vets. They also customize meal plans according to a dog’s individual needs.

Image via The Farmer’s Dog

Also Read:

Step 8: Market Your Retail Business

After positioning your brand and building a coherent message, you can now start focusing on crafting a marketing strategy for your retail business.

Marketing is crucial as you work to start your retail business because it allows you to create awareness about your store and enables you to get customers and drive sales.

As you develop your retail marketing strategy, make sure you run campaigns and use messaging that appeals to your target customers. This will not only help you make a successful start but set you up on your path of success.

Following are some of the strategies you can deploy to market your retail business:

Leverage Social Media

Social media is arguably one of the best channels for promoting your retail business. Your target customers are on social media and you can use creative posts to let them know about your retail store and persuade them to make an order.

To market your retail business effectively on social media, the three platforms you want to pay attention to are Instagram, Facebook, and Pinterest.

These channels are the most customer-centric platforms that provide you with different tools to promote your products to consumers.

Without further ado, let’s break down how to use these channels to grow your retail business.

Instagram is the go-to platform for shoppers because of its visual nature. As a retailer on the platform, you can start to advertise your products on your page and use ads to reach your desired audience. Here’s how to use Instagram to start promoting your retail business on Instagram:

- Curate your visual identity meticulously – Your posts on Instagram should not be random. Instead, develop a distinct brand aesthetic that gives visitors a clear idea of your brand.

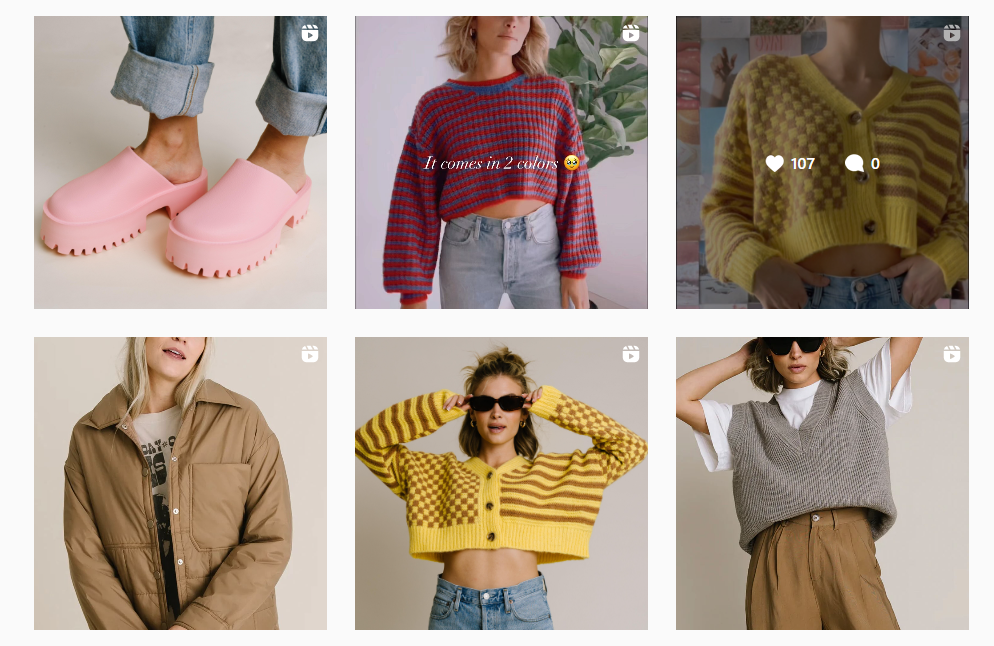

Clad and Cloth demonstrates how to effectively develop a visual identity on Instagram. From their photos, you can instantly tell that the brand sells casual clothes and offers neutral shades with pops of color.

- Make use of Stories – Instagram Stories give you the chance to be informal and start showing your personality. You can use them to showcase your products or give your followers a behind-the-scenes look at your retail store.

- Hashtags – Come up with a branded hashtag and use it on all your posts.

- Instagram Shop – You can sell products directly from within Instagram using this feature by creating shoppable posts.

Facebook is a great channel to start promoting your retail business when used in the following manner:

- Create a Facebook Group – Start a dedicated group where your most passionate followers can congregate to talk about your products and other important events.

- Since you are the owner of the group, you can use it to promote your products and make major product announcements.

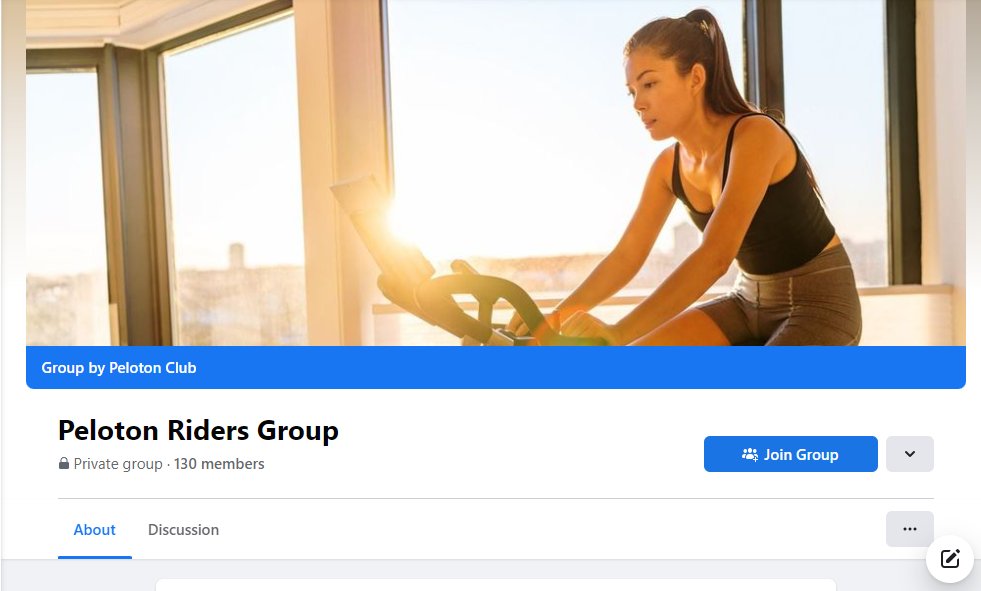

- Peloton, a cycling brand, created a private group on Facebook to bring together its customers to share their experiences. This fosters a community of your customers.

Image via Facebook

- Run Facebook Ads – Facebook’s advanced targeting mechanism makes Facebook Ads an effective tool for reaching your target users. When you start an ad campaign on the platform, ensure you track important metrics like impressions, clicks, and conversion rate.

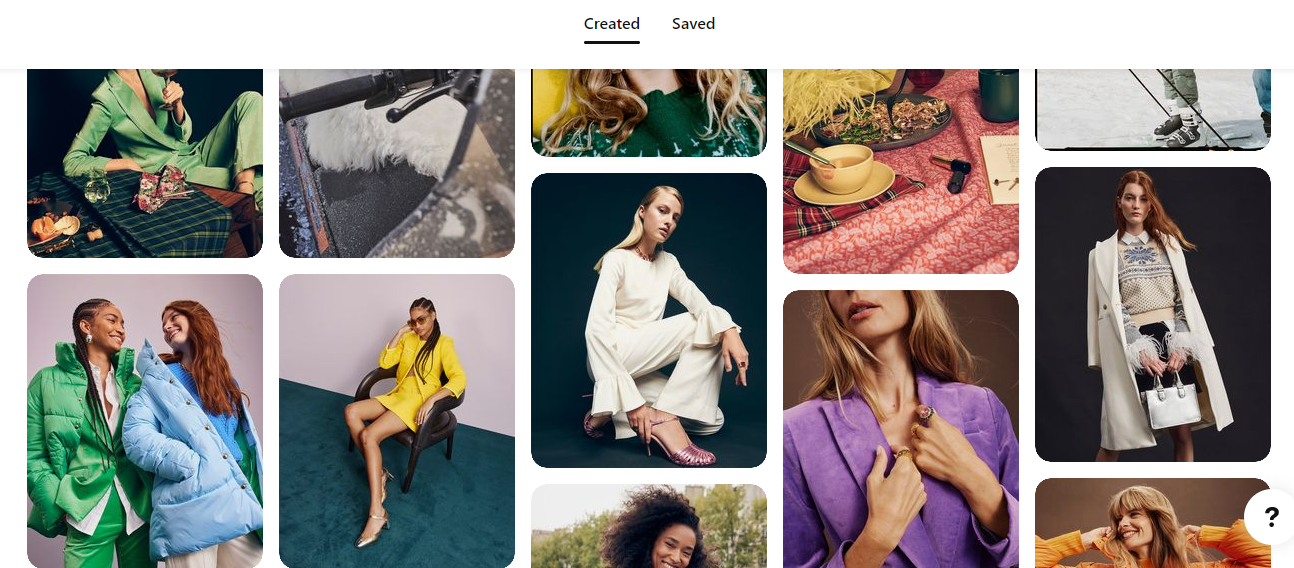

With Pinterest, curation is key if you want to succeed as a retailer on the platform. Like your IG page, ensure your Pinterest boards are exquisitely curated to reflect what your brand stands for.

You should also ensure your boards are simple to make it easy for customers to find what they are looking for. Pinterest works extremely well when you’ve got an apparel brand.

As you can see from J Crew’s boards, they have made it easy for visitors to see their coats, prints, and accessories.

Image via Pinterest

Consider Influencer Marketing

An endorsement from an influencer has a bigger impact on your brand than traditional advertising. This is because shoppers are more inclined to listen to and act on recommendations from people they know and trust.

That’s why it’s important to consider influencer marketing as you learn how to start a retail business.

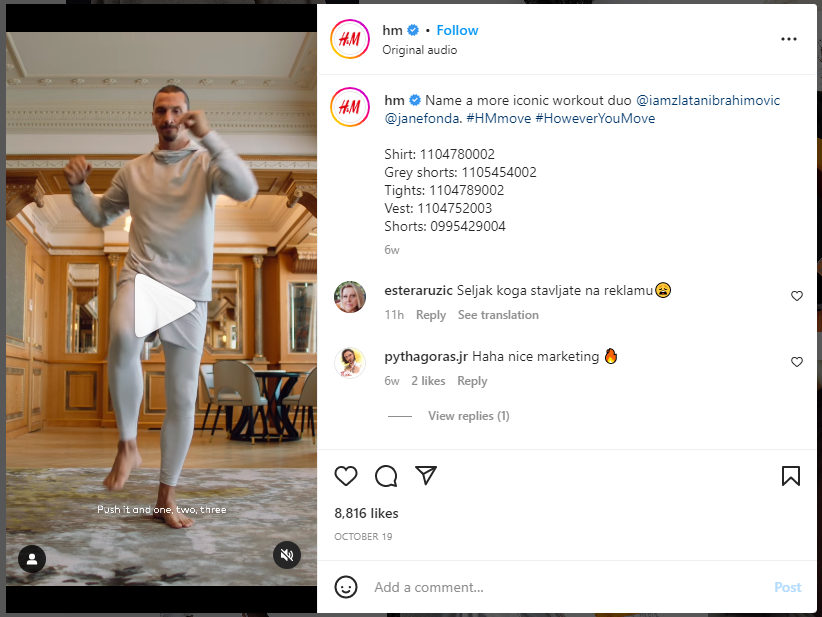

The strategy has been beneficial for H&M who work with influencers like Zlatan Ibrahimovich to market their products.

Image via Instagram

As a small business, you won’t have the budget for such mega-influencers. As a starting point, you can instead find local nano and micro-influencers who would be happy to promote you in exchange for free products.

FAQs

1. How much money do you need to open a retail business?

The money you need to open a retail business totally depends on the location, scale of operations, industry, marketing costs, and more. It could go from a few thousand dollars to millions.

2. What retail business is the most profitable?

The profitability of a retail business is determined by how a business positions itself in the market. By differentiating yourself from the competition, you will attract more customers to your store and make more sales with little rise in expenses.

That said, some of the popular retail businesses worth exploring include:

- Coffee shops

- Restaurants

- Book stores

- Clothing stores

- Pet food supply shop

3. How do I become a small retailer?

If you’re thinking about how you can start a retail business, the first thing you need to do is find a niche and choose your products. Next, you’ll have to find a location for your retail store and build an ecommerce store.

Before you start your store, deploy relevant marketing strategies to attract customers to your store.

4. How much does it cost to open a small shop?

The cost of starting a retail store depends largely on the location and the type of products you want to sell. You’ll have to pay more for a prime location in an affluent neighborhood and to acquire high-end goods for your store.

5. How do I start a successful retail business?

The key to starting a successful retail business is to find a way to stand out from the competition. Also, strive to provide your customers with great value to keep them coming back.

Over to You: Choose Your Business Entity

Finally, the choice of business entity for your retail business rests with you. You need to carefully assess your requirements, your future growth plans, and then see which entity satisfies those. Accordingly, you can make your decision.

And if you find it challenging to start your retail business, you can leverage the services of GovDocFiling.

To understand more about these business entities in detail, check out this infographic below.