Are you starting your own business in the United States but wondering how to get started and which are the legal requirements to consider?

Don’t worry.

You’re in the right place.

Taking the steps to comply with legal requirements may seem like a lot of work, but it’s crucial for long-term business success. Non-compliance can result in missed opportunities.

Filing the paperwork needed to set up your business as an LLC or Corporation, for instance, protects your personal assets from business liabilities. Setting up a business account, on the other hand, makes this protection stronger.

In this post, we’ll talk about the essential legal requirements for starting and running a business. This involves registering your business entity, state and federal filing, legal agreements, business licenses, and everything in between.

Here is an infographic if you need a quick overview.

Now, let’s take a look at the detailed legal requirements for starting your own business and the step-by-step process.

1. Register Your Business Name

A business name is how customers can identify you and distinguish your business from others in your niche.

It builds your brand and helps customers identify your advertising and marketing material. It’s also the name you’ll use to get into contracts and agreements, apply for funding, and more.

Here are the different types of business names you can have.

Legal Entity Name

Except for a sole proprietorship where you can operate under your legal name, the first step for starting your own business is choosing its legal name.

This is the name you’ll use when registering your business with the state.

Once your business name is registered, no other business in your state can register under the same name. Your business remains protected at the state level.

Keep in mind that most states have different legal requirements regarding registering a business name, such as what you can and can’t include. Research the rules in your state first.

Choose a business name that aligns with your business’s operations.

Ensure the name you choose is not registered by any other business. Most states have an online database where you can search for business name availability. Others require you to mail in an official request to check if the business name is already in use.

A better option—register your business with a business formation specialist. The service will include a thorough business name search within your state.

It’s also important to ensure that the business name is available as a domain name and social media handle names. This is an important step in taking your business online and attracting more prospects.

The name should also be scalable, easy to remember, and brandable.

Once you have picked a name, reserve it with your state to establish your intent to use it. You’ll find this provision on your Secretary of State’s website.

There’s likely to be a fee for the name reservation. However, name reservation is an important step.

It keeps other businesses from claiming the name before you can file the necessary legal documents of starting the business formation process.

You could also apply for a trademark for your name.

A trademark protects your business’s name at a federal level. Registering a trademark prevents businesses in every state from using the same name.

Note that you cannot apply for a trademark if another trademark exists that meets all these criteria:

- Is similar to the trademark you’re registering

- Is registered for products or services related to yours

- Is active or live

You can also protect your intellectual property by applying for a trademark. This includes slogans, logos, and catchphrases associated with your business.

Doing Business As (DBA)

A DBA is the assumed or fictitious name you give your business that’s different from its legal name. It’s also known as a trade name.

It lets you operate your business under a different name other than the one registered with the state, or in the case of Sole Proprietorships, your personal name.

Some states require you to file for a DBA. Some do not allow you to register a DBA that’s already in use by another business to avoid confusion.

Domain Name

A domain name is an address that identifies your business’s website on the internet, such as govdocfiling.com.

Domain name registration ensures no other business can set up a website under the same address.

The registration reserves your name for a specific period, mostly one year, but is renewable.

Here are some tips for choosing the right domain name:

- Choose a creative and memorable domain name. The domain name is how customers will find you on the internet and remember your business

- Choose a “.com” extension. This is the extension most websites have, making it what most customers expect and want to see. An extension like “.net” may seem untrustworthy.

- Keep it short and easy to read, but it should still capture what your website is about. Avoid numbers and special characters.

- Make it future-proof by avoiding trendy catchphrases and years (like 2023) in your domain name.

Register your domain name with an ICANN-accredited registrar. The ICANN website provides a database where you can search for accredited registrars.

Image via ICANN

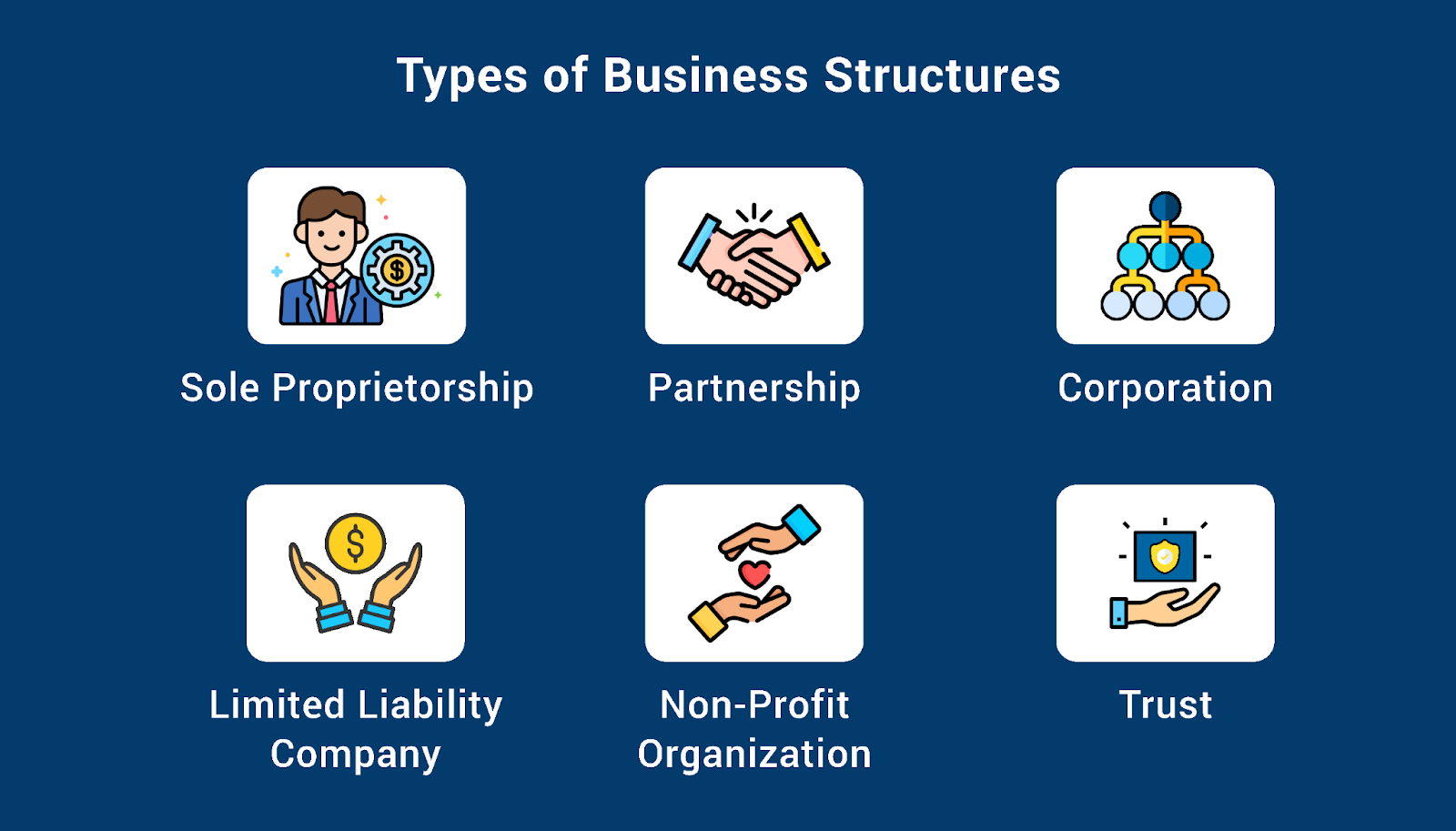

2. Select an Entity Type

Forming a legal business entity is necessary to get authorized to do business. You can choose the business structure that aligns the best with your ownership, taxation, operational, and other unique business needs.

Here are some of the common entity types to start a business.

Sole Proprietorship

A Sole Proprietorship is the simplest business structure you can choose when starting your own business.

There’s no paperwork required. You’ll have minimal legal requirements for starting your own business as a sole proprietor.

If you don’t register your business under any other business entity, it automatically becomes a Sole Proprietorship.

However, if you choose to have a business name for your Sole Proprietorship other than your legal name, you may need to file for a DBA depending on your location.

Keep in mind that there’s no legal distinction between a Sole Proprietorship and the business owner. Your assets can be used to cover business liabilities.

Advantages of Sole Proprietorships

- Sole Proprietorships don’t pay corporate taxes. You’ll report the business’s income on your personal tax returns.

- It’s the most affordable entity type for starting your own business with minimal legal requirements.

Pro Tip: You can use a Sole Proprietorship to test an idea before committing to a more formal business structure.

Partnership

If you are starting your own business with other people but fail to register the business under any legal structure, the business is a General Partnership by default.

Like a Sole Proprietorship, there’s no legal distinction between the partners and the business. Personal assets of the general partners can be used to offset the liabilities and debts of the business.

Apart from a General Partnership, there are several other types of partnerships you can form:

- Limited Partnership (LP): This is where only one of the partners takes personal liability for the business affairs while other partners are passive investors. The passive partners enjoy limited liability.

- Limited Liability Partnership (LLP): Partners in an LLP are protected from the debts arising from the negligent acts of a single partner.

A Partnership is taxed like a Sole Proprietorship where the profit and losses of the business pass directly to the partners.

However, the business will still need to file an income tax return showing how profits or losses are passed on to the partners.

Advantages of Partnerships

- The formation process has minimal legal requirements like a Sole Proprietorship, but with the option to get more funding by bringing in partners

- A Partnership is more flexible to run than other entity types. It has fewer legal requirements and less government control.

Corporation

A Corporation is more structured than other types of business entities.

It has a complex formation process, strict reporting rules and operating terms, expensive annual fees, and the most legal requirements.

A Corporation is a separate entity from business owners and provides the most reliable personal liability protection.

There are two types of Corporations, mainly differentiated by their methods of paying taxes.

- C-Corporations: The company pays corporate income tax. After-tax income distributed to shareholders is then taxed again on their personal tax returns

- S-Corporations: Shareholders are eligible for pass-through taxation. Starting an S-Corporation prevents the double taxation that C-Corporations face

Advantages of Corporations

- They offer the tightest legal protection to the owners’ personal assets.

- Corporations can issue company shares in exchange for investments or as an incentive to attract top talent through an employee stock ownership plan.

Limited Liability Company (LLC)

If the thought of losing your savings, home, car, and real estate to business liabilities scares you but you still seek simplicity, an LLC could be right for you.

Starting your own business as a Limited Liability Company protects you from corporate taxes. You can file your business income under your personal income taxes. However, you are still required to pay self-employment tax.

LLCs can also choose to be taxed as Corporations.

An LLC is fairly easy to form (fewer legal requirements than a Corporation) and maintain, but not as easy as a Sole Proprietorship.

One downside and major difference between LLCs and Corporations is that LLCs lack the investor appeal that Corporations have. LLCs can’t issue shares so most big investors will prefer to invest in a Corporation than an LLC.

Advantages of LLCs

- Limited Liability Companies offer personal liability protection without the complexity that comes with starting a business under an entity like a Corporation

- An LLC gives your business more credibility than a Sole Proprietorship or Partnership

Non-Profit Organization

If the reason behind starting your own business is not to make a profit but to achieve social, environmental, educational, ideological, or political goals, forming a Non-Profit Organization is a good choice.

Legal registration makes the Non-Profit Organization eligible for certain grants. It also becomes possible to apply for exemption from federal or state income taxes.

Advantages of Registering a Non-Profit Organization

- It protects directors’ personal assets from the organization’s liabilities and debts.

- The Non-Profit Organization continues to exist even after a director leaves or passes away.

Trust

A Trust is a legal entity. Running your business through a Trust makes it possible to transfer property and wealth to beneficiaries without undergoing a probate process.

The trustor (person setting up the trust) transfers assets to the trustee who manages these assets for eventual transfer to beneficiaries. This includes managing the associated tax obligations, debts, and liabilities.

Advantages of Setting Up a Trust

- The assets set up in the Trust are protected from the trustor’s and beneficiaries’ creditors.

- It provides privacy regarding the trustor’s property.

3. Complete the Legal Filing Requirements

Based on the entity type you choose, you will have to file the required documents with the Secretary of the State’s office where you want to conduct business.

Here are the filing requirements for the different entity types:

Limited Liability Company

You’ll need to file Articles of Organization with your state government to start an LLC. It’s also called a “Certificate of Organization” or a “Certificate of Formation.”

Although the requirements may vary between states, Articles of Organization filings require basic details about the LLC, such as:

- Its unique business name and principal business address.

- Names and addresses of LLC members, managers, and organizers.

- Details of the registered agent. This is a company or individual who’ll receive the legal and tax documents on your company’s behalf.

- A business purpose that explains what your company does.

- An effective date, if you want a date that’s later than the date approved by the state.

Profit and Non-Profit Corporations

Forming a for-profit or a non-profit Corporation requires filing the Articles of Incorporation with your Secretary of State.

In addition to basic information, such as the registered agent’s details, length of the business duration, and purpose of the business for a non-profit organization, you’ll need to provide details like:

- Names and addresses of the incorporators.

- Names and addresses of the initial board of directors.

- The number and type of shares the Corporation is authorized to issue and their par value.

Do your research to find out about all the legal requirements for starting your own business in the location you’ve chosen.

Some states, for instance, require businesses to publicize their intention to start a company by publishing it in a local newspaper or other local news outlets.

For easy and hassle-free paperwork, consider using our business formation services. You can take advantage of our expedited application processing without any additional cost.

4. File for a Tax ID

Along with state filings, you are legally required to acquire an Employer Identification Number (EIN).

An employer identification number is a nine-digit number that’s unique to your business. It helps the IRS identify your business for tax purposes.

In addition, having a tax ID allows you to hire employees, file taxes, open a business bank account, and sign contracts.

What information will you need to make a tax ID application?

Here are some important things:

- Name and mailing address of the person authorized to act on behalf of the entity. You’ll also need to provide their existing EIN, Social Security Number, or Tax Identification Number.

- Name and address of the business.

- Type of business entity.

- Reason for the tax ID application.

- The date on which the business started.

- An estimate of the number of employees you expect to have in the next 12 months.

- The first date of making wage payments.

- Principal activity of your business.

- The closing month of your accounting year.

Sounds complicated?

You can always use GovDocFiling to take the hassle of applying for a tax ID off your hands. We’ll help you avoid costly errors and save time.

5. Create the Essential Agreements and Contracts

Along with state and federal filings, you should create essential legal agreements and contracts with business partners, vendors, employees, and contract-based workers.

These legal documents can save you time and money and prevent disputes at later stages.

Let’s look at some essential agreements you need to create when starting your own business.

Operating Agreement

If you are starting your own business as an LLC, an operating agreement is essential. Although it’s not legally required, it gives you more control over your own business.

Without it, the state laws, by default, will govern most aspects of your LLC such as the sharing of capital.

An operating agreement also solidifies the limited liability aspect of your business by proving you’re operating it as an LLC.

Besides, the operating agreement will provide details like the management structure, profit sharing, and member investments. It’ll make running the LLC easier by minimizing misunderstandings.

Corporate Bylaws

One of the legal requirements for corporates in most states is to form corporate bylaws. However, even if it’s not mandatory in your state, it’s recommended to create bylaws for smooth functioning of your new business.

Corporate bylaws govern how the business will be run.

They include rules about the Corporate’s management structure and meeting requirements. The bylaws contain policies around stock issuance and other important company procedures and standards.

They also outline the roles of each director, whether shares are voting or nonvoting, and more.

Partnership Agreement

Don’t make the expensive business mistake of failing to document your agreement with your business partners.

If you are setting up a Partnership, a partnership agreement will lay out the rights and responsibilities of each partner.

It’ll outline the percentage of the business each partner owns and how profits and losses will be distributed. It’ll also indicate the decision-making process, method of solving disputes, and what happens in case a partner leaves or dies.

Without setting up a partnership agreement, your state’s partnership laws will govern how your own business runs.

The state’s partnership laws provide a standardized way of resolving common issues that occur in Partnerships. These standard rules may not always be favorable to your business’s goals.

Other legal agreements you should consider creating when starting your own business include:

- Non-disclosure agreements

- Independent contractor agreements

- Confidentiality agreements

- Employee agreements

- Founders’ agreements

Investing in the legal services of a trusted provider can ensure that your agreements cover all the essential legal requirements that will facilitate the smooth running of your business.

6. Open a Business Bank Account

A separate business bank account is one of the legal requirements for operating a separate legal entity, such as an LLC or a Corporation.

Be sure to keep your business funds in the business account and personal funds in your personal account.

In case your business faces a lawsuit and your own finances are mingled with the finances of the business, it becomes hard to prove that the business is operating as a separate legal entity.

You could lose your liability protection in what is known as ‘piercing the corporate veil.’

In addition, a business bank account helps you:

- Receive credit card payments.

- Show important stakeholders that your business is serious.

- Develop a relationship with a financial institution. It’ll be helpful when you need financing to scale your business.

- Have an easier time with bookkeeping and tax preparation by having a single source for all your past business transactions.

Opening a business bank account requires:

- An EIN or your own Social Security Number in case it’s a Sole Proprietorship

- Business formation documents

- Business license

- Ownership agreements

Want to learn about legal business formation requirements in detail?

Check out the infographic below, which we’ve created to help you get more clarity about the legal requirements of starting a new business.

(infographic)

Other Legal Requirements for Starting Your Own Business

Keeping your business compliant with all relevant legal requirements ensures that you remain in operation. Here are some other essential considerations to make.

Obtain the Necessary Permits and Licenses

Some types of businesses also need to acquire special business and professional permits and licenses.

You should check with your state’s governing bodies for any specific legal documentation that may be required.

For instance, businesses in these industries need additional licenses and permits to be legal entities:

- Guns and ammunition

- Home healthcare

- Alcohol

- Transportation

- Construction

- Foodservice

- Professionals like dentists, dentists, and skincare consultants

Besides, if you’re building your own business premises, or making improvements to an existing space, you might need building permits or a Certificate of Occupancy.

Get Business Insurance Coverage

Most states have made obtaining workers’ compensation insurance a mandatory legal requirement for starting a business that’ll hire employees.

The insurance coverage begins from day one of hiring an employee. It protects employees from any medical and legal costs that can result from work-related injuries and illnesses.

It’s also important to get business insurance covers for other areas, such as:

- General liability insurance: It can protect your business from costs associated with generic lawsuits, such as malfunctioning goods that cause injury or property damage. General liability insurance keeps your business operating in the event it’s sued.

- Property insurance: It protects your business’s property, inventory, and facilities from damage caused by common disasters like fire and theft

- Professional liability insurance: If you are in the professional industry, this insurance protects you from claims related to professional negligence or providing improper services

- Product liability insurance: It covers your small business against claims resulting from injury or property damage caused by defective products sold or supplied through your company

Keep in mind that skimping out on business insurance requirements could lead to serious financial challenges in the future, especially if your business faces lawsuits.

Comply with Labor Laws

Establishing a solid hiring process is the first step to ensuring that you comply with labor laws.

This is because some states have rules governing employee terminations. This can make it hard for you to let go of unfit employees. Try to have the right people from the get-go.

At the federal level, the US Department of Labor (DOL) also has numerous laws that protect employees from issues, such as:

- Discrimination, harassment, and unfair treatment

- Unfair compensation

- Wrongful discharge

- Workplace hazards

Hiring good legal counsel for your small business can ensure you meet all legal requirements regarding employment when starting your own business.

FAQs

1. What are the legal requirements for starting your own business in the US?

A. If you’re thinking of starting your own business, some legal requirements you need to comply with include:

- Picking a unique business name

- Selecting the best entity type for the business

- Filing the required business formation documents with your Secretary of State

- Getting an employer identification number (EIN)

- Creating the agreements necessary to run a legal business

- Opening a business bank account

It’s also important to get the right business insurance coverage for your startup, such as general liability insurance. Obtain all the required state and local business licenses and permits, and remain compliant with labor laws.

2. Do I need a lawyer to register a company?

A. Having a lawyer is not one of the requirements of starting your own business, but their knowledge and expertise can help you stay compliant with federal and state laws.

3. How do I register my company for the first time?

A. If you’re thinking of starting your own business for the first time, the first step is to pick and register your business name and select an entity type.

You can then file the necessary formation documents with your Secretary of State. Obtain an EIN for tax purposes and open a business bank account to keep your business and personal finances separate.

4. Does a small business need to be registered?

A. Yes. Business registration is the only way for your small business to be legally recognized.

5. What businesses are not compulsory to register?

A. A Sole Proprietorship and General Partnership doesn’t require any formal registration with your Secretary of State.

Conclusion: Create a Plan for Your Business to Remain Compliant

There are a lot of laws and regulations at the state and federal levels that govern how businesses operate.

Keeping them all in mind can be hard but non-compliance can also have expensive consequences, including the closure of your new business.

Create a plan on how you’ll remain compliant when starting your own business. This starts with working with an expert like GovDocFiling in your business formation process and employer identification number (EIN) application.